Do you want to start investing in equity mutual funds in India in 2025? Our market have been little shaky lately. Since September 2024, the Nifty 50 has dropped by about 14%. That’s a pretty significant correction, right? But here’s a more important point, there are whispers (and some solid signs) that we might be nearing the bottom. That’s music to the ears of pro long-term investors. So, let’s discuss why now might just be the perfect time to jump in, and which funds could be the best bets for long term holding.

See, I’m basically a direct stock investor, so this blog post is written with a perspective of a stock investor. The question is, at this time in the market, if a stock investor would explore a few mutual funds, where would this investor park it? I’ll personally invest the money in lump-sum (in bulk) in a quality scheme.

In this post, let’s discuss which schemes are best for bulk investing at this point in time.

But before that, let’s me share my view of the current market position and why it is like a golden opportunity for long term investors.

How Market’s Dip is A Golden Opportunity for Long-Term Investors?

A 14% Nifty 50 correction since September 2024 isn’t exactly a small blip, it has got people talking.

But here’s where it gets more interesting for long term investor, there are signs that the market might be close to finding its bottom.

- For one, the pace of the sell-off has slowed in early 2025. We’re seeing fewer panic-driven trades and more selective buying, which often signals that the big wave of fear is subsiding.

- Plus, valuations are starting to look more reasonable, P/E ratios for the Nifty 50 have come down from their lofty highs. In Sep’2024 it was at 24.4, now it has come down to 20 levels (-18% down). It is now hovering closer to historical averages.

- Add to that the RBI hinting at a potential rate cut later in 2025 to boost growth, and you’ve got a recipe for a recovery brewing.

Now, I’m not saying we’ve hit the exact bottom, nobody’s got a crystal ball for that. But for informed equity investors with a long-term perspective (think 10-15 years), this is the kind of moment that gets the adrenaline pumping.

When the market’s close to its low point, the smart move is to invest in bulk. Even if you don’t catch the perfect bottom, getting in within, say, a 20% range of it is still a fantastic deal. Historically, markets bounce back stronger after corrections like this.

India’s growth story, backed by infrastructure boom, digital revolution, and a young, ambitious workforce, makes it an ideal long term investing destination.

So, why equity mutual funds and not stock? They spread your risk across a bunch of stocks, and with a pros managing the show, you don’t have to lose sleep over picking individual winners. It is for such people who are comfortable with individual stock picking.

The Best Equity Mutual Funds to Invest in 2025: My Top Two Picks

Alright, let’s get to the good stuff—my deep-dive picks for the best equity mutual funds to invest in 2025. I’ve sifted through the options, looked at performance, consistency, and how they’re poised for the future, and landed on two that I think are absolute gems for long-term investors ready to go big with a 10-15-year horizon. Here they are:

1. Quant Small Cap Fund (High-Growth)

Let’s start with the Quant Small Cap Fund.

If you’re okay with a bit of a wild ride for the chance at some serious rewards, this scheme is for you.

Small-cap funds invest in smaller companies, imagine startups or lesser-known firms with big potential. This fund has been knocking it out of the park by accumulating such companies in its portfolio.

In the last 5 Years, it has given a CAGR (annualized growth) of 52.3%. And note, since September 2024, this mutual fund scheme has corrected by -22%. So, this phenomenal return (52.3% per annum) is after the -22% blip.

But I’ll not make you too optimistic. Possible the 50% CAGR that the fund has reported in the last 5 years, may not be possible in times to come. But even a 25-30% growth rate can be a fantastic wealth builder. A sum of Rs.5 Lakhs, at this rate of growth (25% p.a.) will become Rs.4.5 Crore in 10 years.

Why It’s One of the Best Equity Mutual Funds to Invest in 2025?

The strategy of this scheme is like a dynamite.

The team at Quant uses a mix of quantitative analysis and quick decision-making to jump on opportunities others might miss.

They seems to have a knack for spotting small companies that are about to take off. Take for example firms in sectors like green energy or niche manufacturing that are riding India’s growth wave.

After the 14% Nifty correction, small-cap valuations have come down from their 2024 peaks. The Nifty small cap 100 index have corrected by more than 20% in since December 2024 peak. What does it tell us? It can be a sweet entry point for us, right?

Sure, small caps can be volatile (expect some major bumps,), but over 10-15 years, those ups and downs smooth out, and the growth potential is massive.

The Long-Term Angle

For a bulk investment now, I think, this fund’s perfect because small caps tend to outperform in a recovering market. Moreover, India’s economy is primed for that. But we must keep this in mind, when a market recovers from such a slump majority money will first go into large caps. Slowly, as the market gains momentum and confidence, small cap will also start receiving investments. So, in the initial days of recovery, the small cap index might not see the expected bump-up, for in a long-run, from this point forward, they will be winners.

The key points why I like this fund are two: (1) First like it because its fund managers are dynamic and they are ready to adapt to the changing scenarios. (2) Second, the kind of stocks that’s there in their portfolio also looks good. I’ve checked some of them in my Stock Engine app, and their Overall Scores were reasonably good (seeing from a very long term perspective).

Why long term perspective is essential? With a horizon of 10-15 years, you’re giving these companies time to grow into mid- or even large-cap giants.

Another good point about this fund is their expense ratio is reasonable (around 0.7% for the direct plan). As I’ve said, their manager’s track record is stellar, they’ve consistently beaten the benchmark (Nifty Smallcap 250) by a wide margin.

If you’re dreaming of a hefty corpus down the line, this is a fund that could turn a big investment today into something truly life-changing.

2. Parag Parikh Flexi Cap Fund (Steady Compounder)

Next up, the Parag Parikh Flexi Cap Fund. This one’s like the reliable friend, steady, smart, and ready for anything.

Unlike small-cap funds, this one’s a flexi-cap, meaning it can invest across large, mid, and small caps, plus a little sprinkle of international stocks (think Alphabet and Microsoft).

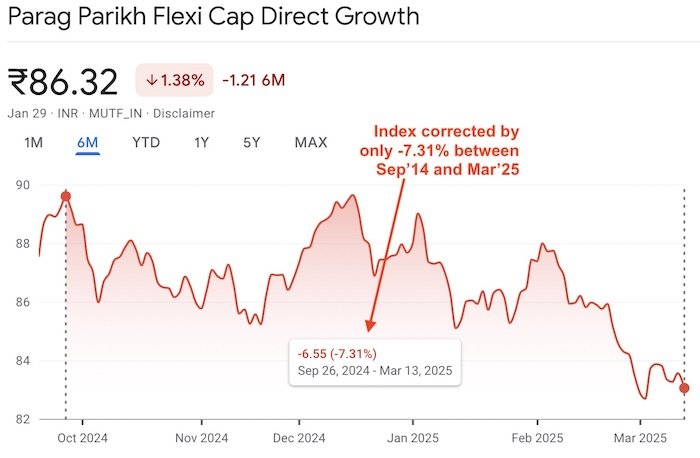

This factor of steady compounding can be seen in their performance as well. Since Sep’2024, the Nifty50 index itself has corrected by about -14%. The Nifty Mid-Cap 50 index too has corrected by about -20%. We’ve already discussed that the small cap-index too has corrected by -22%. But, in this same period, this Flexi Cap Fund has corrected by only -7.31%.

There’s another evidence of its consistent performance. It has generated an averaging return of about 30% over the past 5 years. With way less volatility than pure small-cap funds, a 30% CAGR growth is worth noting.

Why It’s One of the Best Equity Mutual Funds to Invest in 2025:

After the market correction, this fund’s flexibility is a superpower.

- The manager can shift gears, loading up on undervalued large caps for stability or snapping up mid- and small-cap bargains as the recovery kicks in.

- That global exposure (about 30% of the portfolio) is a bonus. It cushions you if India’s market takes a breather, while still letting you ride the domestic growth train.

- The fund has taken a bit of a hit (-7%) in the recent dip (6 months), but that just means we are able to buy the at an even discounted price. For me, its a perfect bulk investment vehicle (for this moment in time).

The Long-Term Angle

For a 10-15-year horizon, this fund’s is a dream. I’m saying this with my experience of managing my personal stock portfolio since 2008. In its lifetime (about 12 years), this fund has given a return of about 19.7% per annum. For dynamic fund of this size, yielding this much long-term return is phenomenal.

I like this fund also for its portfolio diversification and its ability to adapt to situation. Its diversification across market caps and geographies means it’s built to weather storms and capitalize on booms.

The expense ratio’s low (around 0.63% for the direct plan), and the fund manager’s philosophy, buying quality businesses at fair prices, screams long-term wealth creation.

If you’re ready to invest a big sum now, you’re setting yourself up for steady compounding that could grow into a mountain of wealth in years to come (say 10-15 years). It’s less heart-pounding than small caps, but the peace of mind? Priceless.

How to Make the Most of These Picks

So, how do you jump in? If you’re sold on these as the best equity mutual funds to invest in 2025, here area a few more quick tips:

- Go Big with a Lump Sum: Since we’re near a market bottom (or close enough), a bulk investment now could lock in lower prices. Do not use any stock trading platforms to buy the units. Why? Because not every app offers direct plans of mutual funds. To keep the fees low (expense ratio), you have to buy only direct plans. In a 10-15 years time horizon, this small expense savings will create a big difference. How to buy direct plans? Go go the portals of these Fund houses and buy from there (check the above links).

- Set It and Forget It: With a 10-15-year horizon, don’t sweat the short-term dips. These funds are built for the long game.

- Keep Some Cash Handy: If the market dips another 5-10%, you can add more. Flexibility’s your friend.

Conclusion

So, there you go, 2025 could be your year to shine as an equity investor.

With the Nifty down 14% since September 2024 and signs of a bottom forming, now’s the time for long-term players to make a move.

The Quant Small Cap Fund and Parag Parikh Flexi Cap Fund stand out as the best equity mutual funds to invest in 2025. One scheme is for high-growth thrills, the other for steady, diversified gains.

Both are tailor-made for a bulk investment with a 10-15-year view, tapping into India’s unstoppable rise.

What do you think, ready to take the leap? Let me know in the comments.

Disclaimer: I’m not a financial advisor, just sharing my thoughts! Consult a pro before investing.