Let’s talk about the S&P 500 and find a few top stocks that are absolutely killing it in 2025. If you’re someone who’s been keeping an eye on the market or just looking to get a sense of where things are heading, you’re in the right place. I’ve got a list of five top-performing stocks in the S&P 500 for this year so far. I’m going to break it all down for you, why they’re doing so well, what’s driving their growth, and whether they might be worth considering for your portfolio.

So, grab a coffee, and let’s chat about these market movers as of March 2025!

A Quick Look at the S&P 500 in 2025

Before we jump into the specifics, let’s set the stage. The S&P 500 is basically the gold standard for tracking the performance of the biggest and most stable publicly traded companies in the U.S.

It’s a market-cap-weighted index, which means the larger the company, the more it influences the index’s overall performance. In 2025, the S&P 500 has been on a tear, continuing its upward trend from previous years.

Some reports I’ve come across suggest the index has surged about 70% since its low in Oct-2022. While there are always risks, like potential tariffs or economic shifts, the market has been buoyed by strong earnings and forward guidance from many companies.

Now, let’s get to the stars of the show, the top five best-performing S&P 500 stocks year-to-date (YTD) as of early March 2025.

These are the ones that have caught my eye, and I think they’ll catch yours too.

The Top 5 Best-Performing S&P 500 Stocks in 2025

[Updated: 05-March-2025]

| SL | Name | TICKER | Price (USD) | YTD % | Market Cap (USD) | P/E | EPSG (TTM) | Sector |

|---|---|---|---|---|---|---|---|---|

| 1 | Super Micro Computer, Inc. | SMCI | 38.9 | 25.61% | 23.09 B | 16.97 | 79.15% | Electronic technology |

| 2 | Welltower Inc. | WELL | 154.85 | 23.25% | 98.7 B | 188.34 | 57.54% | Finance |

| 3 | Uber Technologies, Inc. | UBER | 76.48 | 22.98% | 159.77 B | 16.69 | 422.53% | Transportation |

| 4 | Texas Pacific Land Corporation | TPL | 1,369.13 | 22.18% | 31.47 B | 69.42 | 12.12% | Miscellaneous |

| 5 | Abbott Laboratories | ABT | 137.71 | 21.13% | 238.83 B | 17.97 | 134.63% | Health technology |

The top performers based on their YTD returns as of early March 2025 is tabulated above. I’ll also walk you through each one, share some insights on why they’re soaring, and give you a sense of what might be next for them.

1. Super Micro Computer, Inc. (SMCI) – 25.61% YTD

First up, we’ve got Super Micro Computer, or SMCI, leading the pack with a 25.61% YTD return.

At $38.90 per share, this company has a market cap of $23.09 billion. If you’re not familiar with SMCI, they’re a big player in the electronic technology sector, specializing in high-performance server and storage solutions.

Think of them as the folks providing the tech backbone for things like AI, cloud computing, and data centers, stuff that’s in crazy high demand right now.

Why the price is Surging? SMCI has been riding the AI wave hard. The explosion of AI applications means companies need powerful servers, and SMCI is right there to deliver. However, it hasn’t been all smooth sailing. Last year, SMCI had a wild ride, starting 2024 with a massive rally but then hitting regulatory speed bumps that had folks speculating they might get delisted from the S&P 500. Clearly, they’ve bounced back in a big way in 2025, and their P/E ratio of 16.37 suggests they might still be undervalued compared to some other tech names.

Plus, their EPS growth of 79.15% TTM (trailing twelve months) shows they’re growing earnings like nobody’s business.

Should You Jump In and but it? SMCI’s volatility makes it a bit of a rollercoaster, but if you’re bullish on AI and data center growth, this could be a stock to watch. Just keep an eye on those regulatory risks, they’ve been a thorn in their side before.

2. Welltower Inc. (WELL) – 23.25% YTD

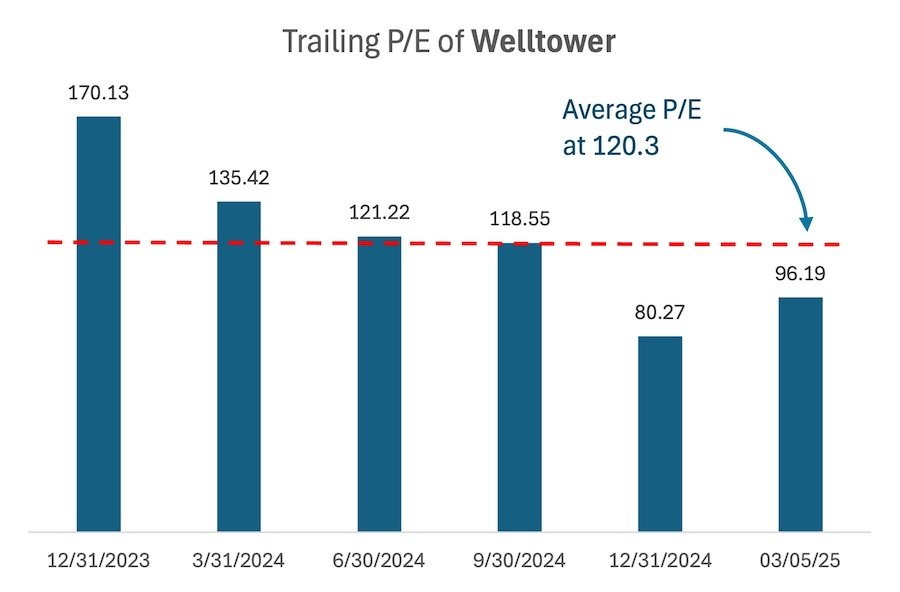

Next on the list is Welltower Inc., ticker WELL, with a solid 23.25% YTD return.

Priced at $154.85 per share, Welltower has a market cap of $38.78 billion and operates in the finance sector, specifically in real estate investment trusts (REITs) focused on healthcare properties like senior living facilities and medical offices.

What’s Driving the Growth of WELL? Welltower is cashing in on some big demographic trends. The aging population in the U.S. means more demand for senior housing and healthcare facilities. Welltower is perfectly positioned to meet that need. Their portfolio includes properties across the U.S., Canada, and the U.K., giving them a nice geographic spread.

With a P/E ratio of 188.34, they’re not cheap, but this stock has historically been trading at a higher P/E since last 5 years.

But their EPS growth rate is worth appreciating. Their EPS growth of 57.54% TTM shows they’re delivering on the earnings front. The healthcare REIT sector has been a safe haven for investors looking for stability amid economic uncertainty, and Welltower’s performance reflects that.

Is It a Good Fit for investors like me and you? If you’re looking for a stock that offers both growth and a bit of defensive stability, Welltower might be your cup of tea. Plus, as a REIT, they’re required to pay out a hefty dividend—something to consider if you’re after income as well as growth. At present, the stock is yielding a dividend of 1.76%.

3. Uber Technologies, Inc. (UBER) – 22.98% YTD

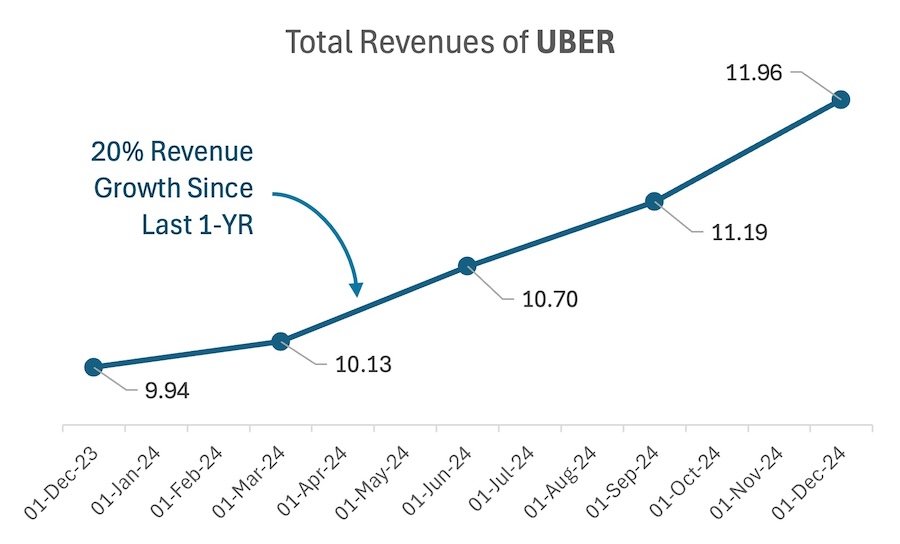

Uber Technologies comes in at number three with a 22.98% YTD return.

At $76.48 per share, Uber boasts a market cap of $159.77 billion, making it one of the bigger names on this list.

Uber, of course, is the ride-hailing giant that’s also expanded into food delivery with Uber Eats and even freight logistics.

What’s Fueling Uber’s price rise in 2025? Uber has been on a tear this year, with some reports noting a 35% jump at one point, though it’s settled at 22.98% YTD as of now. Big-name investors like Bill Ackman have jumped on board, citing Uber’s strong fundamentals and global market share.

The company reported a revenue increase from $9.94 billion to $11.96 billion in their latest quarterly results, and they’re pushing hard to become a “super app” by adding more services to their platform.

The transportation sector, where Uber sits, has been benefiting from increased mobility as the world continues to recover from pandemic-era restrictions, and Uber’s innovation in things like autonomous driving tech keeps them ahead of the curve. Their EPS growth of 422.53% TTM is jaw-dropping, even if their P/E ratio of 16.69 suggests they’re still reasonably priced.

Do I treat UBER as worth Considering? Uber’s growth story is compelling, especially if you believe in the long-term shift toward app-based transportation and delivery services. But keep in mind that they operate in a competitive space, and regulatory challenges, like labor laws around gig workers, could pose risks. But for me personally, UBER is where my attention is.

4. Texas Pacific Land Corporation (TPL) – 21.18% YTD

At number four, we have Texas Pacific Land Corporation with a 21.18% YTD return.

Priced at $1,369.13 per share, TPL has a market cap of $31.47 billion. They’re classified under the miscellaneous sector, but their core business is tied to owning and managing land in Texas, about 900,000 acres of it, to be exact.

They make money through oil and gas royalties, water services, and land leasing.

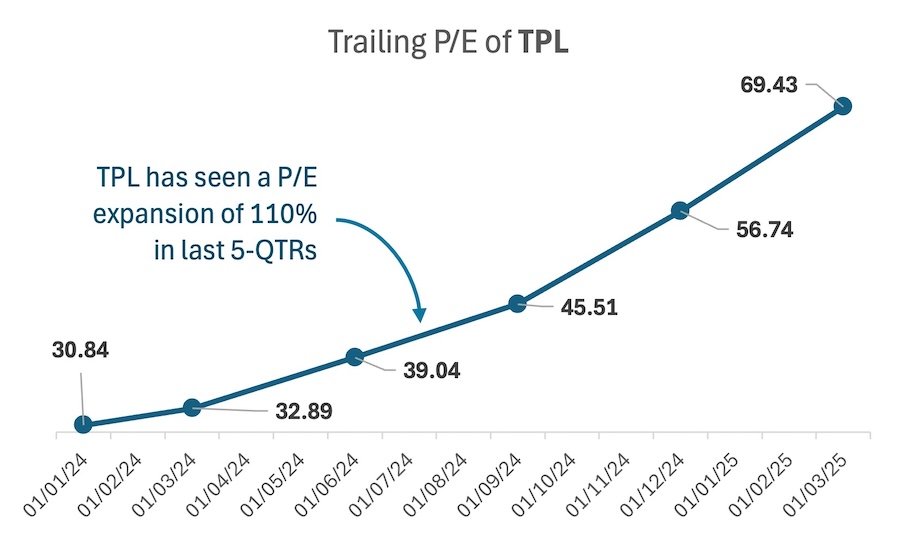

Why Are They Doing So Well? TPL is one of those companies that benefits from being in the right place at the right time. With oil and gas production still a big deal in Texas, TPL’s royalty income has been a goldmine. They’ve also been smart about diversifying into water services, which is a growing need in the arid Southwest. Their P/E ratio of 69.42 is on the higher side, but their EPS growth of 122.12% TTM shows they’re making serious money.

TPL recently joined the S&P 500, which has likely boosted their visibility and investor interest.

What should you do with TPL? TPL is a unique play, part energy, part real estate. If you’re optimistic about the energy sector and the long-term value of land in Texas, TPL could be a great addition to your watchlist. Their high valuation means you’ll want to watch for any pullbacks before jumping in.

5. Abbott Laboratories (ABT) – 21.19% YTD

Rounding out the list is Abbott Laboratories with a 21.19% YTD return.

At $137.71 per share, Abbott has a market cap of $238.83 billion, making it the largest company on this list by market cap. They’re a healthcare technology company known for medical devices, diagnostics, and nutrition products.

What’s Behind Their Stock Price Surge in 2025? Abbott has been a steady performer, and their 21.19% YTD gain reflects their ability to deliver consistent growth. They’re a leader in areas like diabetes care (think FreeStyle Libre glucose monitors) and cardiovascular devices, both of which are seeing strong demand. The healthcare sector has been a bright spot in the S&P 500, especially as investors look for defensive stocks amid economic uncertainty. Abbott’s P/E ratio of 17.87 is reasonable, and their EPS growth of 134.63% TTM is impressive for a company of their size.

Is Abbott Right for small investors like me and you? Abbott is the kind of stock that can give you peace of mind. It’s not as flashy as SMCI or Uber, but it’s a reliable, blue-chip name with a strong track record. If you’re looking for growth with less volatility, Abbott might be a great pick.

What’s Driving These Trends in 2025?

So, what’s the bigger picture here? Why are these stocks leading the pack? Let’s break it down by sector and trend:

- Tech and AI Are Still King: SMCI and Uber are both benefiting from the ongoing tech boom, especially around AI and digital transformation. The demand for AI infrastructure (like SMCI’s servers) and app-based services (like Uber’s platform) isn’t slowing down anytime soon.

- Healthcare Is a Safe Bet: Welltower and Abbott highlight the strength of the healthcare sector. An aging population and advancements in medical tech are driving growth here, and these companies are well-positioned to keep benefiting.

- Energy and Land Remain Relevant: TPL’s performance shows that traditional sectors like energy still have a place in a tech-driven market. With oil and gas production steady and new revenue streams like water services, TPL is a reminder that diversification matters.

Should You Invest in These Stocks?

Now, the million-dollar question, should you add these stocks to your portfolio? Here’s my take:

- If you’re a growth investor who’s okay with some risk, SMCI and Uber could be exciting opportunities. Their explosive EPS growth and ties to hot sectors like AI and transportation make them compelling, but they come with volatility.

- If you prefer stability, Welltower and Abbott might be more your speed. They’re in defensive sectors (healthcare and healthcare REITs) and offer steady growth with less drama.

- TPL is a bit of a wildcard, it’s a unique play on energy and land, but its high P/E ratio means you’ll want to be cautious about entry points.

As always, do your own research and consider your risk tolerance. Things can change quickly, especially with potential headwinds like tariffs or economic shifts on the horizon.

Conclusion

There you have it, the top five best-performing S&P 500 stocks of 2025 so far.

From SMCI’s AI-driven surge to Abbott’s steady healthcare growth, these companies are showing us where the market’s headed this year.

Whether you’re a seasoned investor or just dipping your toes in, keeping an eye on these names can give you a sense of the trends shaping the S&P 500 and the broader economy.

What do you think? Are you eyeing any of these stocks for your portfolio, or do you have other favorites in the S&P 500?

Drop a comment below, I’d love to hear your thoughts. And if you found this post helpful, be sure to share it with your fellow investing buddies.

Until next time, have a happy investing.