We’re diving into a wild story that’s been buzzing around the markets. It is straight from the streets of Seoul to the trading floors of London. If you’ve been keeping an eye on Tesla lately (and who hasn’t?), you’ve probably noticed its stock has taken a nosedive. It is down 41% recently, leaving a trail of stunned investors in its wake. But here’s where it gets really juicy, a group of risk-loving South Korean investors, armed with leveraged bets, have been hit harder than most. And trust me, this tale is equal parts cautionary and fascinating.

So, grab your coffee, and let’s unpack what happened, why it matters, and what we can all learn from this rollercoaster ride. Whether you’re a seasoned trader or just someone who likes a good story about money, ambition, and a little bit of chaos, there is a takeaway for all of us.

The Tesla Obsession Meets Leverage Fever

Picture this, it’s late 2024, and Tesla’s stock is still the darling of the speculative crowd.

Elon Musk is tweeting up a storm, and investors everywhere are dreaming of electric cars and Mars colonies. Over in South Korea, though, the vibe is next-level.

Korean retail investors, known for their fearless approach to high-stakes bets, have latched onto something called the Leverage Shares 3x Tesla ETP.

This isn’t your average stock play. Oh no, this is a turbo-charged financial product listed in London that promises three times the daily return of Tesla’s stock price. Sounds thrilling, right? It’s like strapping a rocket booster to your portfolio.

And these folks weren’t just dabbling. According to data from three local brokerages, compiled by Bloomberg as of February 21, 2025, Korean investors owned over 90% of this ETP’s assets. That’s not a typo, it is actually 90%.

They were all in, betting big that Tesla’s upward trajectory would keep chugging along. For a while, it must’ve felt like pure adrenaline, small price jumps turning into massive wins thanks to that 3x multiplier.

But here’s the catch with leverage: it cuts both ways. When the tide turns, it doesn’t just sting, it slaughters.

The Crash That Shook Seoul

Fast forward to late Dec’2025 and early 2025, and Tesla’s stock starts to tank.

By February, it’s down 41% from its highs, and that 3x Tesla ETP? It’s lost more than 80% of its value since December. Eighty. Percent.

Let that sink in for a second. Imagine pouring your savings into something, watching it soar, and then, bam, seeing it evaporate faster than you can say “Elon.”

For these Korean investors, that’s not a hypothetical; it’s their reality.

I can’t help but wonder what was going through their minds as the numbers turned red. Were they glued to their screens, hoping for a miracle? Did they chalk it up to the game they signed up for? South Korea’s retail investors have a reputation for embracing risk. Think Bitcoin mania a few years back or piling into volatile local stocks.

But this Tesla debacle feels like a gut punch even by their standards.

- Local brokerage Mirae Asset Securities Co. saw the writing on the wall. Just last week, they announced they’re suspending orders for some of these overseas leveraged ETPs. They were waving a red flag at the potential for more carnage.

- Regulators, too, have been side-eyeing this swashbuckling style of investing for a while. It’s not hard to see why, when the losses pile up, it’s not just the investors who feel it; the ripple effects can rattle brokers and markets too.

Why Did They Go All In?

So, what drives a group of people to pile into something this risky?

Part of it is cultural. South Korean retail investors, often dubbed “ants” for their collective power, have a knack for chasing high-octane opportunities. They’ve turned day trading into an art form. Their risk appetite is fueled by fast internet, mobile apps, and a hunger for quick gains.

Tesla, with its larger-than-life CEO and cult-like following, was the perfect muse. Add in the allure of leverage, and it’s like handing a thrill-seeker a jetpack.

But there’s more to it than just bravado. For some, this might’ve been a shot at financial freedom in a country where economic pressures, like insane housing costs and job competition, loom large. Leverage amplifies hope as much as it does risk.

A small win could mean a big payout, a chance to leapfrog ahead. Problem is, when it flops, it’s not just a setback, it’s a knockout.

A Fun fact

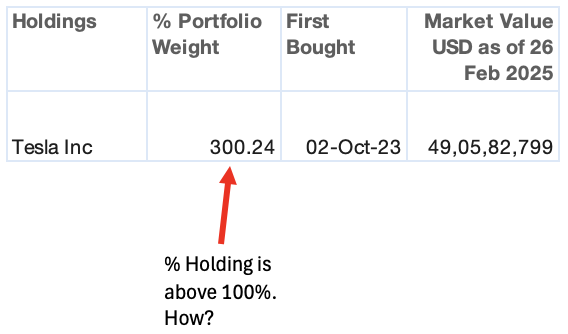

The holding of “Leverage Shares 3x Tesla ETP” is only Tesla Inc. But its “% Portfolio Weight” is showing as 300.24% How? Because it uses leverage. It borrows funds to amplify exposure to Tesla’s daily performance by three times. So the effective exposure exceeds 100% of the fund’s actual assets. It’s not just investors money, it’s borrowed cash juicing the bet.”

Lessons From the Wreckage

Alright, let’s get practical here. What can we take away from this mess?

Whether you’re tempted by leveraged ETFs or just dipping your toes into investing, there’s wisdom to be mined from Korea’s Tesla tumble.

- Leverage Is a Double-Edged Sword

That 3x multiplier sounds sexy until it’s working against you. If Tesla drops 10% in a day, your ETP isn’t down 10%, it’s down 30%. Before you jump into anything leveraged, ask yourself, can I stomach the downside? Because it will come, eventually. - Know What You’re Buying

ETPs (Exchange-Traded Products) like this one are complex. They’re built for daily returns, not long-term holds. They can erode value over time due to volatility and fees. Read the fine print, or better yet, talk to someone who’s been around the block. Don’t let FOMO be your financial advisor. At least, do not invest more than 5% of your portfolio is products as risky as ETPs. OK? - Risk Isn’t a Badge of Honor

I get it, there’s a rush in going big. But there’s a difference between calculated risk and reckless abandon. Figure out your limits before the market does it for you. - Stay Grounded in Reality

Elon’s tweets might move mountains, but they don’t guarantee profits. His tweets are for his profits, not for you and me. Companies stumble, markets shift, and hype fades. Base your moves on fundamentals, not just headlines.

A Relatable Reality Check

Look, I’ve been there, chasing a hot tip, feeling the buzz of a potential win. Maybe you have too.

A few years back, I threw some cash into a hyped-up stock because everyone on Reddit swore it was “going to the moon.” Spoiler: it didn’t. I lost half my investment in a week and spent the next month kicking myself.

It wasn’t leveraged, thank goodness, but it taught me a hard lesson about hype versus homework.

For these Korean investors, the stakes were higher, the fall steeper. I can only imagine the mix of frustration and “what ifs” they’re wrestling with now. But here’s the thing, setbacks don’t have to be the end of the story. They’re data points. Painful ones, sure, but they can sharpen your instincts if you let them.

What’s Next for the Risk-Takers?

Tesla’s slump isn’t the first time Korean investors have taken a beating, and it probably won’t be the last.

They’ve got grit, I’ll give them that. The question is whether this burn will cool their appetite for leverage or just stoke the fire for the next big bet.

Regulators and brokers are stepping in, but culture doesn’t shift overnight.

For the rest of us watching from the sidelines, it’s a front-row seat to a high-stakes drama. Tesla might bounce back (it’s Tesla, after all), but those 3x ETP losses? They’re locked in. It’s a reminder that in the world of investing, the line between bold and bonkers is razor-thin.

So, what do you think? Have you ever taken a flyer on something risky and lived to tell the tale? Drop a comment, I’d love to hear your war stories. And if this saga’s got you rethinking your own moves, maybe that’s the real win here.

Let’s keep learning, keep talking, and keep our eyes on the road ahead—electric or not.

Until next time, have a happy investing.

I done it before, my mistake I lose everything playing margin, never play margin if you don’t have money to cover your margin call you will lose everything.

Lesson learned the hard way—margin trading can wipe you out if you’re not prepared.

The lesson found in the S. Koreans folly is…

A) Stock Markets are like Casinos. You never should put money into them. Unless you can afford to lose it.

B) Once the above is known. Anyone who borrows money to make stock purchases. Is just asking for Financial Disaster.

C) The US Market isnt very stable right now. With some predicting a Hard Reset to soon occur.

As the Market has been crashing more, and more often. More recently. Add other Factors. Like Raw Materials bans. And you will see most of the Tech Industry, including Tesla. Are big losers. Their predictive calculus isnt factoring in there is a raw materials supply issue.

Far as Tesla?

Musks real name is Soros.

Soros are well known for Manipulating Stock & Financial Markets.

You may recall JUNK BONDS of the 1980s. And names like Ponzi.

You can see between Tesla, SpaceX, DoGE-coin, Twitter / X.

Mr. Soros is not exactly a savvy business person.

Who routinely violates trading laws. Manipulating his own stocks. Using Investors Funding.

That said.

Going to be an interesting year.

With another Crash, not a recession, a Crash. Likely to occur.

Investing with borrowed money is risky, and market instability makes speculation even more dangerous.