On one side aluminium price is falling globally. On the other side the cost of Alumina (raw material) is rising. But this increase in raw material cost is not visible in aluminium’s market price.

Why Aluminium price is falling? Because of the import duties imposed by USA. Donald Trump has been in sorts of trade war with China and few other countries.

Talking about Aluminium specifically, USA has imposed a tariff of 10% on Aluminium coming from Europe and China. Moreover, it has also put sanctions on RUSAL (second largest producer of Aluminium).

What does it mean for the world? Lower demand of Aluminium across the world. Why? Because USA is one of the biggest consumer of Aluminium in the world. Low demand is causing the price fall.

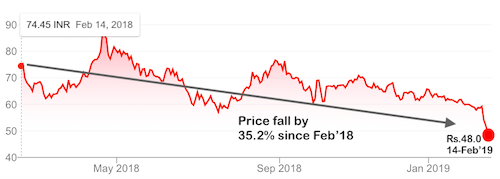

Current Price trend of Aluminium…

In last 12 months, the global price of aluminium has fallen by more than 17%. In Feb’18, its price was $2,255 per tonne. Today in Feb’19, its price is $1,839 per tonne.

In fact, if we will compare April’18 price of $2,597 per tonne, global aluminium price has fallen by 20%+ in just 10 months.

As a rule of thumb, when aluminium price trades at $2,000+ per tonne, price of alumina should trade at $370+ per tonne levels. But the price of Alumina as on today remains as high as $620 per tonne levels.

What does it means for the Aluminium companies? Lower profitability (margins). In this scenario, almost all Aluminium producers are facing huge problems.

The condition is not different for the two Indian Aluminium producers as well.

| Name of Stocks | Market Cap (Rs.Cr.) | Current Price (Rs.) | 52W High Price (Rs.) | Current Price below 52W High (%) |

| Hindalco | 43,316.17 | 192.9 | 267.35 | 27.85% |

| NALCO | 8,768.40 | 47 | 90.1 | 47.84% |

Within last 12 months, Hindalco is trading at 27.85% below is 52 Week high, and NALCO at 47.84% below is 52 week high price.

Though comparison between 52W high is no way to judge price valuation of stocks, but it certainly gives a strong hint for further price analysis.

Which Indian Stock to Buy?

In the Aluminium sector, we have two heavyweight stocks, Hindalco and NALCO. The price of both these stocks have take a good beating in last 12 months.

Out of the two, I have picked NALCO as a better bet. Why? Because NALCO has the lowest cost of production of finished aluminium in the world.

This cost advantage is also reflected in its margins. As reported in moneycontrol, RoCE of these two stocks are as below:

- Hindalco: RoCE – 2.05%.

- NALCO: RoCE – 11.02%.

Profitability of NALCO far exceeds Hindalco. We will discuss about the business fundamentals of NALCO in more detail later. But for the moment, let’s concentrate on the price trend.

There are two scenarios here which makes NALCO as a good stock to watch-out for in next few months:

- In Aluminimum sector, NALCO has the most profitable business.

- Its price has corrected by more than 35% in last 12 months.

Business fundamentals of NALCO is rock solid. But still its price is falling. I am sure it is only a mid-term phenomenon (triggered more by USA-China trade war).

Hence I thought to do a more detailed fundamental analysis of NALCO. Here are my results:

Stock Analysis of NALCO…

#1. Aluminium Demand…

In year 2017, it was estimated that the global demand for Aluminium was 63.2 Million Tonnes.

In 2018, the demand took a massive beating due to trade war between USA and China, also involving EU and RUSAL. This has resulted in the price fall of global Aluminium prices.

Experts say that Aluminium demand will ‘not’ continue to dip in year 2019. Demand growth will be slow at rate of 4-5% in 2019. But for stock prices, it will be enough motivation to turn bullish.

Moreover, Aluminium demand cannot remain low only because of USA’s inflicted trade war. Why? Because of the uncompromisable utility of Aluminium in the world market. Presently there is virtually no economical alternative to Aluminium in the world. Major use of Aluminium are as follows:

- Packaging.

- Construction.

- Electrical equipments.

- Automobiles and Aviation industry etc.

Now we are ready for the detailed stock analysis of NALCO. I use my stock analysis worksheet to analyse my stocks.

#2. Debt & Cash position…

In last 10 years, NALCO has remained virtually debt free. For a company operating in Metal space, this is quite an exceptional achievement. Why? Because metal companies are very capital intensive. Hence companies has to resort to debt to fund its working capital, capital expenditure etc.

Also in last FY, NALCO reported a cash & bank balance of Rs.2,700 odd crores. In last FY (Mar’18), NALCO reported a net profit of Rs.1,300+ Crores. Comparing the cash position with PAT, NALCO has close to 2+ years profit sitting in its bank balance. This is quite an asset.

With so much liquid cash available at its disposal, NALCO can easily pay dividends to its shareholders, and can also plan more share buybacks in next months.

Why share buyback? Because it looks like NALCO may be trading at undervalued price levels. In Nov’18, NALCO has already offered one share buyback proposal at Rs.75 per share.

In FY ending Mar’18, NALCO has paid Rs.900+ crores as dividends to its shareholders.

At current price level of Rs.48 per share, NALCO’s dividend yield is @10% p.a. This is again a reliable signal of undervaluation.

#3. Growth Rates…

I personally feel that NALCO is not a kind of company which can trigger price rise with its ‘growth’ numbers. Why I say so?

Because of its below average growth rate numbers shown in last 10 years. These are numbers computed by my stock analysis worksheet for NALCO:

If this is so, why I am interested in this stock?

Because of its price valuation. I believe that, at current price levels, NALCO can be a good buy. When shares are bought at such undervalued price levels, future price rise is almost inevitable.

#4. Price valuation…

I used my stock analysis worksheet to estimate the intrinsic value of NALCO. It comes out to be greatly undervalued. Look at the results here.

- Current Market Price: Rs.47.3

- Estimated Intrinsic Value: Rs.87.6

Having said that, I’m also aware that even such undervaluation will not help the ‘stock to grow’ till the global Aluminium market recovers. It is important for global Aluminium price to start rising back to $2,200/tonne levels to render profits for NALCO’s investors.

But I believe that in next 12-16 months, Aluminium prices will reach newer heights.

Final Words…

[You can access final report of my stock analysis worksheet here in PDF.]

Currently the aluminium price is falling. But this price fall is not likely to continue in year 2019-20. The price rise is almost imminent. Why?

Because experts say that the current Aluminium prices are already so low that, few companies are operating at break-even levels. So it will not be wrong to assume that $1,840 per tonne is already a rock-bottom price.

This is about the price.

The overall business fundamentals of NALCO is also decent. Why I say decent and not good? Because NALCO being a public sector enterprise, has its own share of disadvantages.

There is too much intervention of Indian Government in these “Navratna” companies. This is the reason why most experts refrain themselves from suggesting these PSU stocks.

But at such price levels, even these stocks becomes a mouth watering proposal.

The overall rating of NALCO as suggested by my stock analysis worksheet is looking like this:

I am targeting NALCO for myself based on following parameters:

- Buy Price: Rs.48 or below.

- Target Price: Rs.60 or above.

- Holding Period: 12 to 16 months.

Mr Mani

Thank you for your in-depth study and let me know why the price of NALCO dropped near 35

Can we invest now keeping price may not increas due to subdued manufacturing activity resulting in low demand

Can you give us in-depth study for NBFC specially Bajaj finance and Shrram trans fin

I want to know whether these penny stocks changes to crorepathi if u invest in few lakhs…very curious..to know the answer…

How does NALCO and Vedanta compare? After all Vedanta market share is appx 50%

Sir You have done a commendable job which is very useful for investor like me . I really thankful to you .

Thanks for acknowledging the utility of the article.

Rite now the price is 37 rs. And I feel it is good time to buy.

This is an good analysis and NALCO is a good example of how market ignores the intrinsic value of a stock. The fact that significant portion of the book value is in cash and equivalent is a strength.

Just want to add 2 general points :

1. EPS growth rate need not be zero as stated as Zero in your analysis.

2. Dividend payout has been unusually high for all PSUs past few years cos of government demand.

Nevertheless, just by holding NALCO at this current cost, the dividend yield can be expected to compound significantly if held for 10 years Plus.

Thanks for an insightful comment.

My stock analysis worksheet estimates growth rate as zero, if in the past, EPS growth has been zero.

Hi Mani, Thank you. If you have time, see if you can review SJVN too.

Dear Mani

Agree with your NALCO price which will be Bullish after six months to more than 57.

Hi Mani, Thanks for sharing such an insightful post with your analysis. I was wondering is this the right time to invest in aluminium and I found your post to be very useful.

hello sir nice explanation again will start investing little by little in this stock thanks again

Take care to check the valuations before investing. Thanks.

Hi Mani , how to get notification when post new article on your blog ?

Readers can please follow for the blog updates at twitter and facebook. Thanks for your query.

Hi Mani,

Thanks for the wonderful post…

below is my observation…

I am with you in the post,

1) low cost production

2) almost zero debt

3) expansion completely fro internal accruals

But first glance of the AR 2017-18 seems that

Bauxite 70 Lakh MT

Alumina Hydrate 21 Lakh MT

Aluminium 4 Lakh MT

as per the details its seems that Aluminium as % of total volume is very less so the impact it gain from the price raise of Aluminium might is not very significant…

while any dip in the price of alumina from $620 USD levels would have major impact on the company profitability …

Please let me know your view …

Note : i have not gone through complete AR , this my view as per first glance

Regards,

Rama