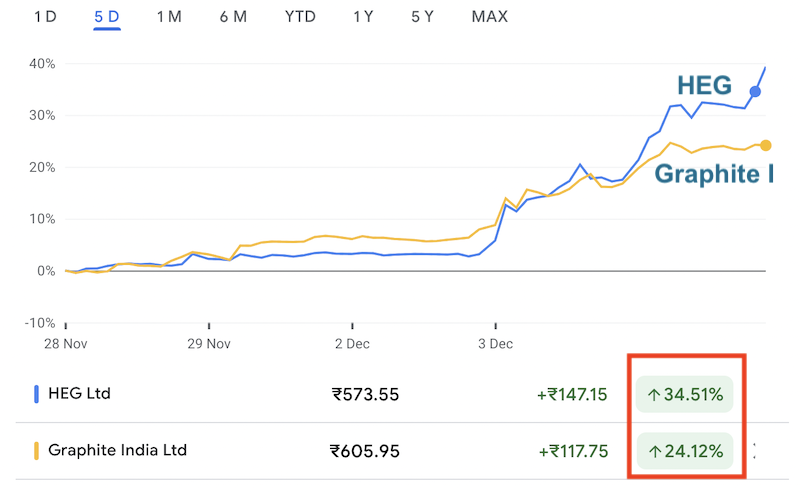

In the past few days, shares of HEG and Graphite India have been rising rapidly. HEG’s stock price has jumped by 30% in just two trading sessions, while Graphite India saw a 17% increase. If you’re wondering why this is happening, the answer lies in a new development between China and the United States that could directly affect Indian companies. Lets read more about this news and my interpretation of this evolving story.

What’s Driving the Surge?

The main reason behind the sudden surge in these two stocks is a change in how a few materials will be traded across the world. These materials are used in chip production.

Let me explain this in simple terms.

China is the world’s largest producer of certain critical materials like graphite. It has decided to impose stricter controls on the export of these materials. On December 3, 2024, China announced that it would stop exporting key materials like gallium, germanium, and antimony (used in chip production) to the United States. These materials are crucial in the manufacturing of semiconductors. These days, semiconductors are used in everything from smartphones to electric vehicles (EVs).

But it’s not just these metals that China is targeting. China is also restricting the export of graphite, which is a key ingredient in the production of both steel and EV batteries. This is where HEG and Graphite India come into the picture.

What Does This Mean for HEG and Graphite India?

HEG and Graphite India are both major players in the graphite industry. They produce graphite electrodes.

These electrodes are essential for producing steel and also play a crucial role in the battery industry.

Since China is now limiting its graphite exports, Indian companies like HEG and Graphite India stand to benefit as global demand for graphite is on the rise.

Following are the use cases of Graphite in the industry:

Graphite is a metallic mineral with many uses, including:

- Batteries

- Steelmaking

- Refractories

- Pencils

- Lubricants

- Nuclear reactors

- Other uses: Fuel cells, semiconductors, LEDs, brake linings, gaskets, clutch materials, etc.

With China tightening its export controls, many countries, including the United States, may turn to India for their graphite supply.

This shift in global supply chains is creating a bullish outlook for Indian graphite producers, and investors are taking notice. That’s why HEG and Graphite India stocks are rising.

The Bigger Picture

The current situation between China and the United States is part of a larger trade conflict that has been brewing for years.

- The U.S. has imposed various restrictions on China. The want to restrict China in technology and critical materials industry.

- In retaliation, China is now limiting the export of materials that the U.S. relies on for its semiconductor industry.

The U.S. has been trying to reduce its dependence on China for key tech materials. So, China has decided to restrict the export of these materials, including graphite.

Graphite is a strategic resource for manufacturing semiconductors and electric vehicle batteries.

This geopolitical tension is shifting the global supply chain and creating opportunities for Indian companies. It is expected that Indian companies like HEG and Graphite India will step in and fill the gap left by China.

The Potential Benefits for HEG and Graphite India

Both HEG and Graphite India has a major growth prospects due to this new shift in the global market.

As China’s export restrictions create a supply shortage, these two companies stand to gain significant market share.

- Increased Demand for Graphite: Graphite is a critical component in both chip manufacturing and EV batteries. With China limiting its supply, the global demand for graphite is likely to rise. Indian companies like HEG and Graphite India, which have strong production capabilities, are positioned to meet this demand.

- Higher Exports: Both companies have significant export businesses. HEG, for instance, generates more than 70% of its revenue from exports, with the U.S. accounting for about 17%.

- Growing Demand in the Steel Industry: Graphite is also used in steel production. Steel producers are likely to benefit from the forthcoming increased government spending. Companies like HEG could see a decent rise in demand for its products in the steel sector as well.

What Does This Mean for Investors Like Us?

For investors, this news presents both opportunities and risks. The sudden surge in stock prices of HEG and Graphite India is a clear indicator of the market’s optimism about these companies’ prospects.

However, it’s important to keep a few things in mind:

- Volatility: Sudden price surges often lead to corrections. Both HEG and Graphite India are now in “overbought” territory according to their Relative Strength Index (RSI). It means that the stock prices could stabilize or even dip in the short term as some investors may look to book profits in these stocks.

- Long-Term Growth: The geopolitical factors are driving this surge in the price. But what happens, if China removes these trade restriction in the next (say) 6 months? Will not these same stocks start to look overvalued then? At that time it will surely lead to a deep correction.

What is the right way? Value the price of these stocks and buy only then.

Conclusion

Indian companies, particularly those involved in critical industries like graphite production, are becoming more prominent players on the global stage.

As an investor, this could be a good time to take a closer look at companies like HEG and Graphite India.

If you believe in the long-term growth of the graphite industry and the global shift away from China, taking a calculated bet of these two stocks may be considered.

That said, it’s crucial to be cautious and assess the market dynamics carefully.

The trade tensions between China and the U.S. could also evolve tomorrow (for better or for worse).

Other Indian listed companies likely to benefit from this trade war are the following:

- Vedanta: It could benefit from increased demand for critical metals like gallium and germanium.

- Tata Technologies: It may gain from opportunities in advanced manufacturing and EV components.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.