Summary:

- I’ll share with you inspiring stories of ordinary people like Rajesh, Priya, and Ankit, who achieved financial freedom through smart investing, persistent effort, and diversified income streams, offering practical lessons for anyone looking to take control of their finances.

Financial Freedom Calculator

Result

Introduction

Financial freedom is a phrase we hear a lot these days, right? But what does it mean for us? For some, it’s about retiring early and enjoying life. For others, it’s having enough wealth to sleep peacefully at night. Or maybe it’s just being free from the burden of having to compulsorily do a job.

In a relatively poor country like ours, where money matters can feel overwhelming to many, financial freedom sounds like an impossible dream. I think, for a majority of middle class India, it is a very tough goal to achieve.

But it is also true that many ordinary Indians have achieved it. Their stories prove it’s not just for the rich or the lucky.

I’m excited to share some real stories with you today.

These aren’t tales of billionaires or Bollywood stars. They’re about people like us with regular jobs and dreams. They faced struggles, worked hard, and found their way to financial freedom.

Let’s dive into their journeys and see what we can learn.

What is Financial Freedom?

What financial freedom really means.

It’s not about having crores in the bank or owning a fancy car. It’s much simpler than that.

It’s about having enough money to live life your way. Enough to pay your bills, handle emergencies, and maybe even chase a passion or two. All this is done without being dependent on your job or work.

For many of us, financial freedom could mean different things. Maybe it’s clearing that home loan that’s been hanging over your head. Or saving enough so your kids can study without worry. Some might see it as retiring at 50 and spending time with family.

Whatever it is, it’s about control, control over your money and your choices.

Achieving this takes effort. It’s not something that happens overnight. You need a plan, some discipline, and a few smart moves.

But as you’ll see, it’s doable.

Real Stories of Financial Freedom

Let me introduce you to some real people who’ve made it happen. Their stories are different, but they all share one thing, they didn’t give up. Their determination to reach the destination of financial freedom was strong.

Story #1: 9-to-5 Job

This is a story of a salaried employee who invested wisely.

Rajesh is a 45-year-old IT guy from Bangalore. He started like most of us do, with a basic job and a small salary. Nothing fancy, he got out of his Engineering college in Tumkur and got a entry level job in Bangalore.

But Rajesh had a habit that set him apart. He started investing early. Back in his 20s, he put a little money into mutual funds every month. It wasn’t a lot, but he stuck with it.

Over the years, his investments grew. He didn’t just stop at mutual funds. He tried stocks, bonds, and even bought a 2-BHK home for himself. Smart, right?

He spread his money around so that if one thing didn’t work, the others could hold him up.

By 40, Rajesh had paid off his home loan. He’d saved enough for his kids’ education too. Today, he’s financially free.

He still works, but it’s because he wants to, not because he has to. Isn’t that the kind of freedom we all dream of?

Story #2: Small Entrepreneur

This is a story of a small business owner who scaled smartly.

I’m talking about Priya from Mumbai. She’s 38 and runs a jewelry business from Borivali.

Her business didn’t start big. She began by selling handmade pieces online. It was just a side hustle for her. Overtime, when she noticed that there are buyers for her design, she saw an opportunity. That was the moment she had to decide between her settled housewife role of a new and unknown world full of opportunities.

She picked the later without much doubts.

Running a business wasn’t easy. Priya had to figure out marketing and pricing on her own. She messed up sometimes, like buying too much stock or charging too little. But she learned fast.

One thing she did right was putting her profits back into the business. Instead of splurging, she focused on growth.

She also reached out for help. Local business groups and mentors gave her advice that made a difference.

Slowly, her business took off. Now she even sells abroad and earns enough to live comfortably. For a housewife like Priya, he ability to build her saving from zero to double-digit lakhs is financial freedom.

Story #3: A Freelancer

The freelancer who diversified his income streams that eventually helped his reach this stage.

I’m talking about Ankit, a 30-year-old graphic designer from Delhi. He didn’t want a 9-to-5 job.

Freelancing suited his personality better. But he knew one thing, relying on just one income wasn’t safe. So he got creative.

Ankit offered more than just design work. He added web development and digital marketing to his skills. If one gig dried up, another kept him going.

He even started selling WordPress design templates online for some extra cash. Passive income, is what he was aiming to achieve.

He saved a lot too. Part of every payment went into a safety net, fixed deposits and mutual funds.

Today, Ankit’s got multiple income sources and a solid backup. He picks projects he loves, not just ones that pay. That’s real financial freedom in action.

Lessons Learned from These Stories

So, what can we take away from Rajesh, Priya, and Ankit?

Their journeys teach us a lot.

Starting early makes a huge difference.

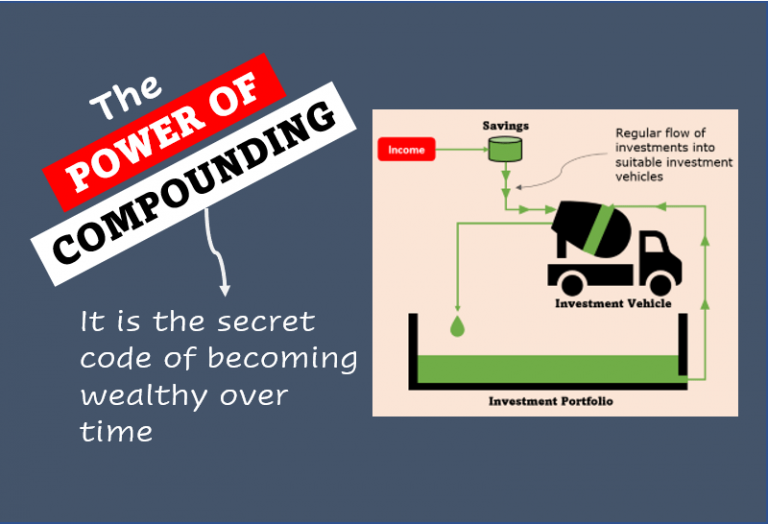

- Rajesh didn’t wait till he was rich to invest. He began small and kept at it. Time worked in his favor.

- Priya’s story tells us to learn from our slip-ups. Mistakes happen, but they’re only bad if you don’t learn and grow from them.

- Ankit showed us the value of not depending on one thing. Whether it’s income or investments, spreading things out keeps you safer.

And all three of them proved that saving and investing go hand in hand. Saving keeps you secure, but investing helps your money grow. Read about, what is more important, saving or investing.

Another big lesson? Don’t do it alone.

Priya leaned on mentors. Rajesh probably read up or talked to experts. Asking for guidance isn’t a weakness, it’s actually a very smart move that majority of us cannot use wisely. But people who do, can grow at double the speed.

How to Start Your Journey Towards Financial Freedom

Feeling inspired from these stories? You should be. Here’s how you can get started.

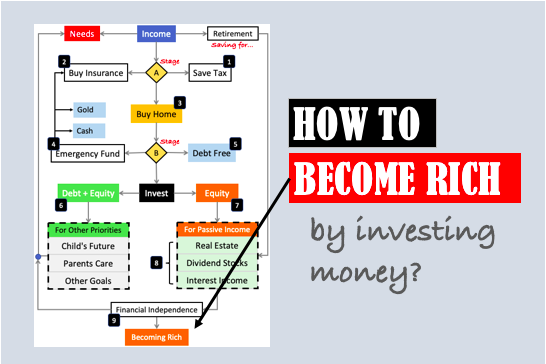

- First, figure out what financial freedom means to you. Is it owning a home? Retiring early? Write it down. Knowing your goal keeps you focused. For me, financial freedom is about generating a passive income which is big enough to take care of all my daily expense needs. Once, I will reach the stage of financial freedom, I’ll think about becoming rich. Read more about how to become rich – the ultimate guide to building wealth and financial freedom.

- Next, take a deep look at your money. Observe, where’s it coming from? Where’s it going? When you know the cash flows, set an expense budget. A budget helps you spot leaks and save more. I remember when I first tried budgeting, it was eye-opening to see how much I spent on chai and snacks. Read about the 50-30-20 Budgeting rule.

- Start investing, even if it’s just a little. Mutual funds are a good place to begin. Or maybe stocks, if you’re ready to learn. The key is to start now. Waiting will only delay your freedom.

Think about extra income too. Could you freelance? Sell something online? Even a small side hustle can add up.

And keep learning. Books, blogs, podcasts, or even a chat with someone who’s done it. knowledge is power. I personally like watching interviews, especially long ones, of all kinds of people. It can give an insight into how the person thinks and do things.

Conclusion

Financial freedom isn’t the same for everyone.

For Rajesh, it’s security. For Priya, it’s growing her business. For Ankit, it’s flexibility.

What is financial freedom for you? Defining it will push you to take the next step. Had I been in my 20s today and I had to define financial freedom for myself, I would say, it be having Rs.10 Lakhs in my stock portfolio.

These stories show it’s not about being born rich. It’s about making choices, small ones, big ones, every day.

It’s about taking control so money doesn’t control us.

So, what’s your next move? Maybe it’s opening that savings account you’ve been putting off. Or cutting back on one expense to invest instead.

Whatever it is, don’t wait. Your financial freedom starts with a single step.

Why not take it today?

![How Wealth Accelerates After Reaching One Crore [Compounding]](https://ourwealthinsights.com/wp-content/uploads/2024/09/How-Wealth-Accelerates-After-Reaching-One-Crore-Thumbnail-768x443.png)