Summary:

- This article guides you through practical steps and smart saving options like PPF, RDs, and mutual funds to build your first one lakh, emphasizing discipline, budgeting, and small lifestyle changes for financial success.

Introduction

You’ve set your sight on saving your first one lakh rupees? That’s a fantastic goal. One lakh might not seem like a massive amount to many, but for beginners, it’s a milestone that can give confidence and a strong start toward financial freedom. I know how tricky it can be to save money with rising costs, family expectations, and the occasional temptation of a new smartphone or a weekend outing. But trust me, with a bit of planning and discipline the one-lakh-milestone is fast achievable.

Let’s discuss about this journey and explore how you can save and build your first one lakh.

Why One Lakh Matters

Saving one lakh is more than just a number. It’s symbolic of your commitment to your financial future.

You can consider it like this, this one lakh can be an emergency fund, a down payment for a two-wheeler, or even the seed money for a small investment.

For many of us, it’s the first big step toward financial independence. I remember when I started saving seriously a back in 2006-2007. I was earning a very modest salary in a small tier-2 city. Every month felt like a juggling act between rent, bills, groceries, and a few leftover for myself.

But the goal of seeing that first twenty-five thousand mark (for you it is one-lakh) in my saving account forced me to think financial planning. I remember, when I reached that milestone it gave me a sense of pride and security I hadn’t felt before.

So, I will suggest you to ask yourself, why does one lakh matter to you? What’s your motivation? Find your answer start accumulating your saving from today.

Start with a Clear Plan

Saving money without a plan is like trying to find your way in a new city without a map. You need direction.

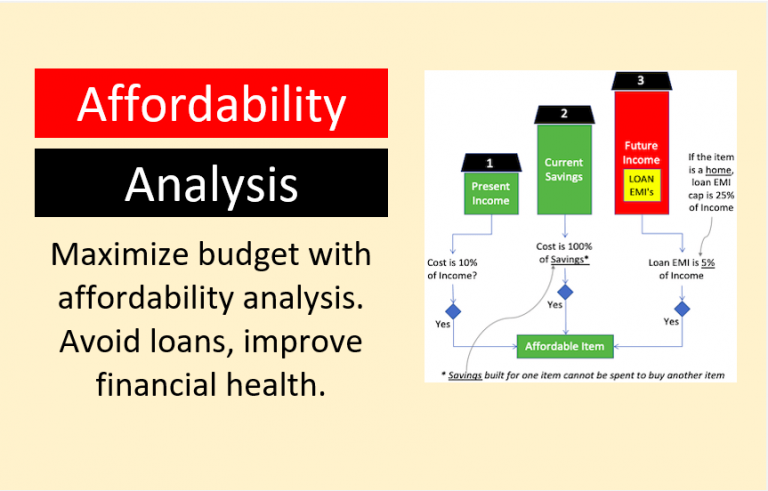

The first step is to understand your income and expenses. Sit down with a notebook or a budgeting app and list everything you earn and spend in a month. If you need guidance in budgeting, I’ll suggest you to read this article on 50/30/20 budgeting rule.

While creating your budget, it is easy to get delusional. You might exclude essentials and include unnecessary line items in your budget. At that time, be honest and include all expense that you think (for you) looks unavoidable. You must also try to foresee the future, at least 5 years ahead, and see if some expense line items find their place in your budget.

What is the idea of creating such a budget? Once you know where your money is going, you can find ways to save for it (creating a buffer) and cut back any overspending.

For example, I used to spend Rs.1000 a month on coffee from a fancy café. Switching to homemade coffee saved me Rs.500 a month. Small changes like this add up.

Your goal is to free up at least 20-30% of your income for savings. If you earn Rs.50,000 a month, aim to save Rs. 10,00 to Rs.15,000.

It might sound tough, but we’ll get to how you can make it work.

Build a Savings Habit

Saving isn’t just about money; it’s about discipline.

One of the easiest ways to save consistently is to treat savings like a bill. Pay yourself first, read more about it here.

The moment your salary hits your account, transfer a fixed amount to a separate savings account. This could be as little as Rs. 1,000 a month. The key is to start small and stay consistent.

I learned this trick from my uncle, who saved Rs.500 a month in a piggy bank for years. It wasn’t much, but it taught him the habit of saving.

Today, he’s retired comfortably because he scaled up that habit over time. If you’re worried about forgetting to save, set up an auto-debit instruction with your bank. It’s like setting a reminder for yourself and forcing you to save before spending a dime.

Now, let’s look at the options that one can use for the purpose of saving.

Five Preferred Savings Options:

1. Explore Government-Backed Savings Schemes

India offers a few reasonably good government-backed savings schemes. They are super safe and reliable.

Let’s talk about a few that can help you reach your one-lakh goal.

- The Public Provident Fund (PPF) is a great option. It’s backed by the government, offers a decent interest rate of around 7.1% (check PPF current rate here), and gives you tax benefits under Section 80C. You can start with as little as Rs.500 a year, and the maximum limit is Rs.1.5 lakh annually. But its only limitation is that it comes with a 15-year lock-in period. Partial withdrawals are allowed after five years.

- Another option is the National Savings Certificate (NSC). It has a five-year lock-in and offers around 7.7% interest (check NSC current rate here). You can invest as little as Rs.1000, and your money grows steadily. For example, if you invest Rs. 20,000 in NSC, it could grow to about Rs. 28,000 in five years.

These government-backed schemes are perfect if you want safety and guaranteed returns.

But the above two savings plans comes with lock-in periods. If you want to consider the alternative, read further.

2. The Power of Recurring Deposits

If long lock-in periods make you nervous, a Recurring Deposit (RD) is a great middle ground.

Most banks and post offices offer RDs where you can save a fixed amount every month for a chosen tenure. Interest rates vary between 3.5% and 7.5%, depending on the bank and the holding period (check here).

Let’s say you save Rs. 2,000 a month in an RD at 7% interest for five years. By the end, you’ll have around Rs. 1.45 lakh, with Rs. 1.2 lakh coming from your contributions alone.

I started an RD with my bank when I was 25. It was just Rs. 1,000 a month. But watching it grow gave me the motivation to save more. I kept contributing to this RD till was 40 years of age. I eventually used this RD coprpus for my home purchase.

I think, RDs are flexible, low-risk, and perfect for building our first one lakh. Contributing just Rs.1,800 per month in an RD will take you to one lakh in about four years.

Plus, you can choose a tenure that suits you, from six months to ten years. It’s like a piggy bank, but it also pays interest.

3. Dip Your Toes into Mutual Funds

Now, let’s talk about something a bit more exciting, mutual funds.

If you’re willing to take a little risk for higher returns, mutual funds can be a game-changer.

Systematic Investment Plans (SIPs) let you invest small amounts regularly, starting as low as Rs.500 a month. Equity mutual funds, which invest in stocks, can give returns of 12-15% annually over the long term, though they come with market risks. For example, if you invest Rs.5,000 a month in an equity mutual fund with an average return of 12%, you could reach one lakh in about 15 months.

Debt mutual funds or liquid funds are safer options, offering 6-8% returns. They invest in fixed-income securities like bonds and are less volatile. You can start with a small SIP of Rs.2,000 in a balanced fund, its mix of eqiuty (risky) and debt (safe). This way you can diversify your savings while also learning about the market.

Curious about debt mutual funds? Check this blog dedicated to the topic.

4. Liquid Funds for Flexibility

If you want quick access to your money, liquid funds are worth considering (as an alternative to balanced funds).

These are a type of debt mutual fund that invests in short-term instruments like T-Secs/T-Bills (short terms bonds issed by the Government of India). They offer returns of around 5-7% and are highly liquid, meaning you can withdraw your money in a day or two (without any risk of loss to the invested capital or the return). They are considered even safet than a bank FD.

Liquid funds are great for parking your savings while earning better returns than a regular savings account.

For instance, if you have Rs. 50,000 to invest, a liquid fund at 6% could grow it to Rs. 53,000 in a year. It’s not a huge jump, but it’s better than letting your money sit idle in gullak.

I used a liquid fund back in 2021, when were expecting another market crash due to the second COVID wave. At that time it was not sure when the crash would happen, so I parked my spare cash in a liquid fund. I could have easily kept the funds in my saving account, but I want to try a liquid fund. The liquid fund fetched me about 0.65% higher return than savings account.

When money is parked in a liquid fund, we can have the same peace of mind knowing I could access the money if needed.

Could liquid funds fit into your savings plan? If you are planning to keep cash in saving account, consdier liquid funds instead (check the return here)

5. Boost Your Savings By Cutting Costs

Saving one lakh isn’t just about investing, it’s also about spending wisely.

Look at your expenses and find areas to trim.

Eating out less, using public transport, or switching to a cheaper phone plan can free up hundreds of rupees a month. I used to buy branded clothes until I realized I could get similar quality from local stores for half the price. That switch saved me Rs.10,000 a year.

Another tip is to avoid impulse purchases.

Before buying something, ask yourself, “Do I need this, or do I just want it?” Waiting 24 hours before making a purchase can help you avoid regrets.

Also, take advantage of discounts and cashback offers when shopping online.

Every rupee you save is a rupee closer to your one-lakh goal.

[Quick Tip: You can also start a small side hustle to make some extra money each month. Let this earning be as small as Rs.100 in a month, but try to make it an assured income stream. If you are good in writing, start a blog of your own. If you are good with gadgets, start a instagram channel which can give you some leads over time. You can also sell some old stuffs of your home on OLX.]

Stay Motivated and Track Progress

Saving one lakh takes time, and it’s easy to lose motivation.

Keep your goal in sight by tracking your progress.

Use the Excel spreadsheet or Google Sheets to see how your saving is growing. Celebrate small milestones, like reaching Rs. 25,000 or Rs. 50,000.

These moments remind you that you’re on the right path.

I used to reward myself with a small treat, like a movie ticket, every time I hit a savings milestone. It kept me excited about my goal.

Also, surround yourself with people who support your financial journey. Share your goal with a friend or family member who can cheer you on.

Who’s your biggest cheerleader?

A Word on Taxes and Inflation

As you save, keep an eye on taxes and inflation.

Some schemes, like PPF and Equity-Linked Savings Schemes (ELSS), offer tax deductions under Section 80C, up to Rs. 1.5 lakh a year. This can reduce your tax burden and leave more money for savings. However, inflation can erode your money’s value over time. At 6% inflation, Rs. 1 lakh today will be worth only Rs. 55,000 in 10 years.

That’s why investing in schemes that beat inflation, like hybrid mutual funds, is crucial.

When I started saving, I didn’t think about inflation. But after learning how it eats away at savings, I shifted some of my money to equity SIPs. I’ll suggest you to read this article: Why staying out of the stock market might be your biggest mistake.

It’s a small step that can make a big difference in the long run. Are you factoring in inflation in your savings plan?

Conclusion

So, how do you actually reach one lakh? Let’s review our learning using a small hypothetical example.

- Suppose you earn Rs.25,000 a month and can save Rs.5,000.

- Put Rs.2,000 into a PPF for safety and tax benefits,

- Rs.2,000 into an SIP for growth, and

- Rs.1,000 into an RD for flexibility.

- In two years your corpus would look like this:

- Your PPF could grow to Rs. 53,000,

- Your SIP to Rs. 60,000 (assuming 12% returns), and

- Your RD to Rs. 27,000.

- That’s Rs. 1.4 lakh whic is well past your goal of one lakh.

Of course, your plan will depend on your income, expenses, and risk tolerance. The key is to start now, even if it’s with Rs. 500 a month.

Do you know what is the best part? By the time you will reach your first lakh, you will become mature enough not to stop at this milestone. Your, next goal will be 5 lakhs, then 25 lakhs, and then a crore.

One you get the taste of wealth building, it a journey which never stops and you enjoy every step.

Have a happy saving & investing.

![Goal-Based Saving - Your Path to Financial Control [ A Method] - Thumbnail](https://ourwealthinsights.com/wp-content/uploads/2025/04/Goal-Based-Saving-Your-Path-to-Financial-Control-A-Method-Thumbnail.png)