As an investor, the goal of capital protection is one of the most important priorities for many. People who want to ensure that they don’t lose the hard-earned money they have accumulated, they will invest with this mindset. Whether you’re new to investing or have some experience under your belt, it is crucial to choose strategies that balance safety with reasonable returns. This becomes even more important when you’re working with a larger capital amount.

In this blog post, I’ll walk you through a rounded investment strategy designed to protect capital while ensuring steady returns. I’ve written it with the focus on what best returns can ge generated by a retail investor who wants to invest with capital protection as a priority.

Here, the investor looking to minimize the risk of loss.

If you have a sizable capital, like Rs.2 crore, but don’t want to risk your money in volatile markets, this blog post can give you an idea about how to think and plan your investment.

Topics:

1. Understanding Capital Protection

Capital protection is a strategy aimed at safeguarding the original investment or principal amount. It ensures that one do not incur a loss on the funds that’s invested.

For conservative investors, this concept is especially important, as the goal is to preserve the hard-earned money without taking unnecessary risks.

While it’s true that no investment can be entirely free from risk, a well-thought-out capital protection strategy can reduce the risk of loss to almost zero. How? By reducing exposure to high-risk assets that can fluctuate drastically in value (low cap stocks, pure equity funds, etc).

Instead, the focus shifts towards investments that offer stability and low-risk returns. A few examples of such investment options are government bonds, fixed deposits, or debt mutual funds.

These assets typically provide more predictable returns, even if they may not generate as high a return as riskier assets like equities.

By allocating a significant portion of your portfolio to such low-risk investments, you can reduce the likelihood of capital erosion. It will ensure that your principal remains intact over time.

2. The Investment Strategy

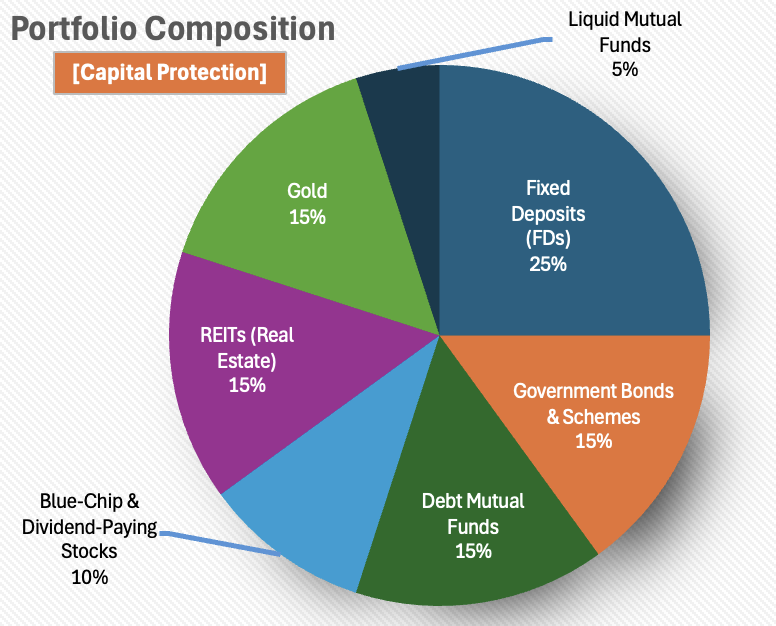

Given that the focus is on capital protection, let’s will balance the investment in a variety of low-risk asset classes. Our eye will be on generating reasonable returns without taking excessive risks.

Here’s how I would structuring the investment portfolio for myself.

Let’s assume that I’ve Rs.2 Crore available for investment and I want to do it with a capital protection mindset.

2.1 Fixed Deposits (FDs)

FDs are secure and they yield very predictable returns.

- Allocation: Rs.50 Lakhs (25% of the portfolio)

- Expected Return: 6.5% p.a.

Fixed deposits are one of the safest investment options, especially for those seeking a risk-free avenue to park their money. When invested in reputed banks, the principal amount is almost guaranteed by the bank. In addition to that we receive interest payouts at a fixed rate over a specified period.

In the context of capital protection, allocating a significant portion of my portfolio to fixed deposits can provide peace of mind. This way, I’ll know that my money is safe and also earning a steady returns.

While the returns may be modest, FDs ensure that you have a reliable, low-risk investment.

2.2 Government Bonds & Schemes

This is a “low-risk long-term Growth” investment option.

- Allocation: Rs.30 Lakhs (15% of the portfolio)

- Expected Return: 7% p.a.

Government bonds and savings schemes such as the Public Provident Fund (PPF) and National Savings Certificates (NSC) are low-risk investment options backed by the Indian government.

These schemes guarantee the safety of our principal while offering decent returns.

- Government Bonds, in particular, offer predictable returns and are ideal for investors who want to avoid market volatility.

- PPF, with its tax-free returns and government backing, is a great choice for long-term wealth creation.

2.3 Debt Mutual Funds

These are also safe investment option that can offer stable returns with only slightly higher risk of loss.

- Allocation: Rs.30 Lakhs (15% of the portfolio)

- Expected Return: 7.5% p.a.

Debt mutual funds invest primarily in government and high-rated corporate bonds, making them a relatively safe choice for conservative investors. As qualified mutual fund managers does the selection of assets, these assets are of higher quality (high rating like AAA+).

While these investments also do carry some risk due to interest rate fluctuations, they are generally considered less volatile than equity-based funds.

A well-chosen debt fund can provide regular income.

This is what makes it a solid option for investors focused on capital protection and also looking for better returns than traditional savings accounts.

2.4 Blue-Chip Dividend-Paying Stocks

Though it is equity, but they are stable with decent growth potential.

- Allocation: Rs.20 Lakhs (10% of the portfolio)

- Expected Return: 12% p.a.

Investing in blue-chip stocks is one of the most popular strategies for capital preservation. It is an investment vehicle that combines growth with safety of capital.

Blue-chip companies are large, financially sound firms with a proven track record of delivering consistent performance. Companies like HDFC Bank, Reliance Industries, and Tata Consultancy Services fall under this category.

In addition to the potential for long-term capital appreciation, blue-chip stocks often pay dividends.

This can provide us with a regular income stream, while still allowing the core of our investment to grow.

Dividend-paying stocks offer an added benefit of reducing overall portfolio volatility.

2.5 Gold

It is a safe haven against inflation and market volatility.

- Allocation: Rs.20 Lakhs (15% of the portfolio)

- Expected Return: 6.5% p.a.

Gold is a timeless asset that has traditionally been seen as a hedge against inflation and market instability. Allocating a portion of our portfolio to physical gold (or gold ETFs) can help protect our capital against currency depreciation and market fluctuations.

While gold does not offer high returns like equities, its stable, long-term performance makes it a prudent choice for capital protection.

Though, it’s also a great option (can give very high returns) during periods of economic uncertainty.

2.6 REITs (Real Estate)

REITs can give decent capital appreciation with dividend income like rental income from physical property. It is comparatively easy to time the purchase of REITs as compared to a physical property, hence, its dividend yield is better than rental yields.

- Allocation: Rs.30 Lakhs (15% of the portfolio)

- Expected Return: 7.5% p.a.

Real estate has been one of the most reliable asset classes for long-term growth and capital protection. With REITs now coming out of stable markets in cities like Bengaluru, Mumbai, and Delhi, they can offer both rental income and capital appreciation.

I think, the ideal time to buy REITs is when economic conditions are weak. During such time REITs valuations are attractive. But it must also be kept in mind that the signs of future recovery is also visible.

During this phase, market pessimism often drives prices lower, offering a chance to invest in quality REITs at a discount. As the economy rebounds, office demand and rental incomes typically improve, leading to potential capital appreciation and higher dividend payouts.

2.7 Liquid Mutual Funds

It offers both liquidity and safety of capital.

- Allocation: Rs.10 Lakhs (5% of the portfolio)

- Expected Return: 4% p.a.

While the returns from liquid are not substantial, they provide an essential benefit — liquidity. If we need access to our funds quickly, these funds ensure that we can easily withdraw our capital without losing any money.

This portion of the portfolio can serve as an emergency fund. They can offer safety and liquidity without significant returns.

3. Portfolio Overview and Expected Return

With the above strategy, the total portfolio of Rs.2 crore would look like this:

| Investment Typew | Percentage of Portfolio | Allocation (₹ Lakhs) | Expected Return (%) |

|---|---|---|---|

| Fixed Deposits (FDs) | 25% | 50 | 6.5% |

| Government Bonds & Schemes | 15% | 30 | 7.0% |

| Debt Mutual Funds | 15% | 30 | 7.5% |

| Blue-Chip & Dividend-Paying Stocks | 10% | 20 | 12.0% |

| REITs (Real Estate) | 15% | 30 | 7.5% |

| Gold | 15% | 30 | 6.5% |

| Liquid Mutual Funds | 5% | 10 | 4.0% |

| – | 100% | 200 | – |

Weighted Average Return

Let’s calculate the weighted average return on the above investment portfolio:

Weighted Average Return = Sum of [{Percentage of Portfolio} * {Expected Return}]

| Investment Type | Percentage of Portfolio | Amount (Lakhs) | Expected Return | Wt. Avg. Return |

| Fixed Deposits (FDs) | 25% | 50 | 6.5% | = 0.25*6.5 = 1.625% |

| Government Bonds & Schemes | 15% | 30 | 7.0% | = 0.15*7.0 = 1.05% |

| Debt Mutual Funds | 15% | 30 | 7.5% | = 0.15*7.5 = 1.125% |

| Blue-Chip & Dividend-Paying Stocks | 10% | 20 | 12.0% | = 0.10*12 = 1.2% |

| REITs (Real Estate) | 15% | 30 | 7.5% | = 0.15*7.5 = 1.125% |

| Gold | 15% | 30 | 6.5% | = 0.15*6.5 = 0.975% |

| Liquid Mutual Funds | 5% | 10 | 4.0% | = 0.05*5.0 = 0.20% |

| – | 100% | 200 | – | 7.30% |

The weighted average return of the portfolio is 7.30%.

This portfolio offers a balanced mix of safety and returns. It aligns with a capital protection strategy while still providing moderate growth.

Conclusion

By allocating capital across fixed-income instruments like FDs, bonds, and debt funds, and supplementing them with stable equities, real estate (REITs), and gold, this strategy aims to safeguard your capital while ensuring that it continues to grow at a reasonable rate.

Remember, while the risk is minimized, it’s essential to regularly monitor and rebalance our portfolio.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.

Thank you for sharing the valuable information

Thanks