Summary:

- This article we’ll explore whether saving or investing is more important, comparing their benefits and risks, and guides you on choosing the right option for your financial goals with practical Indian examples. Jump here to see a mind-cap & a comparison table.

Introduction

I know how much we value every rupee (our income). Growing up, I saw my parents stash the cash aside for emergencies. But is saving enough? Or should we be investing to make our money work harder? This question keeps popping up, especially when we think about rising prices or big dreams like buying a house. Today, let’s dig into what’s more important, saving or investing, and figure out how to make smart choices.

What Does Saving Mean?

Saving is simple. It’s putting money aside for later.

Think of it like keeping your cash safe in a piggy bank or a bank account. You’re not trying to grow it; you just want it to be there when you need it. It is not that money does not grow in savings accounts, but it does only too slowly.

For example, my cousin saves every month for Diwali shopping. That’s saving, money kept safe, ready to use.

In India, we often save in bank accounts, fixed deposits, or even under the mattress for quick access. It’s about security, not growth.

What is Investing?

Investing is different.

It’s about making your money grow over time. Instead of letting it sit, you put it into things like stocks, mutual funds, or property, hoping it’ll increase in value (faster).

My friend Ravi invested in a mutual fund five years ago. Now, his money has grown more than he expected. It has doubled in this span of five years.

But investing isn’t a sure thing. There’s risk involved (of loss of capital), unlike saving. It’s like planting a seed, you hope for a tree, but it needs care and patience.

Saving vs. Investing: The Good and the Bad

So, which is better? Both have their strengths and weaknesses.

Saving feels safe, like a warm blanket. Investing, on the other hand, is like riding a bicycle, exciting but a bit risky.

Let’s try to figure out the differences and similarities in a table to get a better visibility and understanding.

| Aspect | Saving | Investing |

|---|---|---|

| Capital | Safe | There is a risk of loss |

| Volatility | Your money is parked in a bank a/c or FD. Return is assured. Risk of loss is nearly zero. | Market moves ups and downs and so is your invested capital. There is a high risk of loss in short term. But in long term, it feels much safer. |

| Returns | Low returns. Here, the interest/yield is usually 3-7% per year. Not inflation beating. | Higher potential returns, like 8-12% or more, but not guaranteed. It beats inflation in a long term. |

| Access | Easy to access. Withdraw anytime from a savings account. | Less liquid. Some investment options can lock your money for years. But stocks, mutual funds are generally liquid. These days you can have the redemptions in your bank account withn 2 days. |

| Purpose | Short-term needs, like emergencies or small purchases. | Long-term goals, like retirement or buying a house. |

| Tracking | No tracking needed. Just deposit and forget. | Needs research and monitoring, like choosing funds or stocks. |

| Wealth | Savings accumulation with a small return can build wealth over time, but very slowly. Not a suitable option to build wealth for a majority. | Ideal for long term wealth accumulation. Higher return ensured compounding of wealth in later years. |

Looking at this, saving seems perfect when you need quick cash.

But investing could be the way to go for bigger dreams. Why settle for low bank interest when your money could grow faster?

If you can handle the stress of market dips, investing is by far the much better choice for wealth accumulation over a time periods like 7-10 years.

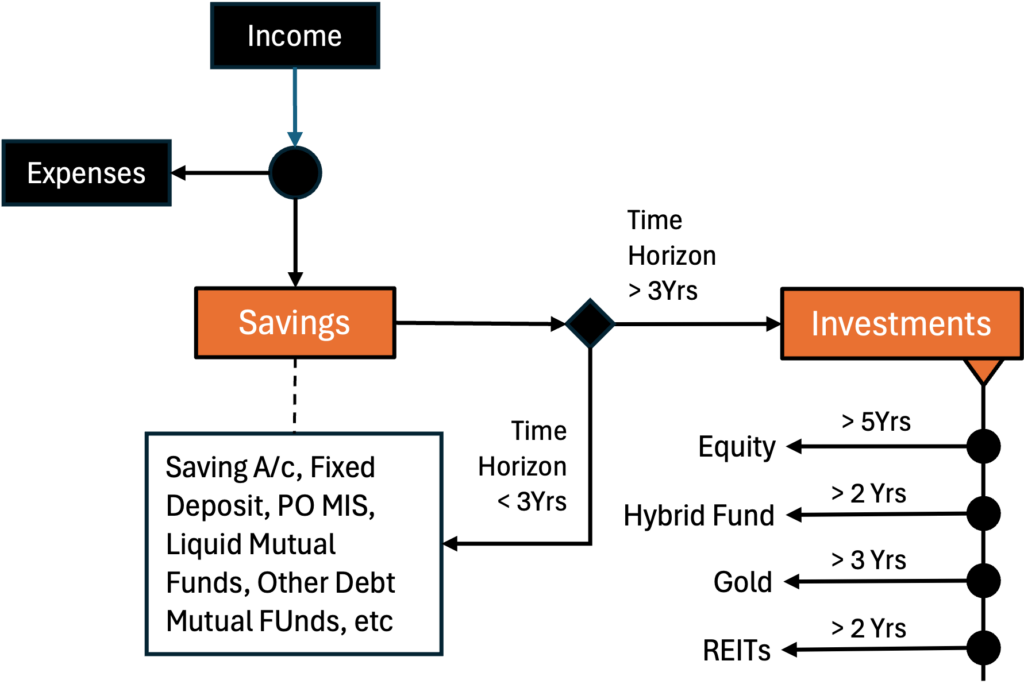

When to Save and When to Invest

Deciding between saving and investing depends on your life’s circumstances.

- Are you saving for a new fridge next month? Then a savings account is your best friend.

- But if you’re planning for your kid’s education 10 years from now, investing might make more sense.

My uncle learned this the hard way. A few years ago, he kept all my money in a savings account. It was safe, but inflation ate away its value. His 50,000 Rupees couldn’t buy as much after five years. That’s when he too started exploring investments.

For short-term goals, say, within one or two years—saving is smarter. You don’t want to risk losing money. But for long-term goals, like retirement or an overseas vacation, investing can help your money grow faster than inflation.

Ask yourself these question:

- How soon do I need this money? If the answer is next 1-2 years, do not invest. Park it in your bank FD (or debt plans of mutual funds). If you will need the money after 5 years, think about equity options. If the period is in between, balanced funds will be better.

- How critical will be the money when the need arise? If the goal is like child’s feed for his university studies, it is a critical need. You cannot afford to park this money in crypto. Neither you can afford to keep it in FD. A middle ground like an equity mutual fund will be better. But again, first ask the question number one.

- How high is my income? If your income is just enough to meet your daily needs, starting with a savings plan will be better. As the income grows, transition towards investing.

- When I’m going to retire? If retirement is close, risky investments must be avoided. For younger people, investing will be better than savings.

Popular Options to Save and Invest

Let’s talk about where you can put your money.

In India, we love options that feel familiar. For saving, a savings account is the go-to choice. Every bank offers one, and you can withdraw money anytime. Fixed deposits (FDs) are another favourite. My uncle swears by FDs because they’re safe and give slightly better interest than savings accounts. Then there’s the Post Office Monthly Income Scheme, perfect for retirees who want steady payouts.

For investing, mutual funds are super popular now. They’re like a basket of stocks or bonds managed by experts. My colleague Priya started a SIP (Systematic Investment Plan) in mutual funds with just 1,000 rupees a month. She’s thrilled with the growth. Stocks are another option, but they need more research. Real estate is big too, but it’s not for everyone, it takes a lot of money for investing. These days, REITs is a great option to invest in real estate.

Here’s a quick look at these options.

| Option | Type | Key Feature | Best For |

|---|---|---|---|

| Savings Account | Saving | Easy access, low interest (3-4%). | Emergency funds, short-term needs. |

| Fixed Deposit (FD) | Saving | Fixed returns (5-7%), locked for a period. | Safe, predictable returns. |

| Post Office MIS | Saving | Monthly payouts, 7.4% interest (as of 2025). | Retirees, steady income seekers. |

| Mutual Funds (SIP) | Investing | Diversified, 8-12% average returns, flexible. | Long-term wealth building. |

| Stocks | Investing | High potential returns, high risk. | Risk-takers with market knowledge. |

| Real Estate or REITs | Investing | Long-term growth, needs large capital. | Big investors, long-term goals. |

These are just a few options. Always check the latest rates and risks before jumping in. Wondering where to start? Talk to a financial advisor or read up on trusted websites like Moneycontrol.

Conclusion

So, what do you think, saving or investing, which wins?

Honestly, it’s not a competition. Both are important, like dal and rice in a meal. Saving keeps you safe for today’s needs. Investing builds your wealth for tomorrow’s dreams. The trick is balance.

Start with an emergency fund in a savings account, maybe three to six months of expenses. Then, dip your toes into investing with something simple, like a mutual fund SIP.

I started small, and it felt less scary.

Money decisions can feel overwhelming, especially with so many opinions out there. But take it one step at a time. Think about your goals, your comfort with risk, and how long you can wait.

What’s your next money move? Maybe it’s opening an FD or starting a small SIP. Whatever you choose, make your money work for you. Money sitting in piggy banks is not ok.

Please share with me your opinion in the comments section below.

Have a happy investing.