Let’s talk about something on which I’ve been researching for a while now. It is a new idea of investment. For so long, hasn’t it felt like we’ve been chasing numbers, returns, and growth, often at the expense of, well, everything else? We see the news about the climate disasters, the widening inequalities, etc. It’s hard not to feel like the traditional financial system is also contributing to these problems. To solve it, one must think out of the box. It’s like that old saying, “You can’t solve a problem with the same thinking that created it.” That’s where Regenerative Finance (ReFi) comes in.

I stumbled upon ReFi a few months ago, and honestly, it felt like a deja vu moment.

It was like remembering something I already knew deep down. Wise people often say, the true wealth isn’t just about money. While investing, we must also think about the health of our planet, the strength of our communities, and the well-being of future generations.

It is something that is ingrained in the culture of humanity. Our ancestors thought of the future and that has been passed down to us as well.

Regenerative Finance (ReFi), at its core, is a completely new way of thinking about finance. It’s a shift from simply trying to sustain the current system. This form of investing is way to actively regenerate what’s been lost or damaged.

It’s about investing in a future where both our portfolios and our planet thrive.

Table of Contents

- 1. What The Purpose of Regenerative Finance (ReFi)

- 2. How Does It Work? The Pillars of Regenerative Finance (ReFi)

- 3. Examples of Regenerative Finance (ReFi)

- – Example #3.1: Regenerative Agriculture

- – Example #3.2: Community-Owned Renewable Energy Projects

- – Example #3.3: Conservation Finance Initiatives

- – Example #3.4: Impact Bonds for Social Enterprises

- 4. The Challenges Ahead

- Conclusion

1. What The Purpose of Regenerative Finance (ReFi)

Beyond “Do no harm” theory, it aims to actively Heal the world.

For years, we’ve been told that “sustainable investing” is the way to go. And don’t get me wrong, it’s definitely a step in the right direction. But sustainability is often about minimizing harm, reducing our footprint, and trying to maintain the status quo. Which is good, of course, but it’s not enough.

Imagine it in this way, consider a farmer whose land has been depleted by years of intensive agriculture. Sustainable farming practices might help him prevent further damage, but regenerative agriculture goes further. It focuses on rebuilding the soil, restoring biodiversity, and creating a thriving ecosystem. It’s about healing the land, making it more resilient, and ensuring that it can continue to support future generations.

Regenerative Finance (ReFi) takes the same approach to finance.

It’s not just about avoiding investments that are harmful to the environment or society; it’s about actively seeking out investments that restore and regenerate natural and social systems.

2. How Does It Work? The Pillars of Regenerative Finance (ReFi)

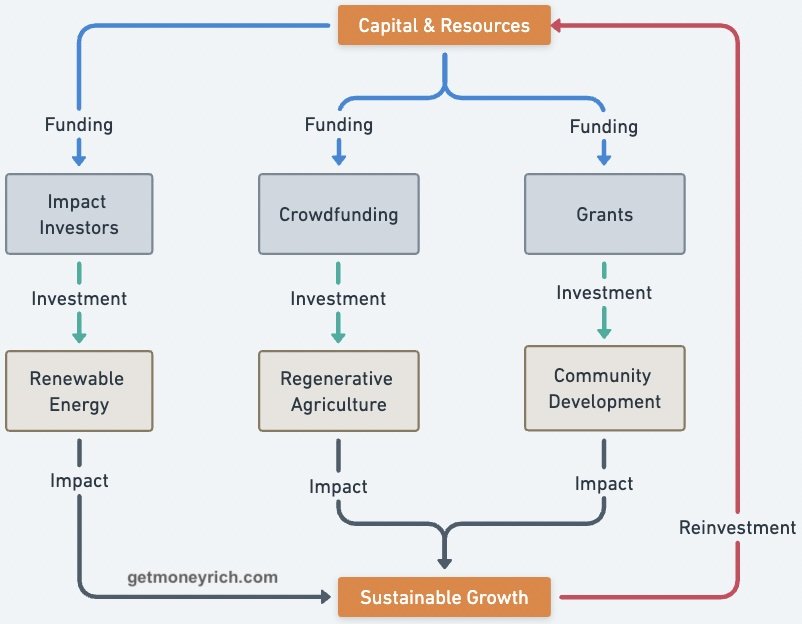

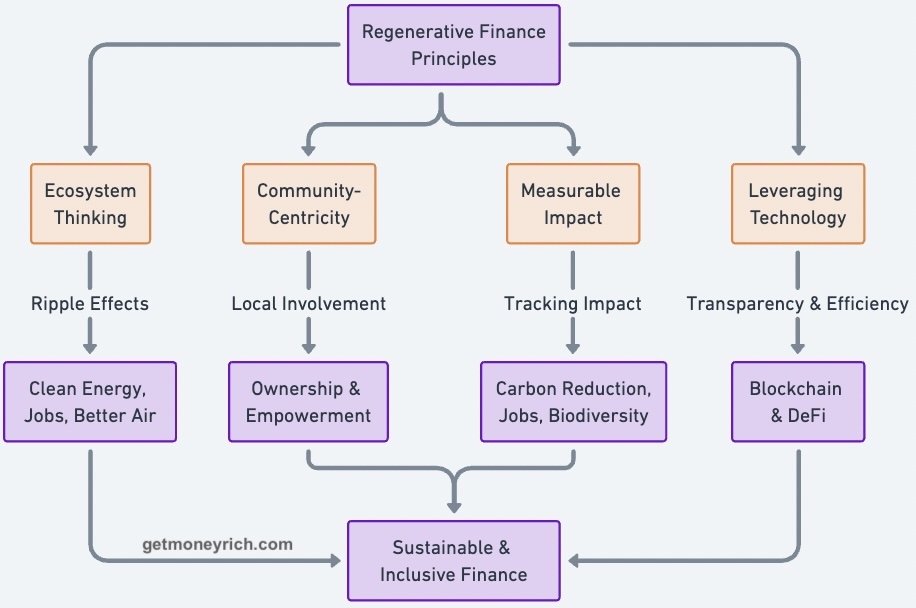

So, how does ReFi actually work in practice? Here are some of the key principles that underpin this approach:

- Ecosystem Thinking: ReFi encourages us to think about the interconnectedness of everything. It recognizes that our financial decisions have ripple effects that extend far beyond our individual portfolios. For example, when we invest in a renewable energy project, we’re not just generating clean electricity; we’re also reducing our reliance on fossil fuels. It creates jobs in local communities, and improving air quality.

- Community-Centricity: ReFi places a strong emphasis on involving local communities in the investment process. It recognizes that communities are the best stewards of their own resources and that they should have a say in how those resources are used. This can involve everything from consulting with community members before making an investment to giving them a direct stake in the project. Imagine a village collectively investing in a solar power plant. What they get in return? Clean energy and a sense of ownership and empowerment.

- Measurable Impact: ReFi emphasizes the importance of tracking and measuring the social and environmental impact of investments. This goes beyond traditional financial metrics like ROI. Instead, it includes factors like carbon emissions reduced, biodiversity restored, jobs created, and improvements in community well-being. These days, there is a technology available to measure this efficiently.

- Leveraging Technology: ReFi increasingly utilizes technologies like blockchain and decentralized finance (DeFi) to increase transparency, reduce costs. It is done to create new opportunities for impact investing. For example, blockchain can be used to track the flow of funds and ensure that they are being used for their intended purpose. DeFi can be used to create new financial instruments that are specifically designed to support regenerative projects.

3. Examples of Regenerative Finance (ReFi)

The truly exciting part about Regenerative Finance is that it’s not just an abstract idea floating around in academic circles. It’s actively being implemented and refined in various corners of the world, demonstrating the potential for a more conscious and impactful approach to investment. Here are a few examples that have particularly caught my eye, showcasing the diversity and innovation within the ReFi space:

Example #3.1: Regenerative Agriculture

Imagine farmland not just as a place to grow crops, but as a living ecosystem capable of drawing down carbon from the atmosphere, improving water cycles, and enhancing biodiversity. That’s the core idea behind regenerative agriculture.

It’s attracting significant investment through specialized funds.These funds seek out and invest in farms and ranches committed to practices the following agricultural methods:

- No-till farming (avoiding plowing, which disturbs the soil),

- Cover cropping (planting diverse crops to protect and enrich the soil),

- Rotational grazing (managing livestock to improve pasture health), and

- Composting (recycling organic waste into valuable soil amendments).

For instance, a fund might invest in an organic farm in Maharashtra that is transitioning to no-till farming. The fund provides the capital for new equipment and training. In return, it receives a share of the increased profits generated by the farm as soil health improves and yields increase.

What I find fascinating is that these funds aren’t just focused on maximizing short-term profits. They’re investing in the long-term health and resilience of the land. Recognizing that healthy soil is the foundation for a sustainable food system and a stable climate is their focus.

They often measure their impact not just in financial returns but also in metrics like tons of carbon sequestered per hectare, increases in soil organic matter, and improvements in water infiltration rates.

Example #3.2: Community-Owned Renewable Energy Projects

For too long, energy production has been dominated by large corporations. It is often done at the expense of local communities and the environment.

Community-owned renewable energy projects offer an alternative model, putting the power – literally and figuratively – back in the hands of the people. These projects typically involve local residents collectively investing in solar, wind, or hydro power facilities that are owned and operated by the community itself.

Think of a small village in Rajasthan coming together to build a solar microgrid. The initial investment might be financed through a combination of community contributions, government grants, and impact investments. The electricity generated by the solar panels is then sold to local households and businesses, providing them with clean, affordable energy.

The profits from the sale of electricity are used to maintain the system, pay back investors, and support other community development projects. These types of projects are so impactful because it also encourages other small businesses in these communities to come up.

What I love about these projects is that they create a sense of ownership and empowerment within the community.

Example #3.3: Conservation Finance Initiatives

For decades, conservation efforts have relied primarily on philanthropy and government funding. But these sources are often insufficient to meet the growing challenges of biodiversity loss and ecosystem degradation.

Conservation finance initiatives offer a new approach, using innovative financial mechanisms to generate revenue from the protection and restoration of natural ecosystems.

- One example is the use of “forest bonds,” which are issued to finance reforestation and sustainable forest management projects. Investors receive a return on their investment based on the value of the ecosystem services provided by the forest, such as carbon sequestration, water purification, and biodiversity conservation.

- Another example is the creation of “biodiversity credits,” which can be sold to companies that are seeking to offset their impact on biodiversity. Think of a project in the Sundarbans, where mangrove restoration is financed through the sale of carbon credits and ecotourism revenues.

These initiatives demonstrate that nature has real economic value and that it can be a source of sustainable income for local communities. These also create jobs for the people living in the forests.

Example #3.4: Impact Bonds for Social Enterprises

Social enterprises are businesses that are designed to address pressing social problems. The problems can be like poverty, inequality, and lack of access to healthcare. But these enterprises often struggle to access the capital they need to scale their operations.

Impact bonds offer a new way to finance social enterprises, linking funding to the achievement of specific social outcomes. An impact bond typically involves a government agency or philanthropic organization contracting with a social enterprise to deliver a specific social service.

Investors provide upfront capital to the social enterprise, and the government or philanthropic organization agrees to repay the investors if the social enterprise achieves the agreed-upon outcomes.

For example, an impact bond might be used to finance a program that provides job training to unemployed youth from disadvantaged backgrounds. If the program succeeds in placing a certain percentage of participants in jobs, the investors receive a return on their investment.

An example of this are “Skill India” program. This promotes local talent and skill development and employment.

What’s so appealing about impact bonds is that they align the interests of all stakeholders.

4. The Challenges Ahead

Let’s also look at the realistic perspective of Regenerative Finance (ReFi).

Now, I don’t want to paint an overly rosy picture. ReFi is still in its early stages, and there are definitely challenges to overcome.

- One of the biggest challenges is scalability. How do we take these small-scale, localized projects and scale them up to have a meaningful impact on the global economy?

- Another challenge is regulation. The current financial system is not designed to support ReFi. There’s a need for new regulations and policies that encourage regenerative investing.

- And, of course, there’s the challenge of educating investors about ReFi. Eduction is necessary to convince them that it’s not just a feel-good investment strategy, but a viable way to generate financial returns. While creating positive social and environmental impact, a monetary return is also possible.

Conclusion

Despite these challenges, I’m incredibly optimistic about the future of ReFi.

I believe that it represents a fundamental shift in the way we think about finance. It is a shift from a purely extractive model to a regenerative one.

It’s about recognizing that our financial decisions have real-world consequences and that we have the power to use our money to create a better future.

I’m not saying that ReFi is a magic bullet that will solve all of the world’s problems. But I do believe that it’s a crucial part of the solution. It’s a way to align our financial goals with our values and to invest in a future that we actually want to live in.

For me, it’s about contributing to something bigger than myself. For me, it is about leaving the world a little bit better than I found it. And I believe that ReFi offers a powerful way to do just that.

What are your thoughts? Does ReFi resonate with you? Share your views in the comments – I’m genuinely curious to hear what you think.

Have a happy investing.

![ROI Formulas: CAGR and XIRR, Meaning, Full Form, Use in Excel [Mutual Funds]](https://ourwealthinsights.com/wp-content/uploads/2018/04/How-to-measure-investment-returns-Image.jpg)