Many people wonder if investing in the stock market can boost their income. I recently received a few questions about this topic, and I realized that many of you might have similar doubts. Let’s demystify this topic step-by-step. By the end of this blog post, you’ll have a clearer idea of whether the stock market can truly help increase your income. Let’s get into it!

Before we dive in, it’s important to understand that investing in stocks isn’t a guaranteed way to increase your income. Like any financial decision, it comes with risks and potential rewards. The key lies in knowing how the stock market works. Knowing this will give a clarity about what types of income it can generate, and whether it aligns with our expectations.

Suggested Reading: Can you really earn money from the share market?

Topics:

1. What Does “Increasing Income” Through the Stock Market Mean?

First, let’s clarify what we mean by increasing income.

When we think about income, it’s usually the money we get regularly, like a salary or revenue from a business.

But when it comes to the stock market, income can come in two main ways:

- Dividends: Some companies pay a part of their profit to shareholders. This payout is called a dividend, and it can give you a regular stream of income.

- Stock Trading: When you buy a stock at a low price and sell it later at a higher price, the profit you make is called a capital gain.

So these are the two ways a normal retail investor can generate income from the share market. However, like many may like to think, “income generation” from stock market is not easy money.

Let’s understand both the above forms of income to understand their pros and cons.

2. Dividends: A Reliable Way to Earn from Stocks

Dividends are like pocket money given to you by the company just for holding their shares.

Let’s say you own 10 shares of a company, and the company decides to give a dividend of Rs.5 per share. You’ll receive Rs.50 (10 shares × Rs.5) as income.

Example: Some companies like ITC, Hindustan Unilever, and Infosys regularly pay dividends. Most of the companies do not pay dividend to their shareholders. There are only a few handful reliable diviend paying companies in the stock market.

If you own enough shares of such companies, dividend can become a reliable source of income, but their yield will be small. What do we mean by yield? Let’s read more.

[Note: Fast-growing companies often prefer to reinvest profits back into the business rather than paying dividends to their shareholders. It means, if a company is not a dividend payer, we must not conclude that it is a low quality company]

2.1 Can You Live Off Dividends?

It is possible, but it takes time and a large investment. If you want dividends to replace a part of your monthly salary, you need to invest in a lot of shares.

The problem is the yield of investment (dividend yield). Let’s understand it using an example.

Suppose, your annual salary (take home) is say Rs.12,00,000 and you want to replace 10% of it from dividend income. Now, in order to earn dividends, you must have dividend paying shares in your investment portfolio.

[Note: Dividend income goals is Rs.1,20,000 per annum]

Now, assuming that you bought a few reliable dividend paying shares. One such example portfolio is shown below:

| SL | Company | Share Price (Rs.) | Shares (Nos) | Investment (Rs.) | Dividend Yield (%) | Annual Income (Rs.) |

|---|---|---|---|---|---|---|

| 1 | BPCL | 293.25 | 400 | 1,17,300 | 7.16% | 8,399 |

| 2 | IOC | 140.2 | 800 | 1,12,160 | 8.56% | 9,601 |

| 3 | NMDC | 228 | 600 | 1,36,800 | 3.19% | 4,364 |

| 4 | Oil India | 445 | 320 | 1,42,400 | 1.86% | 2,649 |

| 5 | Chambl Fert. | 529 | 260 | 1,37,540 | 1.51% | 2,077 |

| 6 | ONGC | 247 | 400 | 98,800 | 5.06% | 4,999 |

| 7 | PTC India | 161 | 800 | 1,28,800 | 4.86% | 6,260 |

| 8 | NLC India | 255 | 600 | 1,53,000 | 1.18% | 1,805 |

| 9 | Power Grid | 331 | 400 | 1,32,400 | 3.56% | 4,713 |

| 10 | NHPC | 85 | 1200 | 1,02,000 | 2.24% | 2,285 |

| – | – | – | – | 12,61,200 | 3.74% | 47,152 |

You can see, even after investing about Rs.12.5 Lakhs in highest dividend paying shares (dividend yield 3.74%). most shares pay much less dividends, your annual income is only Rs.47,000. To reach the goal of Rs.1,20,000 from dividend income, your portfolio size must me about Rs.32 Lakhs.

What does it mean? For a person whose net take home salary is Rs.12,00,00 (about Rs.1,00,00 / month), having a stock portfolio of Rs.32 Lakhs is very unlikely.

Hence, we can say that, replacing even 10% of our salary from dividends earned from the stock market is a tough ask. Most of us can only hope to reach there. For a big majority, it will remain as a dream.

Does living a life our of dividends is only a dream? Yes, as it cannot happen immediately. But over time, with consistent investments and improving yields, dividend income can become a sizeable passive income stream.

How much time it will take for dividend income to become sizeable? My guess is 8-10 years.

[Note: Dividends will be credited into your bank account only once or twice in an year. Moreover, for most investors, the average dividend yield from a typical stock portfolio is below 1% in the initial few years.]

2.2 Real Life Example

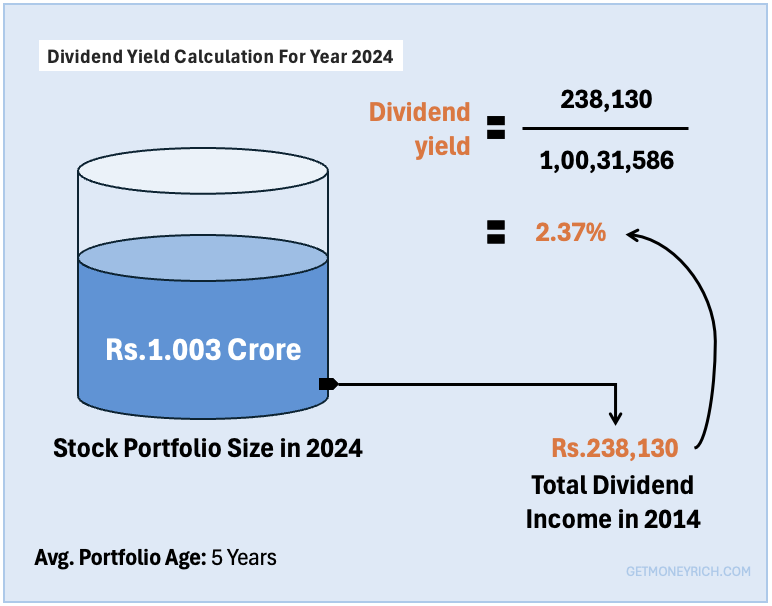

This is an example of stock portfolio whose average size in year 2024 (from January to December) was about Rs.1.0 Crore. Total dividend income earned in year 2024 ((from January to December) is about Rs.2.38 Lakhs.

[Note: The portfolio is a mix of large-caps, mid-caps, some small-cap stocks, and a small percentage in REITs. The objective of this portfolio is growth, not income generation.]

The average dividend yield of this stock portfolio, in the year 2024 was about 2.37%.

It is also important to note that, the average age of this portfolio (average holding time of stocks) is about 5 years.

Had the average age of the same portfolio been below 1 year, the dividend yield will not be above 1%.

3. Generating Regular Income Through Stock Trading

Stock trading, when done professionally, can be a way to generate regular income.

Unlike long-term investing, which focuses on holding stocks for years, trading involves buying and selling stocks within shorter timeframes – sometimes within minutes, days, or weeks.

Professional traders aim to profit from price fluctuations by making multiple trades and consistently capturing small gains.

3.1 Types of Trading for Income Generation

- Intraday Trading: This involves buying and selling stocks on the same day. Traders look for small price movements during the trading session and close all positions by the end of the day. Successful intraday traders rely on technical analysis, charts, and real-time data to identify quick opportunities.

- Swing Trading: Here, traders hold stocks for a few days to a few weeks to profit from short-term price trends. This approach allows traders to capture larger gains than intraday trading while still maintaining a relatively short holding period. Swing traders often use a mix of technical and fundamental analysis to make decisions.

- Positional Trading: Here, traders take positions for weeks or even months, focusing on medium-term trends. This type of trading requires patience and a deeper analysis of market patterns and sector performance.

3.2 How Traders Generate Income

Professional traders develop and follow strict strategies to generate consistent income. They:

- Identify Patterns: Traders analyze price charts and trends to predict movements and find profitable entry and exit points.

- Set Clear Targets: They define profit targets and stop-loss limits for each trade to manage gains and protect capital.

- Use Leverage Wisely: Traders often use margin (borrowed funds) to amplify returns, but they manage it carefully to avoid excessive risk.

- Maintain Discipline: Sticking to a trading plan, avoiding emotional decisions, and executing trades with precision are key to consistent income.

3.3 Example of Income from Trading

Suppose a trader starts with a capital of Rs.5 lakh and focuses on swing trading. They aim for a 3% profit per trade, making about 4 trades a month. If successful, the monthly income would be:

- Profit per Trade: Rs.5,00,000 × 3% = Rs.15,000

- Total Monthly Profit: Rs.15,000 × 4 trades = Rs.60,000

This example shows how systematic trading can generate a steady income stream. However, success requires skill, experience, and a solid understanding of market behavior.

Risks Involved in Stock Trading

Stock trading can offer regular income, but the risks are significant. In fact, the risk of loss is so high that, for a retail investor, stock trading not worth trying. A much better results can be achieved by investing in stocks from compounding.

Statistics show the following data related to stock trading:

- Over 95% of retail traders lose money in the long run.

- Only a small percentage, around 5%, consistently make profits.

This stark reality highlights why trading is not only considered challenging for retail investors but also (in my view) completely avoidable.

Why Most Traders Lose Money

The journey of making consistent profits in the stock market is far more challenging than most people realize.

While trading appears straightforward, buying low and selling high, the reality is that a majority of traders struggle to sustain profits and ultimately lose money.

- One of the key reasons is unpredictable market volatility. Stock prices rarely move in a straight line. They fluctuate based on news, economic events, market sentiment, and host of other factors. I remember days when a seemingly perfect trade, backed by solid analysis, turned into a loss because of an unexpected policy announcement or global market movement. These unpredictable swings can shake even the most confident trader. Read: External factors that effect stock market.

- Another major factor is the lack of discipline. In theory, every trader sets a clear plan: entry points, exit points, and stop-loss levels. But in practice, emotions often take over. When a stock price rises, greed might push a trader to hold on longer, hoping for a bigger profit. Conversely, when prices fall, fear and panic can cause traders to exit too soon or hold onto losses. It is done in a hope for a recovery that may never come. I’ve learned the hard way that emotions can cloud judgment, making it difficult to stick to a plan. Read: An approach to intraday trading.

- Over-leveraging is another trap many fall into. The idea of using borrowed money to boost potential returns is tempting. Margin trading allows you to take bigger positions than your capital allows, but it’s a double-edged sword. Just as gains can be amplified, so can losses. I’ve seen traders wiped out in a matter of days because a leveraged position moved against them. Without careful risk management, leverage can quickly spiral out of control.

- Finally, inadequate knowledge often sets traders up for failure. Trading is not just about luck or intuition. It requires a solid grasp of technical analysis, market behavior, and economic factors. Many beginners enter the market without understanding these essentials, believing that a few good trades will lead to long-term success. Early wins can create overconfidence, but when the market turns, this lack of knowledge becomes evident. I’ve spent countless hours studying charts, patterns, and market indicators, and even then, there’s always more to learn.

[Note: Rakesh Jhunjhunwala started as a stock traders. Most of our famous investors start as a stock trader. But ofter sometime (a few years) they realize the wealth cannot be made by stock trading. The only way to become wealthy (rich) is by long term investing.]

4. Is the Stock Market a Good Way to Increase Income?

- 1. For Short-Term Income Needs: It is Not Ideal. If you’re looking for immediate or regular income, the stock market isn’t a magic solution. Stock prices are unpredictable in the short term. Depending on quick gains can be risky, especially if you’re new to investing.

- For Long-Term Income Growth: Absolutely Yes. If you’re willing to be patient, the stock market can be a powerful tool for increasing your wealth (not income) over time. By investing in strong companies and holding their stocks for several years (1-015 years), we can benefit from:

- Dividend Growth: As companies grow, they often increase their dividend payouts.

- Wealth Accumulation: Our investments can grow significantly over time, allowing us to sell some shares in the future when we need cash.

Conclusion

When I started investing in 2008, I thought I could quickly increase my income by picking the “right” stocks.

But the stock market taught me an important lesson: Wealth building takes time and discipline.

I now focus on long-term investments in companies with strong fundamentals. I reinvest the dividends I receive to buy more shares, which helps my portfolio grow faster. Over time, these investments can turn into a reliable income source.

If you’re a beginner, here’s what I recommend:

- Start Small: Even if you invest Rs.500 a month, get into the habit.

- Focus on Learning: Understand how the stock market works before expecting big returns.

- Invest Consistently: Over time, consistent investments can help you build wealth.

- Reinvest Dividends: This will help your investments compound faster.

The stock market isn’t a quick way to increase your income.

With patience, discipline, and the right mindset, the stock market can help you build wealth and generate income in the long run.

So, start learning, start investing, and watch your financial future grow.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.