💰 Build Your ₹10 Crore: 30-30-40 Budgeting Rule

Summary:

- This article breaks down how much salary you need to build a Rs.10 crore corpus by following the 30-30-40 budgeting rule, factoring in time horizon, income growth, and investment returns. It includes a practical calculator and quiz to help you assess your financial readiness and plan realistically for long-term wealth. Take this wealth building quiz

Introduction

In the process of setting up a long-term financial goal, we often ask this question first “How much money is enough?” For some selected few Indians today, the answer seems to be Rs.10 crore. So, I’m writing this article for such people. Nevertheless, you can use the above calculator to check the financial viability for any corpus and any income levels.

Rs.10 crore is a big number even for high income individuals, but if planned correctly not impossible.

In this post we’ll talk about how much salary the person would need to build a Rs.10 crore corpus. We’ll do this analysis with an assumption that the person will follow the 30-30-40 rule for budgeting.

I’ll also explain how time horizon, income growth, and disciplined investing will play a decisive role in building the required corpus.

But first, let’s understand where this Rs.10 crore figure even comes from.

Why Do People Aim for Rs.10 Crore?

In India, this number is often linked to financial independence for a few people.

It feels like a milestone that gives you the freedom to retire early, start your own business, or just live life on your own terms.

If you invest Rs.10 crore wisely, even a 5% return can give you an income of about ~Rs.3.75 lakh per month (after TDS). That’s a pretty solid passive income, enough to cover living expenses for most Indian families. It can also leave room for a decent travel, hobbies, and emergencies.

But building that kind of wealth isn’t about luck.

It’s about planning, saving, and staying consistent, especially over long periods.

In the next section, we’ll discuss what plans must be engaged to execute the plan of building the Rs.10 Crore corpus.

Take This Wealth Building Quiz

🧠 Are You On Track To Build ₹10 Crore?

Following The 30-30-40 Budgeting Rule

We all have expenses.

Some are essential. Some are optional. And if we’re serious about wealth-building, some of our income must go towards investing. This is where the 30-30-40 rule comes in.

It’s a simple way to divide your monthly income:

- 30% for your needs

- 30% for your wants

- 40% for savings and investments

It’s not a strict formula. But it gives structure. And that is very important. Why? Because it gives us a guidelines on how much of our monthly income should be diverted to investing.

As most people end up spending everything they earn, a budgeting rule like 30-30-40 tell us abour how much investing we must aspire for.

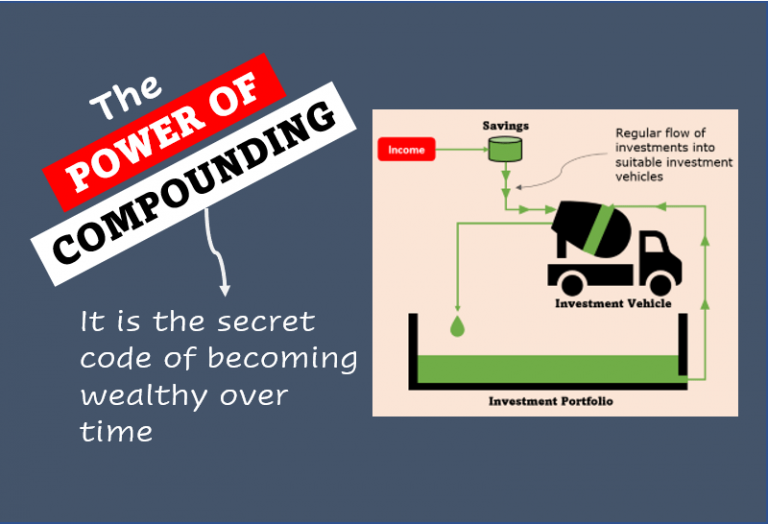

Now imagine saving and investing 40% of your income every year. If that money earns a decent return, you’ll be surprised how fast it grows.

The key is time. And patience.

Time Is Our Best Friend in Wealth Building

Let’s say there are two people want to build a Rs.10 crore corpus. One gives themselves 25 years. The other wants to do it in just 10 years.

Who has the easier job?

It’s the one with more time. Because when your money compounds for longer, it grows faster, even if you’re investing less each year.

This is something most people underestimate. They focus too much on income, and not enough on time.

But here’s the thing. You don’t need a massive salary to get rich. You just need to invest early and consistently. And give your investments time to work.

So, What Salary Is Enough to Build Rs.10 Crore?

Let’s get to the root of this article.

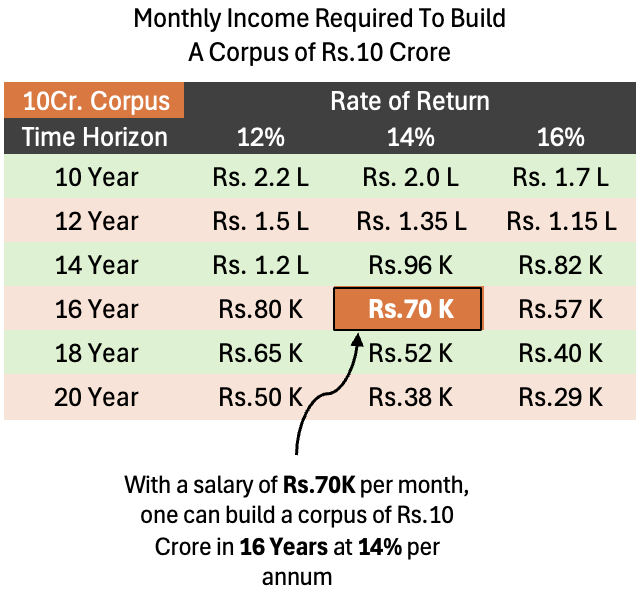

Let’s take an example. Say your current monthly income is Rs.70,000. You follow the 30-30-40 rule and invest Rs.28,000 every month. Let’s assume hypothetically a 0% income raise every year. You’ve decided to invest in equity mutual funds or index funds that give 14% annual returns.

How much time will it take to reach Rs.10 crore?

Roughly 16 years.

But what if you want to reach that goal faster? Say in 10 years? Then, your salary has to be much higher—maybe about Rs.2 lakh per month. Why so high? Because you’ll need to invest more every year, and you have less time for compounding to work.

In short, the higher your salary, or the more years you have, the better your chances.

But What About Average Salaries in India?

According to recent surveys, the average Indian earns between Rs.35,000 per month.

In metro cities, this number is higher, especially in IT, finance, or consulting roles. A mid-level professional might earn Rs.1 lakh to Rs.1.5 lakh a month.

Now if someone with Rs.1 lakh monthly income starts investing early, and sticks to it for 28 years, they can reach the Rs.10 crore goal (at 12% return). It’s not fantasy. It’s math.

But if you’re earning Rs.35,000 a month, it’s harder. Not impossible, but you’ll either need more time, higher returns, or a serious increase in income over time.

This is why it’s important to understand your own situation and make a realistic plan.

A Simple Tool to Help You Plan

To make this process easier, I’ve added a calculator (see above).

You can enter:

- Your target corpus (Rs.10 crore)

- Time available (25 years)

- Expected annual return (12 %)

- Current monthly salary (Say Rs.1 Lakh)

- Expected annual income growth (5% per annum)

The calculator checks whether your current salary is enough, based on the 30-30-40 saving pattern.

If it’s enough, the calculator will acknowledge the same. Else, it will give you an tips on how to reach the goal.

What is Important?

Focus on What You Can Control

Here’s what I believe, don’t get too caught up in the number Rs.10 crore goal.

It’s a good goal, yes. But it’s not the only one that matters.

Start with Rs.1 crore, or Rs.3 crore or any value that feels meaningful to you. Then, work towards it step by step. Increase your income. Keep your expenses in check. And invest every month without fail.

Over time, those small actions add up. And eventually, that big number doesn’t look so big anymore.

The 30-30-40 rule isn’t just about budgeting. It’s about creating balance.

Conclusion

Reaching Rs.10 crore is a long journey, but not an unrealistic one. With the right planning, enough time, and a steady income, you can get there.

The earlier you start, the better.

So, don’t wait for the perfect salary. Just start with what you have. Save. Invest. Grow your income. And most importantly—stay consistent.

And don’t forget to try out the above calculator. It might just change the way you think about your money.

Have a happy investing.