Summary Points:

- Tax Harvesting Basics: Sell and reinvest equity mutual funds or stocks to keep long-term capital gains (LTCG) under Rs.1.25 lakh and avoid the 12.5% tax.

- Tax Loss Harvesting: Use losses from underperforming investments to offset gains, slashing your tax bill (e.g., saving Rs.2,500 on a Rs.1.5 lakh gain).

- Real-Life Wins: See how Priya and Mr. Sarvanan save thousands (like Rs.41,000) by strategically booking gains and losses.

- Pro Tips: Monitor your portfolio, reinvest immediately, and time your moves before March 31 to maximize benefits.

Introduction

Let’s discuss about something that might sound a bit boring at first, taxes, but stick with me because I’m about to show you how to turn this bore into a useful tool. Consider this, you’ve been pouring your hard-earned money into mutual funds or stocks, watching your portfolio grow, and then, you have to worry about tax.

Suddenly, you’re handing over a chunk of your gains just because you made some smart investment moves. Sounds ugly, right? But what if I told you there’s a little strategy called tax harvesting that can help you. Using it, you can keep more of your money while still letting your investments work their magic?

Allow me to explain the basics of Tax Harvesting in an easy to understand language.

What Even Is Tax Harvesting?

So, tax harvesting is basically a useful move for investors like us.

It’s all about playing the tax rules to your advantage so you can lower, or even completely wipe out, the taxes you owe on your investment gains.

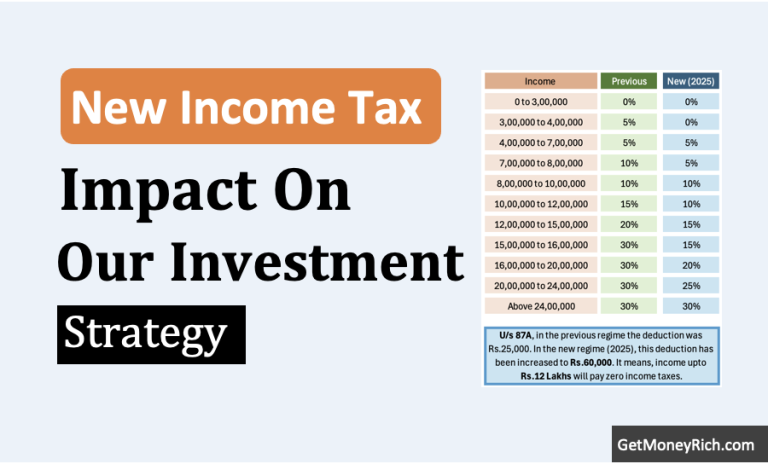

The deal is, in India, as of the Union Budget 2024, if you’re holding onto equity mutual funds or stocks for more than a year, any profit you make is called a Long-Term Capital Gain (LTCG). Those gains are taxed at 12.5%, but only on the amount that exceeds ₹1.25 lakh in a financial year. If your gains are less than ₹1.25 lakh? No tax for you.

On the flip side, if you sell within a year, that’s a Short-Term Capital Gain (STCG), and it’s taxed at a flat 20%. Ouch.

Now, here’s where tax harvesting comes in.

The idea is to keep your LTCG under that sweet Rs.1.25 lakh threshold every year so you don’t owe any tax on it.

How? By selling a portion of your investments, booking those gains, and then immediately reinvesting the money back into the same (or a similar) fund or stock. It’s like hitting the reset button on your investment’s cost basis while keeping your money in the game to keep growing. Pretty slick, right?

Let’s Understand It More Clearly With A Story

Imagine you’re my friend Priya.

- Back in 01-July 2023, Priya invested Rs.5 lakh in an equity mutual fund because she’s all about that long-term growth life.

- By 01-July 2024, and her investment is now worth Rs.5.9 lakh. That’s a gain of Rs.90,000.

- On 02-July 2024 Priya decided to to sell her holdings.

- Since she’s held the fund for over a year, this counts as an LTCG. And because Rs.90,000 is less than Rs.1.25 lakh, she owes zero tax on it.

So far, so good. Now, Priya could just sit back and let her investment keep growing.

But here’s a thing, see what happens if Priya decides not to sell on in 2024.

- By July 2025, her fund’s value jumps to Rs.6.5 lakh. That means her total gain since she started is now Rs.1.5 lakh (6.5 – 5 lakhs). If she were to sell now, she’d owe 12.5% tax on the amount over Rs.1.25 lakh. Now, 12.5% of Rs.25,000, which comes out to Rs.3,125. Not a huge amount, but still, who wants to pay taxes if they don’t have to?

Here’s where Priya decided to use Tax Harvesting.

- In July 2024, when her gains were only at Rs.90,000, she decides to sell.

- She sells her mutual fund units, books that Rs.90,000 gain (tax-free, since it’s under Rs.1.25 lakh).

- After selling, Priya immediately reinvests the full Rs.5.9 lakh back into the same fund.

- Now, her investment’s cost basis is reset to Rs.5.9 lakh.

- Now by July 2025, when her investment hits Rs.6.5 lakh. This time, her gain is only Rs.60,000 (6.5 minus 5.9 lakh). Since ₹60,000 is still under ₹1.25 lakh, she still owes zero tax.

Had she not done this, she’d be paying that Rs.3,125 I mentioned earlier.

By tax harvesting, Priya just saved herself some cash, and kept her investment growing. Genius? Here are a few things to keep in mind.

Tax Loss Harvesting – Another Trick

Okay, so tax harvesting is great when your investments are in the green, but what about when things go south?

That’s where tax loss harvesting comes in, and it’s just as powerful.

Let’s say Priya also invested Rs.2 lakh in another stock back in 2023. By 2025, it’s value dropped to Rs.1.8 lakh. She’s down Rs.20,000 – a loss. But instead of just sulking, share can use this loss to her advantage. How?

Here’s how:

- In 2025, Priya sells that stock, books the Rs.20,000 loss. She then immediately reinvests the ₹1.8 lakh into a similar stock (or even the same one, if she still believes in it).

- Now, that Rs.20,000 loss can be used to offset any capital gains she has elsewhere in her portfolio.

- Let’s say she made Rs.1.5 lakh in LTCG from another investment that year. Normally, she’d owe 12.5% tax on ₹25,000 (the amount over ₹1.25 lakh), which is Rs.3,125.

- But with tax loss harvesting, she can subtract her Rs.20,000 loss from that Rs.1.5 lakh gain. This will bring her taxable gain down to Rs.1.3 lakh.

- Now, she only owes tax only on Rs.5,000 (1.3 minus 1.25 lakh), which is just ₹625.

This way, she saved Rs.2,500 by using tax harvesting.

And here’s the cherry on top, if Priya doesn’t have enough gains to offset her losses in the current year, she can carry forward those losses for up to 8 years. So, if she makes big gains in 2026 or beyond, she can still use that Rs.20,000 loss to lower her tax bill.

It’s like a little tax-saving gift that keeps on giving.

Why I Like Tax Harvesting?

I’ll be real with you, I love strategies that make me feel like I’m outsmarting the system.

Here’s why I think Tax Harvesting is super useful:

- You Keep More of Your Money: Who doesn’t want to pay less tax? By keeping your gains under Rs.1.25 lakh each year (or offsetting gains with losses), you’re basically giving yourself a raise. That’s money you can reinvest, spend on a fancy dinner, or save for a rainy day—your call!

- It Forces You to Rebalance Your Portfolio: Tax harvesting isn’t just about saving on taxes; it’s also a great excuse to take a hard look at your investments. If a fund or stock isn’t performing, tax loss harvesting lets you ditch the underperformer, book the loss, and move your money into something with more potential. It’s like decluttering your portfolio while saving on taxes. Read more about portfolio rebalancing here.

- It’s a Long-Term Wealth Hack: The beauty of tax harvesting is that it keeps your money in the market. You’re not cashing out and stuffing your profits under your mattress, you’re reinvesting right away, letting the power of compounding work its magic. Over time, those small tax savings can add up to a big difference in your portfolio’s growth.

- It’s Totally Legal and Ethical: This isn’t some shady loophole, tax harvesting is a legit strategy that savvy investors have been using for years. The government even gives you that Rs.1.25 lakh exemption and the ability to carry forward losses for a reason. Why not take advantage of it?

A Real-Life Example to Bring It Home

Let’s take a look at someone like Mr. Sarvanan, whose portfolio I came across in one of the articles.

As of March 13, 2025, he’s got a mix of stocks, some winners, some losers.

- His total LTCG from two stocks is Rs.5,12,861.

- But he’s also got a short-term capital loss (STCL) of Rs.1,43,104 and

- A Long-term capital loss (LTCL) of Rs.1,86,000 from two other stocks.

Without tax harvesting, his taxable LTCG would be Rs.3,87,861 (after the ₹1.25 lakh exemption). It means, he’d owe 12.5% on RE.3,87,861 which is around Rs.48,483 in taxes.

But Mr. Sarvanan decides to use the advantage of tax harvesting.

- He sells his loss-making stocks to book that Rs.3,29,104 in total losses (Rs.1,43,104 STCL + Rs.1,86,000 LTCL).

- He then reinvests the proceeds into similar stocks to keep his portfolio on track.

He uses those losses to offset his LTCG, bringing his taxable gain down to just Rs.58,757. Now, he only owes 12.5% on that, Rs.7,345.

That’s a savings of over ₹41,000 in taxes.

And if he didn’t have enough gains to use up all his losses, he could carry the leftovers forward for up to 8 years.

| Description | Amount (₹) |

|---|---|

| Total LTCG from Winning Stocks | 5,12,861 |

| Short-Term Capital Loss (STCL) | 1,43,104 |

| Long-Term Capital Loss (LTCL) | 1,86,000 |

| Total Losses (STCL + LTCL) | 3,29,104 |

| Taxable LTCG Without Tax Harvesting (After ₹1.25 lakh Exemption) | 3,87,861 |

| Tax Owed Without Tax Harvesting (12.5% of ₹3,87,861) | 48,483 |

| Taxable LTCG With Tax Harvesting (After Offsetting Losses) | 58,757 |

| Tax Owed With Tax Harvesting (12.5% of ₹58,757) | 7,345 |

| Total Tax Savings | 41,138 |

A Few Things to Keep in Mind

Now, I’m not gonna pretend tax harvesting is a perfect strategy with zero downsides.

There are a few things you’ve gotta watch out for:

- Timing Is Everything: You need to keep an eye on your portfolio and the market. If you sell a stock at a loss to harvest the tax benefit but the market bounces back the next day, you might miss out on some gains. It’s a bit of a gamble, so you’ve gotta be strategic.

- Transaction Costs Add Up: Every time you sell and buy back, you might have to pay brokerage fees or other transaction costs. These can eat into your savings, so make sure the tax benefit outweighs the costs.

- Don’t Forget to Reinvest: This is a big one. The whole point of tax harvesting is to keep your money growing through compounding. If you sell to book gains or losses but don’t reinvest, you’re basically taking your money out of the game. Don’t break the compounding magic, reinvest right away.

- It Can Get Complicated: Figuring out which losses can offset which gains (e.g., LTCL can only offset LTCG, but STCL can offset both) can make your head spin. If you’re not sure, it might be worth chatting with a financial advisor to make sure you’re doing it right.

Your Action Plan: How to Start Tax Harvesting Today

Ready to give this a shot? Here’s a simple step-by-step to get you started:

- Check Your Portfolio: Look at your equity mutual funds and stocks. Which ones have gains or losses? How long have you held them (to determine if they’re STCG or LTCG)?

- Spot Opportunities: If you’ve got LTCG approaching Rs.1.25 lakh, consider selling to book those gains tax-free, then reinvest. If you’ve got losses, think about selling to offset gains elsewhere.

- Time It Right: Aim to do this before the financial year ends (March 31) to claim the tax benefits for that year. But don’t wait until the last minute, markets can be unpredictable.

- Reinvest Immediately: Whether you’re booking gains or losses, put the money back into the market right away. You don’t want to miss out on growth while your cash sits idle.

- Keep Records: Make sure you track all your transactions and file your income tax return on time. If you’ve got losses to carry forward, you’ll need to file your ITR to claim them in the future.

Conclusion

I’ll leave you with this, tax harvesting (and tax loss harvesting) isn’t just about saving on taxes, it’s about taking control of your financial future.

It’s about being proactive, staying engaged with your investments, and making the system work for you.

Sure, it takes a bit of effort to monitor your portfolio and plan your moves, but the payoff is worth it. Imagine what you could do with all that extra money you’re saving on taxes – a bigger investment, right?

So, what do you say? Are you ready to turn your losses into wins and keep your gains tax-free? Tell me what you think about Tax Harvesting in the comments section below.