Wealth-Building Readiness Quiz

1. How do you react when your stock portfolio drops by 20%?

2. How long are you willing to stay invested in a good company?

3. How much time do you spend researching before investing?

4. Do you have a clear investment theory or theme?

5. How do you view market volatility?

Table of Contents

- Introduction

- 1. Why Is Wealth Creation So Difficult for Most Pepole?

- 2. The Core Pillars of Investment Strategy

- – 2.1 The Unwavering Long-Term View

- – 2.2 Deep Research and Unshakeable Theory

- – 2.3 Buying with a Margin of Safety

- – 2.4 Backing Extraordinary Promoters

- – 2.5 Embracing Theme-Based Investing

- 3. The Psychology That Drives Success

- Conclusion

Introduction

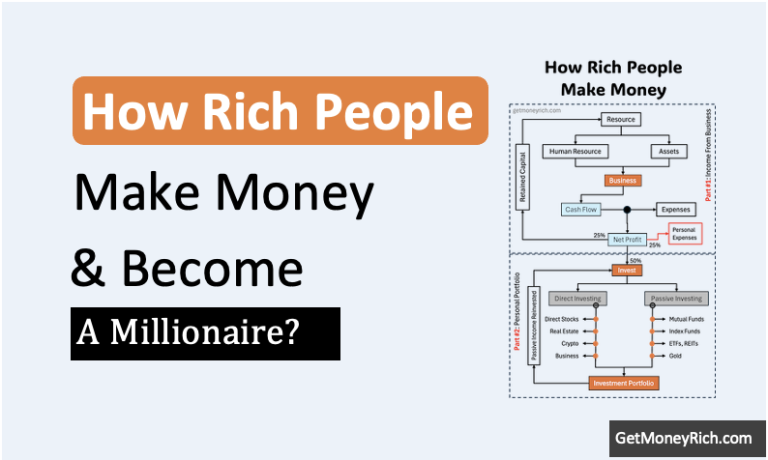

My today’s topic makes many curious. We’ll discuss how to truly build substantial wealth in the stock market over the long term. We often hear stories of incredible success, but what truly goes into it? It’s not just about picking the right stock; it’s a profound blend of investment strategy and, crucially, a very specific mindset.

I call it SSM (Stock, Strategy, Mindset).

Recently, I had the privilege of listening to insights from one of India’s most respected investors. He is someone who started from humble beginnings in a small village and built immense wealth.

His journey, and the wisdom he shared, offers a remarkable blueprint for anyone aspiring to build wealth from scratch. His insights tell us how to navigate the stock market’s ups and down with one ultimate focus in mind – wealth creation.

Taking this interview as our reference, let’s explore what truly sets apart the few who succeed from the many.

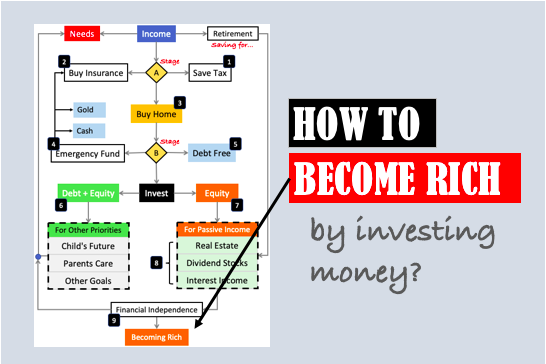

1. Why Is Wealth Creation So Difficult for Most Pepole?

You know, wealth building often looks easy in hindsight. “Oh, I should have bought this, or I should have sold that.” But the reality is far more complex.

After almost a decade long journey in wealth creation, I personally beleive that our psychology plays a big role in the end goal.

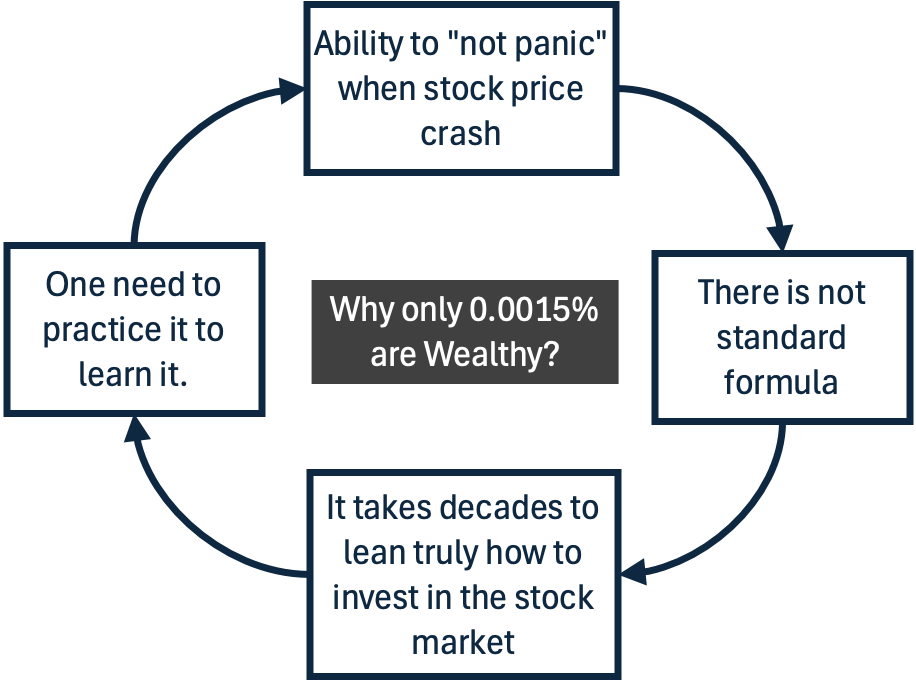

Out of 1.4 billion people in India, perhaps only a tiny fraction, maybe only about 20,000 (0.0015%) have created significant wealth for themselves. The value will even go down when we’ll look for people who done it in the stock market.

Why such a small number (0.0015%)?

- Firstly, you’re dealing with money, and that brings a very different mindset. Imagine buying a share at Rs.100, and in a month, it drops to Rs.60 or Rs.70. Seeing those losses right in front of your eyes can be incredibly difficult to deal with.

- Secondly, the markets are inherently unpredictable. There’s no standard formula, like “buy at 10 P/E and sell at 25 P/E,” that guarantees success. External events, like a change in global trade policies or even a pandemic like event, can temporarily derail entire business models.

- Thirdly, it requires time (say a decade) to develop true professional expertise and a deep understanding of markets and companies. Unfortunately, now many people have the resilience to continue learning about the market year after year.

- Finally, one need to practice to become a good investor. It’s a very tricky subject, akin to learning how to cycling; you don’t learn it by just reading a book. As Mr. Madhu Kela jokindly said “kisi to bina mare jannat nahi milti.” The point is, you to go deep into stock investing and that is where the true learning begings to take shape.

Wealth building in stock market demands a lot of patience. Even when you are doing it, your patience will be tested every single day, whether the market goes up or down.

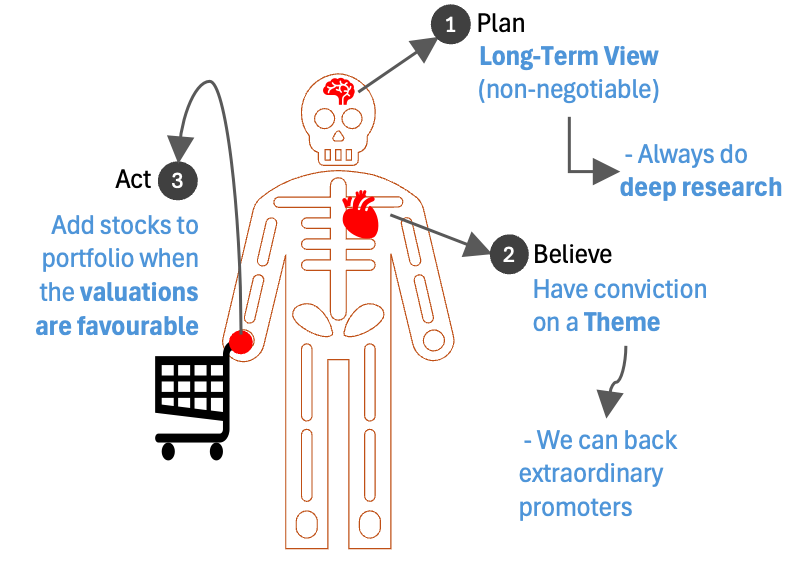

2. The Core Pillars of Investment Strategy

So, what are the actionable strategies that these successful investors employ?

2. 1 The Unwavering Long-Term View

This is perhaps the most fundamental principle.

There is absolutely no doubt that you have to be a long-term investor. Why so?

- Example #1: Companies like Divi’s Laboratories, for instance, had a market cap of Rs.140 crores at IPO (2003) and grew to Rs.1.8 lakh crores. This is an absolute growth of 74,000% (35% CAGR in 22 Years). If you had simply reinvested dividends and stayed put, you could have multiplied your money 1,000 times.

- Another example is Radico Khaitan. This stocks which went from a Rs.100 crore market cap to Rs.35,000 crores. It’s IPO also came in 2003, about 22 years back. Since its IPO, its stock price has appreciated at the rate of 30% CAGR (absoluted growth of 34,000%).

The power of investing is truly realised over long durations. This is what makes a successful investor.

They have seen multiple market cycles and understood that staying invested through these cycles is key to making substantial money.

2.2 Deep Research and Unshakeable Theory

Building wealth isn’t about blind luck; it’s about preparedness.

Your entire thought process, from research to your investment theory, needs to be robust.

Sometimes, it’s not even about massive research, but a profound visualisation.

Think about someone who understood the internet’s potential in 2000. It was a time when Yahoo’s, MSN, and Google’s of the world were in their nascenet stages. Even Orkut or Facebook were not even born in those days. Microsoft and its Window’s application was the only thing that was common among majority.

What happened after 2000 was an explosion of internt related application. Google because the next mega company company of the world.

The internet theory on its own led to an addition of trillions of dollars in wealth globally.

The thing is, once we have a investment related theory, we must continuously work to strengthen it. But it is equally important to listen to the market. This conviction is vital. Why?

Because this conviction in your theory that will help when your portfolio sees significant crashes of like 35% corrections. This type of 35%+ correction will can happen multiple times over two decades for even the best companies.

The ability to go through such drawdowns and still remain convinced requires a very different level of emotional strength, agility, and deep knowledge.

2.3 Buying with a Margin of Safety

This means buying at a price where the downside risk is minimal.

For instance, an investment like Radico Khaitan, bought at Rs.120, later went to Rs.500, then fell to Rs.220 during COVID.

If you buy at a price with a very high margin of safety, you are better equipped to ride out such volatility.

2.4 Backing Extraordinary Promoters

The quality of the promoter and management is incredibly crucial.

You want to back individuals who not only have a “fire in the belly” but also deeply understand of the following:

- Capital allocation,

- How to build strong teams, and

- The deep know-how about how to manage the associated risks in the business.

It’s about backing promoters who are focused on execution rather than just talking.

For example, even during controversial times, like the Adani episode, one seasoned investor saw it as a buying opportunity. Why? Because of the tremendous entrepreneurship and two-decade history of the promoter. Though the opposite is also true. There are some investors, who after this episode, will perhaps not touch Adani stocks any time soon.

The point is, having an indepth ‘knowledge-based-perception’ about the company’s promoters is the key in the process of long term wealth building from the stock market.

2.5 Embracing Theme-Based Investing

While bottom-up stock picking is essential, combining it with larger, powerful themes can provide immense conviction.

For example, after COVID, investing in PSUs as a theme generally made money, regardless of the specific PSU stock.

Another long-term theme identified is carbon neutrality and climate change. These two themes will undoubtedly create many opportunities as the world addresses environmental challenges.

The trick is to identify the theme, then find the right stocks within it. Once you’ve identified, wait for market volatility to present opportunities, do not start buying yet. Add the stock to your watchlist. Then in time when the opportunity comes (deep correction or crash), buy those stocks at a right value.

3. The Psychology That Drives Success

Beyond strategy, it’s the mindset that truly makes the difference. This is what seperates true investors from others.

- #3.1 Emotional Agility and Resilience: It is the biggest differentiator. When the market is noisy and volatile, and you see daily fluctuations, it’s easy to panic. Before buying any stock, a wise investor asks: “If this stock falls by 30%, will I buy more, or will I panic?” If your investment theory remains intact, and the fall is due to temporary reasons. Such a fall becomes a beautiful opportunity to buy more. However, it’s important to distinguish between volatility (temporary price swings) and actual risk (fundamental changes in the company or industry). Knowing when to cut losses due to genuine risk is also vital.

[Note: You can see, this what makes stock investing not so easy. On one side we are saying don’t panic and sell. On the other side, we saying don’t hold if risks are actual. In a pracical scenario, it is very tough to distinguish between volatility and actual risk. This is where deep knowledge of business and promoters comes in handy and this sort of insights comes with decades of investing.]

- #3.2 Extraordinary Passion and Devotion: Investing, especially full-time, is not something like a 9-to-5 job. It requires an “extraordinary passion” and involvement. Nothing of significance is achieved in any field without true devotion. Whether it’s a Sachin Tendulkar or an Amitabh Bachchan, devotion and hard work are universal rules for success. An investor must learn to love the process, not just focus on the ‘potential monetary gains.’

- #3.3 Humility and Continuous Learning: Arrogance has no place in the stock market. The moment you think you “know it all,” the market will teach you a harsh you’ll remember for lifetie. But the problem is, such lessons are often painful. This is why you’ll find, successful investors remain humble, willing to learn, and willing to admit their mistakes. The deep reason is, there are too many variable (in stock market). It is almost impossible for a human mind to comprehend and control all those variable. In a humble state of mind, we remain careful and stay in a learning mood.

- #3.4 Developing Your Own Investment Theory: You cannot borrow the theory of Warren Buffett or Rakesh Jhunjhunwala and expect to become them. We can only aspire to become the best versions of ourselves. For that, we need to have our investment theory. For example, if you think that the coming decade will be for renewable energy, start reading about it. Go to so much depths that when a good opportunity presents itself in from of you, you can grab them with best of your ability. Other who do not have the knowledge as yours will probably ignore them, but you will not.

Conclusion

Building generational wealth isn’t about hitting a target, say Rs.10 crore, and then retiring to enjoy life.

It’s about finding something you are so passionate about that you can envision doing it until your last breath.

It’s a never-ending journey of learning, evolving, and striving for excellence.

In essence, building large wealth over the long term in the stock market isn’t just about financial acumen; it’s a careful blending of patience, resilience, continuous learning, and an unyielding passion for the process itself.

It demands that you develop your own investment theory, endure market volatility with emotional strength. And more importantly, once you start tasting success, it also necessary to remain humble.

Have a happy investing.