Summary Point:

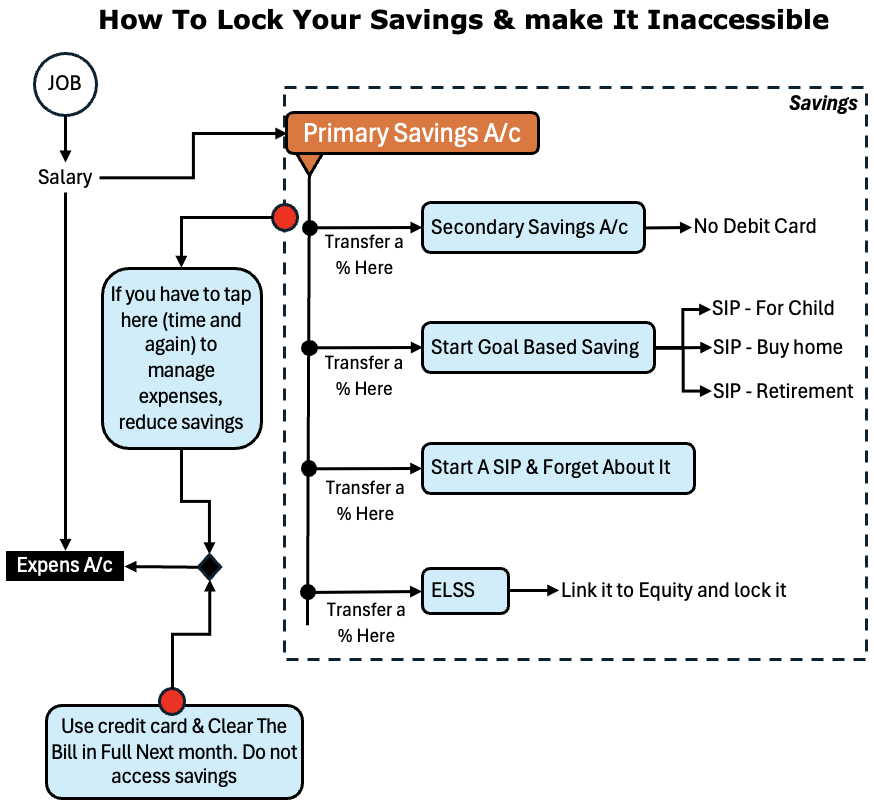

- This article explains how to lock savings by separating salary and savings accounts, disabling easy access, using goal-based SIPs and ELSS, adjusting savings rates, and managing unexpected expenses with credit cards. Jump to the mind map.

Introduction

Most people who are reading this blog post are ones who have their own savings account. In personal finance journey it is the first step. But as important it is to open a saving account, it is also essential to keep its money safe and intact. The money parked in the account should be used for its dedicated goal and not every time there is a unexpected need for cash. In this post, I’ll share with you a method how to lock your savings and make it inaccessible.

1. Separate Your Salary Account & Savings Account

I started in my first job in 2001. Back then, it was common to use ones salary account as the savings account. Till many years, 100% of my paycheck used to land in salary account and stay there till all of it gets spent.

We used to visit our bank, used check books to withdraw almost all cash, and that’s it. Withing the 20th and 25th day of the month, 90% of our salary used to vanish in thin air.

By Year 2003-2004, ATMs started becoming more common in India and then came with it the comfort of Debit cards. Withdrawing money became even easier. Now, my salary used to vanish even faster, by half of the month.

What does this story tell us? It is essential to separate our salary account from savings account.

The salary account will be the one which we use to manage out monthly expenses. Savings account will be the one where money is put to stay. It cannot be used for daily-expense management.

Moreover, I would also surrender the debit card of my savings account. Preferable, I’ll also disable my online access to this savings account. The only way to withdraw money from the savings account will be to visit the bank branch and use the check book.

While I was in job till 2017 (read about me here), I used to transfer online a majority portion of my salary to my savings account. As my savings stay there ‘inaccessible’ it multiplies faster due to the accrued interests.

2. Start Goal Based Savings

I’ll prefer not to keep my money lie idle in my savings account. What I’ll do is goal based savings.

What is goal based savings? First, I’ll segregate the monthly contributions to my savings account from salary account based on my long term goals. Second, I start a SIP for each goal and lock the money even further.

For example, suppose we need an amount Rs.10,00,000 for the child’s future education after 10 years from now. To accumulate this amount, I have decided to start a SIP that will fetch me 14% per annum return. For this cause, if I will allocate an amount Rs.3,850 each month towards the SIP, I will reach the goal.

Similarly, I do the same for my other financial goals.

For the goals which are farther away from today (like child’s education), I’ll chose an equity SIP. For near term goals, I will go with debt linked SIPs, or I’ll keep it in a recurring deposit.

This way, we are actually automating the process of saving account by making it increasingly inaccessible for us. The money keeps getting accumulated (automatically) without our intervention.

3. Start a SIP and Forget About It (Retirement Fund)

Say you are 30 years of age. If today you decide to start saving for retirement, you have 30 years in your hand to build a corpus.

As the time horizon is so long, you can consider investing in stock directly. But, I’ll suggest you to consider equity mutual fund as your preferred choice. Pick a best equity mutual fund and start a SIP. At a rate of 18% per annum return, a mere contribution of Rs.2,500 per month will build a corpus of Rs.3.5 crores in 30 years.

Do you know what is the best part? As the time horizon is so long, and the SIPs debits your bank account on their own, a time will come when you’ll almost forget that you have set a SIP. This is the phase where your savings and investment have gone on the auto mode.

You are saving, but you’ve almost forgotten about it. By the time you’ll recall, probably you will have crores in your SIP account.

4. Keep Money in Equity Linked Savings Scheme (ELSS)

ELSS is a type of multi-cap mutual fund. To know more about ELSS, read here.

How ELSS is a “Saving Scheme?” There are two reasons for it, first it can save income tax under section 80C. Second, it comes with a lock-in period of 3 years (which are normally seen only in debt schemes).

Because of the above two reasons, the net return of the ELSS scheme can almost always beat the inflation (at least). Though in actual terms, their net returns are much higher (check here).

5. Adjust Your Savings Rate If Necessary

You can check the above flow chart again. See how the money is flowing into your savings account.

Your job earns you money which lands in your salary account. A portion of the salary gets transferred to the primary savings account. What remains in the salary account is used to manage expenses.

If you find that even after accounting for all monthly expenses, at the end of the month, a good balance remains in your salary account, take this action. From the next month, increase your saving rate. If you are say saving 35% this month, increase it to say 40-45%.

Alternatively, if you find that you have to tap time and again into your savings account to manage daily expenses, take this action. Reduce your saving rate. Adjust it to a level such that you do will not need to dig into your saving account for taking care of expenses.

Build it as a habit. Money only flows “in” to the savings account. No exits, except for the lined up savings and investment plans.

5.1 Use Credit Card

Yes, this might sound counter intuitive, but here is the thing. Suppose, at the end of the month, an expense item comes for which you have not planned (say an unexpected tour to you hometown).

What we generally do in this situation? We take money from the savings account saying that its an emergency.

But for us, there is a rule, money cannot flow out of savings account for expense management, right?

In this case, use your credit card to pay for your expenses. Next month when your salary comes, reduce your contribution to savings account (may be make it zero). Use this money to pay the credit card bill in full.

See, how you were able to manage your unexpected expense without breaking the savings account rule.

Conclusion

Nobody should use salary account alone. Create a savings account and divert a good portion of your salary there. The money parked in the salary account should not be used as a deposit for emergencies. If necessary, create a separate emergency account.

The money parked in the savings account should be used to accumulate wealth for specific financial goals of life.

I hope this article helps you to get an idea of how to convert your liquid savings into an Inaccessible but a componding machine. Please give me your feedback in the comments section below.

Have a happy investing.