India’s GDP growth for Q2 FY24-25 has fallen to 5.4%. It is a significant decline from the previous quarter Q1FY24-25 (6.7%). This slowdown is below expectations and raises questions about the future trajectory of the economy. In this blog post, I’ll break down why this happened and what it means for the economy. I’ll also try to extrapolate how it could impact our investments. This is an economic shift and allow me to decode it for you (as an investor).

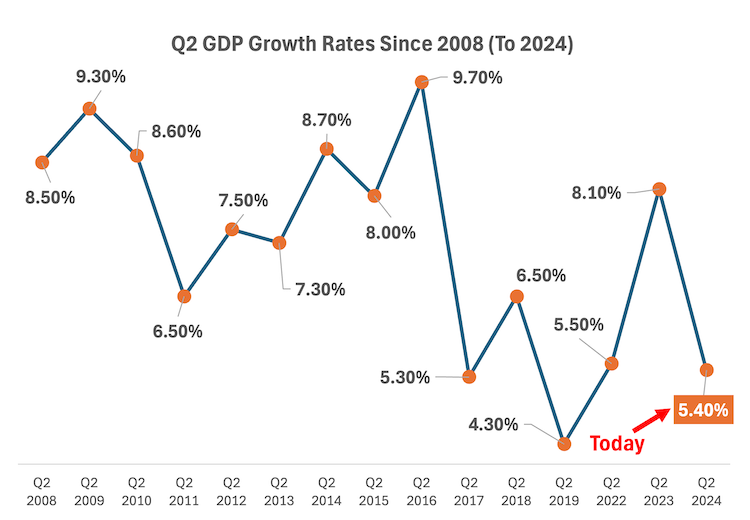

Just for our perspective, check the below chart for the historical Q2 GDP growth rates since year 2008. I’ve intentionally removed the data from year 2020 (COVD) and 2021 (Post-COVID) to get a real picture of the historical Q2 growth rates. By the way, in Q2-2020 and Q2-2021 the GDP growth rates were -23% and +22% respectively.

India’s economic growth has been a topic of concern lately. The latest GDP figures for Q2 FY2024-25 reveal a significant slowdown. The country’s GDP growth rate for the second quarter has dropped to 5.4%, a sharp fall from the 6.7% growth in the previous quarter.

Since year 2008, there have been only four instances when the Q2 GDP growth rate have fallen to 5.5% or below (check the above chart). This raises questions about what has gone wrong and what the future holds for the economy.

Understanding the GDP Numbers

To put things into perspective, the GDP (Gross Domestic Product) is one of the most important indicators of a country’s economic health.

It measures the total value of goods and services produced in the country during a specific period.

- When the GDP is growing, it generally means the economy is doing well, businesses are flourishing, and people are earning more.

- Conversely, when the GDP shrinks, it indicates a slowdown, with potential negative effects on jobs, income, and investments.

In Q1 FY2024-25, India’s GDP grew by 6.7%. However, in Q2, it dropped to 5.4%. This 1.3% decline is a setback for sure.

If we see the historical Q2 GDP growth rates (2008 to 2024), the average is also 7.2%.

So, what caused this sudden dip?

Why Has India’s GDP Fallen?

Several factors contribute to GDP fluctuations, and a fall in growth is often a result of multiple reasons:

- Cyclical Slowdown: The economy goes through cycles. Sometimes it grows, and sometimes it slows down. This kind of slowdown is called a “cyclical slowdown.” While a slowdown might seem alarming, it is not always a permanent situation. It can happen during times of global uncertainty (wars) or after a period of rapid growth (like post-COVID growth).

- External Factors: Global economic conditions, such as a slowdown in major economies, inflation, or changes in oil prices, can also impact India’s growth. The current global environment has been unstable (Russia-Ukraine, Israel-Iran war) with inflation concerns and trade disruptions (Trump factor in US).

- Domestic Challenges: Domestically, several sectors have been facing challenges, such as agriculture, manufacturing, and construction. These sectors play a major role in India’s overall economic performance. Any struggles in them can drag down the GDP growth.

- Investment Slowdown: There has been a reduction in private investment, which is crucial for economic growth. Lower investment levels often mean fewer jobs and reduced economic activity, contributing to a slower GDP growth rate. Why private investments are low? The root cause can be attributed to weak consumer spendings.

What Does This Mean for the Economy?

A slowdown in GDP growth affects more than just government numbers. It can influence many aspects of our daily lives:

- Job Market: Slower growth could lead to fewer job opportunities and stagnation in wages. Young professionals, especially those looking to enter the job market, might face more competition and fewer job openings.

- Government Target: The RBI had initially set a growth target of 7.2% for FY2024-25. Given the current slowdown, reaching this target seems increasingly challenging. This also impacts long-term plans like India becoming the third-largest economy by 2030.

- Investment Sentiment: A lower GDP growth rate can create uncertainty in the stock market. Investors may become cautious. It will lead to lower stock prices, especially in sectors hit hard by the slowdown. For someone like us who are interested in stock investments, this can present both risks and opportunities. It’s crucial to carefully monitor the market and stay informed.

What’s Next for India’s Economy?

The drop in GDP growth in Q2 FY2024-25 highlights some underlying issues that need attention.

The government, along with businesses and investors, will have to focus on measures to stimulate growth. This could include encouraging private investments, improving the ease of doing business, and focusing on sectors that have been struggling.

For individual investors, this slowdown presents both opportunities and risks.

- On one hand, a weaker economy could mean lower stock prices. It presents a chance to buy stocks at discounted prices.

- On the other hand, if the slowdown persists, it could impact the returns on our investments (but only in the short term).

What Should You Do as an Investor?

This is a good time to assess our portfolios.

Here’s how we can navigate these uncertain times when the GDP forecasts are not so optimistic:

- Diversify Your Investments: It’s important to spread your investments across different asset classes like stocks, bonds, mutual funds, and gold. Diversification helps reduce risk and smooth out volatility.

- Look for Strong Fundamentals: In times of economic slowdown, companies with strong fundamentals, consistent earnings, and a solid business model tend to perform better. Focus on stocks that are resilient even in challenging economic conditions. Buy and hold them for very long periods (like 10 years).

- Stay Informed: Keep track of GDP reports and government policies. Understanding the bigger picture can help us make better investment decisions. Keeping track of the broader index like Nifty 200 index will also give a feel of the direction of the stock market’s movement (rising or falling).

- Long-Term Focus: The stock market is volatile in the short term, but it tends to grow in the long term. We must learn not to panic during a slowdown. Instead, use it as an opportunity to buy quality stocks at lower prices.

Conclusion

The slowdown in India’s GDP growth in Q2 FY2024-25 may seem worrying, but it is not a cause for panic.

While it highlights some of the challenges faced by the economy, it also presents opportunities for smart investors.

By keeping an eye on how the economy progresses we adjust our investments accordingly to make the most out of the situation.

As an investor, understanding these macroeconomic changes is crucial. By doing so, we can take proactive steps to secure our financial future.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.

![How Changes in Oil Supply Affect the World and our Investments [Explained] - Thumbnail](https://ourwealthinsights.com/wp-content/uploads/2025/03/How-Changes-in-Oil-Supply-Affect-the-World-and-our-Investments-Explained-Thumbnail-768x463.png)