Introduction: Why to bother about building an alternative income source? Because every extra penny added to the wallet will add weight.

Moreover, the long term goal for “second income” is to become big enough so as to cover the total expense requirements of life on its own.

But what if the alternative income is not big? How much is big? I believe, for a beginner even Rs.500 per month is a big amount. How?

Because it is a “side income”. This second income source needs to managed after managing the hustles of our daily work routines.

Not everyone can generate a steady stream of alternative income for long time.

Hence for a starter, even a consistent Rs.500 per month of extra income deserves appreciation. Clarification is here.

Types of Alternative Income

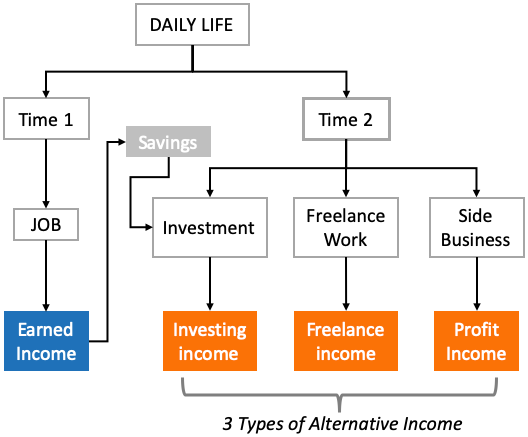

If we can divide our daily life into two time segments (time 1 & time 2), then one segments can be utilised to do job/work and generate “earned income”. The second segment (time 2) can be used to generate “alternative income”.

Generally, we use time-2 for more casual purpose like spending time with family, friends etc. But people who desire alternative income use this time slot (time-2) more effectively. They use it to build a second source of income.

Broadly speaking, there can be three types of ‘second income source’:

- Profit Income: Income from ‘side business’ has more future growth prospects. The main criteria here is “to do what you love”. You cannot start any side business. Identify a work stream which you love. It can be painting, writing, sports, fitness, dancing etc. Try to convert your passion into a side business. Check here for side business ideas.

- Freelance Income: This is the most popular and sought after extra income source. Why? Because it resembles very closely to earned income. People who are in habit of doing job/work for others can easily adapt to freelance work. Moreover, the opportunity of work is more in this category. But it is as time consuming as a job/work. Check here for freelance income ideas.

- Investing Income: This is one of the best form of side income. Why? Because it can be generated passively. No extra work is required to generate this income stream. Just pick good investments and income will keep yielding on its own. Check here for investing income ideas.

Need For Alternative Income?

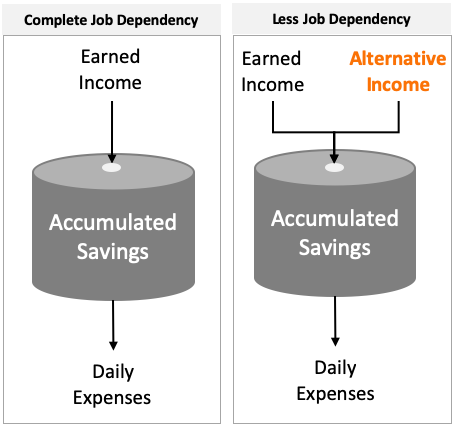

Depending only on one source of income for living is risky.

Alternative income can decrease this dependency. People generally depend heavily on ‘earned income’ from job. Having an extra side income flowing-in can reduce the risk. Read: About salary dependency.

For me, focusing on alternative income helps us to push our own limits. It compels us to think out of the box and do what others are not doing.

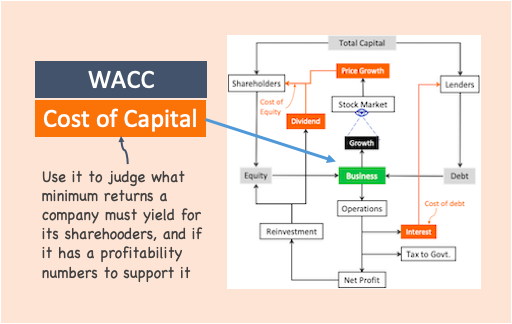

When everyone else is thinking about “how to work hard and earn a better increment from boss“, you will be thinking about “how to earn a higher increment yourself“. Read: About financial Independence.

Yes, having an alternative income source can give you this liberty. Generating higher income will be more in your control. It is as if you are your own boss.

Characteristics of a Good Alternative Income..

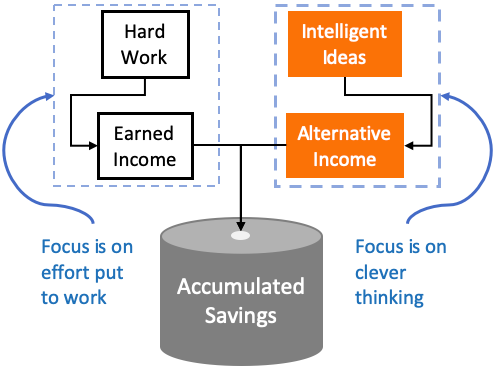

Most of us are salaried people, right? We do our 9-6 job, 5/6 days a week. It is ONLY in our spare time that we can think about side income. Hence, the characteristic of a good side income will be one which can yield with less work & effort.

An ideal side income will be one which can sustain itself in the present scheme of things. What is the ‘present scheme of things’? Busy time table. In this busy schedule, doing additional work is tough. So we must learn to make money in some other way.

Generally we only know one way of making money: “by working hard to earn a living”. But there is another way to earn income. “Making money by implementing intelligent ideas“.

Here the focus is on ‘clever thinking’ and not on hard work.

When I say “clever thinking” it is not about being an Einstein’s or Warren Buffett’s. Clever thinking is about doing those small-small things that help us achieve our goal.

What is our goal? Building an alternative income source. Ask yourself, what least you can do to generate your first Rupee of alternative income.

This article will give you an idea of various options available which can be used to build an alternative income source.

Talking more about characteristics of good alternative income, following also makes a point:

- Automatic: Income must continue to yield on its own. No or less work should be necessary to make it happen. Like buying a monthly income plan – buy it and forget about it. Interest income will continue to yield till eternity.

- Easily Scalable: Suppose your alternative income source is evening tuitions to school students. One can teach only few students in a time slot of 2 hours. Such an income source are difficult to scale. But consider buying an ‘income plan’. Scaling it is super easy. Do a SIP, and scaling happens automatically every month.

- Less Capital Intensive: A real estate property can generate best alternative income (as rent). But for a common man, owning a property is not easy. Why? Because of its high cost of acquisition. But on the other hand, buying a bank deposit is more affordable.

The point is, a common man will continue to accumulate alternative income source only if it has the above minimum three characteristics. Why? Because here the focus is on generating more income from less effort.

How To Value An Alternative Income Source?

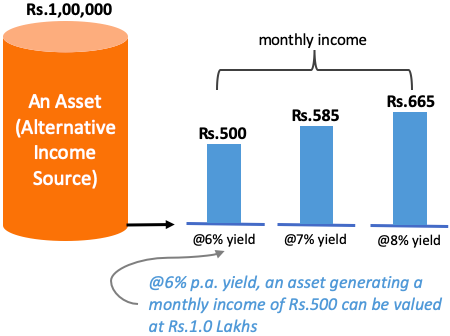

When I said in the beginning of this article that “even Rs.500 per month is a big amount“, I’m sure few eyebrows would have frowned. But there is a basis behind it. Let me explain it with an example.

- Example1: Suppose your father has an annuity which earns him Rs.5,000 each month. He bought this annuity for Rs.10,00,000. In percentage terms this annuity is yielding returns @6% p.a. (=5000×12/1000000).

- Example2: Suppose you have a fixed deposit of Rs.10,00,000 in your bank. This deposit yields an income of Rs.5,000 per month @6% p.a. (net of TDS).

What we can make out from these two examples? An asset worth Rs.10 Lakhs is can yield a risk free income of Rs.5,000 per month.

Let’s correlate this understanding with our concept of side income.

Suppose your secondary income is say Rs.500 per month. By using the above analogy, an income of Rs.500 is equivalent to having an asset of worth Rs.1 Lakhs (=1000000/5000 x 500).

In other words, an alternative income source which is yielding an income of Rs.500 per month is as valuable as a physical or financial asset worth Rs.1 lakh.

Alternative Income Sources

There are few tried and tested methods which can be applied to our daily lives to start a stream of alternative income. What I’ll list here are such options with which one can hardly go wrong:

Type: Side Business

- Youtube Channel: Start posting videos on your youtube channel. What videos you can post? Select a topic which you like. If you are good in cooking, start a food blog on youtube. If you into dancing, start posting your dance videos. Similarly, you can post videos on topic of health, finance, politics etc. See this to create a youtube channel.

- Take Tuitions: Select the subject of your choice and start taking tuitions. If you are good in Hindi teach the subject. Similarly there are great demands for English, Maths, Physics, Chemistry, Biology etc. You can also offer online courses on Udemy and teach online.

- Start A Blog: I started my side business in 2008 with this blog. I used to blog about my learnings of finance and investment. I used to read books, and then implement the ideas. Whatever I learnt from my experience used to go down in my blogs. In 2017 I finally left my job and started blogging full time. Know more about me here.

- Start A Retail Store: I’ve seen a very close friend of mine do this for his family. He invested in a retail shop which dealt with artificial jewelleries, handbags etc. He started in 2016 and today he is planning to expand to a second outlet. My friend is full time employee of a company. His shop is managed by his family. Read about building a business.

- Sell Online: Akin to starting a brick and mortar retail store, one can also start an online store on Amazon, Flipkart etc. I know a person who gets Chinese material (like clothes, handbags, perfumes etc) from Mumbai, Kolkata etc and keeps it in his store house. He has an online store on Amazon which he use to sell these products at a margin. He does this completely working from home.

- Start A Health Club: If you are into the habit of gymming, jogging etc, you can start a health club of your own. Keep a decent monthly subscription fees. People will join your club to get trained under your supervision. These days people like to workout under people who have self-transformed themselves over time. Same logic is applied to a dance, yoga, aerobics classes etc.

- Sell e-Books: If you have a knack for writing good contents, try writing an e-book. The target should be to first pick a topic of your choice. Then prepare a first draft based on what you already know on the subject. The next step will be to start research work on Google. Read articles online. If possible read good books on the subject. Once you are done with this, prepare a final draft. Use kindle direct to publish your ebook for free.

- Develop Product: During my starting blogging days, I used to build excel sheets for myself to evaluate good stocks, for calculating EMI’s, expense tracking, net worth tracking etc. Over a period of time, these sheets matured and I started selling them online on my blog as e-products. Developing a product can be a very profitable business.

Type: Freelance Work

- Part-time Projects: Suppose you are a software developer by profession. You can take personal part-time projects online. There is an authentic online resource called freelancer where all kind of projects are available for a range of people.

- Freelance Writer: Select a topics of your choice in which you have an authority. Then pick few blogs or online resources which takes guest posts from third-party. Approach these people who will then take you articles for a price. An authority writer can make decent income this way. Check bloggingpro for freelance writing jobs.

- Sell Photographs: There is a great resource called Fotolia. It is now been overtaken by Adobe. At Fotolia people can sell their high quality photos online. If you are somebody who has passion for photography, can build this source of side income.

Type: Income From Investments

For a beginner, building an alternative income should start from investments. I have written a detailed blog post on how to get monthly income from investments. I’ll suggest you to read this article for a detail insights about how to generate side income from investing.

The Power Of Habit…

Getting into a habit of alternative income generation is important. For people who only know to earn income from job, this habit is very underdeveloped.

Why to get into the habit? If we get into the habit of doing something, we start doing it regularly. This strategy is particularly helpful in doing things which are difficult to execute.

What is the difficulty here? Finding out time and motivation (day after day) to build your second income. Working for side income in addition to job is not easy. Moreover, in the initial days side income is also very low. Hence keeping oneself motivated in those days is a challenge.

Remember, if your will continue to practice a thing as a habit, day after day, for years together, it become your second character. Once this stage is reached, you will no longer feel the burden of doing-it.

Executing the idea of side income generation as a habit will take you long way ahead towards your goal.

CONCLUSION

While dealing with “alternative income” generation, one must not bother too much about the level of returns. Even if it is low, go for it because here the objective is consistent income generation and not ‘high returns’.

Read more about: Invest to Earn Capital Appreciation & Income Generation…

If you are a beginner, it is important to first get into the habit of ‘maintaining a source’ which can yield consistent income. Yes the focus should be on “maintaining”. Idea is to make the “source grow” with time.

When the objective is to build a sizeable alternative income, it is essential to keep feeding the source. Keep working and make the source grow in size every passing month. This single minded focus can take you long way ahead.

Remember: “You will become financially free when your side income exceeds your expenses”.

![ROI Formulas: CAGR and XIRR, Meaning, Full Form, Use in Excel [Mutual Funds]](https://ourwealthinsights.com/wp-content/uploads/2018/04/How-to-measure-investment-returns-Image.jpg)

worth to read ,Thanks Mani

Sir,

Truly one of the best financial blogs in India.

I wish that these advices get really popular one day. Very valuable information you’re giving.

Respect!

Learned a lot.. want to make it more practical in coming years. Only 23 years old as of now. Hopefully by 35 I’ll achieve financial independence.

Thanks for the awesome feedback

Awesome website.. enormous valuable information at one place. Great job Mani.. you experience will help million and millions of people.. thanks a lot..

Thanks for your awesome feedback.

You have poured many idea to derive second income is laudable . You deserve for your contribution All the best .God bless you .

Thanks for your blessings.