Recently, I got a query from one of my young reader (in 20s). The question says: “I have heard that ROE and ROCE are important metrics for evaluating stocks. But do they really influence long-term stock returns? If I look at last 10-year period, will it prove that high ROE and high ROCE stocks generate better returns? Please explain to me, how can these metrics help me identify the right stocks for long-term investment?”

In this blog post, I’ll share the detail answer that I emailed to the reader. Actually, even while I was drafting the reply, I was sure that I’ll publish this reply as a blog. I asked for the permission of the enquirer that if I can share my answer with my other blog readers, and he agreed (though the name is withheld). I think, every stock investor (especially beginners) can benefit from this blog post.

Introduction

So, you’re in your mid-20s, maybe just starting to get serious about investing. You’re hearing all these fancy terms thrown around – ROE, ROCE, blah blah blah. I get it, it can feel like learning a new language. As you have asked, let’s break down two of these terms. I’ll share my two cents on whether these can actually make a real difference to your long-term wealth building from stocks.

We’re talking about Return on Equity (ROE) and Return on Capital Employed (ROCE). Suggested Reading: A combination of ROCE and EPS growth to identify growth stocks.

Sounds complicated, right? Don’t worry, it’s not rocket science.

Think of it this way: if you’ll ever lend money to a friend, you’d wanna know how well he is using it and how much return he is getting in return, correct? Well, ROE and ROCE are kind of like that for companies.

Companies and stock analysts use these metrics to build a perspective about the profitability of business. These metrics can tell you how well a company is using its money (your investment) to make profits.

Why 10 Years is the Magic Number

Now, why are we talking about 10-year returns?

Well, short-term stock movements are like the weather, unpredictable. If you’re serious about growing your wealth, you need to be thinking long-term.

Think of investing like planting a tree. It takes time to grow, but it’s worth the wait.

Like this tree analogy, we also want to find businesses that can grow strong roots over the long haul. ROE and ROCE are great indicators of that.

ROE: How Good is the Company at Using Your Money?

ROE basically tells you how much profit a company is making from the money that shareholders (like you and me) have put into it.

If a company has a high ROE, it means they are really good at turning your investment into profits. For example, let’s say a company has a ROE of 20%. That means for every Rs.100 of shareholders’ money they use, they generate Rs.20 in net profit.

Awesome, right? This sounds like a magic machine that is compounding your money.

Now, I need to be honest.

A high ROE doesn’t automatically make a company a good investment.

Imagine a company that is borrowing a ton of money to boost its ROE.

That’s like you borrowing from all your friends to show off that you have lot of money, and you know it isn’t sustainable. It works for a while but you are at risk of defaulting on your commitments.

Similarly, highly debt dependent company can be at a huge risk when the economy turns down. If you want to know about the advantages and disadvantages of debt for companies, read it here.

ROCE: How Efficiently are They Using All Their Money?

ROCE goes a step further.

It looks at how well a company is using all its money – both the shareholder’s money (total equity) and the money they’ve borrowed (total debt).

It’s a better measure of efficiency, especially for companies that need a lot of investment to run their business, like factories or utility companies. ROE and ROCE numbers of capital intensive businesses like companies in sectors like oil & gas, steel, cement, automobile, chemical, engineering & construction, etc can say a lot about their profitability.

Think about a big manufacturing company. If their ROCE is consistently high, it means they are making good use of all that equipment and all the money they’ve borrowed to invest in it. They’re probably going to be more successful in the long run and that will eventually reflect in their stock returns.

[Note: Important is to note the long term ROCE pattern of stocks and not only on one year data]

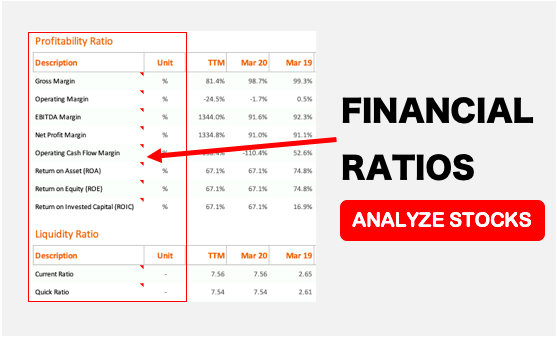

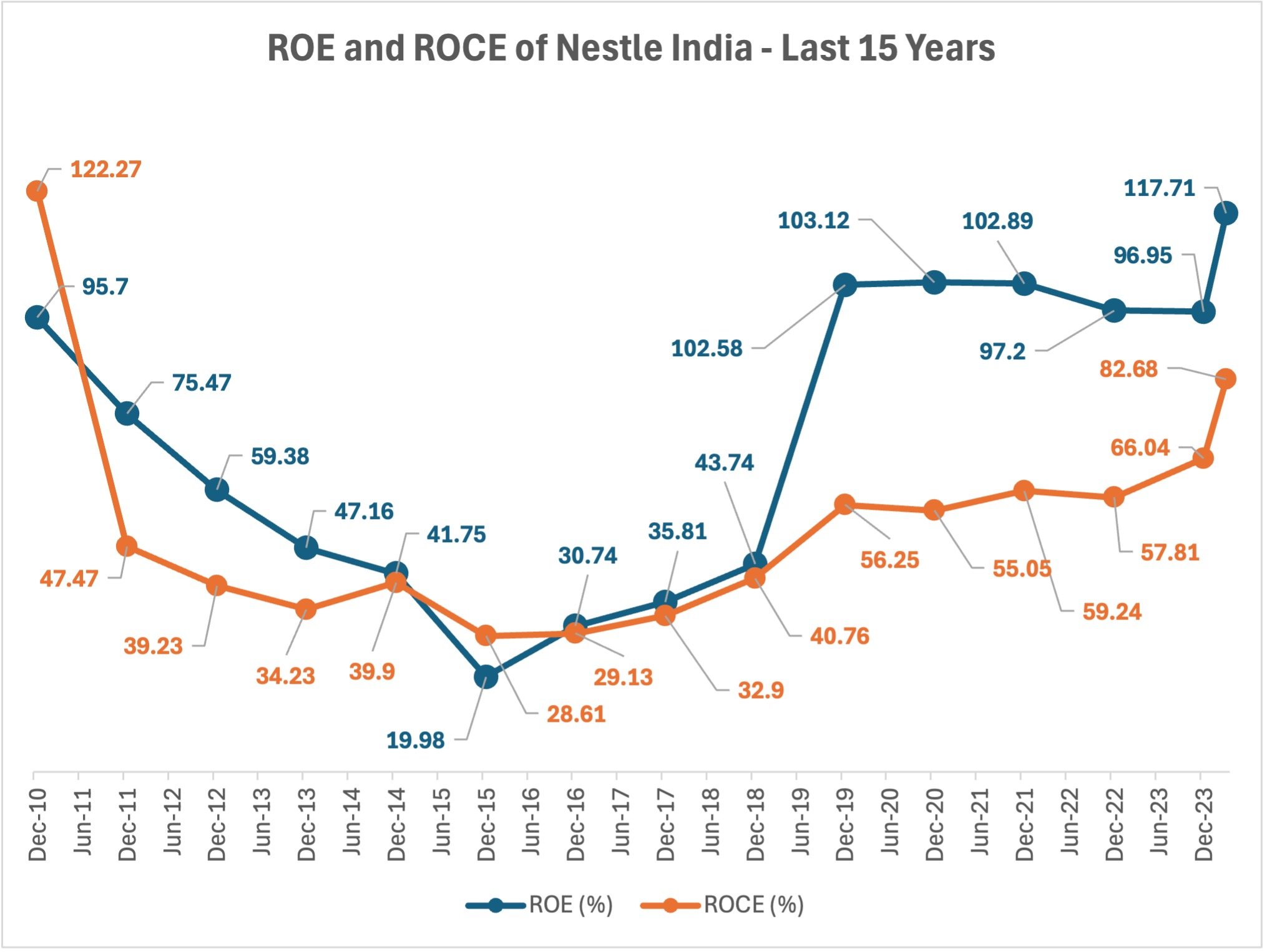

Here is how a long-term ROE and ROCE chart of a company looks like. This chart is of a high ROE/ROCE company (Nestle India). In the last 15 years, its average ROE is 71% and average ROCE is 52%.

The Real Deal

It’s Not Just About the Numbers

Here’s the thing that many people tend to forget: ROE and ROCE are not magic numbers.

They are good starting points to understand the business but they are not the whole story. A company can have high ROE and ROCE, but if it’s in a dying industry, or if they’ve got no more room to grow, they probably won’t generate great long-term returns.

These numbers need to be seen in context of future growth prospects and not in isolation.

Consider this: a model company with 70% ROE and 52% ROCE sounds amazing, right? Now if that company is operating in a sector that is booming (like renewable energy) and they reinvest their profits, there is a great chance it will grow exponentially.

It will also drive your share price.

However, a company with a similar ROE and ROCE in a saturated industry, might not grow as much because they don’t have that many options to reinvest in. Take the case of the FMCG sector, sectors like these are very profitable, but they generally grow at a pace of the country’s GDP. But, if a country’s population is experiencing an expansion of its per-capita income, the same FMCG companies can greatly benefit from it.

If you want to know about the future potential Food & Beverage industry of India, you can read this article.

Consistency is King (and Queen)

Also, it’s not just about the number, it’s about the consistency of the number.

Companies that swing wildly from high to low ROE and ROCE can be a bit of a rollercoaster ride.

You want to look for companies that steadily and consistently do well, even during bad times.

These are often companies with a “moat”, like a strong brand, cost advantage, or patented technology.

My Perspective

From what I’ve seen over my years, the best long-term investments come from companies that consistently deliver high ROE and ROCE.

The company must also be able to reinvest those profits at similar rates of return. I think the concept of Sustainable Growth Rate(SGR) is a related concept, read about it here.

I’ve noticed that market leaders in India, in sectors like FMCG, pharma, and IT, consistently demonstrate how these metrics can lead to awesome long-term gains.

But be careful! Don’t fall for companies with just one-off gains trying to look amazing for that one year. Dig deeper and see how they perform over long periods, check the business model, and identify their long-term strategy.

What This Means for You

For all those who are just starting, it’s all about finding companies with solid fundamentals, sustainable profits, and a track record. You must be looking for companies who consistently post high ROE and ROCE numbers.

Don’t get caught up in short-term hype. Focus on quality businesses that are in it for the long haul.

So there you have it. ROE and ROCE are valuable tools, but use them wisely. They are just one part of the puzzle to finding those fantastic long-term investments.

Here are a list of stocks whose long term returns have been north of 20%. Check their ROE and ROCE numbers:

| SL | Name | ROE | ROCE | 10Y CAGR (Returns) |

|---|---|---|---|---|

| 1 | JSW Steel | 11.80% | 13.30% | 25.93% |

| 2 | Divi's Laboratories | 12.20% | 16.50% | 21.63% |

| 3 | Elecon Engineering C | 24.50% | 31.30% | 38.36% |

| 4 | Tanla Platforms | 31.70% | 38.30% | 45.90% |

| 5 | Maharashtra Seamless | 18.10% | 22.90% | 22.47% |

| 6 | Jyoti Resins & Adhes | 49.30% | 65.90% | 78.24% |

What does it mean? high ROE and ROCE stocks generally do well in long term. But you can see, there are a couple of high-return stocks in the list whose ROE and ROCE numbers are not high.

So this explains that only profitability is not enough, the scope of future growth in business is also a vital return-generating factor.

Happy investing! Let me know in the comments if you have questions, and I’ll do my best to help out.