In the stock market, as an investor, you have three main choices – pick individual stocks, buy mutual funds, or explore Exchange Traded Funds (ETFs). Each option has its unique features, benefits, and challenges. Among these, investing in Nifty 50 ETF could be a wise long-term bet. People who seek a balanced, diversified, and cost-effective way to invest in equity, ETFs is the way forward.

Personally, I believe the Nifty 50 ETF is a good choice for anyone who wants to participate in the India’s growth story. It is a way to simplify your equity investment without getting bogged down by the complexities of analyzing individual stocks. It’s aligns with a long-term wealth-building strategy.

Before we talk about the benefits, I want to highlight one drawback index investing (like ETF investing). Across the world, index investing has gathered huge popularity. Till the size of index investing was limited, it was OK, but now it creating a disparity. How? Index investing (like in ETFs) leads to concentration of money in a few top-weighted stocks within the index. Heavyweight stocks in the index are receiving disproportionate inflows. Such inflows can potentially inflate their valuations. As a result the main reason why people practice index investing, diversification, gets diluted.

Despite this, Nifty 50 ETFs remain beneficial for most investors compared to individual stocks. Let’s discuss more about it.

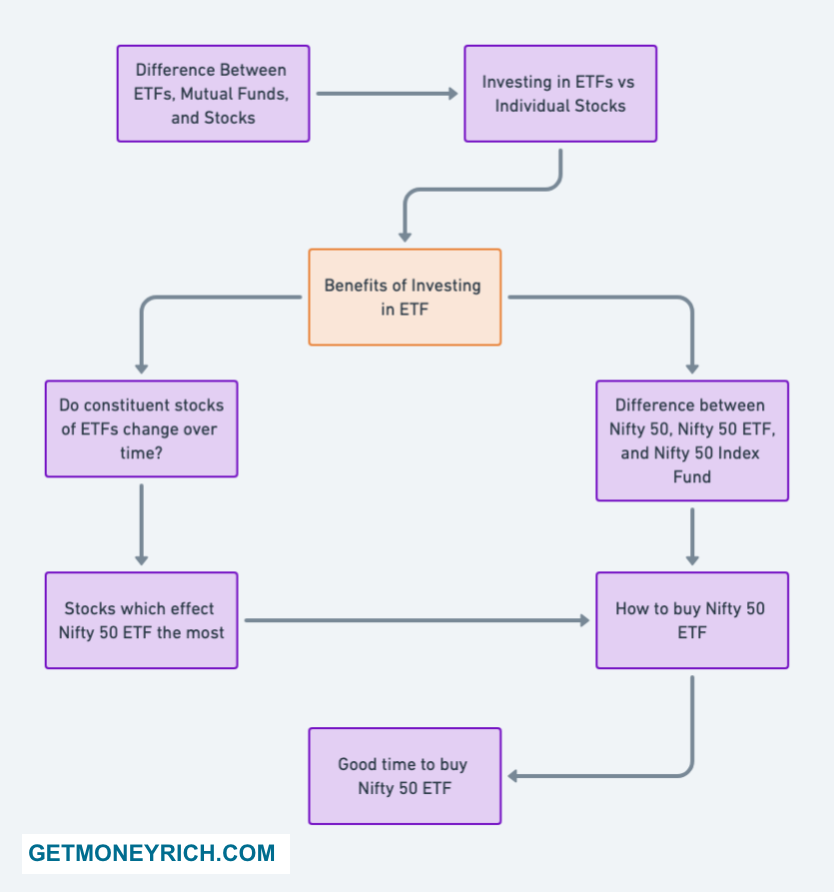

Topics:

Q1: What is The Difference between Stocks, Index Funds, and ETFs?

This is a table comparing ETFs, Index Funds, and Individual Stocks to give you a clear idea to understand the similarities and differences between them (check this 30 second reel).

| Feature | Pure Equity ETF | Index Fund | Individual Stocks |

|---|---|---|---|

| Quick Understanding | It’s an Index Fund, which are traded like stocks | It’s a basket of stocks | It’s represents an ownership in a company |

| Pricing | Prices fluctuate throughout the trading day like stocks | Priced once daily at NAV (Net Asset Value). | Prices fluctuate throughout the trading day based on demand, supply, and company performance |

| Diversification | High. The invested money is distributed between all stocks in the basket | High. Same as ETF | No diversification |

| Trading Method | Like Individual Stocks | Bought/redeemed directly through the fund house (end-of-day NAV). | Bought and sold on the stock exchange during market hours. |

| Expense Ratio (Benchmark: Nifty 50) | About 0.05% (lower than an index fund (*) | About 0.1% | No expense ratio. But brokerage, taxes, etc. Cost of one trade could be about 0.65% to 0.70% |

| Minimum Investment | Buy at least one unit | As low as Rs.500. | Buy at least one share |

| Liquidity | Highly liquid | Less liquid (as compared to ETF and stocks) | Highly liquid |

| Risk | Like Index Fund | Moderate, portfolio is diversified | High |

| Income Tax on Capital Gains | Same Rules | Same Rules | Same Rules |

| Need For Research Before Investing | Minimal | Minimal | Extensive |

| Potential For Returns | Line Index Fund | Averaged | High |

| Control | No control over underlying holdings. | No control over underlying holdings. | Full control over stock selection and timing. |

(*) Why ETFs have a lower expense ratio that an equivalent index fund? For example, a Nifty 50 ETF has a lower expense ratio than a Nifty 50 Index Fund because: (1) it operates like a stock and doesn’t require continuous management of investor inflows and outflows by the fund house. (2) ETFs trade on the stock exchange, eliminating administrative costs associated with issuing or redeeming units directly with investors. (3) ETFs do not incur distribution or marketing expenses like index funds often do, further reducing costs.

Q2: Should I invest in individual stocks or ETFs?

2.1 Stocks

Investing in individual stocks is suitable for those who have the time, knowledge, and confidence to analyze companies.

If you enjoy researching financial statements, understanding industries, and tracking stock market trends, stock investing could be rewarding.

However, it comes with higher risks since your money is concentrated in fewer companies, and poor stock selection can lead to significant losses.

Stock investing requires patience, discipline, and a clear understanding of your financial goals.

2.2 ETFs

ETFs, like a Nifty 50 ETF, are ideal for those who prefer simplicity and diversification. For people who cannot spend time picking individual stocks, ETF are the next best alternative.

ETFs automatically replicate the performance of an index, spreading your risk across many companies. For busy professionals, ETFs are a low-cost and low-effort way to participate in the stock market’s growth.

Personally, I believe ETFs work well for long-term wealth creation with lower stress compared to individual stocks. People who want to invest in equity on autopilot, pure equity ETFs are the best alternative to individual stocks.

Q3: What are the benefits of investing in a Nifty 50 ETF compared to buying individual stocks?

3.1 Diversification

Investing in a Nifty 50 ETF offers instant diversification by giving you exposure to the top 50 companies in India across different sectors.

This minimizes the risk of a single company’s poor performance affecting your portfolio.

In contrast, with individual stocks, your portfolio’s success depends heavily on your ability to pick the right companies. How to pick right companies? It requires extensive research and monitoring.

3.2 Prevents Panic Selling

ETFs also save you from emotional decisions, like panic-selling when market is crashing. Why? Imagine, you had only one stocks (say TCS) in your portfolio on March’2020 (covid crash). For a brief period, there was extreme negativity prevailing in the society. Would you not have sold your holdings in TCS during such times? The chances are high, right?

Now consider this, you had a basket of stocks instead of only TCS. You basket had stocks like HDFC Bank, Bajaj Finance, Nestle, Britannia, M&M, Esab India, Siemens, ABB, Britannia, and the likes. Doesn’t a basket of such quality stocks would have give more confidence to hold-on instead of selling.

For me, a basket of stocks would have sounded much safer. In fact, I would have bought more of the ETF units during the crash.

3.3 Cost Effectiveness

Here is the result of analysis of expense ratios of 203 nos index funds and 153 nos ETF:

| Description | Avg. Expense Ratio (%) | Remarks |

|---|---|---|

| Nifty 50 Index Funds | 0.312 | 203 Nos Index Funds |

| Nifty 50 ETFs | 0.229 | 153 Nos ETFs |

This is another significant benefit of investing in ETFs over individual stocks or even index mutual funds.

A Nifty 50 ETF has a very low expense ratio, often under 0.1%.

This expense ratio is much lower compared to the higher transaction and management costs associated with maintaining a portfolio of multiple individual stocks.

Additionally, ETFs eliminate the need for constant monitoring of market movements or individual company news, making them ideal for busy professionals.

Personally, I find ETFs to be an excellent tool for long-term investors seeking steady returns. With lower stress compared to managing individual stocks, ETFs are a great alternative investment options for equity investors.

Q4: Do the stocks in Nifty 50 ETFs change over time? How often does Nifty 50 make changes to its stock components in a year?

To know which are the component stocks of Nifty 50 and their individual weights, check the link.

Yes, the stocks in a Nifty 50 ETF can change over time.

Nifty 50 index itself undergoes periodic reviews and rebalancing. The Nifty 50 index is designed to represent the top 50 companies listed on the National Stock Exchange (NSE) based on factors like free-float market capitalization and liquidity.

These reviews typically happen twice a year, in March and September, during which underperforming or ineligible companies may be replaced with new ones. This ensures the index remains a true representation of India’s largest and most actively traded companies.

Related Trivia:

- The Nifty 50 index is reviewed and managed by the Index Maintenance Sub-Committee (IMSC) of the NSE.

- Stocks are added or removed based on their free-float market capitalization, trading volume, and liquidity. It os done to ensure that the top 50 companies of the market represent the index. Generally speaking, underperforming stocks are replaced with better-performing, eligible ones.

How Nifty 50 ETFs constituent stocks are rebalanced?

For Nifty 50 ETFs, this rebalancing is automatic. If the index components change, the ETF also adjusts its portfolio accordingly.

As an investor, we don’t need to worry about manually tracking these changes.

Personally, I see this as a big advantage because it keeps the portfolio updated with India’s market leaders. The IMSC does the job for us, without requiring our active involvement.

Had it been an individually picked stock portfolio (not ETF), we would have to manually change our portfolio mix as per the changes in Nifty 50 portfolio constituents and weight changes.

This is also one factor that makes ETFs a great passive investment tool for long-term wealth building.

Q5: What’s the difference between Nifty 50, Nifty 50 ETF, and Nifty 50 Index Fund?

The Nifty 50 is a stock market index.

It tracks the performance of the 50 largest companies listed on the NSE. Nifty 50 serves like a benchmark to measure the health of the Indian stock market. If someone wants to buy Nifty 50, they cannot do it because it is an index.

The best way to invest in the Nifty 50 index is to buy its ETF, index fund, or buy each of the component stocks by oneself. Check its component stocks here.

So now, let’s see how are index funds and ETFs difference and related to the index.

Nifty 50 Index Fund replicates the Nifty 50 index but operates like a mutual fund.

In an index fund, we as investors, can buy and sell units at the fund’s Net Asset Value (NAV). When we invest in it, we essentially own a small portion of all 50 companies in the index.

The Nifty 50 ETF is an index fund that trade like stocks.

A Nifty 50 ETF is also mirrors the Nifty 50 index (like an index fund). In fact, it is almost like an index fund. But unlike index funds, ETFs trades like a stocks on the exchange. Hence it becomes very flexible for we investors to buy and sell them anytime we like.

Personally, I find ETFs better for cost-efficiency and flexibility, while index funds are more suitable for systematic investments (SIPs).

Q6: What are some stocks that affect the Nifty 50 the most?

The performance of the Nifty 50 index is heavily influenced by stocks with the largest free-float market capitalization. These are companies with higher weights in the index.

As of now, stocks like Reliance Industries, HDFC Bank, ICICI Bank, Infosys, and TCS have significant impacts on the Nifty 50.

These companies belong to sectors like energy, banking, and IT, which dominate the Indian economy.

Since the index is weighted by market cap, larger companies have a bigger say in its movement.

For example, if HDFC Bank performs well or poorly, the Nifty 50 is likely to reflect that impact more predominantly.

Personally, I find this weighting system to be both a strength and a limitation. On one side, it provides exposure to market leaders. But on the flip side, it concentrates risk in a few large-cap stocks.

Generally speaking. as an investor in a Nifty 50 ETF, we automatically benefit from these giants’ growth while also diversifying across other component companies (nifty 50 has 50 component companies).

[Note: For comparison sake, like we value Nifty 50 index in India, in the US, S&P 500 index is as valuable. Imagine, the kind of diversification an index (ETF) investor is getting in the US (spreading money across 500 top stocks. I wanted to tell you this just for your perception about the site of the US’s stock market.]

Q7: How do I buy a Nifty 50 ETF?

Here is a list of top Nifty 50 Exchange Traded Funds currently trading on the NSE and BSE.

| Name of ETF | Type | Expense Ratio (%) |

|---|---|---|

| ABSL Nifty 50 ETF | Nifty 50 ETF | 0.06 |

| Axis Nifty 50 ETF | Nifty 50 ETF | 0.07 |

| Bajaj Finserv Nifty 50 ETF | Nifty 50 ETF | 0.07 |

| Bandhan Nifty 50 ETF | Nifty 50 ETF | 0.09 |

| DSP Nifty 50 ETF | Nifty 50 ETF | 0.07 |

| HDFC Nifty 50 ETF | Nifty 50 ETF | 0.05 |

| ICICI Pru Nifty 50 ETF | Nifty 50 ETF | 0.03 |

| Invesco Nifty 50 ETF | Nifty 50 ETF | 0.10 |

| Kotak Nifty 50 ETF | Nifty 50 ETF | 0.04 |

| LIC MF Nifty 50 ETF | Nifty 50 ETF | 0.06 |

| Mirae Nifty 50 ETF | Nifty 50 ETF | 0.04 |

| Motilal Oswal Nifty 50 ETF | Nifty 50 ETF | 0.06 |

| Quantum Nifty 50 ETF | Nifty 50 ETF | 0.09 |

| SBI Nifty 50 ETF | Nifty 50 ETF | 0.04 |

| UTI Nifty 50 ETF | Nifty 50 ETF | 0.05 |

Buying a Nifty 50 ETF is straightforward and similar to purchasing stocks.

- First, you need a demat account and a trading account with a broker.

- Log in to your trading platform.

- Search for the Nifty 50 ETF of your choice (for example, SBI ETF Nifty 50).

- Place a buy order during market hours.

Unlike mutual funds, ETFs are traded on the stock exchange. Hence, the price of ETF, like stocks, fluctuates throughout the day. So, if your buy price matches the current market price, the trade gets executed. A similar process is there for selling the holding ETF units. Learn more about Exchange Traded Funds (ETFs) here.

Q8: How do I know when it’s a good time to buy a Nifty 50 ETF?

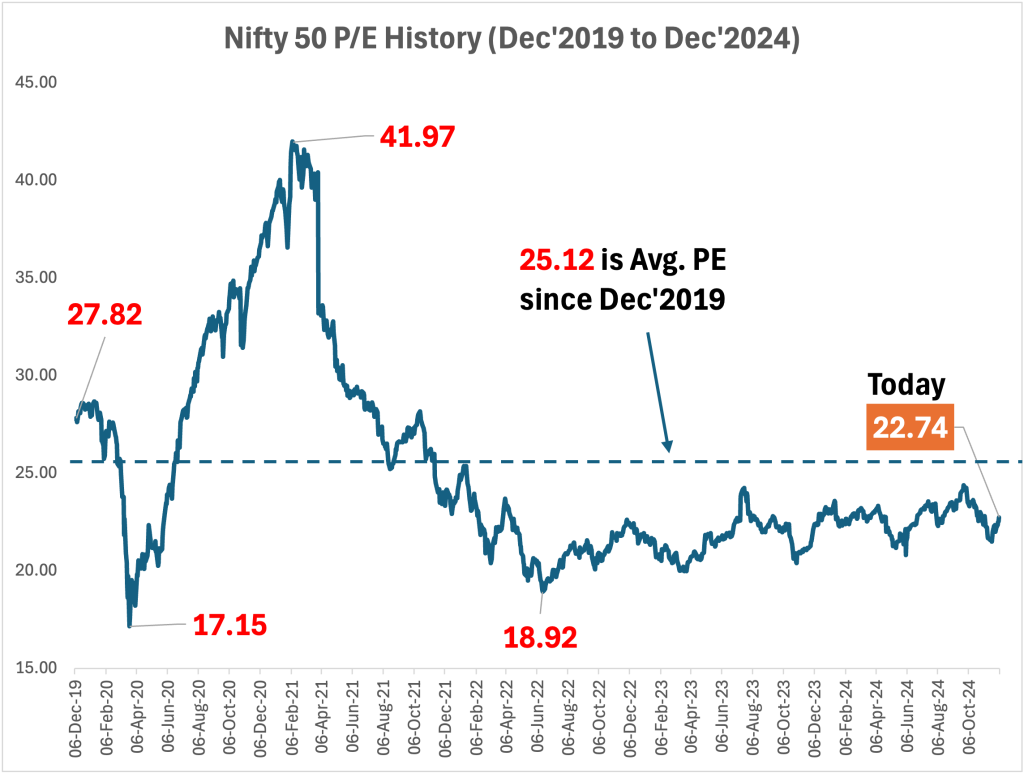

The best time to buy a Nifty 50 ETF is when markets are undervalued or during a correction.

Look at valuation metrics like the Nifty 50’s Price-to-Earnings (P/E) ratio or Price-to-Book (P/B) ratio.

Historically, lower ratios indicate better buying opportunities. Alternatively, we can also use Systematic Investment Plans (SIP). In SIPs we can choose to invest a fixed amount regularly, irrespective of market levels. T

his method minimizes the need to time the market and helps average out costs over time.

From my perspective, market timing is tricky and not always necessary for ETFs like Nifty 50, which aim for long-term growth.

If one unsure about valuations, start small and focus on the long-term trend rather than short-term fluctuations.