Summary Points:

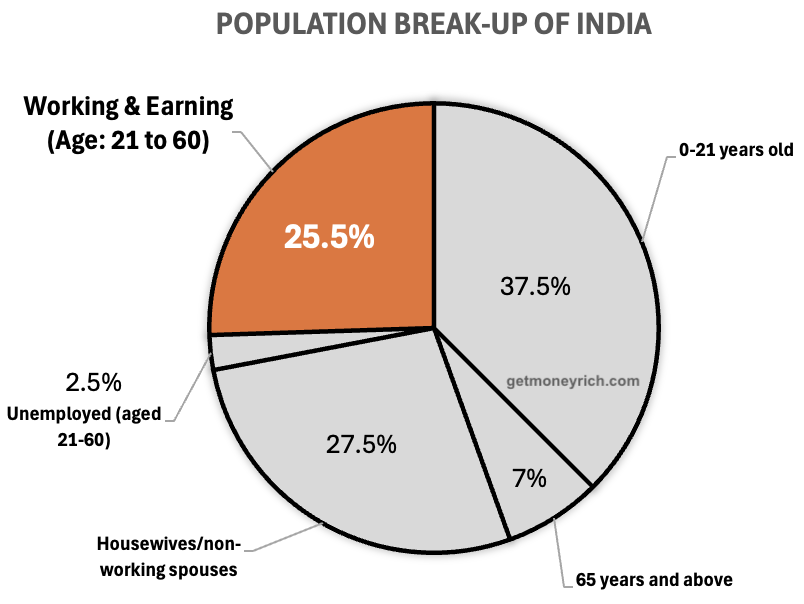

- Only 25.5% of India’s 143.81 crore population (36.67 crore) are working and earning, and 7.67% of them (2.81 crore) paid income tax in FY 2023-24.

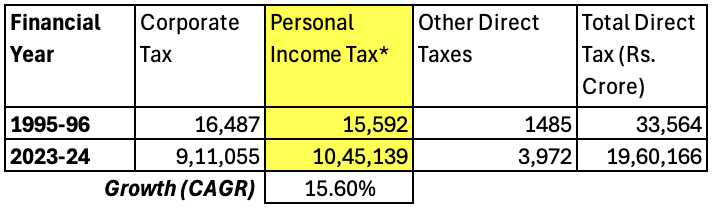

- Personal income tax has grown at 15.6% per year over 29 years, outpacing the Sensex (11.58%) and GDP growth (10-11%).

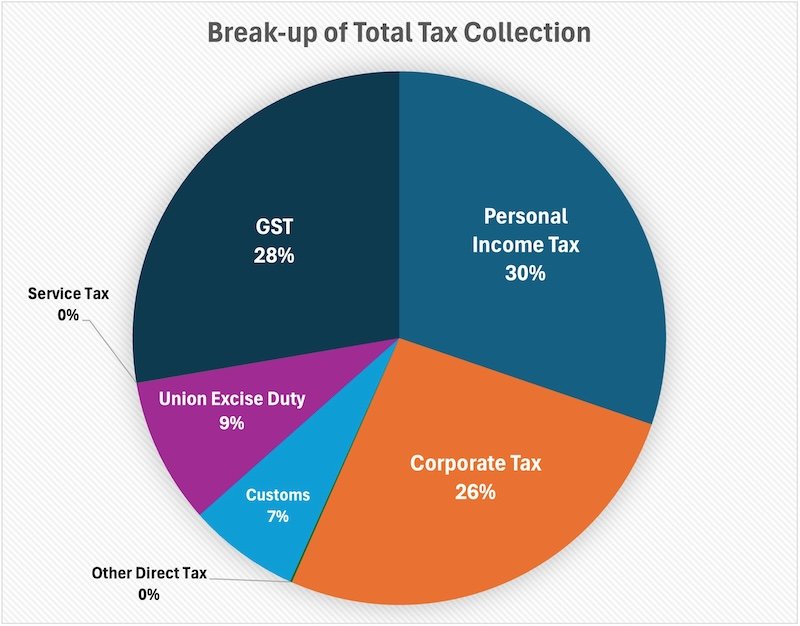

- Indirect taxes like GST, paid by all, make up 43.28% of total tax revenue (Rs.14,95,911 crore), showing everyone contributes.

- The top 1% of taxpayers (2.81 lakh) pay 50% of income tax, highlighting an unequal burden.

- The “tax avoider” label is unfair – Indians are contributing significantly, directly and indirectly.

Introduction

Today I’ll talk about something that’s been bothering me for a while. You’ve probably heard this line thrown around a lot: “Only 2% of Indians pay income tax.” Sounds bad, right? To me it does, because it is kind of humiliating when we are being openly referred as thieves, like 98% of us are avoiders who don’t care about contributing to the nation. This narrative is unfair, incomplete, and honestly, a bit demeaning.

So, allow me to declutter some facts and figures for you which will prove that this narrative of “only 2% Indians pay income tax” paints us in a wrong light.

The “Only 2% Pay Income Tax” Claim: What’s the Truth?

I came across a news article which said that out of India’s total population of around 143.81 crore in 2025, only 2% pay income tax. That’s about 2.81 crore people in FY 2023-24.

At first, I thought, “The number 2% is so tiny. Are we really not paying our taxes?”

But then I started thinking, does this number tell the whole story? So I decided to dig deeper.

Everyone cannot pay income tax

India’s population is huge, but not everyone can pay income tax, right?

We’ve got kids, elderly folks, housewives, and people who are unemployed. So, I did some data searching and math to figure out who’s actually in a position to earn and pay taxes. These are approximates guesses but I think they are close enough to make a point.

Here’s what I found:

- 0-21 years old: About 37.5% of our population is under 21, kids and young adults who are still studying or just starting out. That’s around 53.93 crore people.

- 65 years and above: Around 7% are senior citizens, mostly retired. That’s 10.07 crore people. I’ve assumed that a big majority of this category are falling under the tax exemption section. Most of them are also not in a position to file their ITR regularly.

- Housewives/non-working spouses: Roughly 27.5%, mostly women who manage households and don’t work outside. That’s 39.55 crore people.

- Unemployed (aged 21-60): About 2.5% of the population in the working age group (21-60) who don’t have jobs. That’s 3.60 crore people.

Add all these up: 37.5% + 7% + 27.5% + 2.5% = 74.5%. So, 74.5% of India’s population, around 107.14 crore people, aren’t even in a position to earn taxable income.

That leaves us with 25.5%, or 36.67 crore people, who are “working and earning.”

Out of these, 2.81 crore paid income tax in FY 2023-24. That’s not 2% of the total population, it’s 7.67% of the working and earning population (= 2.81 ÷ 36.67 × 100).

See the difference? When you say “only 2% pay income tax,” it sounds like almost no one is paying (98% is not paying).

But when you look at the people who can pay, it’s 7.67%. That’s a much better number, don’t you think? I know, it is still not a great number.

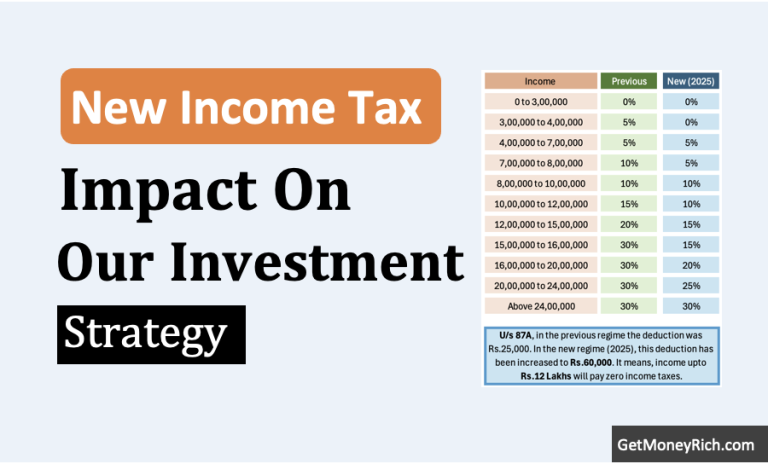

We must also not forget that we are talking about India. In our country, annual income of majority people is within Rs.2.0 Lakhs. What is the income tax exemption limit? Till FY 2023-24, income upto Rs.7 Lakhs was tax exempted. As per the latest budget (Feb-2025), people earning upto Rs.12 Lakhs will be tax exempted. So, if these people are not paying tax, it means that their annual income is within the tax exemption limits. How can they be blamed for that?

We’ve Been Growing Our Tax Contributions at 15% per annum

Now, let’s talk about something even more interesting.

I’ve collected some historical data from the department of revenue.

In FY 1995-96, personal income tax (PIT) collection was Rs.15,592 crore. By FY 2023-24, it had jumped to Rs.10,45,139 crore. That’s a decent increase over 29 years, growing at rate of 15.6% per year. To put that in perspective, the Sensex, our stock market index, grew at just 11.58% per year over the same time.

So, our tax payments have been growing faster than the stock market.

Think about that for a second.

While the government might say, “Oh, we’ve increased tax collection by 15.6% per year,” we can turn it around and say, “We taxpayers have been increasing our contributions by 15.6% every year for 29 years.”

That’s a huge effort, especially when you consider that inflation (around 5-6% per year) and nominal GDP growth (around 10-11%) were much lower. We’re not just paying taxes, we’re growing our contributions faster than the economy or the markets.

So why are we still called tax avoiders?

Everyone Pays Taxes – Even If It’s Not Income Tax

Here’s another point that supports my case that Indian citizens should not be referred as income tax avoiders.

The “2% pay income tax” narrative only talks about direct taxes, the personal income tax. But what about indirect taxes, like GST, Customs, and Excise Duty? These are taxes we all pay when we buy things, whether it’s a packet of biscuits, a new phone, or petrol for our bikes.

You can’t escape them, even if you don’t file an income tax return.

I looked at the tax collection data for FY 2023-24. The government collected a total of Rs.34,56,019 crore (Rs.19,59,956 + Rs.14,95,911) in direct and indirect taxes. Here’s the break-up (as % of total tax):

- Total Direct Taxes: 56.72% (Rs.19,59,956 crore)

- Personal Income Tax: 30.24% (Rs.10,45,139 crore)

- Corporate Tax: 26.36% (Rs.9,11,015 crore)

- Other Direct Taxes: 0.11% (Rs.3,802 crore)

- Total Indirect Taxes: 43.28% (Rs.14,95,911 crore)

- GST: 27.69% (Rs.9,57,608 crore)

- Customs: 6.74% (Rs.2,32,936 crore)

- Union Excise Duty: 8.83% (Rs.3,05,169 crore)

- Service Tax: 0.01% (Rs.346 crore)

Look at that, 43.28% of the government’s tax revenue comes from indirect taxes. That’s Rs.14,95,911 crore paid by all of us, whether we’re a daily wage worker buying soap or a businessman buying a car.

GST alone is 27.69%, almost as much as personal income tax (30.24%).

So, when someone says, “Indians don’t pay taxes,” I want to ask, really? What about the GST I paid on my morning chai, or the Customs duty on my new earphones?

Everyone is contributing, even if it’s not through income tax.

The Burden on a Few – But We’re Still Contributing

An NDTV article also pointed out something that shows how unequal the tax system can be.

Out of the 2.81 crore people who paid income tax in FY 2023-24:

- The top 1% (2.81 lakh people) paid 50% of the total personal income tax.

- The top 9% (25.3 lakh people) paid 87% of it.

That means the top 10% (28.1 lakh people) are carrying a huge burden, while 90% of taxpayers (25.29 crore) paid between Rs.0 and Rs.1.5 lakh.

This shows two things.

- First, a small group of high earners is paying the bulk of the income tax. A half of it comes from just 2.81 lakh people.

- Second, most taxpayers are paying very little because their incomes are low or they claim exemptions.

But does that mean the rest of us aren’t contributing? Not at all. We’re paying through indirect taxes, and those who do pay income tax are increasing their contributions at 15.6% per year, as we saw earlier.

Why the “Tax Avoider” Label Hurts

I find it really unfair when people say, “Only 2% pay income tax,” as if the other 98% are just sitting around avoiding taxes.

We have to see things in correct light.

- Most of that 98% can’t pay income tax because they’re either too young, too old, not working, or earning too little.

- Out of the 36.67 crore who are working and earning, 7.54 crore filed income tax returns in FY 2023-24, that’s 20.6% of the working population.

- Out of those 7.54 crore filed returns, 2.81 crore actually paid tax (7.67%).

That’s not a small effort, especially when you consider that many of the remaining 29.86 crore (36.67 – 7.54) are earning below the taxable limit. A huge majority of our working population is also engaged in informal jobs like farming or small shops. In these areas, tax compliance is tough (government’s role is key here).

Plus, we’re all paying indirect taxes. Here is the data I’ve collected from the department of revenue.

| FY | Total GST |

| 2017-18 | 4,42,561 |

| 2018-19 | 5,81,559 |

| 2019-20 | 5,98,749 |

| 2020-21 | 5,48,777 |

| 2021-22 | 6,98,114 |

| 2022-23 | 8,49,132 |

| 2023-24 | 9,57,032 |

That Rs.9,57,032 crore from GST in FY 2023-24 didn’t come from thin air, it came from every single one of us buying daily essentials.

So why do we get labeled as tax avoiders? It feels like a slap in the face, especially when we’re growing our income tax contributions at 15.6% per year and paying GST on everything we buy.

A Fairer Way to Look at It

Here’s how I think we should tell this story:

- Out of India’s 143.81 crore people, only 25.5% (36.67 crore) are working and earning. Of those, 7.67% (2.81 crore) paid income tax in FY 2023-24. That’s a much better number than 2%, right?

- Personal income tax has grown at 15.6% per year for 29 years—faster than the Sensex (11.58%) and GDP growth (10-11%). We taxpayers are stepping up, year after year.

- Indirect taxes like GST make up 43.28% of total tax revenue (Rs.14,95,911 crore). Every Indian pays these taxes, whether they’re a kid buying a chocolate or a senior citizen buying medicine. We’re all contributing to the nation’s growth.

So, instead of saying, “Only 2% pay income tax,” why not say: “7.67% of India’s working population pays income tax, and their contributions have grown at 15.6% per year for nearly three decades. Plus, every Indian pays indirect taxes, which make up 43.28% of the government’s revenue.”

Doesn’t that sound more fair? It gives credit to all of us for the role we play in building our country.

Change the Narrative

I’m tired of hearing that we Indians don’t pay taxes. It’s not true, and it’s not fair.

We’re paying, whether it’s through income tax, GST, or Customs duty. We’re growing our contributions faster than the stock market. And even if only a small group pays income tax, they’re carrying a huge burden, the top 1% pays 50% of it.

So, let’s stop with the “tax avoider” label and start recognizing the effort we’re all putting in.

Next time someone says, “Only 2% pay income tax,” tell them the real story. Tell them about the 15.6% growth in income tax, the 43.28% from indirect taxes, and the fact that most of us are contributing in one way or another. We’re not tax avoiders—we’re taxpayers, and we’re proud of it.

What do you think, friends? Have you felt the same way about this “2%” narrative? Let’s talk about it in the comments, I’d love to hear your thoughts too.

[Note: Writing this blog felt personal because I’ve heard the “tax avoider” label thrown around too many times. But the numbers tell a different story, one of effort, growth, and contribution. We Indians are doing our part, and it’s time the narrative reflects that. So, let’s share this story, and take pride in being taxpayers – direct or indirect. After all, every rupee we pay is helping build a better India, isn’t it? Experts, give us that credit please.]