Annuity Plan Comparison Tool

Select a feature from the dropdown below to instantly see which annuity plans offer it, helping you make an informed decision for your financial future.

Please select a feature to compare annuity plans.

Introduction

We often hear about annuities as a financial product (associated with retirement planning). It is a way for retirees to generate guaranteed steady income stream.

For many of us, the word “annuity” might sound like a jargon, rigid structures, or simply another way to ensure money keeps flowing in your golden years. But what if I told you there’s a deeper, more profound benefit hiding beneath the surface of those annuity brochures?

It is a benefit that isn’t just about rupees and percentages. It’s but about unlocking genuine peace of mind and the freedom to truly live your retirement dreams?

I’ve studies deeply the nuances of various annuity plans from different annuity providers. After reading about them a unique perspective emerges. I want to share it with you.

Annuities aren’t just income generators. they are powerful tools for psychological liberation and strategic lifestyle enablement (regular income, peace of mind, confident lifestyle planning).

1. The Illusion of Rigidity Linked To Annuity

At first glance, annuities might seem like a one-size-fits-all solution, offering a fixed income for life.

However, a closer look reveals a surprising degree of flexibility and customisation. You’re not just getting an annuity, you’re building a key part of your financial future.

For instance, you can choose between the following:

- Single Life Annuity (income for your life), or

- Joint Life Annuity (income for you and your spouse, or

- Even for other family members like parents, children, or siblings.

This immediate choice allows for tailored coverage based on your family structure and dependents.

Beyond who receives the income, there’s flexibility in how and when it’s received. You can opt for various payout frequencies like below:

- Monthly, Quarterly, Half-yearly, or Yearly. This type of payout frequency will align with ones personal budgeting needs.

- Some plans even offer increasing annuities, where your income grows annually by a simple or compound rate (e.g., 3% or 5%). It provides a buffer against inflation and rising expenses. I’ve seen LIC, and PNB Metlife offering such plans.

There are people whose priority will be to leave a legacy. In this case, following options are available in annuity:

- Return of Purchase Price: This ensure that your initial investment is returned to your nominee upon your (or the last survivor’s) demise. Annuity providers like Canara HSBC, LIC, Axis Max Life, and PNB Metlife

- Some plans even allow for a Return of Balance Purchase Price: Here, any unused portion of your initial investment is returned. HDFC Life, ICICI Pru, and PNB Metlife offer these option.

This counters the common misconception about Annuity that once its purchases, that your money is “gone” forever.

2. Beyond the Expected Benefits of Annuity

The primary goal of Annuity is guaranteed steady income.

However, some annuity plans go a step further.

They offer features that act as a crucial safety net for unforeseen circumstances. Imagine a case like sudden, severe illness or a permanent disability disturbing your future financial requirements.

There are plans allow you to surrender the policy and receive a portion of your purchase price (e.g., 95%) in such critical situations. Canara HSBC offers such a plan.

This type of provision is vital that transforms a long-term income plan into a dynamic contingency fund. For a person who is in such kinds of distress, such an option feels like a lifeline.

Some providers also offer a loan facility against your annuity. This is another way to get access to additional funds during contingency.

Though this type of fund access becomes available only after a certain period (e.g., six months) from policy commencement. Not all companies offer this but providers like Canara HSBC, HDFC Life, and ICICI Pru has this option.

An annuity plan with the above discuss option adds another layer of financial adaptability.

3. The Ultimate Benefit of Annuity

I’ve read this somewhere which a very accurate insight about true use of annuity:

“The greatest value of a well-chosen annuity isn’t just the money it provides; it’s the mental freedom it offers. When a significant portion of your essential post-retirement income is guaranteed for life, your primary financial worries are alleviated.”

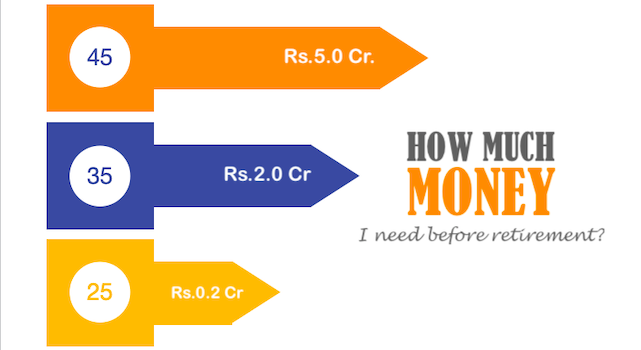

Think about it this way. Say you have bought a reasonably big annuity plan. Now, you know that your basic living expenses are covered. This will happen regardless of market fluctuations or unexpected events. This assurity due to annuity frees up your other assets.

This way, you can afford to be bolder with your remaining investments. You are more likely to exploring growth opportunities you might otherwise shy away from. Or, more simply, it allows you to truly relax and enjoy your retirement without constantly monitoring your investment portfolio.

A well rounded annuity has the powers to shift your focus from managing money to living life fully. It is a way to make you experience financial freedom in real sense.

In this this psychological frame of mind, you can pursue passions, travel, spend quality time with loved ones, or engage in hobbies without the constant nagging concern of “Will my money last?”

4. What is The Takeaway For Us

So, when you consider an annuity, look beyond the numbers and the jargon. See it as an investment that will give you a peace of mind.

Ask yourself the following

- What level of core income do I need to feel completely secure?

- How can this security free me up to pursue other dreams or take calculated risks with my remaining assets?

- Which specific features (like critical illness surrender or joint life options) align with my family’s unique needs and potential challenges?

I’ve heard people referring to annuity as an option for only for the financially astute. But I think they are for anyone seeking a predictable financial anchor in an unpredictable world.

They are for those who want to fulfill their promises, enjoy their golden years tension-free, and ensure their lifestyle isn’t compromised.

By securing a guaranteed income, you’re not just buying financial stability; you’re investing in the priceless luxury of knowing your basic needs are covered. It allows you the mental space and confidence to truly embrace the longest holiday of your life.

To understand how an annuity fits into your holistic financial plan, talk to an annuity advisor. But before visiting them, write down your requirements. Share it with the advisor, and let him help you pick an annuity options that best suits your requirement.

I’ll also suggest you to visit advisors of multiple annuity providers (check the above annuity tool). Make sure that you take notes which you are discussing. Note down all good and bad points. Finally, compare all options and pick the best alternative.

Have a happy investing.