Not everybody likes investing in small-cap stocks. Why? A general feeling about small-cap stocks is that they tend to default on their creditors and investors. But it is an excessive generalization of the fact.

However, it is also true that it is more likely to find badly managed companies among the group of small-cap stocks. Mid-cap and large-cap stocks have become bigger because they are better managed. But it does not mean that all small-cap stocks are bad.

Best Small Cap Stocks To Buy in India [2024]

(Updated: 01-June-2024) Check The Stock Engine

| SL | Name | Price | Market Cap(Cr) | Price Score [OF 5] | Growth Score [OF 5] | Management Score [OF 5] | Profitability Score [OF 5] | Financial Health Score [OF 5] | MOAT Score [OF 5] | GMR Score |

| 1 | KRITI:[526423] | 111.25 | 552.09 | 4.90 | 2.71 | 3.14 | 3.14 | 3.90 | 3.10 | 87.06 |

| 2 | PIXTRANS:[500333] | 1311.65 | 1784.37 | 4.90 | 3.50 | 3.51 | 2.08 | 3.80 | 3.12 | 86.83 |

| 3 | EMAMIREAL:[533218] | 101 | 382.03 | 2.30 | 3.92 | 2.90 | 5.00 | 3.33 | 4.10 | 86.45 |

| 4 | Vadilal En:[519152] | 3538.5 | 305.26 | 4.80 | 3.25 | 2.69 | 3.23 | 3.23 | 3.20 | 86.23 |

| 5 | TALBROAUTO:[505160] | 287.50 | 1772.84 | 3.50 | 2.66 | 3.98 | 4.01 | 3.67 | 3.63 | 85.92 |

Is Investing In Small-cap Stocks Risky?

Yes, investing in small-cap stocks is risky. How? To understand this, allow me to present some numbers about small-cap stocks.

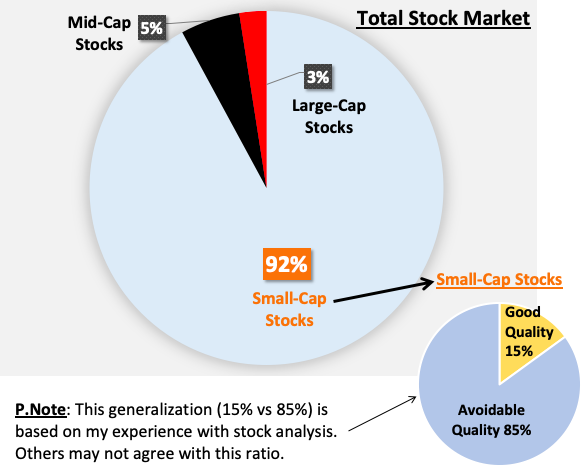

There are about 4,000 numbers stocks in the market. Among this group, about 3,660 numbers (92%) are of small-cap in nature. The balance is mid-cap (5%) and large-cap (3%).

So, there are high chances that an untrained investor might pick a small-cap share from a lot of all stocks. What is the risk? Only 15% of all small-cap shares are of investment quality. The balance is avoidable.

[Note: The risk for an untrained investor is magnified due to another factor. Even if these investors avoid the small-cap group of shares, what remains available are mid-cap and large-caps. These stocks, in India, often trade at overvalued price levels. Buying an overvalued stock is as bad as buying a low-quality stock]

What is the point?

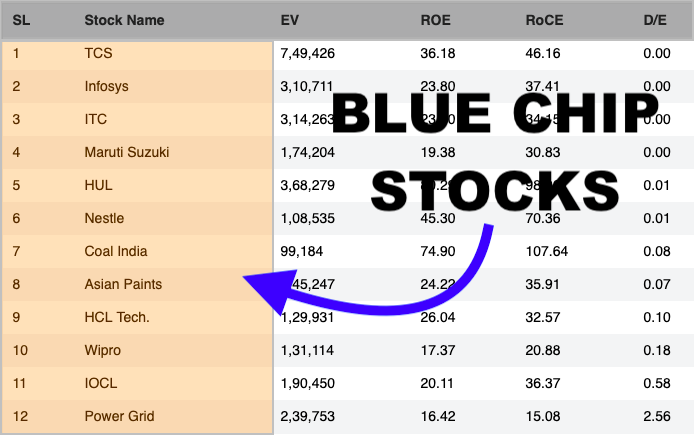

Large-cap and mid-cap stocks are generally of superior quality, though there are few exceptions. But people who do not know the process of price valuations might end up buying an overvalued stock from this group. So, to invest in them, the knowledge of price valuation is a must.

Most of the stocks which trade in the market are small-cap in nature. But only a handful of them is of good quality. Hence, to invest in them, knowledge of evaluating the financial health of a company is a must.

About small-cap stocks

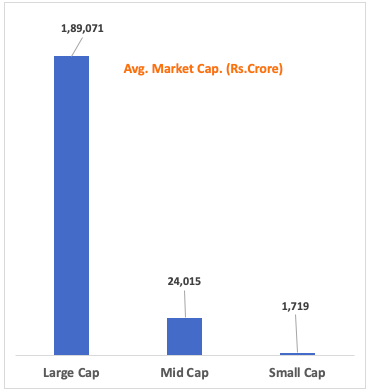

What are small-cap stocks? The term “cap” linked to the word “stocks” talks about its market capitalization. All stocks whose average market cap is less than Rs.10,000 Crore ($1.5 Billion) are referred to as small caps.

We must not confuse between the terms ‘penny stocks’ and ‘small-cap stocks’. What is the definition of a penny stock? In the US market, a small-cap stock trading below $1 per share (< Rs.70 per share) is called a penny stock.

In our Indian market, we can find several small-cap stocks trading at a price range of over Rs.100 per share. So, not all small-cap stocks can be categorized as penny stock.

[Note: Penny stocks are an exaggerated form of small-cap stocks. If small-caps are risky, pennies are even riskier]

Two Notable Advantages of Investing In Small-Cap Stocks

The associated risk while investing in small-cap stocks has been discussed. But it is also true that good small-cap stocks carry notable advantages within themselves. In this section, let’s try to unearth its benefits.

#1. Institutional Investors Avoid Them

How it is an advantage?

Institutional investors are mainly banks, mutual funds, and insurance companies. When these agencies invest in a stock, they pump in large sums of money. When they start buying stocks of a company, its share price jumps significantly. Hence, such stocks start to move towards overvaluation.

For a person who is already holding a small-cap stock, the influx of money from institutional investors in it can result in windfall gains.

But if one wants to buy undervalued stocks, they must look for companies that have still not attracted the attention of institutional investors.

But institutional investors avoid investing in small-cap stocks. Why? The tiny market capitalization of small-cap stocks is the problem. How?

Suppose there is a quality small-cap stock whose market cap is say Rs.2,500 crore. A mutual fund would like to buy stocks worth Rs.500 crore in that company. By doing so, the mutual fund would gain 20% ownership of the company. But there are limitations on the maximum stake institutional investors, like mutual funds, can buy in a company.

Someone might ask, why the mutual fund cannot invest less than Rs.500 crores? In theory, they can invest, but they would avoid it. Why? Suppose there is a multi-cap fund whose AUM is Rs.10,000 crore. To improve their portfolio’s performance, investing less than Rs.500 crore might not be impactful.

So the point is, even if the stock is of high quality, institutional investors might avoid it for the above two reasons. It might keep a quality stock remain at undervalued levels. This factor alone makes small-cap more suitable for small retail investors.

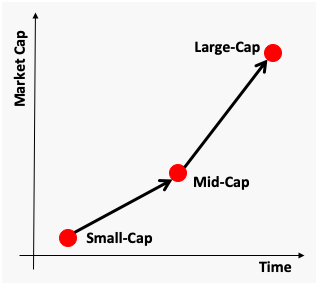

#2. Fast Growth

In the company’s life cycle, it starts as a small-cap and later becomes a large-cap. Today’s RIL and TCS was once a small-cap. Good small-cap’s of today can become large-cap’s of tomorrow.

Companies which are capable of such a transition can render phenomenal growth rates for its investors. As the size of the company grows, it yields more profits (EPS). As the EPS of the company soars, it carries with it the stock price.

All companies grow right? So why small-cap companies are special? They are special because they are “small”.

Good companies which are already too large has less scope of growth. The innovation and capital required for such companies to grow is very high (Read – self financeable growth). Hence, majority large-cap companies show lower growth rate numbers as compared to small-caps.

How A Novice Should Invest In Small-Cap Stocks

The easiest way is to do it “indirectly“. The better way of doing it is by self-analysis.

- Indirectly: It is possible to invest indirectly in small-cap stocks. There are three indices of NSE which tracks the performance of a group of small cap stocks. They are, Nifty Small Cap 50, Nifty Small Cap 100, and Nifty Small Cap 250. One can buy index funds that tracks these indices. This way, without exposing oneself directly to small-cap companies, one can invest in a basket of it.

- Self-analysis: How I do it? I follow the Nifty Small Cap 250 index. Whenever the index corrects by more than 10%-15%, I look at its individual constituents. The stock that looks interesting to me, I do the financial health analysis of its business. Once I’m satisfied I do the price analysis of its stocks. A financially healthy company available at a fair price is my goal.

Conclusion

People who desire to invest in small-cap stocks should do it with caution.

What can be most dangerous about small-cap stocks is the quality of their business. I believe that only about 15% of all these stocks are of investment grade. The balance are avoidable.

Now, 92% of all stocks listed in the stock exchange are small-caps. So it is highly likely that people may end-up buying a low-quality small-cap stock. So here comes the need of caution.

These stocks have a small market cap. Even small trading volumes in these stocks can result in large price volatility. So people must not panic looking at their price movements. Do the fundamental analysis, and hold on to such stock irrespective of the price movements. In long term, it will bear its fruits.

It is specially true for the present market times. The Nifty and Sensex are trading at their all time peaks. If a correction happens in times to come, where we should invest? Invest in a quality small-cap stock and hold on to it for next 10-15 years.

[Suggested Reading: About long term investment strategy]

Have a happy investing.

![Sensex 30 Companies: Their Weightage in The Index [2025]](https://ourwealthinsights.com/wp-content/uploads/2022/03/Sensex-Weightage-Stocks-Thumbnail2-768x392.jpg)

![Understanding Block Deals: A Guide for Retail Investors [Also Fact Check]](https://ourwealthinsights.com/wp-content/uploads/2024/11/Block-Deals-Fact-Check-Thumbnail3.png)

Great article. I appreciate ur hard work. Thank you.

Thanks

Great article. I typically try to separate wheat from chaff by getting into small caps when they get promoted from Small50 to MidCap150 index. Although not fool proof but this kind of works better as compared to directly investing in smallcaps.

Good suggestion. Thanks