What is annuity? It is an investment product for retired people. Only after retirement, a person can get the benefits of annuity.

Annuity is purchased to generate guaranteed regular income. The frequency of income generated by annuity can be monthly, quarterly, semi annually or annually (depending on selection).

Is annuity a life insurance?

Annuity is basically a product of insurance providers like LIC, SBI Life, ICICI Prudential, HDFC Life etc. But it is not a life insurance policy.

In fact it resembles more a debt based ‘income plan’ than a life insurance policy. It’ll not be wrong to say that annuity is opposite of life insurance. How? Life insurance benefit is taken after death or end of term, but annuity’s benefit is availed during the lifetime.

So what is insured here? Annuity assures the investor of a predefined regular payout for life time. If the person age overshoots the tenure, risk is on the insurance company.

To make annuity more attractive for people, there are several types of annuities available for purchase.

Topics:

- Examples of Annuity:

- Main Types of Annuity.

- Advantages of Annuity.

- Disadvantages of Annuity.

- Closer Alternatives of Annuity.

- Conclusion.

Examples

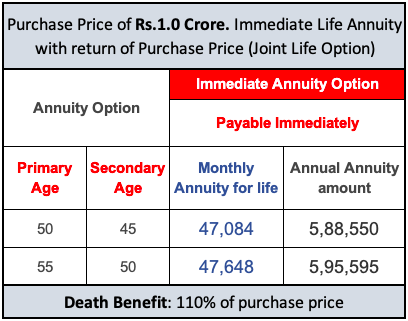

Allow me to explain an annuity using an example of HDFC Life Pension Guaranteed Plan. There are two types of annuity plan shown in their website: Immediate and Deferred Annuity. I’ll explain both.

1. Immediate Annuity:

Immediate annuity begins to generate monthly income right away. It is generally purchased by people who have retired and needs immediate income.

- Annuity Option: In the above example, the details of person buying the annuity is like this: (a) Age of primary applicant: 50 years. (b) Age of spouse: 45 years. This person has bought the annuity with Joint Life Option.

- Joint Life Option: In this type of annuity, monthly payments will be made till either the primary or secondary applicant (spouse) is alive.

- Purchase Price: It is the price that the buyer pays to buy the annuity. In this example, the buyer bought the annuity for Rs.1.0 Crore (Service tax is applicable).

- Monthly Annuity for Life: The annuity is bought with a cost of Rs.1.0 Crore. Upon investment, the monthly payment of Rs.47,084 starts immediately. This payment will continue for life.

- Death Benefit: After the death of the primary and secondary beneficiary, the principal amount is returned to the heirs (or a nominee). The returned money is equal to Rs1.1 Crore (110%).

[Annual Annuity Amount: Had the person chose the annual payout option (instead of monthly payouts), the money will be paid only once each year. The amount that is paid is Rs.5,88,550 (equivalent to Rs.49,045 = 588550/12). In this case the yield will be slightly better]

Yield of Annuity: This is an interesting calculation. To calculate this we will have to first note the cash-returns generated by the annuity. There are two types of returns here:

- Monthly Payouts: Rs.47,084.

- Death benefit: Rs.1.1. Crore (return of principal amount).

[Assumption: Actual payout will be for lifetime. But for the ease of calculation I’m assuming payout period as 30 years. It means that we are assuming a life expectancy of 30 years after retirement (Age: 50+30 years). In this case the death benefit of Rs.1.1 Crore will be paid out on the 31st year.]

To calculate the yield, we will take help of the IRR function of the excel sheet. The working is shown below. The calculated return (yield) of this annuity plan is 5.7% p.a.

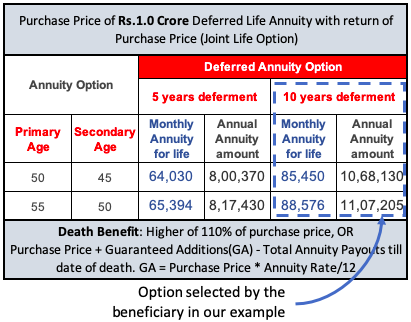

2. Deferred Annuity:

Deferred annuity does not begin to generate monthly income right away. It is purchased by people who still have few years left before retirement. They are interested to first build the retirement corpus, and then when they retire, use the corpus to buy annuity, which in turn generates income.

- Annuity Option: In the above example, the age of primary applicant is 50 years, and spouse is 45 years of age. The primary applicant has still not retired. Retirement is still 10 years ahead in future.

- Years Deferment: 10 years deferment means, the annuity will start paying monthly income to the annuitant after 10 years from the date of purchase.

- Joint Life Option: In this type of annuity, monthly payments will be made till either the primary or secondary applicant is alive.

- Purchase Price: The buyer (at 50) bought the deferred annuity for Rs.1.0 Crore with a goal of income generation after 10 years from today.

- Monthly Annuity for Life: The annuity is bought with a cost of Rs.1.0 Crore. Upon investment, the monthly payment of Rs.85,450 starts after 10 years from date of purchase.

- Death Benefit: After the death of the primary and secondary beneficiary, the principal amount is returned to the heirs (or a nominee). The returned money is equal to Rs1.1 Crore which is 110% of the principal amount (or = Purchase Price + Guaranteed Additions(GA) – Total Annuity Payouts till date of death).

Yield of Annuity: Even in case of deferred annuity, like immediate annuity, there are two types of cash-returns:

- Monthly Payouts: Rs.85,450.

- Death benefit: Rs.1.1. Crore.

[Assumption: Actual payout will be for lifetime. But for the ease of calculation I’m assuming payout period as 30 years. Hence the death benefit of Rs.1.1 Crore will be paid out on the 31st year of the payout period (or on 41st year from date of purchase of annuity]

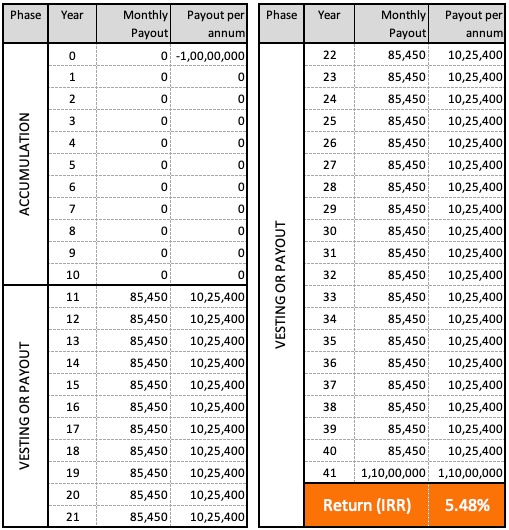

In case of deferred annuity, monthly payouts will start “after 10 years from the date of purchase“. Hence to calculate the yield of annuity the excel working sheet will look like this:

To calculate the yield, we’ve taken help of the IRR function of MS Excel. The calculated return (yield) of our example deferred annuity plan is 5.48% per annum.

P.Note: Monthly Payouts (Return): Deferred Annuity: Rs.85,450 (5.48%), Immediate Annuity: Rs.47,084 (5.7%). Though monthly payouts in case of deferred annuity is bigger, but still the yield of immediate annuity is higher.

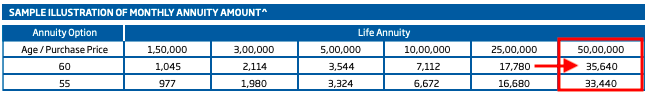

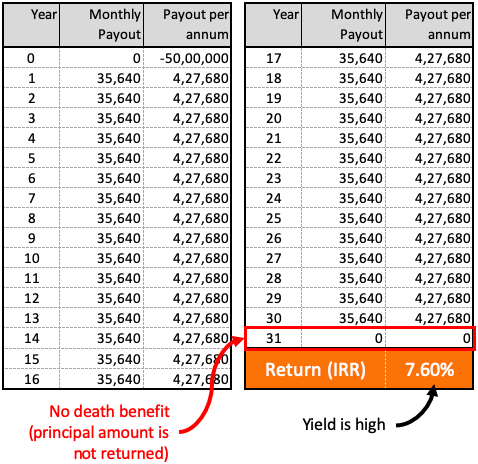

3. Immediate Annuity (No Death Benefit)

I will show you an example of HDFC Life New Immediate Annuity Plan. In this annuity, the principal amount is not returned back. Hence, it will be interesting to see the yield of such plans.

Policy Details:

- Purchase Price: Rs.50 Lakhs.

- Monthly Payouts: Rs.35,640.

- Death benefit: Nil.

[Assumption: Actual payout will be for lifetime. But for the ease of calculation I’m assuming payout period as 30 years. It means the company has to keep the monthly payout running for next 30 years. After the lapse of 30 years, principal amount stays with the insurer]

Lets calculate the yield using the IRR function of Excel sheet. The working is shown below. The calculated return (yield) of this annuity plan will be 7.6% p.a.

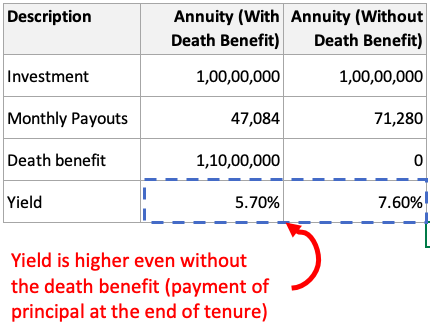

P.Note: See the comparison of the following two annuity plans. Check which annuity has a higher yield?

Main Types of Annuity

Not every body would like to buy an annuity to generate fixed income for lifetime. Depending on ones priority and needs, the insurance sector offers different types of annuity plans. Each annuity plan serves their own set of purpose.

Lets see few annuity plans and their purpose:

- Payout for lifetime (No Death Benefit): The beneficiaries will get a predefined payouts (monthly, quarterly, annually etc) for life. Upon death of the beneficiaries, the payout will stop. In this case the principal amount used to buy the annuity is also lost. Means there is no death benefit in this type of annuity. But in this type of annuity has a maximum yield (see here).

- Payout for lifetime (With Death Benefit): The beneficiaries will get a predefined payouts (monthly, quarterly, annually etc) for life. Compared to above, here the payout is slightly less. But in this case principal amount used to buy the annuity is payable after the death of the beneficiaries. The principal amount is paid to the nominee or legal heirs (see examples #1 & #2).

- Payout only for a pre determined period: Here the payout is not for lifetime. The payouts can be for the durations like next 5 years, 10 years, 15 years etc. If the buyer dies before the term expires, the nominee will continue to receive the payout till the end of the term.

- Payout with annual increase: In the initial years, the payout will be lower. But with time it will grow. Consider this, when a retired person needs money the most? The higher will be the age, more will be the need for money. This is exactly what this type of annuity offers. Here the payout will grow at a predetermined rate of say 3% per annum.

Advantages of Annuity

There are several advantages of buying an annuity. Even those people who do not like annuity cannot miss to give the following credits to it:

- Certainty of Income: Once an annuity is purchased, the income generation is almost certain. It is as certain as central government paying interest on bonds, or big bank’s paying interest on deposits. Insurance provides like LIC, ICICI Pru, SBI Life, HDFC Life etc are best annuity providers. Why? Because these are big companies. They are going to continue sending payouts till like next 100+ years. Unless the company goes bust, annuity income will continue to yield.

- Fixed Interest Rate: Once you buy an annuity, the interest that it will pay becomes fixed for rest of the life. In a country like India, where risk-free rates will fall with time, a fixed interest rate offer is beneficial. How? Suppose you bought a bank’s 10-year FD @7.0% interest which pays you monthly income. After 10 years, your FD will break and you will be asked to buy another FD. After 10 years from now, likely interest rate will be only 6% per annum. This is called reinvestment risk

- No Investment Limit: One can buy annuity of any amount. There is no upper limit. Compare this with other retirement linked income generators like PO-MIS, PO-SCSS, or PMVVY. They all have an upper investment limit (of </= 15 lakhs). For people who have a big retirement corpus, this is a huge advantage. Why? Because if not annuity, then they will have to look towards bank deposits (low yield), or debt mutual funds (higher risk). Annuity is a good compromise. Read: about systematic withdrawal plan (SWP).

- Tax Exemption: During the accumulation phase, money invested in annuity provides the benefit of tax deduction. But in vesting phase, income from annuity is taxed at ones marginal tax rate. Read: Limitations of Sec 80C.

- Immediate Income Generator: There can be no better immediate income generator than annuity for retired people. Why? Because no other investment vehicle can pack these three benefits in one basket (certainty of monthly income, fixed interest rate for life, no investment cap). Ask a fund manager who generates monthly income for its clients – he knows the real value of annuity.

- Joint Option: Annuity can be purchase with ‘joint life option’. Such an annuity will continue to generate income till the primary applicant and the spouse is alive. This provides a huge financial security for the elderly.

Disadvantages of Annuity

Not everyone likes annuity as an investment vehicle. Even retired people pick annuity cautiously. The reason for the restricted fan-following of annuity is its few dominant disadvantages.

- Liquidity Lock: Suppose a person bought an annuity of Rs.1.0 Crore against which the monthly payout is say Rs.47,084 (see this example). Though the monthly payout will continue to yield for life, but the principal amount (Rs.1.0 Crore) is locked forever. It can never be withdrawn prematurely. It can come back only as a part of death benefit. For retired people, losing on this liquidity is a big psychological hurdle.

- Yield is Low: Frankly speaking, I do not think the yield is low. Why? Because an annuity bought today, is beating inflation. How? Today’s yield: 7.6% p.a. (see this example). Average inflation for next 30 years: 6% per annum. So it’s not so low, right? But for sake of comparison, let’s compare it with SCSS (@8.6% for 5+1 Year), PO-MIS (@7.6% for 5 Year), Bank FD (@7% for 10 Year).

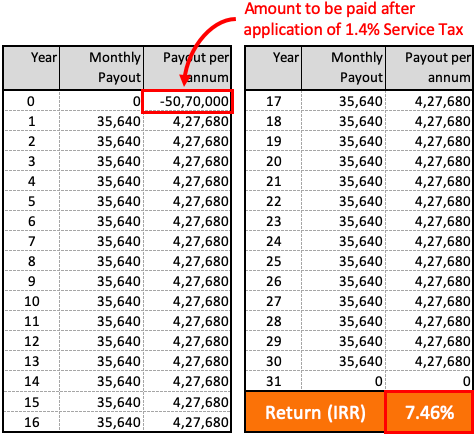

- Service Tax @1.4%: This tax imposed on purchase of annuity makes it a disadvantage for its investors. Why? Annuity is an income generator for “retired people”. Why our government wants to collect tax from it? Anyhow the yield of annuity is only OK (7.6%); but imposition of service tax makes it lesser (7.46%). See the working below:

It is true that if we will try to see annuity from the point of view of yield (returns), we would not like it. So an important question arises, what are the alternatives available for annuity investors?

Closer Alternatives of Annuity

What is a strong point of annuity? It is a risk free (long term) monthly income generator, and there is no cap on its investment. What makes annuity weak? Low yield.

So, a better alternative of annuity must display the following characteristics:

- No investment limit.

- Higher yield than annuity.

- Consistent monthly income generator (for very long time)

I can think of only two alternatives here. But both of them has their own limitations.

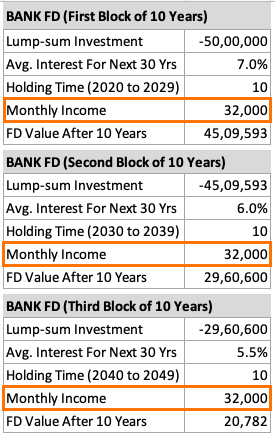

1. Bank’s Fixed Deposit (Hypothetical Consideration)

As on today, on an average, a bank FD might pay an interest of 5.93% for next 30 years. In this case there will be 3 investment blocks of 10 years each. First Block: Year 2020 to 2029, Second Block: 2030 to 2039, Third Block: 2040 to 2049.

Such a FD can yield a monthly income of Rs.32,000 per month for next 30 years. What will be the overall yield of this FD? Lets use the Excel’s IRR function to check the yield. It’s yield will be 6.2% p.a.

FD is a great alternative for annuity. But there is a weakness which blunts its edge a bit over annuity. What? It is its maximum holding time.

Most banks do not allow FD term to be more than 10 years. It means, after 10 years FD will mature and the person would have to buy it again for next 10 years.

So what is the problem? After 10 years, the interest rate of FD will fall (from say 7% to 6%). There is reinvestment risk. This substantially brings down the overall yield of FD (6.2% p.a.) below the annuity (7.6% p.a. – see this example).

[P.Note: Unlike what has been shown above, a bank FD will not allow systematic withdrawal of Rs.32,000 each month. What bank’s FD can yield each month is only the interest component and that too after adjustment of TDS @10%]

So what is the conclusion? Bank’s FD is not an alternative of annuity. Though with some alterations in its terms and conditions (longer holding like 30 years & systematic withdrawals), FD’s could have been a close rival of annuity.

2. Systematic Withdrawal Plans (SWP)

SWP plans are offered by mutual funds. Compared to Bank FD’s they tick nearly all the check-boxes to be the best alternative to annuity.

What are SWP? Mutual fund schemes allow its investors to withdraw a specific amount of money each month. Hence the name “systematic withdrawal plan”.

Suppose you invest in a mutual fund scheme called ICICI Pru Regular Savings. You bought its units with an investment horizon of 30 years. But your only condition was, you need a monthly withdrawal of Rs.36,000 from the fund.

P.Note: This mutual fund is capable of generating 8% p.a. returns over a longer horizons like 30 years. Its portfolio composition is 80% debt and 20% Equity.

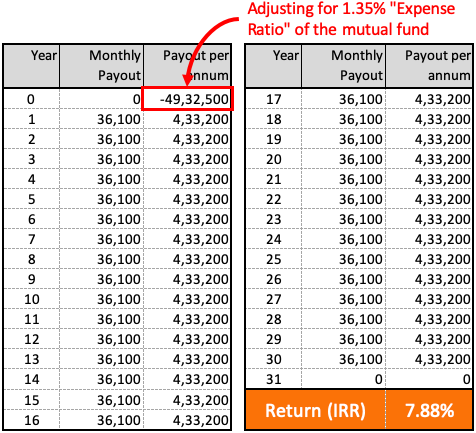

Let’s see if the systematic withdrawals of Rs.36,000 can be sustained by this mutual fund for a period of next 30 years. We will use the IRR function of Excel sheet to check the feasibility:

So what is the conclusion?

Expected yield from the fund was 8% per annum. But the fund can generate a monthly income of Rs.36,000 per month with even 7.88% yield. Hence, we can say that the fund will be able to support the systematic withdrawals of Rs.36,000 easily for next 30 years.

Moreover, a yield of mutual fund (@7.88% p.a.) is higher than the yield of annuity (@7.6% p.a. – see this example), hence SWP is a better alternative than annuity.

Apart from yield, there is another thing which makes SWP’s more dear over annuity. It is its taxation. Debt funds has the option of “indexation benefit”. Let’s understand it like this:

- LTCG on Debt Fund (after 3 years): @20%

- But this 20% is after indexation.

- Yield of SWP: @8% (say).

- Average Inflation: @6% (for next 30 years).

- Net return: 2.0%.

- LTCG @20% will be applicable on 2.0%.

- Hence, net of tax return in SWP is only 7.6%.

Compare this with return from annuity. Whole of income generated from annuity (not only interest component) is taxed at marginal tax rate (as per ones tax slab).

Limitation of SWP: To eliminate the possibility of STCGT (Short term capital gain tax), which is taxed at marginal rate, just buy the mutual fund 36 months before taking the first withdrawal. This should be more than enough to give you the maximum benefit of LTCG and indexation.

Conclusion

If you are somebody who is building corpus for retirement, then make sure to use a portion of this corpus to buy annuity. If my corpus is large enough, I’ll at least use 30% of it to buy annuity (my preferred annuity plan)

Which retirement vehicle shall be used to accumulate funds for building retirement corpus? EPF and NPS are my top two pics.

If you can contribute more, and has longer time horizon available before retirement (15+ years), using mutual funds will also be a great idea.

Post retirement, considering a debt mutual fund for income generation is also not a bad idea. Buying a high rated debt fund, and using its systematic withdrawal plan (SWP) to generate monthly income is worth considering (check here).

I feels that, locking money for lifetime just for 7% returns in annuaity is worst.

Better to do Fixed Deposit as I will get approx. annuity returns. Also I will have freedom to use principal at any time.

Yes, this can be one way of looking at Annuity.

D most people who invest in annuity ever live to see it to full maturity?

Retired people (mainly ex-government employees) get pension, right? This is nothing but income yielding from annuity.

What a fantastic post! this is so chock full of useful information. Finance company management handling, not an easy job, Need a perfect tool like software.