Annuity Calculator

Introduction

Planning for retirement almost feels like a giant puzzle, right? You’ve worked hard, saved diligently, and now you’re wondering how to make your retirement corpus last?

That’s where annuities come in. It is a tool often misunderstood but powerful when used right.

Today, let’s unravel the annuity puzzle in a way that makes it simple for future reference.

I’ll try to explain these in an easy way: what annuities are, when they make sense, and how to pick the right one for your retirement.

1. Basics of Annuities

Annuities are financial products designed to provide a steady income stream.

Typically, people use it post-retirement. How? By converting a lump sum or periodic investments into regular payouts.

In India, they are offered by insurance companies.

They are regulated by the Insurance Regulatory and Development Authority of India (IRDAI). It ensures that it remains a safe investment option.

Off late, annuities are becoming more popular among Indian investors as well.

With increasing life expectancy and the shift from traditional pension systems, annuities have become crucial for retirement planning. They offer a reliable income to cover living expenses and mitigate financial uncertainties.

2. Types of Annuities Available in India

All annuities are not the same.

The Indian market offers a diverse range of annuity types. Each of them cater to different financial needs and risk profiles:

2.1 Timing of Payouts

This groups annuities based on when the payments start, which is crucial for matching ones retirement timeline.

- Immediate Annuity: Payments begin soon after you invest a lump sum, typically within a month. It’s perfect for those retiring now who need income right away. You can choose monthly, quarterly, or yearly payouts, and customize with options like adding a spouse or a money-back feature.

- Deferred Annuity: Payments start at a future date after an accumulation phase where your investment grows. It suits younger individuals or those not needing immediate income, offering a chance to build a larger retirement corpus through guaranteed or market-linked returns.

2.2 Risk and Return Profile

Here the focus is on the level of risk and potential returns, helping one decide based on his/her comfort with market fluctuations.

- Fixed Annuity: Offers guaranteed, stable payments by investing in low-risk assets like Treasury Bills or corporate bonds. It’s ideal for risk-averse retirees who want predictability. You can opt for fixed or inflation-adjusted payouts to keep up with rising costs.

- Variable Annuity: Ties payments to market performance, investing in assets like stocks or mutual funds. It offers higher potential returns but comes with risk, appealing to experienced investors. These can be immediate or deferred, with varying maturity periods.

2.3 Payout Duration and Beneficiary Options

This category looks at how long payments last and who benefits, addressing longevity and legacy concerns.

- Life Annuity: Pays a steady income for the policyholder’s entire life, stopping at death. It’s great for those worried about outliving their savings, effectively tackling longevity risk.

- Joint Life Annuity: Provides income for the policyholder and their spouse, continuing until the surviving partner passes away. Known as a joint and survivor annuity, it’s popular among couples to ensure financial security for both.

- Life Annuity with Refund of Purchase Price: Delivers lifetime payouts, and upon the annuitant’s death, the nominee receives the initial investment amount. It balances lifelong income with a death benefit for heirs.

- Annuity Paid for a Fixed Term: Pays out for a set period, like 10, 20, or 30 years, regardless of whether the annuitant is alive. Shorter terms yield higher payments, ideal for covering specific phases like early retirement, but they may not address longevity if the term is too short.

These types of annuities allow retirees to tailor their income streams, balancing stability and growth based on individual circumstances.

3. Mitigating Longevity Risk and Sequence of Returns Risk

Annuities are instrumental in addressing two critical retirement risks:

- Longevity Risk: The risk of outliving savings is mitigated by life and joint life annuities. They provide guaranteed income for the lifetime of the annuitant or surviving spouse. This ensures financial security regardless of how long one lives. There is a growing concern with increasing life expectancy in India, but annuities can take care of this type of risk.

- Sequence of Returns Risk: This risk arises from poor investment returns early in retirement, forcing asset sales at low values and depleting the portfolio. Annuities, especially fixed and immediate types, offer a predictable income stream. It reduces the need to liquidate investments during market downturns. This preserves the portfolio, allowing recovery during market upswings (read this study from Morgan Stanley).

4. Factors to Consider When Choosing an Annuity

Selecting the right annuity involves evaluating multiple factors to align with retirement goals:

- Type of Annuity:

- Choose based on when income is needed (immediate vs. deferred). Immediate annuities suit those retiring soon, while deferred options are better for younger investors planning ahead.

- Also decide the risk tolerance (fixed vs. variable).

- Payout Options:

- Decide on frequency (monthly, quarterly, half-yearly, annually). You’ll get a slightly higher income if you choose the annual payout option.

- Also carefully pick the payout duration (lifetime, fixed term).

- Joint life options are crucial for couples, ensuring income for both the survivor.

- Fees and Charges:

- Deffered annuities may include administrative fees, mortality and expense risk charges, and surrender charges. Understanding these costs is essential to avoid eroding income. There’s a fees charged by insurance provider.

- Riders and Additional Features:

- Consider optional benefits like death benefits, guaranteed minimum income benefits, or critical illness coverage, which can enhance the plan’s value. For instance, life annuity with refund of purchase price offers a death benefit, adding security.

- Tax Implications:

- Contributions to deferred annuities may qualify for deductions under Section 80CCC, up to ₹1.5 lakh annually, shared with other Section 80C investments.

- Payouts are taxable as income, but a portion may be tax-free as return of principal, based on the exclusion ratio (read about the annuity taxation here). Consult a tax advisor for specifics, especially under the old and new tax regimes for FY2024-25.

- Financial Strength of the Insurer:

- Select a provider with a strong claim settlement ratio and financial stability, ensuring reliability. Research the insurer’s reputation and customer service. Service providers like LIC, HDFC, or ICICI are a few reliable brands.

- Inflation Protection:

- Some annuities offer inflation-adjusted payouts. It is crucial for maintaining purchasing power over time.

- Liquidity and Surrender Options:

- Understand terms for early withdrawals, which may incur penalties, particularly before age 59½, with an additional 10% tax possible, affecting liquidity needs.

- Purchase Price and Premiums:

- Assess affordability, as annuities often require significant lump sums or regular premiums, impacting overall financial planning.

- Annuity Rates:

- Compare rates from different insurers to maximize income.

If you are interested to know about who are the annuity providers in India, check the government’s Protean portal.

Role of Annuities As Retirement Income Strategy

Annuities should be part of a holistic retirement plan.

A person who has included EPF, PPF, and NPS, mutual funds, stocks etc in the investment portfolio must complement them with the annuity option.

Annuities provide a guaranteed income floor to cover essential expenses, allowing other investments to be allocated for growth or discretionary spending.

For example, NPS mandates using a portion of the corpus to purchase an annuity at retirement, integrating it with lump sum withdrawals for flexibility.

Tax Implications and Interactions

Under the old tax regime for FY2024-25, contributions to deferred annuities may qualify for deductions under Section 80C (up to ₹1.5 lakh, shared with other investments) and Section 80CCC specifically for pension plans.

Section 80CCD(1) offers additional deductions for NPS contributions, with a combined limit.

Senior citizens benefit from higher standard deductions (up to ₹50,000 under ‘Salaries’) and potential tax rebates, reducing liability

How payouts are taxed?

- Annuity payments are taxable as income. Though there is an exclusion ratio determining the tax-free portion as return of principal.

- For example, under Section 10(10A), certain lump sum commutations may be exempt, subject to conditions, as noted in the tax implications research.

Annuities can be funded by EPF or PPF lump sums at retirement, providing immediate income. With NPS, they ensure a steady income stream, while equity investments cover growth needs. This layered approach balances stability and potential returns, as seen in case studies.

Case Studies and Practical Examples

To illustrate the effective use of annuities, consider the following examples, reflecting real-world applications:

Rajesh’s Retirement Strategy

- Profile: Aged 60, retiring with a Rs.1 crore corpus.

- With Annuity: Invested 50% (Rs.50 lakhs) in an immediate annuity, receiving approximately Rs.29,000 monthly (assuming a 7% annuity rate).

- Without Annuity: Allocated the remaining 50% to growth-oriented investments. Invested in mutual funds and fixed deposits, facing market volatility and risking outliving savings.

- Outcome: Achieved a stable income base, ensuring financial security and peace of mind, while maintaining potential for asset growth

Priya’s Pre-Retirement Planning:

- Profile: Aged 55, with a Rs.2 crore retirement corpus, planning to retire at 60.

- Strategy: Allocated 40% (Rs.80 lakhs) to a deferred annuity starting at age 60. Another 30% (Rs.60 lakhs) in equity mutual funds for growth. Balance 20% (Rs.40 lakhs) in fixed deposits for liquidity, and 10% (Rs.20 lakhs) in government bonds for stability.

- Outcome: Secured a guaranteed future income stream, maintained growth potential, ensured liquidity for unexpected expenses, and balanced risk and reward across asset classes, demonstrating a comprehensive retirement strategy

NPS Annuity Selection Example

Consider this Scenario.

There is an investor with a Rs.50 lakh NPS corpus at retirement. He chooses an annuity plan without comparing rates. This hasty step could result in a loss of up to Rs.21 lakh in total monthly income over 30 years.

What’s suggested? He must compare various annuity plans (for better rates) instead of going to a default option.

What options are available?

- Annuities without return of purchase price (ROP) offer higher returns. It is suitable for those needing more income.

- Those with ROP benefit heirs, is ideal for legacy planning.

Hence, I’ll say that comparing annuity rates and understanding options is crucial to maximize retirement income (read this economic times article).

Tax Advantages and Considerations

Let’s talk about how annuities fit into taxes in India (FY2024-25).

Annuities can save you some tax money. Bbut the income you get from them is taxable.

Here’s what you need to understand:

- Under the old tax regime, you can claim a tax deduction of up to Rs.1.5 lakh per year. This covers investments NPS, NSC, EPF, and life insurance.

- There’s also a special section, called 80CCC, just for annuity contributions. So, if you put money into a deferred annuity, it can reduce your taxable income, up to that Rs.1.5 lakh limit, which includes other investments.

Now, what about the money you get from annuities?

- Those payments are taxed as income, like a salary.

- But there’s a small relief, senior citizens (aged 60-80) and super senior citizens (above 80) get a standard deduction. This means you can reduce your taxable annuity income by up to Rs.50,000 in the old tax regime or Rs.75,000 in the new regime. This is one good way to lowers your tax bill.

Here’s how income tax works for seniors in the old regime:

- Up to Rs.3 lakh: No tax for anyone.

- Rs.3 lakh to Rs.5 lakh: 5% tax for seniors (60-80), but no tax for super seniors (above 80).

- Rs.5 lakh to ₹10 lakh: 20% tax for both.

- Above Rs.10 lakh: 30% tax for both.

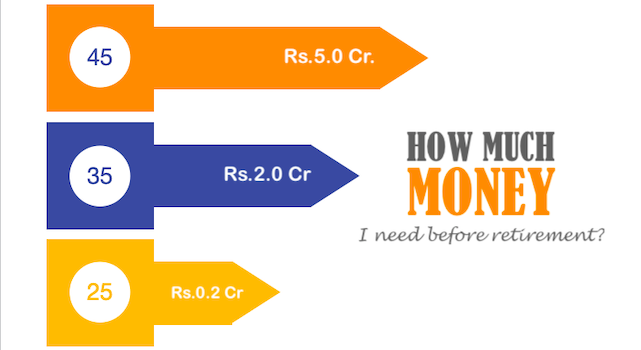

How much should you invest in annuities?

I’ll personally allocate at 40% of my retirement corpus to a full life annuity plan.

Also, buying an annuity between ages 40-45 (the early the better) can get you better rates. It immediately transpates into more income later.

Allow me to explain how it works.

Buying an annuity between ages 40-45 can get you better rates. How?

Purchasing a deferred annuity at a younger age often leads to higher payouts in the future. Deferred annuities have an accumulation phase where your money grows before payments start. Starting early, say at 40 or 45 (or earlier), gives your investment more time to build up. Here the compounding is coming into play.

- In fixed annuities, this growth comes from guaranteed interest rates offered by the insurer, steadily increasing your corpus.

- In variable annuities, your money is invested in market-linked assets like stocks or mutual funds, where gains depend on market performance. This can potentially lead to a much larger larger corpus if markets do well.

Additionally, insurers often offer better annuity rates to younger buyers. Why?

Because the payout period is expected to be longer, spreading their risk.

For example, if you buy at 35, the insurer knows payments might not start until 60, giving them time to manage your funds. This can lead to more favorable terms compared to buying at, say, 65, when payments start sooner and the insurer’s risk is higher.

So, starting early not only boosts your corpus but also secures better rates for higher retirement income.

Conclusion

Annuities offer a robust solution for retirement planning.

It addresses key risks and provides financial stability.

By understanding the types, evaluating selection factors, integrating them into a broader strategy, and learning from case studies, individuals can enhance their retirement security.

This comprehensive approach ensures informed decisions, ultimately supporting a financially secure retirement.

Have a happy investing.