Hey everyone, and welcome back to my new blog post. I recently received an email from a reader asking, “If more people buy units of a mutual fund, does that push the NAV higher?” It’s an intriguing question, and it’s something a lot of investors wonder about. So today, through this blog post, we’ll be diving deep to declutter this idea and explore how demand for mutual fund units affects their NAV.

But before that, we must first know the basics.

Table of Contents

Mutual funds, simply put, are like a big purse where many people put their money together. This pooled money is then used by the fund manager to buy stocks (in case of pure equity funds). For other types of mutual funds, the fund manager may use the funds to also buy bonds, gold ETFs, or other assets.

When we invest in a mutual fund, we buy “units,” and the price of each unit is called the Net Asset Value, or NAV.

In this blog post we’ll discuss if purchasing new units can effect the NAV of a mutual fund or now. There are two answers to it, one is a theoretical and other is a practical answer. Both gives the opposite conclusions. This is where it gets interesting and I thought to blog about it.

1. What is NAV in Mutual Funds?

NAV represents the per-unit value of a mutual fund scheme. It is calculated as:

NAV = (Total Assets – Total Liabilities) / Number of Outstanding Units

Let’s break this down:

- Total Assets: This is the total value of all the stocks, bonds, cash, and other assets the mutual fund owns.

- Total Liabilities: This includes any expenses the fund owes, like management fees.

- Outstanding Units: This is the total number of units held by all investors in the fund.

So, the NAV is basically a reflection of how much the underlying assets of the mutual fund are worth at any given time, minus the fund’s liabilities, divided by the number of units.

When the value of the underlying stocks of the fund (assets) goes up, the NAV also goes up.

To simplify, NAV is the price at which you buy or sell mutual fund units. For example, if the NAV is Rs.100, you pay Rs.100 per unit when investing in that mutual fund scheme.

Before we get into the effect of new investments on a mutual fund’s NAV, we must know what drives the NAV of funds.

2. Key Drivers of NAV Movement

The NAV of a mutual fund fluctuates daily. Here are the primary factors that influence its movement:

- Market Movements of Underlying Assets: Mutual funds invest in stocks, bonds, or other securities. If the prices of these assets rise, the total asset value increases, pushing the NAV higher. Conversely, a fall in asset prices lowers the NAV.

- Dividends and Interest Income: Mutual funds earn income from dividends (in equity funds) and interest (in debt funds). This income adds to the total asset value, increasing the NAV.

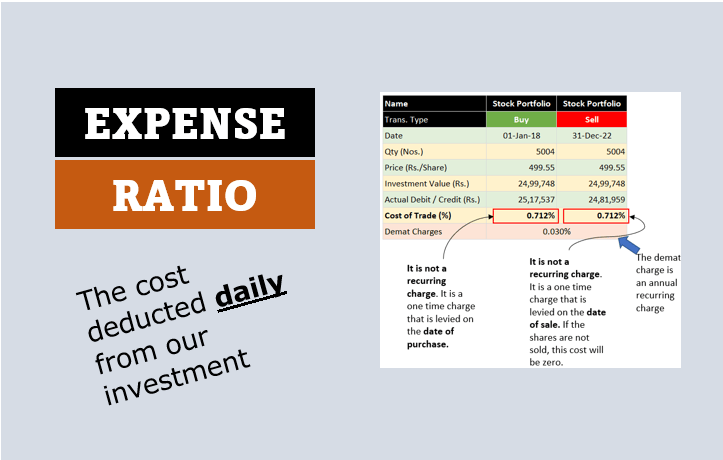

- Expenses Deducted by the Fund: Mutual funds charge fees like fund management and administrative costs. These expenses reduce the NAV. To know more about how mutual funds charge expense ratio, read this article.

- Inflow or Outflow of Investments: When investors buy units, the fund receives more money to invest in assets. Conversely, redemptions mean the fund needs to sell assets, potentially impacting NAV.

Suggested Reading: Story of my uncle which declutters how hidden costs impacts our returns from mutual funds.

3. Does Your Investment Affect NAV? [Theoretical Scenario]

When you invest in a mutual fund, your money is used to purchase units at the prevailing NAV. This is an important understanding, just keep it in your mind.

Let’s illustrate this with an example:

Example:

- Current NAV: Rs.100

- Total Assets of the Scheme (AUM): Rs.1 crore

- Number of Outstanding Units: 1 lakh

You invest Rs.20,000 in this mutual fund.

- The number of units allotted to you = Rs.20,000 / Rs.100 = 200 units.

- The fund’s total assets now increase to Rs.1,00,20,000.

- Simultaneously, the number of outstanding units rises to 1,00,200.

Using the NAV formula:

New NAV = Total Assets / Number of Outstanding Units = Rs.1,00,20,000 / 1,00,200 = Rs.100

Hence, your investment does not change the NAV when done at the current NAV. If we see a particular investment in isolation, it will show that the NAV will not change when me and you will buy new units. But this is not how the mutual funds actually work.

So, we must read another example, which is more practical to get a real sense of whether NAV gets effected due to new funds flows into the mutual funds schemes.

But before, let me describe to you how mutual funds work. It is an essential understanding, so be with me please.

4. How Mutual Fund Investments Work

How does our money actually get used in the market?

When we invest in a mutual fund, the fund manager doesn’t immediately rush out and buy stocks the moment they receive our money.

They typically deploy the funds in a phased manner, called ‘tranches’.

Here’s how it generally works:

- Pooling of Funds: The mutual fund gathers all the money from investors like you and me. We can choose to invest in SIPs or a through a lump-sum amount.

- Tranche Investments: The fund manager then deploys this money into the market in multiple steps, or ‘tranches’. This is a smart move. It means that they don’t buy all the stocks at once and potentially move the market price. They do it step by step.

- Liquidity: The fund also keeps a certain amount of cash on hand, to meet redemption requests or to pounce on opportunities.

The fund manager uses the funds to buy a variety of stocks (not just one stock). They also deploy the accumulated funds to buy other assets based on the theme of the mutual fund scheme.

Why this understanding is essential for us? It is because, we must know that all our monies does not get invested in one go. Just remember this fact and you will understand the significance of it in the next section.

5. What Happens When Investment is in Tranches? [Practical Scenario]

Recall back our example as explained in the section #3 above.

Now, consider another scenario where the same Rs.20,000 is invested in 5 tranches of Rs.4,000 each over 5 days.

The fund house deploys this money to buy stocks in the portfolio. Buying these stocks increases their demand, potentially raising their prices.

Let’s examine how this impacts NAV:

- First Tranche: Rs.4,000 invested at NAV of Rs.100. The fund buys stocks, slightly increasing their prices. NAV may rise to Rs.100.10.

- Second Tranche: Rs.4,000 invested at NAV of Rs.100.10. The fund repeats the purchase, causing another marginal rise. NAV increases to Rs.100.20.

This sequence continues, and by the end of all tranches, the NAV could rise slightly due to the market impact of bulk purchases.

So in this example, we can understand how our investments cab indirectly effect the mutual fund’s NAV.

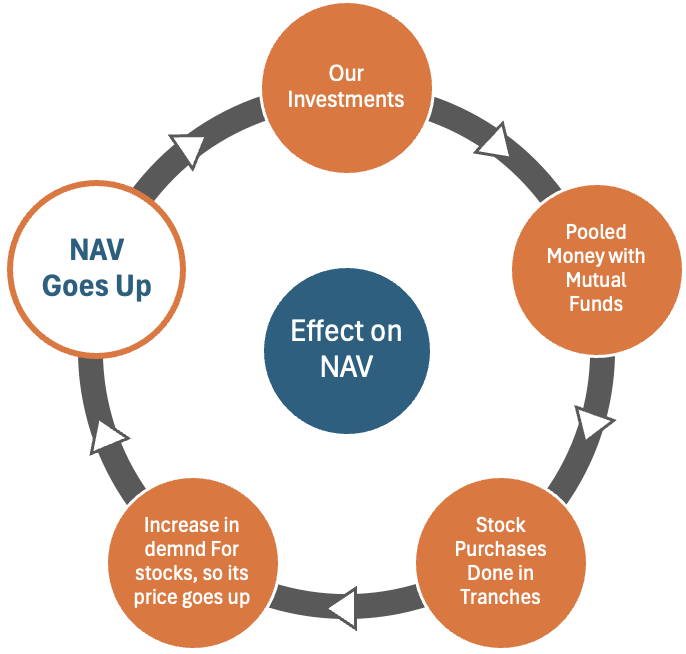

Also, remember that, everyday popular mutual fund schemes can receive money worth several crores from investors like us. So, the cycle shown in the above flow chart is for a day’s pooled money, imagine repeating the same cycle day-after day (24×7) for months and years together.

Hence, it is a fact that when DIIs (mutual funds) start buying or selling stocks, the it creates a momentum for the whole stock market. So its only logical to assume that our investments or redemptions in mutual funds schemes can actually effect the NAV.

But I’ll like to dig a bit deeper. Mutual Fund’s (DIIs) Buying cannot always cause the stock price to go up. How?

Here is the explanation…read further.

6. Does Buying Stocks Always Increase Their Prices?

It’s true that large purchases of stocks can create upward pressure on their prices.

However, the extent of this impact depends on the following:

- Stock Liquidity: If a mutual fund buys a large-cap stock like Reliance or TCS, the impact on the stock price might be minimal. Why? Because these stocks are very liquid and traded in huge quantities. However, if the fund buys a small-cap stock, the price can jump up noticeably. Why? Because smaller companies’ stocks are not traded as heavily. Their supply is limited, and a big purchase can push up the price (read this example).

- Market Conditions: In a volatile market, even a smaller trade might cause a more significant price change. In a stable market, the price changes will be less pronounced

- Volume of Purchase: The size of the trade matters. A big fund buying a large chunk of a stock will have a greater impact than a small fund making a small purchase.

6.1 Example:

Imagine a mutual fund manager has Rs.100 crores to invest.

If they decide to buy Reliance stocks, the price might not move much. Why? Consider the following two facts about Reliance:

- Market Capitalization: Well, Reliance has a massive market capitalization of about Rs.16,87,000 crores. It means, the total value of all its outstanding shares is enormous.

- Trading Volume: Also, on an average a whopping Rs.1,774.23 crores worth of Reliance stock is traded daily on the stock exchanges.

So, compared to the overall market cap and the daily trading volume, the fund’s Rs.100 crore purchase is relatively small. It’s like trying to make a ripple in the ocean. The impact is negligible.

However, if that same fund manager were to buy stocks of a small company with a much lower market cap and significantly lower trading volume, their Rs.100 crore investment would have a much bigger impact. Simply because there aren’t as many shares changing hands daily and it would create a large buying pressure.

The increase in price will result in a rise in the NAV of the fund. Though it will also matter that what is the weight of the stock in the mutual funds portfolio mix. A stock whose weight in the scheme’s portfolio is say only 0.15%, in this case even a 20% change in the stock’s price will not effect the NAV much. If you want to know which stocks have large weights in the Nifty, read here.

Conclusion

Will NAV Always Rise with New Investments?

Not necessarily. Here are two scenarios:

- Neutral Scenario: If the additional money received by the fund is not immediately invested, the NAV remains unchanged.

- Adverse Scenario: Suppose the fund uses new investments to buy stocks during a market downturn. Even after purchasing, the stock prices may continue falling, causing the NAV to decline.

As an investor, don’t worry too much about short-term NAV fluctuations caused by new investments.

We must focus on the fund’s overall portfolio quality and long-term performance.

NAV changes due to market conditions and fund strategy are more significant than the impact of individual investments.

Final Thoughts

So, does higher demand for mutual fund units push its NAV up?

Well, it’s not that simple.

While mutual funds buying stocks can definitely increase demand and push up the stock prices, this doesn’t directly translate into a huge surge in NAV. Just because we are buying more units, NAV will not go up.

The impact on NAV depends on several factors like:

- The stock’s liquidity,

- The size of the trade,

- Market conditions and

- How fund manager deploys the money through tranches.

The NAV changes is more of a reflection of the prices of the underlying stocks in the fund.

As an investor, we must remember to focus on our long-term goals rather than stressing too much about short-term NAV fluctuations. Our goal should be to pick mutual funds that align with our investment strategy and time horizon, not just the current NAV.

Happy investing, everyone! And let me know if you have more questions in the comments below.