Before this incident I never heard of a home construction loan. One of our colleague was constructing a home for himself.

In this age of rapid urbanisation, he decided to construct a home, all by himself. He had set a lavish plan for himself. He was planning to construct a really nice home.

We were wondering how he was managing his time and finances for its construction. He introduced us to “home construction loan“.

Who Require Home Construction Loan?

This is NOT like our traditional home loans. Hence, to get more idea about it, I rang up a home loan department of a financing company.

They informed me few interesting things about home construction loan.

If you also have a plot, and you are thinking to build your own home on it, then you might need to read this article.

One day, I would also like to construct a home for myself. Maybe it’ll only be a holiday home, but I’ll like to have one. 🙂

This idea is motivating, right? Everything can be tailor-made in that house (acording to our likings). It is a dream project.

But to make this dream a reality, arranging it’s financing will be an important part of that project. Home construction loan offered by various banks in India can do the financing.

How Home Construction Loan is Different From Traditional Home Loans?

When I started talking to the financing company, I was always referring to them my requirement as “home loan”.

They rightly corrected me that, what I seek is called “home construction loan”, not home loan.

From the borrowers (we) perspective, we must first realise that a traditional home loan, and home construction loan are different. What is the difference? Check the below table:

- T.B.C: To Be Constructed.

- Borrower: Person to whom the loan is paid.

To summarise, in case of home construction loan, the overall responsibility of constructing the property and paying back the loan EMIs (to bank) is on the borrower.

But in case of traditional home loans, the borrower needs to only worry about the timely payments of EMIs. The responsibility of construction is on the developer/builder.

Let’s know more about how a borrower must prepare himself to handle home construction loan…

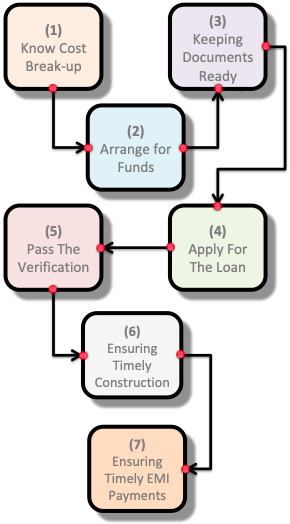

How to prepare for loan?

Applying for home loan is easier. More preparations are required to get ones home construction loan approval.

Lets’ understand the important steps in slightly more detail:

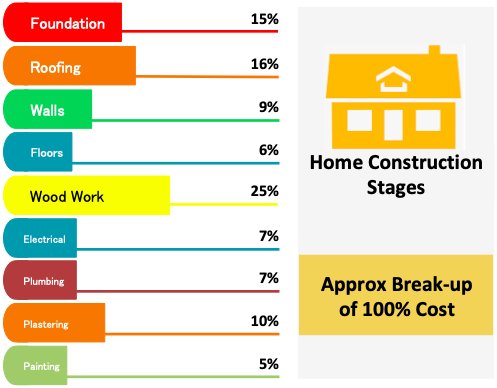

1. Know Cost Break-up: Why?

Typically, for a middle class Indian, the cost break-up of building a home will look like this (ask your architect for such cost break-up):

Why the borrower must know cost break-up?

Because it will help in planning the cash-flows required to build the house. How?

Suppose you are constructing your own house. Total cost of building your house is say Rs.100 Lakhs.

Let’s also assume that a bank has sanctioned your home construction loan of Rs.80 Lakhs (80%). The loan disbursal will be done in two stages:

- First Instalment of Rs.28L: [35% After Foundation is Complete] – Please check the above cost break-up. Foundation work will consume Rs.15 Lakhs (15%). It means, till you’ve spent at least 15 lakhs from your own pocket, bank will not release the first instalment.

- Second Instalment of Rs.52L [65% After Roofing & Wall is Complete, and wood work is starting]. To complete these 3 activities, the disbursed amount of Rs.28L will already be consumed. At this stage, the house is almost half ready. Now the bank will release the balance Rs.52 Lakhs.

So you can see, how the knowledge of cost break-up helps to understand the disbursement logic of the bank.

Had we not knew about what cost goes into building the foundations, we would have thought that banks are unfairly asking you to complete the foundation before releasing the first installment.

2. Arrange For Funds: Planning cash flows

To ensure the progress of work (construction) without halts, one must be ready to manage the cash flows needs.

In cash flow management, the borrower must be clearly aware of two things: (1) Where all the money is coming from, & (2) When loan money will start to come.

Where are the funds coming from?

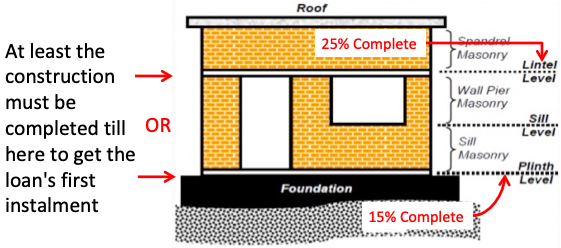

- Self Contribution (20%) – Borrowers Contribution: The borrower must be ready to spend his portion of financing (20%) even before getting the first instalment (loan) from bank. Banks would like to see the borrower’s money already spent, in building the foundation etc before disbursing their first instalment.

- Home Construction Loan (80%) – From Bank. Before starting to build the home, it is necessary to apply for loan, and get its approval. In this case it is important to understand that banks will release the first instalment only after they are assured that the borrower has already spent his 20%. It is an essential understanding, because this is what banks would like you to sign on fine-prints before approving your home construction loan.

To build a home for self, a person will need home construction loan. Getting your loan approved is a part of arranging your future cash flows.

But here it is essential to remember that, banks will not give you any lump-sum to start the construction of home. The construction must start from the borrowers funds. Loan money will come next.

When loan money will be released? After the construction work is complete till foundation or lintel level (example).

3. Keeping The Documents Ready: For Loan Application

Following documents will be necessary to apply for home construction loan:

- Identity Proof:

- PAN/Aadhar/Passport/Voter Card etc.

- Address Proof:

- Permanent Residence: (Passport/Voter Card etc).

- Current Residence: (Aadhar/Utility Bill etc).

- Income Proof:

- ITR/Form 16 of last 3 years.

- Bank Statement (6 months).

- Salary Slip (3 months).

- Balance Sheet/P&L account Certified (last 3 years).

- Property Documents

- Land’s Original Sale Deed on which one intends to construct home.

- Proof of Land Tax paid.

- Non Agriculture Land permission issued by district collector.

- Property Register Card issued in name of loan applicants.

- Search and title report.

- Proof of tax paid under Urban Land Ceiling Act.

- Sanctioned Building Plan.

- Cost of construction of home as certified by a licensed architect.

- Permission of Corporation to build a home.

- Own contribution proof etc.

4. Application & Verification of Loan

Home construction loan application processes is explained in these 3 steps:

- Step 1 – Verification of loan applicant: Verification is done by the bank. On basis of architectural plan developed by the architect, one knows the fund (cash flow) requirement. At this stage one can approach the bank for loan. The bank will check the persons affordability based on the submitted income proof documents & his/her credit rating. They will also judge whether the requirement is authentic and trust worthy.

- Step 2 – Techno-Legal Verification: Tech: The authenticity of request is verified. It will start with cross-verification of property valuation. This is important as this property is going to kept as a mortgage against the loan. Legal: Legal verification is done by a nominated lawyer of the bank. The lawyer will check if the property documents are authentic and reliable. The objective of doing this is, in case of need, when bank wants to auction the property, at that time they should not face any legal problems. Techno-legal verification is done to ensure that if the mortgaged property (when ready) will be enough to secure the loan for the bank.

- Step 3 – Loan Approval: A final approval letter will be issued to the borrower after legal and technical verification is complete. But no loan will be disbursed yet. The milestones for the instalments release will be mentioned in the loan agreement papers. Borrower must double check this clause before signing on the fine print.

Other points about Home Construction Loan

There are few aspects of home construction loan in India which the borrower must be aware of.

Few such points are discussed in brief here:

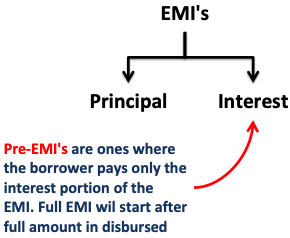

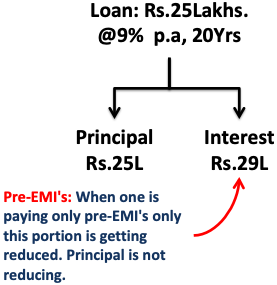

(a). About Pre-EMIs

As we have seen, loan disbursal is not done in one lot. It happens in stages. Till the full loan amount is paid by the bank, they charge only the Pre-EMI’s.

It means, the borrower is paying a slightly smaller EMI. The EMI is smaller in two ways:

- Amount Disbursed: EMI will be calculated on the portion of amount disbursed till date, not on the total approved amount.

- Interest Portion: Here the borrower pays only the interest portion of the EMIs. Full EMI will start after full amount is disbursed.

In a way this is a good thing for the borrower. But there is a slight downside to it as well. Pre-EMI’s do not reduce the loan’s principal component. Read more: Should you pay home loan early?

(b). About Income Tax Deduction

As a rule, EMI’s paid on home construction loan is valid for income tax deduction u/s 80C (principal portion) and u/s 24 (interest portion).

But there are layers of detail one must remember about the applicable tax deduction:

- Full Tax Deduction: What is full deduction? Deduction u/s 80C plus 24. Till the construction of house property is finished, deduction are allowed under section 24.

- Cannot Claim Deduction: Till the construction of property is finished, one cannot claim tax deduction neither u/s 80C or 24.

- EMI’s Paid Till Last Day of Construction: One can claim the tax deduction on the Pre-EMI’s paid (u/s 24 – till construction was in progress). But for this, one has to wait for the construction to get over. Once the construction is over, aggregate the total payment made. The deduction of full amount is allowed under five equal instalments (means distributed for next five years).

- Principal Paid During Construction Years: No tax deduction can be availed on this portion of the EMI.

Maximum Tax Deduction allowed under the two sections:

- (1) U/s 24 – Rs.150,000 in a FY (for the interest paid).

- (2) U/s 80c – Rs 100,000 in a FY (for the principal paid) in a financial year.

(c). Sticking To The Approved Plan & Schedule

It is important for the borrower to stick to the approved house plan during the tenure of construction.

Bank will accept any alterations to the approved building plan. They may even stop the loan disbursal.

It is also important to complete the project on schedule. If there are unjustified delays, banks will stop the loan disbursal.

What is the problem if loan disbursal stops? As a borrower, you will continue paying the pre-EMI’s. It will be a cost to the borrower which is reaping no benefits (delayed project, no tax benefits etc).

(d). Which Banks Offer Home Construction Loans in India?

Following banks (or finance companies) can offer home construction loans:

- PNB Housing: Check here.

- Bajaj Finserv: Check here.

- DHFL: Check here.

- ICICI Bank: Check here

- etc.

These banks offer home construction loans based on 1 Year MCLR (Marginal Cost of Lending) rates.

Interest Rate = 1 Year MCLR + Mark-up

At present MCLR rates for the four tenor of loans are as below:

| SL | Loan Tenure | MCLR |

| 1 | Overnight | 7.85% |

| 2 | 1 Month | 7.95% |

| 3 | 3 Month | 8.05% |

| 4 | 6 Month | 8.20% |

| 5 | 1 Year | 8.30% |

The Market-ups charged by various banks (over 1Y MCLR) are as below:

| SL | Banks | Mark-Ups |

| 1 | Axis Bank | 0.25% |

| 2 | HDFC Bank | 0% |

| 3 | ICICI Bank | 0.30% |

| 4 | SBI | 0.25% |

| 5 | PNB | 0.05% |

Thank you for sharing the informative article.

Is there any bank which gives for foundation cost as well ?? And what if we are doing for rent purpose

“Home Consruction Loans are the Loans for the purpose of self-construction of a residential house property. This is a unique offering for customers who already have land owned by them and need funds for financing the construction of the residential house property on the land. I never knew home construction loans and traditional home loans are different. I would recommend this blog to anyone looking for a home loan. It consists of all the necessary information like Pre-EMI’s, income tax deductions etc. Once you reach this blog, consider your research done. I am very confident that I can rely on this blog and prepare for a home loan.

“

would you write blog on loan for plot purchase and (loan for plot purchase and construction of house)

Hi,

Home construction loan interest is same or differs from different banks?

It differs

Hi Mani,

I read your blog about home construction Loan.

its nicely explained you did great job we liked it.

I am not sure whether is this the appropriate way to contact you about query. The query is related to home loan construction as per your explanation we understood about the loan process. But one point it does not clear that when I approach to the bank asking for home construction loan all banks are saying i need to complete the foundation first, bring the construction up to ground level then bank will process for the loan ..

So i am surprise if we have money to do foundation then what else is remain maximum cost if required for foundation only so whats is the use of bank loan. Could you please explain of guide how i can get home construction loan from the beginning ?

Regards,

G

Hi, thanks for your query.

Disbursement in case of “construction loans” happens in instalments. The loan will be paid on basis of progress of work.