Coca-Cola (NYSE: KO) is one of the most well-known consumer beverage companies globally. With a market capitalization of $290.81 billion, the company has maintained its leadership in the non-alcoholic beverage industry for decades. However, a fundamental analysis is necessary to assess whether Coca-Cola is a strong long-term investment at its current price of $64.55 per share.

This report evaluates Coca-Cola’s financial health using its Profit & Loss Account, Balance Sheet, and Cash Flow Statements from the past four years (2020-2023). Additionally, we apply the Discounted Cash Flow (DCF) method to estimate its intrinsic value and determine whether the stock is overvalued or undervalued.

1. Revenue & Profitability Analysis

Coca-Cola has maintained stable revenue growth over the past four years:

| Year | Revenue ($ Billion) | Net Income ($ Billion) | Diluted EPS | Net Margin (%) |

|---|---|---|---|---|

| TTM | 46.36 | 10.41 | 2.41 | 22.4% |

| 2023 | 45.75 | 10.98 | 2.47 | 24.0% |

| 2022 | 43.00 | 9.54 | 2.19 | 22.2% |

| 2021 | 38.66 | 9.77 | 2.25 | 25.3% |

| 2020 | 33.01 | 7.75 | 1.79 | 23.5% |

| Growth (CAGR) | 7.84% | 6.78% | 6.83% | – |

Key Takeaways:

- Revenue grew at a CAGR of 7.84% from 2020 to FY24(TTM). It shown as decent post-pandemic recovery. Remember, these numbers must be viewed in terms of the US market.

- Net income improved, reaching $10.41 billion in FY24(TTM) from $7.75 in year 2021. It grew at a CAGR of 6.78% per annum.

- The EPS (Earning Per Share) of the company also grew at 6.83% per annum between 2020 and FY24 (TTM).

- Coca-Cola maintains a high net margin (~24%), reflecting strong pricing power and cost efficiency.

The company’s ability to sustain high margins despite inflationary pressures and currency fluctuations highlights its pricing power and brand strength.

To get a relative perspective of Coca cola company with respect to a similar Indian company, lets compare the numbers of Coca Cola with Varun Beverages (does bottling and distributed of Pepsi outside US).

| Year | Revenue (Rs.) | Net Profit (Rs.) | EPS | Net Margin (%) |

|---|---|---|---|---|

| 2024 | 20,128.92 | 2,594.63 | 7.67 | 12.89% |

| 2023 | 16,121.94 | 2,055.92 | 15.82 | 12.75% |

| 2022 | 13,211.99 | 1,497.43 | 23.05 | 11.33% |

| 2021 | 8,891.16 | 694.05 | 16.03 | 7.81% |

| 2020 | 6,487.11 | 329 | 11.4 | 5.07% |

| Growth (CAGR) | 28.61% | 58.24% | -8.43% | – |

What distinguishes Varun Beverages (India) from Coca Cola (US) are the four key factors.

- On one side (Positive), Varun Beverages of India has shown a stellar growth of 28.61% in revenue and 58.24% in net profit. In the similar period, the revenue and net profit growth of Coca Coal was only 7.85% and 6.78% respectively.

- On the other side (Negative), Varun Beverages of India has shown a negative EPS growth of -8.43% as compared to a positive grown of 6.85% of Coca-Coal. In terms of Net Margins, Coca-Coal company is much more profitable at about 24% compared to about 10% for Varun Beverages.

There are a set of pros and cons of Varun Beverage. These factors should have an influence on valuation on the valuation of these stocks. For me personally, factors like a negative EPS growth and low net margin should be a sure P/E deflator. But a strong revenue and profit growth works as an even better P/E inflation. See what is the result:

| Name | P/E | Revenue Growth (%) | Profit Growth (%) | EPS Growth (%) | Net Margin (%) |

|---|---|---|---|---|---|

| Coca Cola | 27.48 | 7.84% | 6.78% | 6.83% | 24% |

| Varun Beverage | 69.50 | 28.61% | 58.24% | -8.43% | 10% |

2. Balance Sheet Strength

A strong balance sheet is essential for a company’s financial health. Let’s review Coca-Cola’s key financial position indicators:

| Year | Total Assets ($B) | Total Liabilities ($B) | Equity ($B) | Debt/Equity Ratio |

|---|---|---|---|---|

| 2023 | 93.43 | 66.58 | 26.85 | 2.48 |

| 2022 | 92.81 | 65.20 | 27.61 | 2.36 |

| 2021 | 87.29 | 61.00 | 26.29 | 2.32 |

| 2020 | 86.38 | 62.00 | 24.38 | 2.54 |

Key Takeaways: Coca-Cola has a high debt-to-equity ratio (~2.5x), meaning it funds operations with significant debt. Assets have grown steadily, while equity has remained stable. The company’s leverage is high but manageable, given its consistent cash flows.

While Coca-Cola’s high debt levels may concern some investors, strong free cash flow generation ensures that debt obligations remain covered.

3. Cash Flow Strength

Free Cash Flow (FCF) is crucial for dividends, debt repayment, and expansion. Below is Coca-Cola’s FCF performance:

| Year | Operating Cash Flow ($B) | CAPEX ($B) | Free Cash Flow ($B) |

|---|---|---|---|

| 2023 | 12.40 | 2.65 | 9.75 |

| 2022 | 11.00 | 2.15 | 8.85 |

| 2021 | 10.50 | 1.85 | 8.65 |

| 2020 | 9.80 | 1.60 | 8.20 |

Key Takeaways: Coca-Cola generates over $9 billion in annual FCF, making it a cash-rich company. The company invests around $2-3 billion annually in capital expenditures (CAPEX). High FCF means Coca-Cola can comfortably pay dividends, repurchase shares, and service debt.

With strong FCF, the company can maintain and increase dividends, which is a key attraction for income-focused investors.

4. Valuation Analysis

We apply the Discounted Cash Flow (DCF) model to estimate Coca-Cola’s intrinsic value. Our assumptions:

- Free Cash Flow (FCF) Growth Rate: 4% (moderate scenario)

- Discount Rate (WACC): 8%

- Terminal Growth Rate: 2.5%

Step 4.1: Project Future Free Cash Flows (FCF)

We assume 4% annual growth for the FCF for the next 5 years. Given 2023 FCF = $9.75 billion, we use the below formula:

FCF(next year) = FCF(previous year) × (1 + growth rate)

| Year | FCF (Projected @4% Growth) |

|---|---|

| 2024 | 9.75 × 1.04 = 10.14 |

| 2025 | 10.14 × 1.04 = 10.55 |

| 2026 | 10.55 × 1.04 = 10.97 |

| 2027 | 10.97 × 1.04 = 11.41 |

| 2028 | 11.41 × 1.04 = 11.87 |

Step 4.2: Calculate Terminal Value (TV)

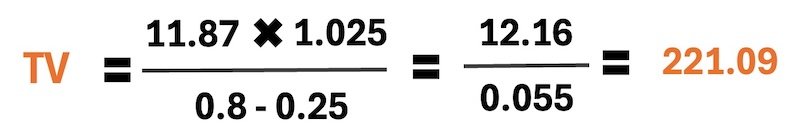

Using the Gordon Growth Model:

TV = FCF(last year) × (1+g) / (WACC−g)

where:

- g = 2.5% (0.025 terminal growth rate)

- WACC = 8% (0.08 discount rate)

- FCF(2028) = $11.87B

TV = 11.87 * 1.025 / (0.8 – 0.25) = 12.16 / 0.055 = 221.09

So, the calculated Terminal Value of Coca Cola company from year 2028 and beyond is $221.09 billion.

Step 4.3: Discount All Future Cash Flows to Present Value (PV)

Now, we discount all FCFs and TV using:PV=FCF(1+WACC)tPV = \frac{\text{FCF}}{(1+WACC)^t}PV=(1+WACC)tFCF

| Year | FCF (Billion) | Discount Factor (8%) | Present Value (PV) |

|---|---|---|---|

| 2024 | 10.14 | 1 / (1.08)^1 = 0.9259 | 10.14 × 0.9259 = 9.38 |

| 2025 | 10.55 | 1 / (1.08)^2 = 0.8573 | 10.55 × 0.8573 = 9.05 |

| 2026 | 10.97 | 1 / (1.08)^3 = 0.7938 | 10.97 × 0.7938 = 8.71 |

| 2027 | 11.41 | 1 / (1.08)^4 = 0.7350 | 11.41 × 0.7350 = 8.39 |

| 2028 | 11.87 | 1 / (1.08)^5 = 0.6806 | 11.87×0.6806 = 8.08 |

| Terminal Value | 221.09 | 1 / (1.08)^5 = 0.6806 | 221.09 × 0.6806 = 150.49 |

Step 4.4: Sum All Present Values of All Future Cash Flows

Enterprise Value = Sum of Present Values

Enterprise Value = 9.38 + 9.05 + 8.71 + 8.39 + 8.08 + 150.49 = 194.10 billion

Step 4.5: Find Intrinsic Value per Share

Now, we adjust for cash, debt, and outstanding shares:

- Market Cap: $290.81 billion

- Price / Share: $64.55

- Shares Outstanding: 4.5 billion (approximate)

Intrinsic value per share : Enterprise Value / Shares Outstanding = 194.10 / 4.5 = $43.13

Step 4.6 Comparison With Current Price

- Enterprise Value (EV) = $194.10 billion

- Shares Outstanding = ~4.5 billion

- Intrinsic Value per Share = $43.13

- Current Price = $64.55

Since the intrinsic value ($43.13) is lower than the current price ($64.55), Coca-Cola appears overvalued based on this DCF model.

Key Takeaways: Based on DCF analysis, Coca-Cola’s intrinsic value is $43.13, while the stock trades at $64.55. This suggests the stock is overvalued by ~50%. Investors buying at this price may not get exceptional returns unless growth exceeds expectations.

5. Risk Factors to Consider

Despite its strong fundamentals, Coca-Cola faces some risks:

- Declining Soda Consumption: Consumers are shifting toward healthier beverages, which could slow growth in carbonated soft drinks (CSD). However, Coca-Cola is expanding into water, tea, coffee, and energy drinks to mitigate this risk.

- High Debt Levels: With a Debt-to-Equity ratio of ~2.5x, Coca-Cola relies heavily on debt. Rising interest rates could increase borrowing costs, reducing net income.

- Currency Fluctuations: As a global company, Coca-Cola earns revenue in multiple currencies. A strong USD negatively impacts its international revenue and profit margins.

Conclusion

Coca-Cola remains a financially strong company with stable revenue growth, high profitability, and consistent free cash flow (~$9B annually). Its global brand power and strong dividend payouts make it a reliable choice for income-focused investors. However, at the current price of $64.55, our DCF analysis suggests the stock is slightly overvalued, with an intrinsic value of $43.13.

While long-term investors may prefer to wait for a pullback near $45-$50 for better value, dividend investors might still find Coca-Cola attractive due to its low beta (0.62) and stable payouts.

That said, risks such as declining soda consumption and high debt levels warrant careful consideration.

Would you like to compare relative valuation metrics (P/E, P/B) and D/E ratio of Coca-Cola with the Indian company called Varun Beverages (PepsiCo) for a broader perspective? Here is a quick comparison:

| Name | P/E | P/B | D/E |

|---|---|---|---|

| Coca Cola | 27.48 | 19.58 | 2.425 |

| Varun Beverage | 69.5 | 0.56 | 9.57 |

Have a happy investing.