What are the biggest problems in investing money that people face in real life?

We give a lot of attention to what we must do as a good investment practice.

But it is also advisable to look into the Don’ts of investing money.

If we only know the Don’ts, we stand a great chance of avoiding major investment losses.

So what are the biggest problems in investing money?

In this blog post we will see the top 6 problems that common people face in investing money.

If if we look deep into all these 6 problems, one thing will be clear, they all have roots in the investors emotions.

A person who is able to control his emotions while investing, is already half successful.

Balance success can be achieved by practicing wise investments.

Wise investments is a byproduct of knowledge.

The more a persons learn about investing, wiser will be his/her investment decisions.

Obtaining knowledge is within our control. We can read books, take mentoring of expert and gradually learn wise investing.

But controlling emotions is more difficult.

Generally people practice investment in accordance with ones psychological maturity.

More mature people have been found to be more successful in investing money.

But does it mean that one has to change self to become successful in investments world? The answer is Yes and No.

Yes because, one must practice investment with maturity otherwise losses are only around the corner.

No because, one is asked to modify only specific understandings to become a successful investor.

Lets see what investment traits must be built-in ones psychology to overcome the biggest problems in investing money, and gain success.

#Problem one – Investing money in things one doesn’t know

How many times we buy stocks of companies about which we only know the name?

Which are its product? Who is the CEO? How profitable is the company?

Is the company financially healthy? These are few questions that one must know before buying stocks.

But do we do it?

Investors like Warren Buffett reads last 10 years annual reports of companies before buying its stocks.

It will not take less than 5-6 days to read last 10 years annual reports of companies.

Add another 2-3 days to comprehend and draw conclusions about the company.

It may happen that after all this study and hard work that the company is not good for investing.

So all the effort of reading goes in vain and one will have to start all over again.

This is the way champion investors work. They are not compulsive investors. They try to invest only when they know majority things about the company.

But not everyone has time and interest to research stocks like this.

Does it mean that they should not invest in equity? No, even such people can invest in equity.

They can invest in equity indirectly. They can buy ETF’s, index funds or other equity linked mutual funds.

But if one wants to buy direct stocks, knowing business and doing its stock analysis is a must.

#Problem Two – Investing by seeing only the brand name

This is one step better than problem one. Here the person at least know something about the company.

But knowing something is not enough. As William Shakespeare said, “Whats in a name”.

We often get too carried away with the preconceived image that has been build in our mind about a brand.

We all knew that Premier and Hindustan Motors was a big brand once in India.

But today, you will buy its stocks if available? No. And what is the reason?

Because you know that their cars are not selling well in India now.

Its good that people have updated information about these two companies.

But what happens if you did not knew this updated and bought their stocks?

There are cent percent chances that you will make only losses out of these stocks.

In a similar way, a lot of people buy stocks just because their names are familiar or they know the names of their high flier CEO’s.

Example: Would you not have bought stocks of Kingfisher Airlines had you not known the fate of Vijay Mallya?

There are high chances that people buy stocks of companies just because that, they are charmed by the enigmatic personality of its CEO.

But is this the right way of investing in stocks? Following a successful personality is good, but when it comes to your hard earned money, believe no one.

Use your own analysis and then put your money in any investment vehicle.

Read: How to know if a stock is worth buying.

#Problem Three – Expecting too much, too soon

Suppose you want to have a baby, can you and your spouse deliver a baby in one day.

No, its not possible. Nature takes its own time to get things done.

Another example, suppose you start a business and your partners/investors want to see turnover in hundreds of crore within a week.

Can you do it?

No, this is also not possible. Like nature, business also takes time to churn money and deliver profits.

To be successful in investment world, it is essential to have realistic expectations.

One cannot deliver a baby in one day. Similarly, one cannot double money in few days in stock investing.

Stock can grow only as fast as their underlying business in long term.

In investment, a consistent growth should be ones number one priority.

When we invest in debt linked investments, growth will be consistent but small.

If you can little bit compromise on consistency, bigger returns are possible.

But again, expecting too much, too soon shall be avoided.

If a common man can earn 12% to 16% in India in long term, he must be very satisfied.

[Just for clarification, even if one earns a returns as high as 16% per annum, the money doubles only every 4.5 years]

Keep a check on expectations and let your knowledge do the talking, not your emotions.

#Problem Four – Not holding long enough

If someone will ask me one strategy that a common man must follow to earn positive returns in stocks, I will say, follow long term holding strategy,

Yes, buying good stocks and doing nothing for next 5 years is the best strategy for a common man.

The way stock prices move in short term, even Warren Buffett cannot do much about it.

So it will be needless for we common people to try and control it.

Stock prices are like waves on the surface of the sea. As we see only the waves, we get awed and effected by its strength.

But these waves are only the surface phenomenon.

Sea is not only what we can see on its surface.

Actually the deepest portion of sea is approximately 10 kilometres below its surface.

So next time when you see the waves, do not get afraid, try to play with it.

Similarly, in short term, stock prices are like waves.

Below these rippling prices are huge business fundamentals of good companies.

One must not take buy and sell decisions just by seeing the prices.

What is more important is the business fundamentals which lies buried inside companies financial reports.

Buy good stock and hold it for long term. Let the business fundamentals do the balance work for you.

#Problem Five – Trying to predict Mr. Market’s movements

Benjamin Graham, the Guru of Warren Buffett didn’t address stock market as Mr. Market as a joke.

He knew very early that Mr. Market is the Boss. No one can control it.

Whenever people have tried to outsmart Mr. Market, they have only faced defeat.

The best strategy for common man is to focus on stock analysis and not on market analysis.

I do my own stock research and keep building my own list of good stocks.

I then wait for Mr. Market to give me buying and selling opportunities.

I prefer to await instead of trying to predict market movements.

I have my list of good stocks, which I track on daily basis.

Stock prices are always volatile.

When market price of my holding stocks goes too up, I sell it and book profits.

When market price of my list of stocks goes too low, I buy them.

It has been observed that Mr. Market always gives buy and sell opportunity to everyone.

We have to just build our list of good stocks and wait for Mr. Markets moves (no predictions).

In rare times, Mr. Market become too moody. It lets stock market to crash.

This is the moment of huge buying opportunity.

Sometimes (like these days, Sensex 30,000 levels), Mr. Market lets stock market to peak. This is the moment of huge selling opportunity.

If people can only prepare their own list of good stocks, making money in stock market will not be so tough.

#Problem Six – Not building a diversified portfolio

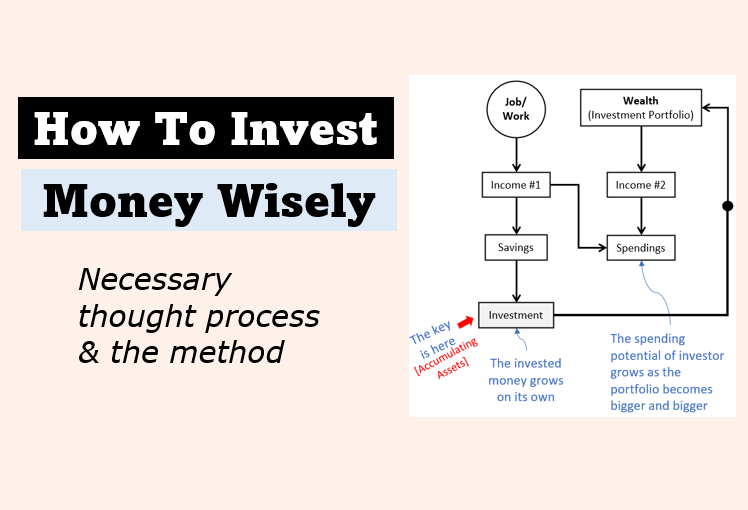

It is essential to visualise ones investment as individual legs to a big dinning table.

The dinning table will be able to serve you food only till it is standing on its legs.

The stronger are the legs more stable will be the table.

Generally we have four legs to a table. If we try to balance the table on only one leg, it will fall.

Similarly, we shall not try to balance our investment portfolio only on one set of investment vehicles.

Balancing ones table (investment portfolio) on multiple legs is advisable.

Let your portfolio consists of stocks, funds, gold, real estate, ETF, cash etc.

This form of portfolio diversification gives maximum safety to your invested money.

Never rely on only one investment vehicle.

I have created a rule for myself that I will not invest more than 30% in any one investment option.

Once I reach this limit, I start diverting funds to other options.

Build your own rule and start investing.

Final Words…

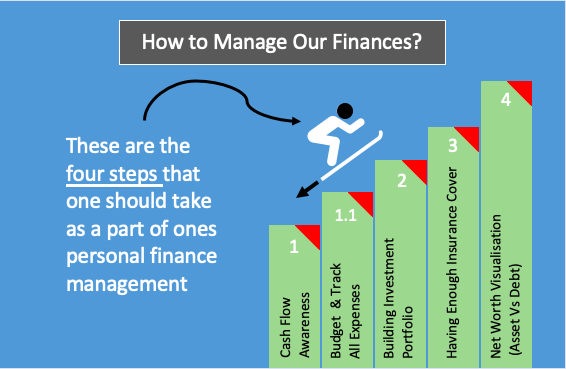

To understand how much you must allocate to which investment vehicle, one must learn how to build an ideal investment portfolio.

Target should be to build a portfolio which not only remains safe but must also give enough returns when time comes.

To do this, it is essential to practice goal based investing.

What we have discussed in this blog post are some of the biggest problems in investing money that common men face.

But this does not mean that if we follow these 6 rules, there will be no mistake.

Investing is a lesson which people learn with practice, and when we practice, we make mistakes.

Do not get disturbed by mistakes.

Mistakes will happen, but important is to keep learning from mistakes and do not repeat it again.

The six problems that we have discussed here are the most frequently encountered mistakes in the world of investments.

If we can learn to overcome these so called “biggest problems in investing” money, we can easily conclude that we have mastered at least 80% of all investing errors.

Let the message spread.

Have a happy investing.