Building The Required Corpus with SIP

Summary:

- Vishal Dev, a 25-year-old from Gurgaon, aims to build a Rs.1 crore corpus by age 45 through disciplined SIP investments in equity mutual funds, and this guide outlines his step-by-step plan, emphasizing early investing, compounding, and smart fund choices for young Indians.

Introduction

Imagine yourself as a 25 year old man fresh into your first job. At this stage itself you are dreaming of financial freedom. Sounds exciting, right? That’s where Vishal Dev, a 25-year-old software engineer from Gurgaon, found himself. Like many of us, he wanted to secure his future without sacrificing today’s joys.

What was his goal? To build his first one crore corpus by age 45.

How did he plan to get there? Through Systematic Investment Plans, or SIPs.

Let me walk you through Vishal’s journey and show you how you, too, can build a one crore corpus with discipline and smart choices.

About SIP in Mutual Funds

SIPs is a simple way to invest in mutual funds.

You put in a fixed amount every month, and it gets invested in a mutual fund scheme of your choice. We can think of it like the bank’s recurring deposit (RD), but the main difference being how your money is getting used.

- In SIP, your funds are used to buy stocks, bonds, etc .

- In RD, the banks keep your money and use it to offer loans to others.

And, the above two differences is what generates the alpha (higher returns) for SIP over RDs.

SIPs also offer us the advantage of rupee cost averaging. Check the link to use a unique free Online Rupee Cost Averaging calculator.

Vishal started with Rs.10,000 a month.

He chose equity mutual funds because they offer better returns over the long term. Equity funds in India can give between 14-20% annual returns over 10-20 years horizon.

In the same period, RDs will probably yield about 6-7%. So it is obvious why Vishal picked equity over RD.

How Compounding Will Work For Vishal

A Compounding Calculator

When we invest through SIPs, our returns earn returns. Vishal’s Rs.10,000 monthly SIP, assuming a 17% annual return, could grow to Rs.2 crore in 20 years. That’s the power of SIP investing, it can help one big a sizeable corpus without excessive load

Let’s look at how Vishal’s investment shapes up in 20 years.

Vishal has invested Rs.10,000 monthly at 17% for 20 years. At this rate, he’ll invest Rs.24 lakh in total. But his final corpus will be a whopping Rs.2 crore in 20 years. That is about 8.42x of his invested value.

But consider two alternatives;

- Late Start: Had Vishal waited 3 more years to start, his final corpus would have reached only to Rs.1.2 Crore even though he continued his SIP for 17 years.

- Early Start: Had Vishal started just 1 year earlier, he would’ve need just Rs.8,300 per month SIP to reach the same goal of Rs.2 crore. Just because his money stayed invested or 21 years and not 20 years, his saving is Rs.1,700 per month.

That is why experts say, time is money. The earlier you start, the less you need to invest.

Signs: Will Vishal Become Rich, Ever?

In our youth, we are very ambitious.

We want big homes, fancy vacations, and early retirement.

Though we may not realize it, but inflation is a huge road-blog to our aspirations. Let me tell you how.

At 6% annual inflation, Rs.1 crore today will be worth only Rs.55 lakh in 20 years. That is why, it not only essential to save but also to invest our money (especially in equity – to bear inflation).

Rupee depreciation plays a negative role in our wealth building efforts. As the rupee weakens against the dollar, imported goods and foreign education get costlier. Equity SIPs, with their higher returns, help you stay ahead of inflation and currency challenges.

Picking equity as our vehicle to built large wealth over time is not an option, its a necessity. What Vishal did right was, he picked a quality equity fund over risk free options.

Another great example. Long time back I met Hema, a 27-year-old profession from Bhubaneswar. She delayed buying a car to start her SIPs. She invests Rs.15,000 monthly in mutual funds. The logic that she gave me have stuck with me since all these years. “A car loses value, but my investments grow.” Smart, isn’t she?

Young Indians even in Tier-2 cities like Bhubaneswar, Jaipur, or Coimbatore are catching on.

They’re prioritizing wealth creation over flashy purchases.

Choosing the Right Funds – A Critical Step

Not all mutual funds are created equal.

Vishal spent time researching funds that matched his risk appetite and goals. He picked a mix of Flexi-Cap and Mid-Cap funds. Why?

- Flexi-Cap funds invest across large, mid, and small-cap stocks, offering diversification. One such good funds is “Parag Parikh Flexi Cap Fund (D).” This is a five start rated fund which has generated a 18.15% CAGR in the last 10 years period.

- Mid-Cap funds focus on growing companies with higher return potential. One such quality fund is “HDFC Mid Cap Opportunity Funds (D)”, which has delivered an 18.19% annualized return over the past 10 years.

Mid-Cap funds are riskier than Large-Cap funds. If the market crashes, they can fall more.

Hence, Vishal balanced this by allocating 60% to a Flexi-Cap fund and 40% to a Mid-Cap fund.

He avoided sectoral funds, which are too volatile for long-term goals.

What I do? I do check the fund’s 5-10 year performance. I also check their expense ratio, and fund manager’s track record before investing. But more importantly, if I want to invest in mutual funds, I’ll buy only direct plans.

Step-by-Step Plan to One Crore Corpus

So, how do you start? Let’s break it down:

- Set a Clear Goal: Decide your target (Rs.1 crore) and timeline (20 years). Use a SIP calculator to estimate your monthly investment (jump to this calculator). For example, Rs.1 crore in 20 years at 17% returns, you’ll need Rs.5,000 monthly.

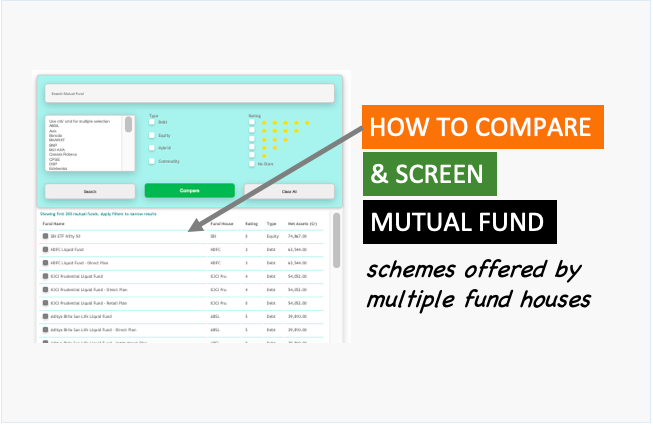

- Research Funds: Look for funds with consistent performance. Platforms like ValueResearch show past returns and ratings. Stick to 3-4 funds to diversify without overcomplicating.

- Automate Your SIPs: Set up auto-debits from your bank account. This ensures discipline. Vishal’s SIPs deduct on the 5th of every month, right after his salary credits.

- Review Annually: Check your funds’ performance once a year. If a fund underperforms for 2-3 years, consider switching. But don’t chase short-term gains.

- Increase Investments: As your income grows, step up your SIPs. A 5% annual increase can lower your monthly investment load significantly. For example, 5% step-up SIP, only Rs.3,800 monthly contribution will take you to one crore.

Common Mistakes to Avoid

I’ve seen friends who made mistakes, which otherwise might look too small, but made a mess of their wealth building journey. Let me highlight a few learnings out of them:

- First, don’t stop your SIPs during market dips. That’s when you buy more units at lower prices.

- Second, avoid investing in too many funds. It’s hard to track, and you dilute returns.

- Third, don’t expect quick returns. SIPs are for the long haul, when I say long, I’m talking about 15-20 years.

- Fourth is related to the fees. Funds with high expense ratios eat into your returns. Direct plans, which skip distributors, have lower fees. Read more about direct plane here.

Vishal ignored market noise and stayed focused. No matter what happened, one this he kept constant was high SIPs. He never stopped it, even during times when he was at his lowest. One more thing Vishal willingly chose to do was, he only invested in direct plans. He said, the next best thing to direct stock investing is direct plans of pure equity funds.

Why Delay Lifestyle Purchases?

This is where Vishal’s story gets real and extremely practical.

He wanted a swanky car at 30. Instead, he bought a used one. This way he neither had to liquidate his mutual fund unites not cut down the SIP.

When Vishal had to buy a home, he picked a smaller apartment compared to what his friends and colleagues were buying. He wanted his home loan EMI low enough that his SIP should not get disturbed.

He also planned regular prepayment to his home loan to substantially reduce the purchase cost of his house. Read more about home loan prepayment & its benefits in this link.

Ask yourself, do you need that Rs.25 lakh car now, or can you drive a Rs.5 lakh one. Remember, any purchase that is either going to disturn your monthly SIP or erode your accumulated corpus (mutual fund unites) is a bad purchase.

Keeping the lifestyle cost low is the way to accumulate Rs.1 crore in a fastest possible time.

Conclusion

Building a Rs.1 crore corpus isn’t a dream, it’s a plan.

Vishal show it’s possible with discipline and patience.

Start small, stay consistent, and let compounding work its magic.

India’s growing economy and rising SIP adoption make this the perfect time to begin.

So, what’s stopping you? Grab this SIP calculator, pick your funds, and take the first step today. Your future self will thank you.

Have a happy investing.