Gujarat Pipavav Port share price is currently trading at range close to its intrinsic value. Hence it looks exciting.

But before looking at its financials in more detail, lets know more about this company.

Introduction: Gujarat Pipavav Port is India’s first private port.

It was promoted and developed by M/s SKIL Infrastructure (along with Government of Gujarat).

It is located in Saurashtra Gujarat (140 km from Bhavnagar).

Gujarat Pipavav Port is often referred as “all weather port”.

The port started its commercial operations in year 2002.

In year 2005, APM Terminals acquired the port from SKIL Infrastructure.

APM Terminals is one of the worlds largest container terminal operators of the world.

APM terminals is owned by Maersk (worlds largest container shipping company).

Gujarat Pipavav Port got itself listed in BSE and NSE in year 2010.

The port generates its revenues by providing port handling and marine services.

Containers, Bulk Cargo and LPG Cargo is handled in the port.

Gujarat Pipavav Port also provides their own CFS (Container Freight Station) through which it also generates sales.

Currently APM Terminals (as promoters) holds 43% stake in this port.

As promoters holdings are so high, it is a good sign for the investors.

Such companies are generally better managed and controlled compared to others.

Currently Tejpreet Singh Chopra (Age:45) is the Chairman of the port and Keld Pedersen (Age: 49) is the Managing Director.

In the Annual Report of the company, Chairman’s speaks of the “low freight rates” prevailed in year 2016, and “slow down in global trade” is adversely effecting the shipping lines of the world.

As a result the impact is also felt on the ports.

But the chairman also talks about the growth potential in India.

He hints that the “container shipping trade” in the west cost of India is likely to grow at 6% per annum.

The chairman also speaks about how LPG penetration in India is increasing.

Government of India has a target to provide LPG to 96% population in India.

In order to meet this target, GOI must import LPG.

This has further potential to improves the revenues of the port in times to come.

Gujarat Pipavav Port Share Price

In year 2004, it reported-annual-income was Rs.51.31 Crore.

In Mar’2017 (after 14 years), its reported annual income is Rs.718.46 Crore.

This means a CAGR of 20.7% per annum.

7 years back, the port has been making only losses.

But since FY2010-11, it made a positive EPS. Since then its EPS has grown at a fair rate.

IN FY10-11 its EPS was Rs.1.35. In Mar’2017, it reported EPS was 5.17.

This means a CAGR of 10.06% per annum in a span of 6 years.

Considering that the shipping industry is under tremendous pressure since 2014-14 due to global slowdown, maintaining a EPS growth of 10.06% per is not bad.

Considering that prospective growth of India Inc. in next decade, I personally feel that privately managed ports like Gujarat Pipavav has bright future.

Lets see how its stock price has behaved in last 5 years:

In Nov’2013, Gujarat Pipavav Port share price was at Rs.54 levels.

By the Apr’15, Gujarat Pipavav Port share price jumped to Rs.255 levels (CAGR : 175%, in just 2 years).

Today in Nov’2017, Gujarat Pipavav Port share price is trading at Rs.135 levels.

In a span of las 14 months (Sep’16 to Nov’17) there is a large price dip of -26.8%.

Such big fall in last 1 year prompted me to check the business fundamentals of Gujarat Pipavav Port.

The result of my analysis is presented here for my readers knowledge…

Gujarat Pipavav Port share price vs business fundamentals (5Y Data)

Till Apr’2015, Gujarat Pipavav Port share price was bullish. It was almost consistently moving up.

Since last 2 years the stock price of Gujarat Pipavav Port has only been tumbling down and down (Rs.255 to Rs.135 levels).

But irrespective of this price fall, it is true that Indian Economy will rise fast in coming years.

Which means, in coming years there will be major imports and exports of items in this country.

Indian Ports will have to play a very important role in import and exports of goods.

For a private port like Gujarat Pipavav, growth potential is very high.

But for sure, this is not going to happen very soon. I assume a minimum time horizon of 5 years.

Moreover, the business fundamentals of Gujarat Pipavav Port is also not bad at all.

See this comparison betweenGujarat Pipavav Port share price and its business:

Share Price: falling post Apr’15

Reserves & Surplus: Continuously increasing since past 5 years (Mar’13). Growth rate has been good at 16.1% per annum.

Income (Turnover): Continuously increasing since past 5 years (Mar’13). Growth rate has been decent at 10.74% per annum.

Net Profit (PAT): Continuously increasing since past 5 years (Mar’13). Growth rate has been good at 27.57% per annum.

Equity dividend payout: The company paid dividend first in FY-1061-7 since last 5 years.

EPS: Increasing since past 5 years (Mar’13). Growth rate has been good at 27.57% per annum.

Looking at this chart, it is clear that since Apr’2015, companies sales and net profit has taken a beating due to global slowdown in trade.

But if we can ignore the major dip in FY14-15, since last two years the company has been making more sales turnover and net profit.

But still the company share price is going down. This is what is making Gujarat Pipavav stock interesting.

Lets evaluate how Gujarat Pipavav has performed in last 2 quarters (post Mar’17)

Gujarat Pipavav Port share price vs business fundamentals (after Mar’17)

The results of Gujarat Pipavav Port for the first two quarters (June & Sep’17) is available in bseindia.com website.

If we will see Gujarat Pipavav Port’s quarterly results for the last 5 quarters, the fall in price looks justified.

In last 5 quarters, Sensex jumped from 27,000 levels to 33,000 levels (CAGR: 22.2%).

So it means that the mood of the market was buoyant. But Gujarat Pipavav Port’s has faired well.

Income (Turnover): Decreasing since past 5 quarters (Sep’16). Growth rate has been negative at -2.5% per annum.

Net Profit (PAT): Decreasing since past 5 quarters (Sep’16). Growth rate has been negative at -5.75% per annum.

EPS: Decreasing since past 5 quarters (Sep’16). Growth rate has been negative at -5.85% per annum.

Considering global slowdown in trade in last couple of years, these slumps in sales and profit was only expected.

But important question for investors is to ask self, is the present slump temporary or permanent?

My assumption is that this is just a short term trend. In long term (next 5 years) this Port is going to see bigger highs.

Stock Analysis of Gujarat Pipavav Port Limited

My readers are aware that on getmoneyrich, a stock analysis worksheet is also offered for the readers helping them to learn the process of fundamental analysis of Indian stocks.

I have used this worksheet to do some number crunching for Gujarat Pipapav Port.

Allow me to share some of my observations here.

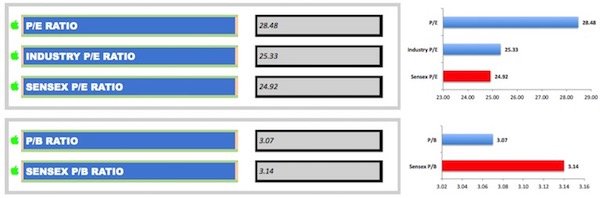

#1. Price Earning (P/E) & Price Book value (P/B) Ratio:

P/E & P/B ratio is one excellent stock metric which gives us a quick idea of stocks current price valuation.

As a thumb rule, a stock whose P/E ratio is above 15 is considered expensive. A stock whose P/B is above 1.5 is also considered expensive.

But this thumb rule has now become obsolete.

Hence it is essential to use other, more relevant, comparator.

The stock analysis worksheet compared Gujarat’s Pipavav P/E with its industries (Shipping) P/E ratio to get an idea about its price valuation.

The stock analysis worksheet also compared the companies P/E and P/B with its Sensex’s overall P/E & P/B ratio to get an idea about its price valuation.

The result was like this:

Compared to Industry and Sensex P/E ratio, Gujarat Pipavav Port looks overpriced.

Compared to Sensex P/B ratio,Gujarat Pipavav Port looks better priced.

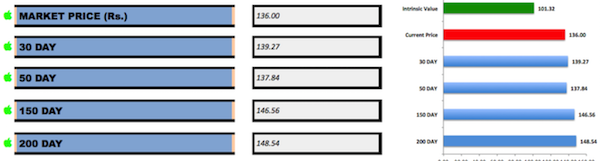

#2. Simple Moving Average (SMA):

Analyzing stock price based on SMA is part of technical analysis.

I personally feel comfortable in including a tinge of technical analysis in my stock research.

It gives me a better feel of how the stock price has been moving in the past as compared to today’s price.

When we look at SMA (200, 150, 50 & 30 day) and compare it with current price, the trend is very clear. The price has been gradually falling.

SMA works like a fire alarm for analysts.

If SMA is showing a growing trend, analysts become cautious about the stock price tending to become overvalued.

If SMA is showing a falling trend, analysts become cautious and dig deeper into the cause of such price fall.

In last 200 days, price of a Gujarat Pipavav Port has only been falling.

Such consistent price falls makes stock price fall below its intrinsic value.

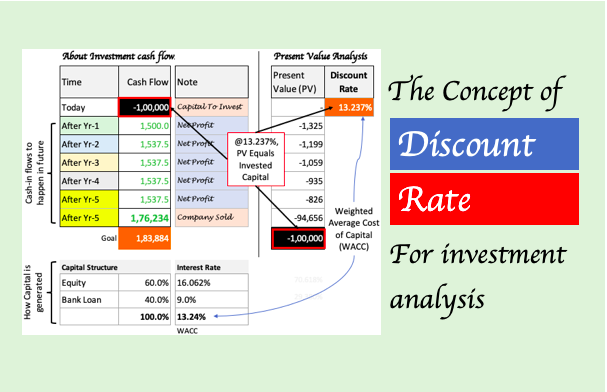

#3. Intrinsic Value:

This is the heart of my stock analysis worksheet.

Though I am no expert of estimating intrinsic value of companies, but still this worksheet works for me.

It gives me a rough idea of where the current price of stock is trending (undervalued or overvalued).

Though I know that the calculation is not immaculate, but who can claim to the exact intrinsic value of a company.

Even the great Warren Buffett prefer not to boast about his ability to estimate intrinsic value of stocks.

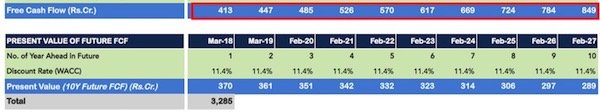

What I saw interesting about Gujarat Pipavav Port is its ability to generate free cash flow:

This worksheet confirms that Gujarat Pipavav Port will continue to generate free cash flow in next 10 years.

Though you can see that the growth of FCF that this worksheet has considered is on lower side only.

Still the calculated intrinsic value of this stocks is very inviting.

Using this worksheet, I could understand that the current share price of Gujarat Pipavav Port is not undervalued.

But it is treading very close to it.

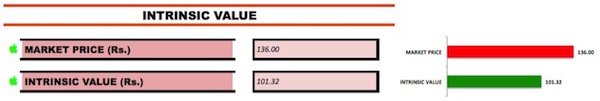

The intrinsic value verses current share price looks like this:

Current market price is Rs.136.

Calculated intrinsic value by this worksheet is Rs.152. But as per value investing rules, the calculated intrinsic value must be applied with “margin of safety“.

Generally, the agreed price after application of margin of safety is two-third (2/3rd) of the estimated intrinsic value.

Hence: 2/3 x 152 = Rs.101.32

After application of Margin of Safety, Gujarat Pipavav Port share price looks expensive.

But we cannot ignore this fact that in last 14 months, this stock price has already fallen by more than -26.8%.

Considering that the price trend is falling, it business fundamentals are also intact, even current price of Rs.136 still looks reasonable.

In ideal case, people must wait for further price dips (till 101 levels) then take the next step.

#4. Overall Rating of Gujarat Pipavav Port:

This is the best part of my stock analysis worksheet. It consolidates the results and gives a one line, clear answer.

The worksheet has analyzed Gujarat Pipavav Port based on the following parameters.

* Price Valuation

* Business Fundamentals

* Profitability &

* Price history

Though this worksheet gives more weightage on Price valuation and Business fundamentals, but it also considers companies profitability and price history.

For Gujarat Pipavav Port, the overall grading falls just short of good. The main reason being, its current market price is above its intrinsic value.

Only those stocks which is both fundamentally strong, and also displays undervalued market price, this worksheet will give it high grades.

The overall results looks like this:

According to the rule of my stock analysis worksheet, any stock which obtains an overall grades of 85% or more, is a good stock.

But here, Gujarat Pipavav Port has scored 82.8%.

Considering the overall numbers of Gujarat Pipavav Port, I still consider this stock as reasonably valued.

Dear Mani,

Thanks for posting the analysis on Gujarat Pipavav Ports, which is very useful, I was doing a similar analysis using your worksheet but some reason I got the Intrinsic value 73.4, with an overall score 86.6% and at the stock is overvalued at CMP 81.7, is there anything wrong in my workings?