Summary:

- Let’s compares the 5-year performance of Mirae Asset Large Cap Fund, SBI Bluechip Fund, and ICICI Prudential Bluechip Fund, analyzing returns, risk, costs, and portfolio strategies to help growth-oriented professionals choose the best large-cap mutual fund for wealth creation.

XIRR CALCULATOR

Mutual Fund XIRR Calculator

Enter investments as negative numbers (cash out) and returns/current value as positive numbers (cash in).

| Date | Amount |

|---|---|

Introduction

As a growth-oriented professional, you’re likely looking for investments that can turbocharge your wealth while keeping risks in check. Our mutual fund universe is well suited to meet this goal. Currently, there are over 5.6 crore SIP accounts and Rs.50.78 trillion in assets by 2023. We investors have plenty of options within India.

But how do you pick the right one?

Large-cap mutual funds are known for their stability and exposure to India’s top companies. These type of funds are favorite for busy professionals like you who want growth without wild swings.

So in this blog post, we will explore this fund category. We'll compare three heavyweights (Our Trio):

- Mirae Asset Large Cap Fund,

- SBI Bluechip Fund, and

- ICICI Prudential Bluechip Fund.

Our comparison will be between a five year period from January 2020 to December 2024. Our analysis will be done by comparing their returns, risk, costs, and more.

At the end, we’ll uncover which fund might best fuel your financial goals.

What is the goal? Reading such a blog post will build an perspective to look deep into mutual funds and pick the winner for ourselves.

Why Compare Large-Cap Funds Over 5 Years?

Large-cap funds invest at least 80% of their assets in India’s top 100 companies by market cap.

This is done per SEBI’s rules. Hence, this type of fund becomes a solid bet for growth with lower volatility. As compared to other types funds (mid- or small-cap funds), the risk return-return ration of large-cap funds is clearly more balanced.

I feel, the 2020–2024 period is a perfect lens for comparison. This period will capturing unprecendented events like the 2020 COVID crash, the 2021–2022 bull run, global turmoils, central banks policies, etc. In these last five years, it seems that the mutual fund industry has seen everything.

Though I'm calling it unprecedented, because all that has happened in a narrow zone of five years, but the market in generally also behaves very cyclically. Covid or no covid, market will have its own mood swings.

These cycles test a fund’s resilience and ability to deliver for growth-seekers.

We’ll evaluate "our trio" using the following key metrics:

- Annualized returns (lumpsum and SIP),

- Risk-adjusted returns (Sharpe Ratio),

- Volatility (standard deviation),

- Expense ratios,

- Portfolio composition, and

- Performance against benchmarks like NIFTY 100 TRI and BSE 100 TRI.

While past performance isn’t a crystal ball, it reveals consistency and strategy. It gives us investors an idea of what best or worst we can expect from our future investments.

The Chosen Mutual Funds Schemes

Let's look at our three picked mutual fund schemes. All three are large-cap equity funds with massive investor followings:

- Mirae Asset Large Cap Fund: It is managed by Mirae AMC. This fund targets capital appreciation through a diversified portfolio of large-cap stocks, with a growth-oriented tilt. The AUM of this scheme is about Rs.38,000 crore. Generally speaking, the investors seeking high returns from blue-chip companies like HDFC Bank and Infosys will buy this scheme. Its strategy emphasizes value investing in growth businesses. This type of investment approach appeals to professionals chasing long-term gains.

- SBI Bluechip Fund: It is run by SBI Mutual Fund, India’s largest fund house. The focus of this scheme is on market-leading companies for stability and growth. The AUM of this scheme is about Rs.45,000 crore. This is one scheme which is known for its balanced approach. It blend giants like Reliance Industries with select mid-caps stock. It is one scheme which are favoured by people who want growth but with a safety net.

- ICICI Prudential Bluechip Fund: It is managed by ICICI Prudential AMC. This fund has an AUM of about 65,000 crore. It prioritizes stable blue-chip companies for consistent growth. Its heavy weighting toward giants like ICICI Bank. It is ideal for professionals seeking high returns with minimal fluctuations. Its disciplined strategy has earned strong ratings from Morningstar and CRISIL.

These funds are all large-cap by SEBI’s definition. They offer a fair comparison but differ in portfolio construction and risk appetite.

I've picked these three scheme as I think it will add a spice to our analysis and which is good for growth-oriented investors.

Methodology: How I Analyzed The Performance

I've analyzed the funds from January 2020 to December 2024, using data from reliable sources like Morningstar India, Moneycontrol, and AMFI.

Key metrics include:

- Annualized Returns: Lumpsum and SIP returns (CAGR and XIRR) to measure growth.

- Sharpe Ratio: Risk-adjusted returns to gauge reward per unit of risk.

- Standard Deviation: Volatility to assess stability.

- Expense Ratios: Costs impacting net returns.

- Portfolio Composition: Sector allocations and top holdings to understand strategy.

- Benchmark Comparison: Performance against NIFTY 100 TRI (Mirae, ICICI) and BSE 100 TRI (SBI), plus large-cap category averages.

Performance Analysis

Let’s dive into the numbers.

We'll compare our funds across metrics to see who shines for growth-oriented professionals.

Annualized Returns (Lumpsum and SIP)

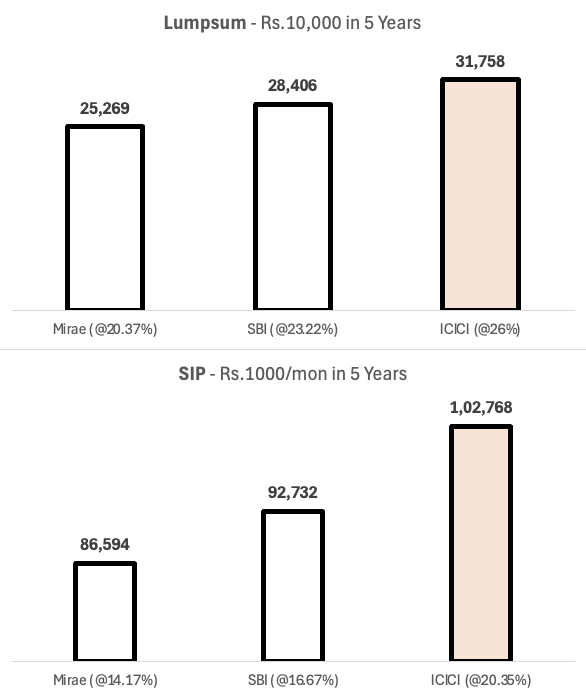

- Mirae Asset Large Cap Fund:

- Lumpsum: 20.37% CAGR, trailing peers but strong for large-caps.

- SIP: 14.17% XIRR, reflecting steady growth via cost averaging.

- Remark: This scheme has benefited from 2021–2022 bull run but lagged in 2023’s IT rally due to broader sector exposure.

- SBI Bluechip Fund:

- Lumpsum: 23.22% CAGR, outperforming Mirae and the large-cap category average of ~18%.

- SIP: 16.67% XIRR, solid for disciplined investors.

- Remarks: This scheme has shown sStrong recovery post-2020 crash. The growth was driven mainly by financials and consumer stocks.

- ICICI Prudential Bluechip Fund:

- Lumpsum: 26% CAGR, the leader, beating benchmarks and peers.

- SIP: 20.35% XIRR, exceptional for SIP investors.

- Remarks: It excelled in the 2023 IT rally and maintained consistency across cycles.

Benchmark Comparison:

- NIFTY 100 TRI returned 18.5% CAGR.

- BSE 100 TRI ~22% CAGR.

ICICI outperformed both the index. SBI also beat them comfortably. Mirae slightly exceeded benchmarks. It is a suggestion that active management has added value to the scheme.

The large-cap category average of about 20% was outpaced by all three (Mirae has just managed).

Risk-Adjusted Returns (Sharpe Ratio)

To learn about the concept of Sharpe Ratio, you can please read this blog post.

- Mirae Asset: Sharpe Ratio ~0.85. I've estimated this based on 20.37% return and ~15% standard deviation. A sharpe ratio of below one means the return is decent but lower due to moderate returns. The risk-return balance is only decent.

- SBI Bluechip: Sharpe Ratio ~1.0. I've estimated it based on 23.22% return and ~14.5% standard deviation. A sharpe ratio of about 1 mean a strong balance between the risk and reward.

- ICICI Prudential: Sharpe Ratio ~1.2. I've estimated it based on 26% return and ~14% standard deviation. This scheme has the best risk-adjusted performance. It is ideal for growth-oriented pros. A sharpe ratio of 1.2 or high is an excellent indicator.

[Note: The assumed risk free rate is about 7.62%, typical for Indian bonds in 2020–2024]

Insight: ICICI delivers the best return for the kind of risk the investor is taking. SBI offers a solid middle ground. Mirae’s lower ratio reflects its trailing returns, but it’s still competitive.

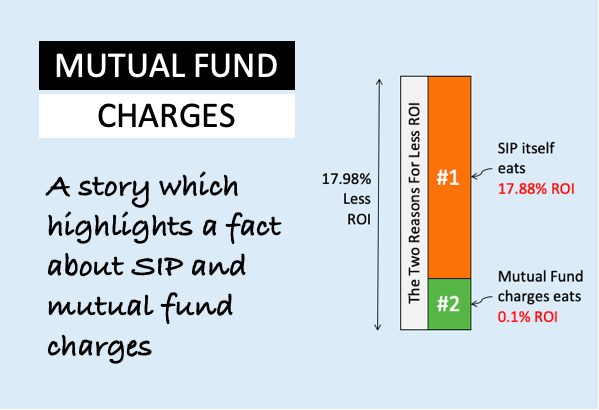

Expense Ratios

- Mirae Asset: 1.56% for a Regular Plan. Higher costs eat into returns. It is a drawback for long-term growth. For a Direct Plan, the expense ratio is 0.74%,

- SBI Bluechip: 1.5% for a Regular Plan and 0.82% for a Direct Plan. These numbers say that it is a cost-efficient fund which eventually boosts it net returns as well.

- ICICI Prudential: 1.41% for Regular Plan and 0.89% for Direct Plan. It direct plan has a slightly higher expense ratio that SBI's but justified it by the stellar performance.

Insight: SBI and ICICI’s lower fees make them more attractive for cost-conscious professionals. Mirae’s 1.56% (likely Regular Plan) suggests a higher distributor commission. So consider the Direct Plan whose expense ratio is lower at 0.74% for better returns.

Portfolio Composition

- Mirae Asset:

- Sectors: Financials (34%), Technology (11.41%), Consumer Goods (16.1%), Energy (12.41%).

- Top Holdings: HDFC Bank, Infosys, Reliance Industries, ICICI Bank, Bharti Airtel.

- Allocation: Giant 73.23%, Large 13.65%, Mid 11.79%, Small 1.33%, Cash 0.48%.

- Remarks: Diversified but mid-cap exposure adds growth potential and risk.

- SBI Bluechip:

- Sectors: Financials (34%), Consumer Goods (14.82%), Technology (11.45%), Industrials (8.55%).

- Top Holdings: Reliance Industries, HDFC Bank, ITC, Larsen & Toubro, Infosys.

- Allocation: Giant 70.7%, Large 19.77%, Mid 9.53%, Cash 3.93%.

- Remarks: Heavy financials and cash buffer enhance stability, but less IT exposure hurt 2023 gains.

- ICICI Prudential:

- Sectors: Financials (30.34%), Technology (11.41%), Energy (12.41%), Auto (10.16%).

- Top Holdings: ICICI Bank, Reliance Industries, Infosys, HDFC Bank, Bharti Airtel.

- Allocation: Giant 82.28%, Large 15.24%, Mid 2.39%, Small 0.1%, Cash 1.69%.

- Remarks: Giant-heavy portfolio and IT focus drove 2023 outperformance, ideal for growth with low volatility.

Benchmark and Peer Comparison

We've compared three funds were compared against benchmarks and large-cap peers (Period was between January 2020 to December 2024).

- The NIFTY 100 TRI, used by Mirae Asset and ICICI Prudential, returned ~18.5% lumpsum and ~15% SIP XIRR, per AMFI estimates.

- The BSE 100 TRI, SBI Bluechip’s benchmark, delivered ~18% lumpsum and ~14.5% SIP XIRR.

ICICI’s 26% and SBI’s 23.22% lumpsum returns significantly beat these, while Mirae’s 20.37% edged ahead.

Large-cap funds averaged ~18% lumpsum and 14–15% SIP XIRR, per ETMoney, with all three funds outperforming, ICICI leading.

The 2020 COVID crash (~40% market drop) saw ICICI recover fastest due to its giant-heavy portfolio, followed by SBI. Mirae’s mid-caps lagged initially but rallied in 2021.

In 2022, RBI rate hikes hit financials; ICICI’s IT exposure and SBI’s cash cushioned losses, while Mirae relied on diversification.

The 2023 IT rally boosted ICICI (22% IT) and Mirae (20% IT), but SBI (15% IT) trailed. These dynamics highlight each fund’s strengths for growth-oriented investors.

Key Insights and Takeaways

For growth-oriented professionals, this analysis reveals clear winners and trade-offs:

- ICICI Prudential Bluechip Fund shines with a 26% lumpsum return, 20.35% SIP XIRR, and the best Sharpe Ratio (1.2). Its giant-heavy (82.28%) portfolio and low volatility (14%) make it ideal for those seeking high growth with stability. Its 0.89% expense ratio is a cherry on top.

- SBI Bluechip Fund delivers a strong 23.22% lumpsum and 16.67% SIP XIRR, with a competitive Sharpe Ratio (~1.0) and the lowest expense ratio (0.82%). Its balanced portfolio and 3.93% cash buffer suit professionals wanting growth with a safety net.

- Mirae Asset Large Cap Fund trails with 20.37% lumpsum and 14.17% SIP XIRR, hampered by a high 1.56% expense ratio (consider the Direct Plan at 0.6%). Its mid-cap exposure (11.79%) adds growth potential but increases volatility (15%).

Suitability: ICICI is the top pick for maximizing returns with lower risk, perfect for busy professionals. SBI is great if you prioritize cost efficiency and stability. Mirae suits those willing to accept slightly higher risk for mid-cap upside. All three beat the NIFTY 100 TRI (18.5%) and category average (18%), validating active management for growth-seekers.

Your choice depends on balancing growth, risk, and costs. ICICI’s consistency across market cycles (2020 crash, 2023 rally) makes it a standout, but SBI’s lower fees and Mirae’s growth tilt are compelling.

Keep monitoring performance, as markets evolve.

Conclusion

Comparing large-cap funds shows why they’re a cornerstone for growth-oriented professionals like you.

ICICI Prudential Bluechip Fund leads with stellar returns and low volatility, followed closely by SBI Bluechip’s cost efficiency and Mirae Asset’s growth potential.

Each fund navigated India’s rollercoaster markets, 2020’s crash, 2022’s rate hikes, 2023’s IT boom, with distinct strengths, offering lessons in resilience and strategy.

Ready to build your portfolio? I'll consdier Consider starting an SIP in ICICI or SBI for disciplined growth, or explore Mirae’s Direct Plan to cut costs.

Have a happy investing.