If you’re in your 20s or 30s, retirement might feel like a distant dream. It is like a far-off goal you’d rather not think about it today. I get it. Life’s busy, bills are piling up, and saving for something 30 years away doesn’t exactly scream “urgent.” But here’s the thing, the earlier you start, the more control you’ll have over your financial future. And no, I’m not about to tell you to dump all your money into Provident Fund (PF), Employee Provident Fund (EPF), or National Pension System (NPS) and call it a day. Those are great tools, sure, but they’re not the whole toolbox. They come with low liquidity, less flexibility, and honestly, they might not grow your wealth as much as you deserve.

Let’s talk about taking charge of your retirement portfolio, your way. I’m talking about equity mutual funds, direct stock investing, or a mix of both. These options can turbocharge your savings and give you the kind of corpus that makes your 60-year-old self high-five your 30-year-old self. Stick with me here, I’ll explain it to you using some examples, and show you why building your own portfolio beats leaning on traditional options like PF, EPF, etc.

The Problem with PF, EPF, and NPS

Don’t get me wrong, PF, EPF, and NPS have their place. They’re safe, they’re steady, and they’ve been the go-to for generations of Indians building their retirement nest eggs.

If you’re a government employee with PF or a private-sector worker with EPF, you’ve got a solid foundation.

NPS, with its market-linked returns, adds a bit more spice to the mix.

But here’s where they fall short:

- Low Liquidity: Want to dip into your savings for an emergency? Tough luck. These options lock your money away until retirement, and even then, you might only get partial access (like with NPS, where you can’t withdraw more than 60% post-lock-in).

- Limited Flexibility: You don’t get to tweak your investments based on market conditions or your goals. With NPS, for instance, fund managers decide the equity-debt split, not you.

- Capped Growth: Returns are decent but rarely spectacular. NPS equity schemes, for example, have averaged 12% over the long term, while PF and EPF hover around 7-8%. That’s fine, but it won’t make your money work as hard as it could.

So, why settle for “fine” when you could aim for “fantastic”?

Let’s explore how mutual funds and direct stocks can change the game, especially if you’re starting young.

Option 1: Mutual Funds

If the idea of picking individual stocks makes you break out in a cold sweat, don’t worry, mutual funds are your best friend. These are professionally managed pools of money invested across stocks, bonds, or both.

For retirement, equity mutual funds (think large-cap, mid-cap, small-cap, multi-cap, or even dividend funds) are where the magic happens.

Why? Because over 25-30 years, equity mutual funds can deliver average annual returns of around 18%, way higher than PF, EPF, or even NPS at its best. The key is to start early, stay consistent, and let compounding do the heavy lifting.

You don’t need to be a stock market guru; fund managers handle the nitty-gritty for you.

Option 2: Direct Stocks + Mutual Funds

Now, if you’re comfy digging into company balance sheets or tracking market trends, direct stock investing can take your portfolio to the next level. Pair it with mutual funds, and you’ve got a powerhouse combo.

Imagine splitting your investments, say, 45% in quality stocks (think blue-chip companies or growing mid-caps) and 55% in equity mutual funds.

Over 30 years, this mix could push your average returns to around 22% per year. That’s not just growth—that’s wealth-building on steroids.

Yes, stocks come with risks, and not every pick will be a winner. But if you focus on fundamentally strong companies and diversify across sectors, you can manage the volatility while reaping higher rewards.

Example: Meet Priya, Arjun, and Sameer

Still wondering if this is worth it?

Let’s look at three 30-year-olds, Priya, Arjun, and Sameer.

They’re all starting today, investing Rs. 10,000 per month for the next 30 years (until they’re 60). Here’s how their retirement corpora stack up based on their choices:

| Investor | Priya (NPS) | Arjun (Mutual Funds) | Sameer (Stocks + Mutual Funds) |

|---|---|---|---|

| Age | 30 | 30 | 30 |

| Monthly Investment | Rs. 10,000 | Rs. 10,000 | Rs. 10,000 |

| Investment Duration | 30 years | 30 years | 30 years |

| Total Invested | Rs. 36,00,000 (10,000 × 12 × 30) | Rs. 36,00,000 (10,000 × 12 × 30) | Rs. 36,00,000 (10,000 × 12 × 30) |

| Average Annual Return | 14% | 18% | 22% |

| Corpus at Age 60 | Rs. 5.49 crore | Rs. 14.11 crore | Rs. 37.71 crore |

| Lump Sum Access | 60% (Rs. 3.26 crore); 40% in annuity | 100% (Rs. 11.98 crore) | 100% (Rs. 26.34 crore) |

| Liquidity | Low (locked until retirement; partial withdrawal post-lock-in) | High (redeem anytime) | High (sell stocks or redeem funds anytime) |

| Flexibility | Low (fund managers control allocation) | High (choose funds, adjust as needed) | Very High (full control over stocks and funds) |

| Risk Level | Moderate (market-linked but diversified) | Moderate to High (equity-focused) | High (stocks add volatility) |

- Priya: The NPS Believer

Priya sticks to the National Pension System because it’s safe and offers tax benefits. Assuming an average return of 12% per annum (a mix of equity, debt, and government securities), here’s what she gets:- Monthly Investment: Rs. 10,000

- Total Invested in 30 Years: Rs. 36,00,000 (10,000 × 12 × 30)

- Corpus at 60: Rs. 5.5 crore

- Catch: She can only withdraw 60% (Rs. 3.26 crore) as a lump sum; the rest must buy an annuity. Plus, no flexibility to tweak her investments during market dips.

- Arjun: The Mutual Fund Fan

Arjun goes all-in on equity mutual funds, diversifying across large-cap, mid-cap, and small-cap funds. He averages 18% per annum over 30 years:- Monthly Investment: Rs. 10,000

- Total Invested in 30 Years: Rs. 36,00,000

- Corpus at 60: Rs. 14.11 crore

- Perk: Full liquidity, he can access the entire amount whenever he wants. He can also adjust his fund choices based on life goals or market conditions.

- Sameer: The Stocks + Funds

Sameer splits his Rs. 10,000 monthly investment, 45% in quality stocks and 55% in equity mutual funds. His portfolio averages 22% per annum:- Monthly Investment: Rs. 10,000

- Total Invested in 30 Years: Rs. 36,00,000

- Corpus at 60: Rs. 37.71 crore

- Bonus: Total control and liquidity. He can sell stocks or redeem mutual fund units anytime, giving him freedom to adapt.

Why Self-Building Wins?

Look at those numbers again.

Priya’s Rs. 5.49 crore is solid, but Arjun’s Rs. 14.11 crore is more than double that, and Sameer’s Rs. 37.71 crore is in a league of its own. All three started with the same Rs. 10,000 a month, but their choices made all the difference. Here’s why building your own portfolio beats the single-option trap:

- Higher Returns: Mutual funds (18%) and stocks + funds (22%) outpace NPS (14%) by a mile over the long haul.

- Flexibility: You’re not locked into someone else’s strategy. Want to shift from mid-caps to large-caps? Done. Need cash for a big life event? Withdraw without begging for permission.

- Control: You decide how aggressive or cautious you want to be—not a fund manager or a government rulebook.

- Wealth, Not Just Savings: PF, EPF, and NPS help you save. Mutual funds and stocks help you grow. There’s a big difference.

How to Get Started in Your 20s or 30s

Feeling inspired? Here’s how to kick things off:

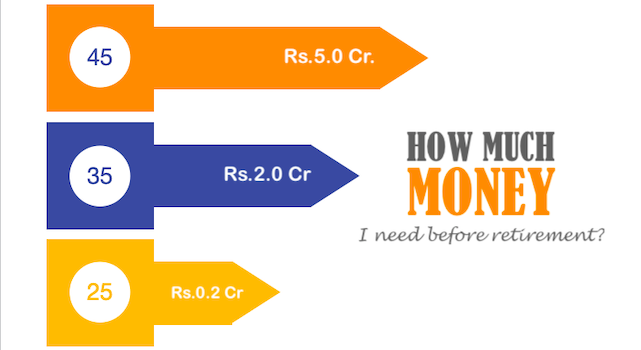

- Set a Goal: How much do you want at retirement? Rs. 5 crore? Rs. 10 crore? Plug your numbers into a compound interest calculator (tons are free online) to see what you need to invest monthly.

- Start Small, Stay Consistent: Even Rs. 5,000 a month can grow massively over 25-30 years. Use Systematic Investment Plans (SIPs) for mutual funds to automate it.

- Pick Your Path:

- Mutual Funds: Go for a mix, 40% large-cap, 30% mid-cap, 20% small-cap, 10% dividend funds. Platforms like Groww or Zerodha make it easy.

- Direct Stocks: Research quality companies (think Reliance, HDFC Bank, or emerging stars) and start with small positions. Use a demat account and learn as you go.

- Stay Patient: Markets will dip. That’s normal. Keep investing through the ups and downs—time smooths out the bumps.

- Learn a Little: You don’t need an MBA, but understanding basics (like P/E ratios for stocks or expense ratios for funds) will boost your confidence.

Conclusion

Listen, 20s and 30s are the perfect time to plant these seeds. You’ve got decades ahead to let your money grow, and trust me, your future self will thank you.

PF, EPF, and NPS are like the family car, reliable but not built for speed. Mutual funds and stocks? They’re the sports car you customize to your liking.

Take Priya, Arjun, and Sameer. They all started at 30 with Rs. 10,000 a month. Priya played it safe and ended up with a decent nest egg. Arjun took a smarter route and more than doubled her corpus. Sameer went bold and built a fortune. You’ve got the same shot—they’re not special; they just made a choice.

So, what’s your move? Stick with the crowd or build something bigger? I say go for it. Start small, dream big, and watch your retirement turn into something you can’t wait to enjoy.

Have a happy investing.