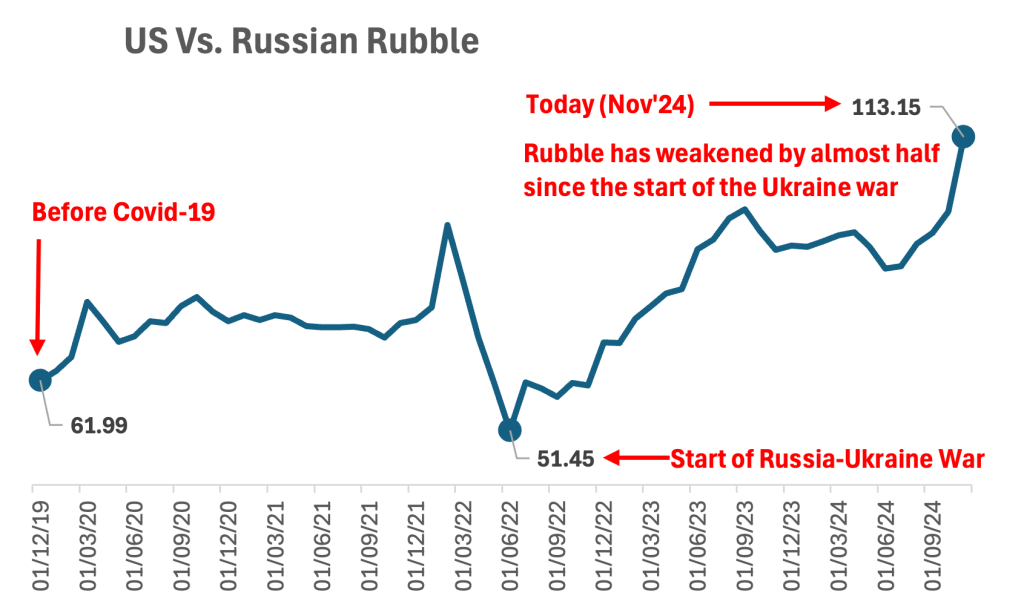

The Russian ruble has seen a significant drop in its value recently. To understand why, we need to look at the bigger picture of what’s happening in Russia’s economy. Let’s break this down step by step.

1. What Does Currency Depreciation Mean?

Before diving into the reasons, let’s understand what it means when a currency like the ruble loses value.

Imagine you need Rs.80 to buy $1 today, but tomorrow, you need Rs.100 for the same $1. That means the rupee has become weaker.

The same is happening with the ruble – it’s losing value compared to stronger currencies like the US dollar.

See the below chart to know how Russian Rubble has depreciated since the start of the COVID-19 pandemic and the Ukraine war:

2. The Root Causes of the Ruble’s Fall

2.1 Economic Sanctions

The most important reason behind the ruble’s depreciation is the sanctions imposed by the US and its allies on Russia due to the Ukraine war.

- What are sanctions? Sanctions are rules or restrictions placed on a country to limit its trade or financial activities. For Russia, these restrictions include blocking banks like Gazprombank from doing business with foreign countries.

- How do sanctions affect the ruble? Russia earns foreign money (like dollars or euros) by selling things like oil and gas to other countries. But because of sanctions, it’s becoming harder for Russia to receive payments in foreign currencies. With fewer dollars coming into the country, the demand for rubles goes down, which weakens its value.

Think of it like a school exam. If a student is barred from using essential study materials or resources, their performance is likely to suffer. Similarly, Russia’s economy is struggling because it’s being cut off from crucial global financial resources.

2.2 Central Bank’s Emergency Moves

The Central Bank of Russia is like the manager of the country’s money system (like our RBI). It tries to protect the ruble’s value by taking different steps. Recently, it stopped buying foreign currencies like dollars.

- Why did they stop buying foreign currencies? When the central bank buys foreign money, it keeps the ruble’s value stable. But with sanctions in place, they decided to hold onto their remaining dollars instead of spending them.

- The unintended effect: This decision made the ruble even more unstable because investors started doubting whether Russia could handle the crisis. When people lose trust in a currency, its value drops even faster.

2.3 The Cost of Geopolitical Tensions

Russia has been in a prolonged conflict with Ukraine. Wars are expensive, and Russia has been spending a lot on this conflict. On top of that, the sanctions make it harder for Russia to fund the war or support its economy.

- The double burden: On one side, Russia is spending heavily on war. On the other side, it’s earning less money from exports due to sanctions. This imbalance is putting enormous pressure on the economy, causing the ruble to weaken further.

2.4 Public Panic and Market Reaction

When a currency like the ruble falls sharply, people start to worry. Russians fear that their money might lose all its value, leading to hyperinflation (where prices skyrocket). Here is an extreme example of hyperinflation which was faced by Zimbabwe in the past.

• Example of panic: Imagine hearing that the Rs.100 note in your pocket might only buy what Rs.10 does today. You’d rush to spend or exchange it before it becomes worthless. That’s what many Russians are doing – rushing to buy goods or foreign currencies like dollars.

This panic further weakens the ruble because more people try to sell it, flooding the market with too many rubles.

I personally see this as a classic example of how global events affect local economies. The ruble’s fall isn’t just about one bad decision. It’s the result of a combination of factors: sanctions, war expenses, and public fear.

For India, this situation reminds us of the importance of a stable economy. It shows how critical it is for a country to have strong foreign trade relationships and manage its finances wisely.

While this may seem like Russia’s problem today, such global events can influence oil prices, trade deals, and even the stock market in other countries, including ours.

3. What Can We Learn from This?

- Global events affect us all: Even though Russia’s ruble problem might seem far away, it can impact global oil prices. This could lead to higher fuel costs in India.

- Economic stability is key: Countries that depend too much on one source of income (like oil and gas for Russia) are vulnerable during crises. Diversification is important for both individuals and nations.

- Panic makes things worse: Whether it’s stock markets or currency values, fear and speculation can amplify problems. Staying calm during such times is crucial.

Conclusion

The fall of the Russian ruble is a lesson in how interconnected the world is today.

Sanctions, war, and public panic have created a perfect storm for Russia’s economy.

While we watch these events unfold, it’s a reminder to keep our own financial systems strong and diversified to weather any global ripple effects.

Stay informed, stay prepared.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.