Day trading seems exciting. Buy stocks in the morning, sell them by evening, and pocket quick profits – it sounds simple, right? However, for most retail investors, especially beginners, the reality is very different. Making consistent profits through day trading is incredibly hard. Let’s explore why.

Topics:

1. Unpredictability of stock price movements

Imagine trying to predict where a bird will fly next. It’s hard because its movements depend on many factors, like wind direction or sudden noises.

Similarly, predicting the movement of a stock price during a single trading day is nearly impossible. Why? It’s because prices are influenced by countless variables. Most of these factors are out of the control of the retail investors. Hence, predicting the direction of the price momentum becomes almost like impossible.

Stock prices move due to a combination of factors. Some prominent ones are as below:

- Supply and demand,

- News (company specific, economic, global, etc),

- Global market trends, and

- Large institutional trades.

For example, if Apple Inc announces an out of the box product launch (like an Apple EV), its stock price might rise, right? But what if, at the same time, China decides to preferential tax incentive for foreign portfolio investors? Such a news flow from China will squeeze money from USA and make it flow to China. If this happens, Apple’s positive news might get overshadowed, and the stock price could fall instead.

Big players like mutual funds or hedge funds also have access to advanced tools, insider information, and algorithms that track even the smallest market signals. Retail traders, on the other hand, rely on delayed data, basic charts, or news alerts that might already be outdated by the time they act.

This unpredictability gets further amplified by random events like sudden government policy changes or unexpected earnings reports.

These can cause sharp price movements that no one saw coming.

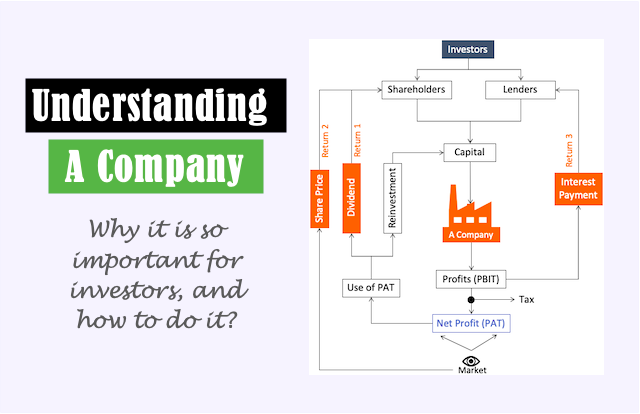

From my experience, relying on intraday price predictions is like betting on a 10 sided dice. Every time, our change of failing is 9 out of 10. The odds are never in our favor. Instead of chasing intraday profits, it is much better to learn to read financials of a company so it becomes easier to access if the company is growing, profitable, sufficiently liquid, price correctly, etc. I believe building an understanding of a stock’s long-term potential can give much better return in long term than gambling (day-trading). Patience and research give better results than trying to outguess the unpredictable market movements of a single day.

2. High Day Trading Costs

Day trading isn’t just about buying low and selling high. It’s also about covering costs.

Every day-trade comes with expenses like brokerage fees, transaction charges, and taxes. On average, these costs amount to 0.2% of the total transaction value (buy and sell combined). While this percentage seems small, its impact on profits is massive. Let’s understand it with an example.

[Note: For intraday trades, total cost is about 0.2%. For delivery trades cost can be as high as 0.72%.]

Suppose you buy shares worth Rs.1,00,000 and sell them on the same day. You’ll pay Rs.200 in trading costs. To break even, the stock price must rise by at least 0.2%. If you aim for at least a tiny profit, say Rs.100 (0.1%), the stock price must rise by 0.3%.

Now, here’s the challenge: consistently finding stocks that move 0.3% or more (in a day) in your favor during a single day is no small feat. Markets don’t move in straight lines; they fluctuate unpredictably.

Additionally, day traders often face emotional pressures like fear (worrying about losses) and greed (chasing unrealistic gains). These emotions can lead to overtrading or poor decision-making.

Frequent trades amplify risk of loss.

In my view, day trading’s slim margins are its biggest weakness. Moreover, these returns comes at a huge risk of loss. I’ve personally practiced day-trading multiple time. As compared to long-term investing, the risk-return balance of day-trading makes day-trading not-worthy.

3. Low Net Profit Margins Require Huge Capital, Increasing Risk

Day trading involves chasing small profits from frequent trades.

But the reality is, these profits are so slim – around 0.1% per trade – that making meaningful money requires a massive capital investment.

Let’s understand it with more clarity.

Suppose you want to earn Rs.1,000 in a single day. At a 0.1% profit margin, your trade size must be Rs.10,00,000 (10 lakh rupees). Now, here’s the catch: exposing such a large amount of money to market fluctuations comes with high risks.

For example:

- Say you buy Rs.10 lakh worth of shares at Rs.100 each (10,000 shares).

- To achieve a net profit of Rs.1,000 (where cost is 0.2%), the stock price needs to rise just Rs.0.30 to Rs.100.30.

- However, markets are unpredictable, and the price could just as easily fall by Rs.0.50 instead, dropping to Rs.99.50.

- This would result in a loss of Rs.5,000 (vs expected profit of Rs.1,000).

Even with stop-loss orders to limit losses, emotional factors like fear and greed often prevent traders from acting rationally. Many retail traders hope for a “bounce back” and hold on too long, exposing themselves to even bigger potential losses losses.

The need for huge capital and the risks it entails make day trading highly unsuitable for retail investors.

Most retail traders neither have the required capital nor the experience to handle the pressure of losing large sums.

I think, a long-term investment strategy is far safer and more rewarding. Day trading, with its razor-thin margins, is best left to professionals.

4. Emotional Stress Leads to Poor Adherence to Stop-Loss Rules

Stop-loss rules are crucial in day trading to limit losses when a trade goes against you.

For instance, if you set a stop-loss at 0.3% below your buy price. It means you’re prepared to exit the trade if the price falls that much. However, sticking to this rule is harder than it sounds, mainly because of emotional stress.

For example: Imagine you buy shares at Rs.100 each. Your expectation is that the price would rise. But instead, it drops to Rs.99.55, hitting your stop-loss limit. Ideally, you should sell immediately. However, emotions like hope (believing the price will bounce back) or fear (not wanting to book a loss) can lead you to hold on. If the price falls further to Rs.99, the loss grows significantly. Considering your trade size is as high as Rs.10 Lakhs – the loss will be a whopping Rs.-20,000.

[Remember, You were doing intraday for only Rs.1000 net profit per day. But see what the a small fluctuation of Rs.1 did to your profitability]

This emotional cycle repeats often in day trading, where decisions must be made quickly under pressure.

From my experience, mastering emotions is harder than analyzing markets. For beginners, the stress of sticking to stop-loss rules often leads to larger losses. A disciplined mindset is essential, but even seasoned traders struggle with this.

5. Panic-Selling Often Replaces Rational Decision-Making During Extended Losses

Panic-selling is a common response when day traders face continuous losses.

It occurs when fear overpowers logical thinking. It leads traders to exit positions hastily without evaluating the situation.

Let’s say a trader buys shares at Rs.100 each, expecting the price to rise. Do not get misguided by Rs.100, remember, the invested amount is in tune of Rs.10 Lakhs.

In this scenario, the price drops steadily to Rs.99 instead of rising. The total quantum of loss showing in your trading screen will be Rs.-10,000.

In such moments, anxiety builds as the loss grows.

Ideally, the trader should evaluate the market conditions calmly – maybe the stock has the potential to recover, or the loss is within their risk tolerance.

However, panic often leads them to sell all shares at Rs.98, locking in a significant loss.

This happens because extended losses trigger a fight-or-flight response. Traders fear losing more money and react emotionally rather than rationally. Unfortunately, panic-selling often leads to missed opportunities, as prices may recover soon after.

6. Psychological Pressure from Daily Losses Reduces Decision-Making Efficiency

Day trading often involves quick decisions and frequent trades.

When losses occur daily, they add immense psychological pressure. This constant stress can wear down even the most disciplined traders over time.

For instance, imagine you lose Rs.-2,000 today, Rs.-1,500 tomorrow, and Rs.-3,000 the day after.

The cumulative effect of these losses isn’t just financial – it also takes a mental toll. You were in the market to make just Rs.1000 per day, risking Rs.10,000 daily. But what you are actually getting back in return? A cumulative loss of Rs.-6,500 and lot of mental stress.

You may start second-guessing your strategies, hesitating on trades, or rushing into bad ones just to “recover” losses. This fear of continued failure creates mental fatigue, which lowers your ability to think clearly and make effective decisions.

Moreover, trading under constant stress often leads to impulsive behavior. For example, traders might ignore stop-loss rules, take unnecessary risks, or overtrade in a desperate attempt to turn things around.

These behaviours only worsen the situation.

7. Profit Inconsistency Means Gains on Some Days are Wiped Out By Losses on Other

One of the biggest challenges in day trading is profit inconsistency.

A trader might make Rs.2,000 on a good day but lose Rs.3,000 the next. Over time, these gains and losses often cancel each other out, making it difficult to achieve net profitability.

Why does this happen? Stock prices are highly unpredictable in the short term.

Even when traders analyze charts and use strategies, market conditions can change suddenly due to news, events, or unexpected buying and selling activity.

For instance, a trader might profit from a rising stock in the morning but lose it all in the afternoon when the market turns bearish.

Additionally, trading costs – like brokerage fees and taxes – further eat into profits. Even a well-planned trade can result in minimal gains once these expenses are deducted.

Do not forget to factor-in the cost of a bad decisions.

The inconsistency makes day trading a frustrating endeavor for retail investors. This is why many traders find themselves stuck in a cycle of gains and losses without meaningful progress.

8. Large Players and Algorithms Dominate Movements, Leaving Little Room for Retail Traders To Succeed

Day trading may seem like an exciting way to make quick money, but retail traders face significant challenges due to the dominance of large players and algorithms. These entities operate on a different level, making it hard for individual traders to compete effectively.

Let me explain this point in more detail as it is perhaps the most important negative aspect of day-trading for retail investors:

8.1. Who Are the Large Players?

Large players include institutional investors like mutual funds, hedge funds, and proprietary trading firms. They have access to resources and tools that retail traders can only dream of. These resources include:

- Vast Capital: Large players trade in crores, influencing stock prices significantly.

- Access to Better Data: They buy premium research reports and have access to real-time market data.

- Dedicated Teams: They employ financial analysts, traders, and strategists to plan and execute trades.

For example, if a large mutual fund decides to sell a particular stock, the volume of shares sold can cause a noticeable price drop, leaving retail traders struggling to adjust their positions.

8.2 What Are Algorithms in Trading?

Algorithms, or algo trading, refer to automated systems programmed to execute trades based on specific conditions. These algorithms analyze massive amounts of data and execute trades within milliseconds.

- Speed Advantage: Algorithms can place thousands of orders faster than a human can blink.

- Precision: They follow predefined rules, avoiding emotional decisions.

- Complex Strategies: Algorithms can analyze patterns and trends that are invisible to the human eye.

For example, an algorithm might detect a minor price inefficiency and execute hundreds of trades to profit from it before a retail trader even notices the change.

8.3 How Do Large Players and Algorithms Impact Retail Traders?

The dominance of large players and algorithms creates an uneven playing field for retail traders. Here’s how:

- a) Market Manipulation: Large players can move the market by trading in high volumes. For instance, if a hedge fund buys a significant number of shares, the demand causes prices to rise. Retail traders, noticing the upward movement, might buy the stock, only to see the price drop when the large player starts selling.

- b) Front-Running by Algorithms: Front-running occurs when algorithms detect a large order and place their trades ahead of it to benefit from the expected price change. Retail traders often lose out because their orders are executed at less favorable prices.

- c) Price Volatility: Large trades and algorithmic activity often increase volatility, causing rapid price swings. Retail traders, with limited tools and slower decision-making, struggle to navigate such unpredictable markets.

- d) Information Gap: Large players have access to insider insights and advanced analytics, while retail traders rely on delayed or publicly available information. This puts retail traders at a disadvantage, as they are often reacting to events after the fact.

8.4 Why Retail Traders Struggle to Compete

Retail traders face multiple challenges when competing against large players and algorithms:

- Lack of Capital: With limited funds, retail traders cannot influence prices like large players.

- Limited Tools: Professional trading platforms and algorithms are expensive and inaccessible to most retail traders.

- Emotional Decision-Making: Retail traders are more likely to make emotional decisions, unlike algorithms that follow strict rules.

- High Costs: Trading fees, taxes, and other expenses further reduce profitability.

Conclusion: My Perspective

From my experience, retail traders should avoid trying to beat large players at their own game. Instead of engaging in day trading, consider long-term investing. Long-term investing benefits from compounding and reduces the impact of short-term volatility. We’re less likely to panic when holding stocks for years instead of minutes. Moreover, unlike day trading, long-term investing relies on analyzing company fundamentals, where retail investors can have an edge.