Yesterday I read this latest news about a groundbreaking discovery in China’s Hunan Province. It has made the whole financial world buzzing. A discovery has been made at the Wangu gold field in Pingjiang County. It has revealed one of the largest gold deposits in history. It is estimated that over 1,000 tonnes of gold can be mined from this area. The estimated worth of this gold deposit is a staggering $83 billion (about INR 7 Lakh Crore). For those of us keeping an eye on developments in the universe of gold investments, this latest update demands attention. Let’s break down why this news is relevant to us in India.

1. What is the Discovery All About?

China, known as one of the largest gold producers in the world, has just uncovered more than 40 gold veins (40 numbers distinct deposits). The gold is found at a depth of up to 2,000 meters at the Wangu gold field.

Experts think that it is just the beginning. Further exploration could push this deposit even deeper, potentially unlocking more gold reserves.

Gold mining can influence the gold’s demand-supply balance in the market. A gold deposit of this size could have a major impact on global supply and demand.

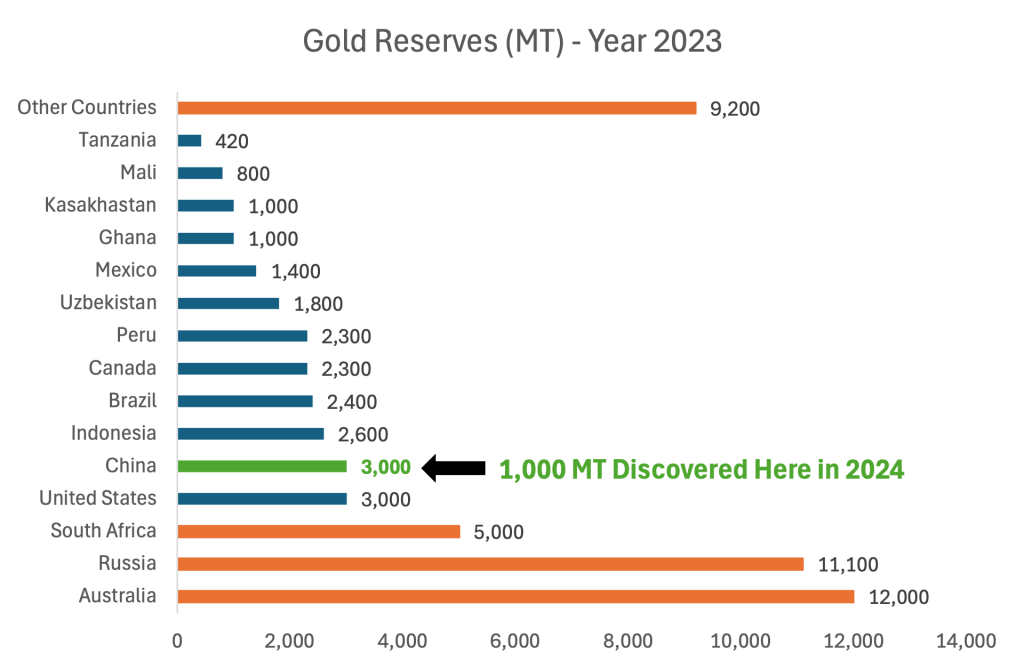

The estimated value of the discovery, at around $83 billion, is huge. This quantum of gold reserves can be compared to some of the world’s largest known gold reserves, like those in South Africa.

To understand how big is this discovery, let me give you a list of past discoveries. It will help you build a perspective of the current china’s gold discovery.

Past Gold Discoveries

| Name of Discovered Site | Tonnes of Gold Discovered | Year of Discovery | Remarks |

| Witwatersrand Basin, South Africa | Over 50,000 tonnes | Late 19th century | Largest gold-producing region in history; accounts for ~50% of all mined gold |

| Carlin Trend, Nevada, USA | ~3,100 tonnes | 1960s | Major ongoing gold-producing area in the U.S., known for “invisible gold” |

| Grasberg Mine, Indonesia | ~900 tonnes | 1988 | One of the largest gold and copper reserves globally |

| Muruntau Gold Mine, Uzbekistan | ~4,700 tonnes | 1958 | Largest open-pit gold mine globally, continuously productive |

| Kalgoorlie Super Pit, Australia | ~1,500 tonnes | 1893 | One of Australia’s most famous gold deposits, still operational |

| Mother Lode, California, USA | Significant but unspecified | 1848 | Sparked the California Gold Rush; gold located in 100-mile-long ore deposits |

| Wangu Gold Field, China | ~1,000 tonnes | 2024 | Recently discovered in Hunan Province, potentially the largest modern reserve |

Country Wise Gold Deposits of The World

2. Why Should Indian Investors Pay Attention?

Gold has always been an important part of the investment portfolio of Indian investors.

Whether it’s through physical gold, gold ETFs, or mutual funds, gold continues to be a popular choice. All investors who seek to maintain a diversified portfolio, gold stays as an equity balancer in their portfolios.

But here’s the thing: India imports more gold than it produces.

So, any significant change in global gold reserves or production impacts India. Why? Because it impacts the gold supply and hence its price.

2.1 Global Gold Supply and Demand

China is already the world’s largest producer of gold, accounting for nearly 10% of global output. It produces about 370MT of gold each year.

| Rank | Country | Mine Production (MT/Annum) |

| 1. | China | 370 |

| 2. | Australia | 310 |

| 3. | Russia | 310 |

| 4. | Canada | 200 |

| 5. | United States | 170 |

| 6. | Kazakhstan | 130 |

| 7. | Mexico | 120 |

| 8. | Indonesia | 110 |

| 9. | South Africa | 100 |

| 10. | Uzbekistan | 100 |

However, despite this, it still relies heavily on imports to meet its domestic demand. This new discovery could help alleviate some of that dependency. But, it’s unlikely to shift the global balance dramatically since China consumes more gold than it can produce in a year.

This means that global gold prices might not drop overnight, but there could be fluctuations based on how the market perceives the significance of this quantum of discovery.

For Indian investors, this could mean some short-term price adjustments, which could offer opportunities for buying gold at a relatively better price.

2.2 Impact on the Indian Stock Market

Gold effects the Indian stock market as well. Read about gold price and stock market correlation.

Companies involved in gold trading will get effected by such a major discovery of gold in China.

If this gold discovery leads to an increase in global supply, the prices of gold might stabilize or even dip temporarily. It will potentially impact gold-related stocks.

- A dip in gold price will reduce the raw material cost of such companies. Hence, their margins might improve till they pass on the price benefit to the consumers.

- If they will pass on the price benefit to their customers, it may result in demand increase and will increase the revenue.

Indian stocks like MMTC, Gitanjali Gems, or Rajesh Exports, which deal in precious metals, the discovery could influence their performance in the short run.

For long-term investors, buying stocks of such companies may be better. But I will prefer this step, if the gold price slips, I’ll rather accumulate some physical gold instead of buying stocks of gold related companies.

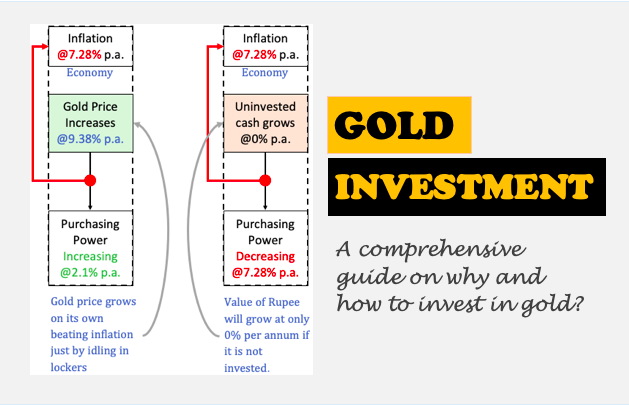

2.3 Gold and Inflation Protection

Does more gold in the world mean less value?

Not necessarily, because demand for gold isn’t solely driven by its availability. These days, as governments also accumulate gold to hedge risks, gold demand also comes from geopolitical stability.

Gold is not called a safe investment for any random reason, gold’s associated with the world money in very deep rooted. Anytime, when the value of our currency is at risk, gold demands pick-up. What brings currency value at risk? Following points:

- Interest rates.

- Inflation rates.

- Economic growth indicators.

- Trade balance (exports vs. imports).

- Political stability.

- Monetary policy decisions.

- Foreign exchange reserves.

- Geopolitical events.

- Public debt levels.

- Speculative trading in forex markets.

So I think, this discovery will not automatically translate to lower gold prices in India.

In fact, it may lead to more strategic gold purchases by central banks around the world. It will be better for future demand of gold in this world.

What’s Next for Indian Investors?

Now, what can you, as an Indian investor, do in light of this discovery?

- First, it’s essential to stay informed. While the news might create short-term volatility in the gold market, gold remains a long-term asset that holds its value over time. If you’re planning to add gold to your portfolio, this discovery could give you the opportunity to buy during a temporary dip, depending on how the market reacts.

- Second, keep an eye on the stock market. Companies involved in the gold trade might experience price changes, both positive and negative. For example, if global gold production increases, gold-related stocks might face price drops, but gold-focused ETFs and mutual funds could see increased interest.

Conclusion

In a globalized world, events like these in China can ripple across the world.

Whether it is small retail investors like us or someone with a more diversified portfolio, it’s important to understand how such discoveries can affect your investments.

While China’s new gold deposit might not completely change the game, it adds a new layer to the global supply and demand equation.

A long term gold investor (accumulator) would welcome such a finding. Such news will attract more investors towards gold. Such news will work as a marketing opportunity for the gold community.

Let’s see how this plays out in the coming months. Until then, continue to diversify and stay informed.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.