Why I’m blogging about this topic? SIP is an investment method that most people use to invest gradually and consistently. It is a very practical method to accumulate wealth over time. But there is a way to make the SIPs even more effective. Step-up SIP is the way to do it. I feel the conventional SIP version is outdated. Existing SIP investors must switch to Step up SIP. Please check the FAQs for quick answers.

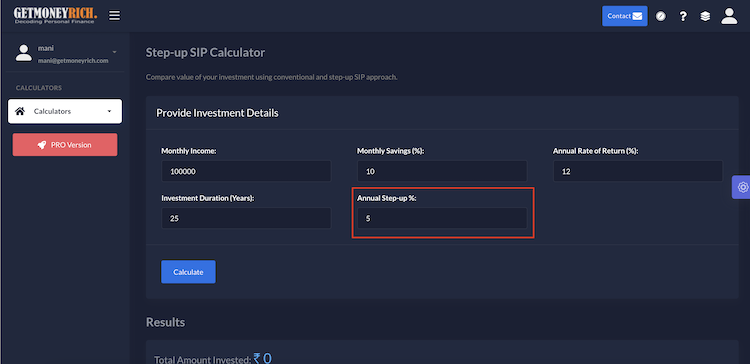

Step-up SIP Calculator

Introduction

Suppose an investor is using a conventional SIP calculator. He wants to know the appreciated amount upon investing in a SIP for the next 10 years. He is investing Rs.1000 per month in an index fund that can yield a return of 12% per annum. Upon inputting these details into the calculator, his final appreciated amount was Rs.2,32,339.

There is a problem with this calculation.

The calculation is not wrong, but the logic with which the final amount is calculated needs refinement.

Suppose the investor is a newbie in his early twenties. He has just got a job that pays Rs.25,000 per month. The man wanted to explore investment. He was advised to start a SIP in an index mutual fund. Considering the costs of living and other liabilities, at the moment he could spare only Rs.1000 per month for the SIP.

Please note that Rs.1000 is about 4% of his monthly income.

Over time, his income will grow, right? Hence, his investment potential will also increase. I’m assuming that the person will continue to invest 4% of his income into this index fund. This increased capability of the investor must be factored into calculating the final investment corpus.

How it can be done? By considering a SIP Step-up factor.

The Step up SIP calculator does just that. It considers a step up in monthly investments each year. A person who is investing Rs.1,000 today, can invest Rs.1,100 after one year from now. This growth potential is factored in the Step up SIP calculator. To get quick answers about step-up SIP, jump to the FAQs.

Conventional SIP vs Step up SIP (Example)

As shown in the above-tabulated comparison, the person is investing Rs.1000 per month for 12% per annum returns. The SIP will continue to run for the next 10-Years.

Under a conventional SIP, the accumulated corpus at the end of ten years is Rs.2.32 Lakhs.

A Step up SIP with monthly contributions growing at a rate of 10% every year, will build a corpus of Rs.3.27 Lakhs.

The final amount accumulated through Step up SIP is 41% higher than the conventional SIP.

Please note that a 10% growth each year means, the following amounts:

Observe the increased amount each year. In the first year, the amount was Rs.1000. In the following years, the amount became 1100, 1210, 1331, and so on. Please note that these enhancements are spaced at an interval of one year each. Hence, In all likelihood, the investor will not even notice the extra load of the enhanced monthly contributions.

What is the benefit? Without noticing, the investor has increased the size of his final corpus by 41%.

By simply optimizing the contributions each year as per one’s affordability, a gradual step-up, the final accumulated amount can get a major boost.

Utility of Step-up SIP

Suppose, you’ll need Rs.2.0 Crore after 20-years from now. You would like to invest systematically to build the corpus. As the time horizon is long, you’ve decided to invest in an index fund that can fetch a return of 12% per annum. A conventional SIP will require a monthly contribution of Rs.20,000 each month to reach the goal.

If for some reason, you are able to spare only Rs.8,000 each month at the moment, you will miss the goal by a long way.

What is the solution?

A simple solution is the use of Step Up SIP. Start with a monthly contribution of Rs.8,000. Gradually increase the contributions by 11% each year. This way, your goal of Rs.2.0 crore will be reached in the next 20 years.

Use the Step Up SIP calculator to check the numbers yourself.

Step-up SIP is especially helpful when the goal is so large that it is not affordable through a conventional SIP plan. One can factor in future step-ups in the monthly contributions to make it affordable today. In our example, the investor factored in 11% per annum step-ups to start investing within his ambit of affordability.

Had the provision of step-ups in the SIP not been there, probable the person would have not started investing in the first place. He would have gotten discouraged seeing that his present affordability of Rs.8000/month would have taken him less than halfway (Rs.80 Lakhs only).

Conclusion

In the past, almost everyone adopted the conventional SIP for investing. SIP is a household term. I feel the step-up SIP will see the same level of acceptability in times to come.

Why a conventional SIP became so popular? Because it helped us to invest small-small amounts each month and still build substantial wealth. Investments through SIPs are more practical than lumpsum investing.

It will not be wrong to say that Step up SIP is an upgraded version of conventional SIP. Step-up SIP makes investing even more practical.

Suppose my goal is to accumulate Rs.3.5 crore in 20 years.

- Conventional SIP: A multi-cap fund assumed to yield a 16% per annum return in 20 years was selected. Through a conventional SIP, I’ll need to contribute Rs.20,000 per month to reach the goal. Use this calculator to do the math.

- Step up SIP: A multi-cap fund assumed to yield a 16% per annum return in 20 years was selected. Upon a 10% step-up, I’ll need to start contributing only Rs.8,900 per month to reach the goal.

You can see how practical and reachable wealth accumulation becomes through a step-up SIP.

About ten years back, there were no alternatives like a step-up SIP. I feel step-up SIP is one of the most underrated investment methods. Why? Because it helps us to plan our investment by factoring in our current affordability and future earning potential.

Final words

Step-up SIP makes investing very convenient, especially for people with low salaries. Such people can build substantial wealth over time by using the step-ups in contributions.

The only risk of using the step-up SIP is that people may start to underinvest. If their ability is to invest Rs.2,000 per month, they will do only Rs.1,000. They will assume a high step-up growth rate, like 20%, to meet their goals. Please remember that a step-up growth rate of above 15% shall be avoided.

FAQs

Step-up SIP is like a conventional SIP but with periodic increments of investments. The monthly contributions automatically get a step up at the end of the period. Suppose a person starts a SIP with Rs.1000 monthly contributions. At a 10% annual step-up, the contributions after one year will be Rs.1,100. Here the step-up periods can be quarterly, semi-annually, or annually.

In trading apps like Zerodha, in the order booking form itself, there is a provision for “automatic step-up”. If you are not using such apps, the step-up can be implemented manually. For example, start a SIP with Rs.1000 per month for the first 12 months. In the second year, stop the first SIP but do not sell it. Then, start a second SIP with an increased monthly contributions to Rs.1,100 per month. In the third year, increase the monthly contributions to Rs.1,210 per month. If the investment horizon is 10 years continue this process for all these 10 years

Ideally, a 10% step-up should be good. But to logically decide the quantum of the step-up, one must use a Step-up SIP calculator. First, draw the specification of your final goal. Decide what to achieve, and which investment vehicle will be suitable. Say the goal is to accumulate Rs.2 crore in 20 years at a 12% return from an index fund. Then decide what maximum monthly contributions you can start as of today. Say you have decided on Rs.8000 per month. Use the Step Up SIP calculator to fix the quantum of the step-up. Start with zero percent, and then keep increasing it by 1%. Rs.8,000 per month, at a 12% return, will need a step up of 11% to accumulate Rs.2 crore in 20 years. You can check this example for a quick reference.

The best way to calculate it is through an online Step up SIP calculator (above). Alternatively, it can be calculated in an excel sheet. It can also be done mathematically by solving the summation formula.

As of date, existing SIPs cannot be stepped up. The only alternative is to stop the existing SIP and start a new one with the automatic step-up option. If your investment app does not support automatic step-up, it can also be done manually as explained in FAQ #2 above.

For a large financial goal, the current affordability factor may not allow one to start with large monthly contributions. In such a case, a step-up SIP comes very handy. But if the current affordability is not a limitation, then conventional SIP will work. But we must also plan for unexpected inflation. Suppose you’ve estimated that Rs.2 crore will be sufficient for your child’s future 20 years from now. Here you’ve estimated the corpus assuming average inflation of 4.5% per annum. But in a growing economy like India, inflation can play a spoilsport. Hence, a cushion must be built for it. For me, a SIP with at least a 5% step-up, working as a factor of safety, is essential.

Thanks for reading this article through to the end. If you found it useful please consider sharing it or leaving your comment below.

Have a happy investing.

Suggested Reading:

I am following your blog since 2014 and it always remain informative and interesting.Thanks

Thank you for your continued support the feedback.

People often underestimate the power of increasing your investment. Overtime, this can easily multiply your corpus. So it is always advised to increase your investment whenever one receives a raise.

Excellant article. I like the way explain the topic

Thanks for taking your time-out to put your comments.

Good Article

Your article is very organized to understand..

Good Job!!