Summary:

- This post highlights five promising hidden gem stocks. Its as idea (a case study – not an investment advice) on how investors can build long-term wealth and achieve their Rs.1 Crore dream through patience, research, and faith in India’s growth story. Jump here to see how my Stock Engine’s Scores these stocks.

How To Identify Quality Stocks

Take This Quiz

Introduction

Like many of you, I dream of a better future for my family. A good school for my kids. A comfortable home. Maybe a trip to the hills someday. That’s what I call my Rs.10 Lakh dream. It is a number that feels big but real, something to aim for over the years.

To get there, I’ve been digging into the stock market, not chasing quick wins. Instead, I’m looking for companies I can trust for the long haul. Not the usual big names like Reliance or HDFC Bank, though. I wanted something different, stocks that aren’t on everyone’s radar but have the spark to grow.

Today, I’m sharing five such companies I’d bet on for my family’s future.

They’re not perfect, but they feel right to me. Let’s know more about those stocks.

Why I Believe in Long-Term Investing

I wasn’t always a patient investor.

Around year 2010, about 15 years ago, I lost Rs.10,000 chasing a “hot” stock tip from a friend. It was not a pleasant experience for me. That’s when I realised short-term trading isn’t for me.

Long-term investing is was something that felt different and I was psychologically more built for it. Thakfully, at that time, instead of getting discouraged and getting away from stocks investing as a whole, I found solace in long term investing. I could feel that it was different and built for me.

It’s like planting a mango tree, you water it, wait, and one day, it gives you fruit.

Stock market is perfect for this. Our economy is growing, our population is young, and new sectors are popping up. Beyond the Nifty 50, there are mid-cap and small-cap companies growing at 20-30% a year.

Why settle for the usual when these hidden gems can shine brighter?

For me, long-term investing is personal.

It’s about sleeping soundly, knowing I’m building something for my kids. Data backs this up too. The Nifty Midcap 50 index has grown by 4X times in last 5 years (33% CAGR). In the same period, the Nifty 50 index has growm by 2.5X times (CAGR of 20%). In a growing economy like India, the future holds similar possibilities.

Sure, there will be ups and downs, like it has been in the past (2008 crisis, Brexit, Covid, Ukrain war, Trump tariff’s, etc). Similarly, future can also be as volatile. But the time smooths them out.

Isn’t that what we want, “a growth that we can count on without the stress?“

How I Picked These Stocks

Choosing stocks isn’t just about returns. I learned that the hard way.

I look for companies with strong finances, good revenue growth, low debt, and a solid track record.

But I also ask the following questions:

- Does this company fit my family’s values?

- Can it grow for the next 10-20 years?

- Is it part of India’s future?

Finding answers to these qualitative questions is not easy. For that, I as an investor should know more about the company. What is the best way to do it? By digging into the annual reports. I also read what analysts say, and think about the world my kids will live in.

Technology, healthcare, green energy, these are areas I believe in.

I try to not get too much attracted by the Nifty 50 giants. They’re safe, but everyone knows them. So the possibility of stellar returns are remote from such stocks. Instead, I went for mid-caps and small-caps. These are companies with room to grow but is much less hyped.

These stocks can be riskier, no doubt. Their prices swing more, and not all will succeed. But I spread my bets (diversification) and focus on businesses I understand and beleive it. For example, I’m a mechanical engineer who understands capex, expansion plans, growth, process, equipments, automation, etc. So I tend to bet on such stocks more.

Success in stock investing is not not about following the crowd, it’s about finding value others might miss.

My Five Bets for the Future

1. Tanla Platforms – Digital Best

Imagine getting an OTP from your bank or a text from your favourite app. Chances are, Tanla Platforms made it happen.

This Hyderabad-based company is a leader in cloud communications. It helps businesses send secure messages. It’s not a flashy name, but it’s growing fast, over 30% revenue increase in recent years. Its balance sheet is clean, with no debt and a high return on equity of 25%.

With 5G rolling out and digital transactions booming, Tanla is in the right place.

Why do I like it? Kids are glued to their phones, right?. The digital world is the future for these kids. And Tanla is quietly powering this digital world.

But there can also be a catch, big global players like Twilio could challenge smaller Indian companies (like tanla). Still, I think Tanla’s focus on India gives it an edge.

If I had to start investing in Tanla today, I would start accumulating it gradually. In the last 6 months, the stock is down -35%. Slow gradual accumulation with earns and eyes fully receptive to the news is what I think will suit my styles of investing.

2. Suzlon Energy – Green Energy

Suzlon Energy used to be a wind energy star, then hit rough times with debt. Between 2013 and 2023, the stock was almost flat. But since then, it has given 7X returns.

There is no doubt that with so much buzz related to green energy around, the company is surely turning around. Till March’23, its interest coverrage ratio was at 2X, now it is 6X. Between Mar’23 and mar’24, it has rediced its total debt by “17 Times” (Mar’23 1904 Crore, Mar’24 109 Crore).

In the last quarters, it has further slashed its debt by 70%. It has also bagged orders for 1,500 MW of wind projects in 2023. India’s push for renewable energy, imagine capacities reaching like 500 GW by 2030, makes Suzlon a smart bet.

Its profit margins are improving, and it’s starting to win contracts again.

This stock feels personal to me. I want my family to breathe cleaner air. Suzlon’s wind turbines are a step toward that.

Yes, it’s not without risks. The past mismanagement left scars. Looking ahead, execution is key for this company. But at its current price, I see more upside than downside (for myself).

Doesn’t a greener India sound like a future worth investing in?

3. Metropolis Healthcare – Health is Wealth

Healthcare is close to my heart. A few years ago, my father felt very sick, and I saw how vital diagnostics are for the right diagnosis.

Metropolis Healthcare runs over 150 labs across India, growing its revenue by 20% yearly. It’s not a hospital chain, it focuses on tests like blood work and cancer screenings.

With Indians spending more on health and insurance, Metropolis is riding a wave I think. Its EBITDA margins are solid at 25%, and it’s expanding into smaller cities.

I’d pick this stock because it’s about protecting my loved ones. If my family needs a test, I want a name I trust.

The risk? Government regulations could squeeze profits. But I believe India’s healthcare boom will keep Metropolis growing. A steady stock for a steady need.

4. Dixon Technologies – Electonics Theme

Dixon Technologies makes TVs, phones, and appliances for brands like Samsung and Xiaomi.

It’s a quiet giant in India’s push to manufacture locally.

Thanks to government schemes like PLI, Dixon’s sales grew at a rate of 32% per annum in last 5 years. Now, it’s even starting to export, which could be another huge plus.

Its financials are strong, with new factories coming online.

I like Dixon because it’s also about pride. Every time I see a “Made in India” label, I smile. This stock is for the India my kids will inherit, one that builds, not just buys.

The downside? It depends on government policies and global demand. But with India’s electronics market exploding, Dixon feels like a winner.

5. CAMS: The Backbone of Our Investments

CAMS (Computer Age Management Services) might sound boring, but it’s not.

It handles the paperwork for 70% of India’s mutual funds.

Every time you invest in a SIP, CAMS is there. As more Indians pour money into mutual funds, AUM doubled in five years, CAMS keeps growing.

Currently this growth stocks is also yield a 1.77% dividend. It is one stock which has a very steady cash flow.

This stock resonates with me because I’m a SIP investor myself. CAMS feels like a partner in my wealth journey.

The risk is low, but new tech or regulations could shake things up.

Still, its niche monopoly makes it a safe. I think it is a steady bet for me.

Who doesn’t love a stock that grows quietly?

Building Your Rs.1 Crore Dream

These five stocks, Tanla, Suzlon, Metropolis, Dixon, and CAMS, are my bets for the long term. They’re not perfect, but they’re diverse: tech, energy, healthcare, manufacturing, and finance.

I plan to invest regularly in these stocks for next few months at least. Idea is to buy the dip. Though, I’ll also keep my an eye on their quarterly results.

Mid-caps and small-caps can be volatile, so I spread my money across them. My main stock portfolio has more stable stocks, but I planning give me a growth push now.

But the patience will be the key for me here. Stocks like Suzon, Tanla, etc can be very volatile. Since all this time, I’ve invested more defensively. Banking, Technology, Metals, Pharma, etc are my main long term bets. But I want to add more fizz.

I’m not expecting to be a crorepati tomorrow. But I want a combination of these five stocks to get to Rs.1 Crore valuation in next 10-15 years down the line. Suggested Reading: How wealth explodes after reading 1 crore.

What’s my advice to myself? Start small. Research these companies yourself. I’ve checked the scores of these stocks in my Stock Engine, and it looks like this:

List of Stocks & How My Stock Engine See’s It

| SL | Name | Overall Score (100) | Stock Engine’s Remarks |

|---|---|---|---|

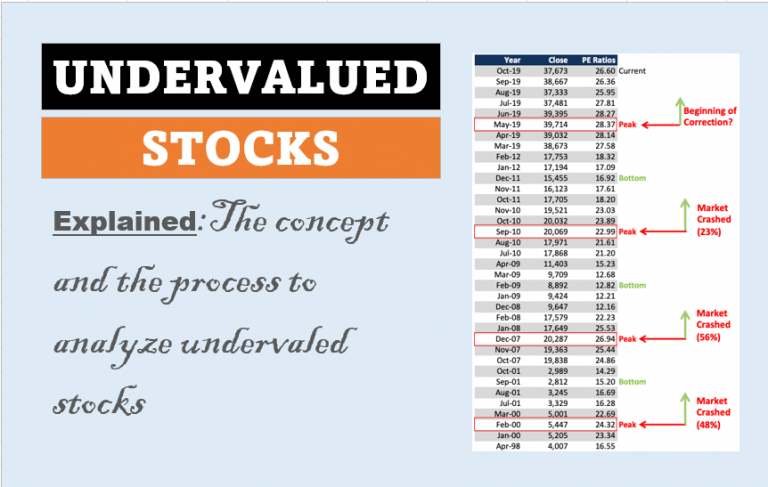

| 1 | Tanla | 71.12 | I May Buy [Price is nearly undervalued But Fundamentals are only OK] |

| 2 | Suzlon | 50.75 | I May Wait For Correction [Price is Overvalued & Fundamentals are OK] |

| 3 | Metropolis Health | 52.56 | I’ll Avoid [Price is Overvalued & Fundamentals Must also Improve] |

| 4 | Dixon Tech | 61.5 | I’ll Add to My Watchlist & Wait For Correction [Price is Overvalued But Fundamentals are Reasonable] |

| 5 | CAMS | 78.0 | I’ll Will Wait [Price Must Correct But Fundamentals are Strong] |

A Quick Note

Before I go, a small disclaimer. I’m not a financial advisor, just a guy trying to secure his family’s future. These stock picks are based on my research, but they come with risks. Mid-caps and small-caps can be unpredictable.

Always talk to a financial planner and do your own homework before investing. My only agenda is to share what I’m learning, nothing more.

Have a happy investing.