Early Retirement Tax Calculator

Estimate the tax implications of withdrawing your investment corpus for early retirement in India.

Introduction

Financial independence and early retirement (FIRE) have gained significant traction in India. There are people who aim to retire in their 40s or 50s by saving aggressively and investing wisely.

However, the tax implications of withdrawing from investments before the standard retirement age (typically 58-60) can pose hidden costs that affect long-term financial plans.

I present to you my study which is a comprehensive analysis of the tax implications for common investment vehicles, Public Provident Fund (PPF), National Pension System (NPS), mutual funds, and stocks.

My study will also offers strategies for minimizing tax liabilities considering our Indian current tax laws.

1. Background

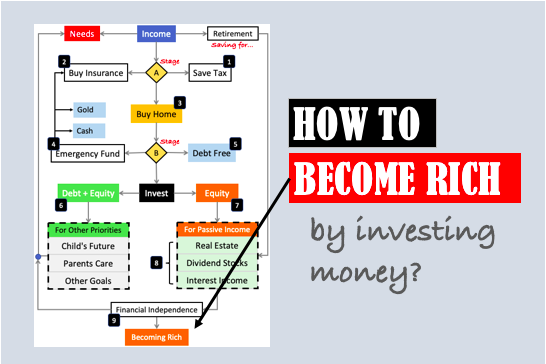

Allow me to first touch the topic of FIRE (Financial independence and Early Retirement) in India.

What is financial independence? It refers to having sufficient wealth to live without relying on traditional employment income.

What is early retirement? It involves retiring before the conventional age.

In India, the FIRE movement is gaining popularity. There are individuals, who are passionate about their FIRE goal, are saving 50-70% of their income and investing in tax-efficient instruments to achieve early retirement.

However, early retirement means accessing investment accounts sooner. This can trigger tax consequences that are often overlooked.

In our country, the personal income tax system is complex. Hence, understanding the implications of FIRE is also vital for optimizing financial plans and ensuring a secure retirement.

2. Tax Implications of Early Withdrawal from Investment Vehicles

When planning for early retirement, the information about the tax treatment of different investment vehicles will play a critical role.

Below are the details about the tax implications for PPF, NPS, mutual funds, and stocks. I’ve shared with you the tax implication of these investments focusing on early withdrawals.

2.1 Public Provident Fund (PPF)

What is the tax treatment of PPF?

It is classified under the Exempt-Exempt-Exempt (EEE) category. It means that everything from contributions to interest earned to withdrawals are all tax-free under Section 80C of the Income Tax Act, 1961. This is a significant advantage for long-term savings.

What are the withdrawal rules of PPF?

- Partial withdrawals are allowed only after 5 years from the end of the financial year in which the account was opened. Moreover, all withdrawals has no tax implications.

- Full withdrawal is permitted at maturity (15 years). Extensions in 5-year blocks are possible without tax penalties.

What are the implications if one opts for early retirement?

Since PPF withdrawals are entirely tax-free, it is an ideal instrument for early retirees. However, the 15-year lock-in period may limit liquidity for those needing funds before maturity.

For example, if an individual contributes Rs. 1.5 lakh annually for 15 years at an 7.1% interest rate (as of 2025), the corpus would grow significantly. The withdrawals would not attract any tax, making it a tax-efficient option for early retirement planning.

2.2 National Pension System (NPS)

What is the tax treatment of NPS?

NPS contributions are eligible for deductions under Section 80C (up to Rs. 1.5 lakh) and an additional deduction under Section 80CCD(1B) (up to Rs. 50,000).

At maturity, 60% of the corpus can be withdrawn tax-free, while 40% must be used to purchase an annuity. The income from annuity is taxable as per the individual’s income tax slab.

What are the withdrawal rules of NPS?

Partial withdrawals are allowed only after 3 years of contribution. But these withdrawals are limited to 25% of the subscriber’s own contributions (excluding employer contributions). These withdrawals will be and are tax-free if made for specific purposes. The purposes are defined as follows:

- Higher education or the marriage of children,

- Purchase or construction of a residential house/flat in own name or joint with spouse,

- Treatment of specified illnesses (e.g., cancer, kidney failure),

- Meeting medical/incidental expenses due to disability,

- Setting up a new venture/start-up,

- Expenses for skill development/reskilling/self-development.

A maximum of 3 withdrawals are permitted during the entire tenure, with a 5-year gap required between each withdrawal.

The rules for the premature exity is also very specific. After 5 years, premature exit is allowed. 20% of the corpus withdrawable will be tax-free. The remaining 80% used for annuity purchase.

If the corpus is less than Rs. 2.5 lakh, complete withdrawal is permitted without annuity purchase.

What are the implications if one opts for early retirement?

NPS offers flexibility for early retirees through partial withdrawals. But the tax-free limit (25% of contributions) and conditions restrict its use.

For example, if an individual contributes Rs.50,000 annually for 10 years and needs funds for a child’s education, they can withdraw 25% (Rs. 1.25 lakh) tax-free. But further withdrawals, after 25%, may have tax implications.

This makes NPS less flexible compared to PPF for early retirement, especially for those not meeting the specific conditions.

2.3 Mutual Funds

What is the tax treatment of mutual funds?

The tax on mutual fund withdrawals depends on the following:

- Type of fund (equity or debt) and

- The holding period. The holding period is classified as short-term capital gains (STCG) or long-term capital gains (LTCG).

Equity Funds:

- STCG: If sold within 1 year, taxed at 15% (increased to 20% from 23rd July 2024, as per Budget 2024).

- LTCG: If held for more than 1 year, gains above Rs. 1 lakh are taxed at 10% (increased to 12.5% from 23rd July 2024, with the exemption limit increased to Rs. 1.25 lakh for FY 2024-25).

Debt Funds:

- STCG: If sold within 3 years, taxed as per the investor’s income tax slab.

- LTCG: If held for more than 3 years, taxed at 20% with indexation benefits, which adjust the purchase price for inflation, effectively lowering the taxable gain.

What are the tax exemtions associated with mutual funds?

Equity-oriented mutual funds, including ELSS, offer tax deductions under Section 80C. The withdrawals fall under the EEE category for ELSS, making them tax-free at maturity.

What are the implications if one opts for early retirement?

Early withdrawals from mutual funds, especially equity funds, can result in higher taxes due to the STCG rate.

For example:

- If an individual invests Rs.1 lakh in an equity fund and sells it after 6 months for Rs. 1.2 lakh, the gain of Rs.20,000 is taxed at 15% (Rs.3,000).

- Whereas holding for 13 months and selling at the same price would incur LTCG tax of 10% on Rs. 20,000 above Rs. 1 lakh (Rs. 2,000 tax, but all gains till Rs.1 lakh falls under tax exemption).

This highlights the tax efficiency of longer holding periods for early retirees.

2.4 Stocks

What is the tax treatment of mutual funds?

Similar to mutual funds, the tax on stock sales depends on the holding period, with STCG and LTCG classifications.

- STCG: If sold within 12 months, taxed at 15% (increased to 20% from 23rd July 2024, as per Budget 2024).

- LTCG: If held for more than 12 months, gains above Rs. 1 lakh are taxed at 10% (increased to 12.5% from 23rd July 2024, with the exemption limit increased to Rs. 1.25 lakh for FY 2024-25).

- Securities Transaction Tax (STT) is also applicable on listed equity shares.

- Loss Carry Forward: Short-term capital losses (STCL) and long-term capital losses (LTCL) can be carried forward for 8 years. STCL can be used to set off gains against both STCG and LTCG while LTCL only against LTCG.

What are the implications if one opts for early retirement?

Selling stocks early (within 12 months) attracts a higher tax rate, making it less tax-efficient.

For example:

- Selling Rs.1 lakh worth of shares after 6 months for Rs. 1.2 lakh incurs a Rs. 3,000 tax (15% on Rs. 20,000).

- Whereas holding for 13 months and selling at the same price incurs Rs.2,000 tax (10% on Rs. 20,000 above Rs. 1 lakh, but all gains till Rs.1 lakh falls under tax exemption).

- The grandfathering clause exempts gains accrued up to 31st January 2018 from tax, but this is less relevant for recent investments.

3. Strategies for Minimizing Tax Liabilities in Early Retirement

To optimize tax efficiency during early retirement, I’ll share with you my understanding of the matter.

You can consider the following strategies, tailored for people in the Indian context:

- Maximize PPF and NPS Contributions: Since PPF withdrawals are entirely tax-free, prioritize building a significant corpus in PPF. Given its 15-year lock-in rule, it aligns with long-term retirement goals. For NPS, I’ll say ensure that the majority of the corpus remains invested for tax-free growth at maturity.

- Hold Investments for Longer Periods: Include stock and mutual funds inthe portfolio. But hold them for 10-15 years to benefit from lower LTCG tax rates. This reduces the tax burden significantly, as illustrated in the examples above.

- Tax-Loss Harvesting: Offset capital gains by selling underperforming assets. STCL can be set off against both STCG and LTCG, while LTCL can only be set off against LTCG. This strategy is particularly useful for mutual funds and stocks, where market volatility can create opportunities for tax savings.

- Withdrawal Sequencing: Plan withdrawals from tax-free or tax-efficient sources first. For example, oney can be drawn from PPF, before tapping into mutual funds or stocks. For NPS, one can use partial withdrawals judiciously for specific needs while preserving the bulk of the corpus. This sequencing ensures taxable income is minimized, especially in the early years of retirement.

- Diversify Across Tax-Efficient Instruments: Consider tax-saving FDs, ELSS mutual funds, and other EEE instruments to minimize taxable income during retirement. ELSS, for instance, has a 3-year lock-in and provides tax-free withdrawals at maturity. This makes it suitable for early retirement planning.

- Annuity Planning for NPS: For NPS, part of the corpus must be used to buy an annuity. The annuity provides regular income which is taxable as per the individual’s slab. Choosing an annuity with lower taxable payouts or deferring annuity purchase can help manage tax liability during early retirement.

4. Impact of Tax Changes on Financial Independence Goals

Income tax landscape is dynamic in India. In almost every union budget, we expect some tweaks in the tax slabs etc.

Every change has an impact on early retirement planning.

Forexample, the Union Budget 2024 introduced significant amendments, including:

- STCG Rate Increase: From 15% to 20% for stocks and equity funds sold within 12 months or 1 year, respectively, effective from 23rd July 2024.

- LTCG Changes: Exemption limit increased from Rs. 1 lakh to Rs. 1.25 lakh, but the tax rate rose from 10% to 12.5%, also effective from 23rd July 2024.

These changes have several implications:

- Higher STCG rates make early withdrawals from stocks and equity funds more expensive, potentially discouraging short-term trading for early retirees.

- LTCG adjustments still favor long-term holding but reduce the overall tax benefit, requiring investors to reassess their portfolios.

As a result of these changes, we as investors may prioritize tax-free instruments like PPF and NPS, which remain unaffected by these changes. We can also diversify into ELSS for additional tax savings.

Staying updated with tax law changes is crucial. They can significantly alter retirement planning strategies.

For example, the increased STCG rate may push early retirees to hold investments longer. Similarly, LTCG exemption increase offers some relief for long-term gains.

Conclusion

Achieving financial independence and retiring early (in Indian context) requires careful consideration of tax implications.

While PPF offers tax-free withdrawals, NPS provides partial withdrawal flexibility with some tax benefits.

Mutual funds and stocks, however, can be tax-inefficient if withdrawn early due to higher STCG rates.

By understanding the tax treatment of each investment vehicle helps at the times when the person is actually retiring.

Furthermore, employing strategies like longer holding periods, tax-loss harvesting, and withdrawal sequencing, early retirees can minimize their tax burden.

Have a happy investing.