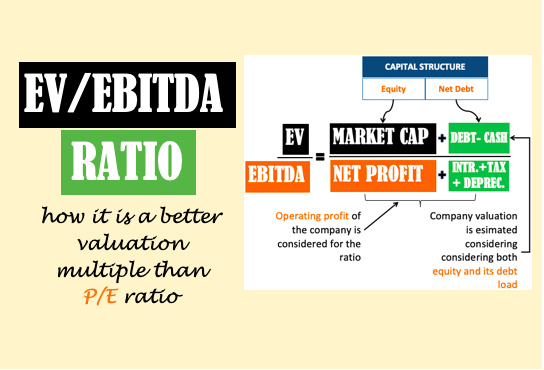

The Power of EV/EBITDA Ratio: A Guide to Understanding and Using this Valuation Ratio

The EV/EBITDA ratio is a financial metric that is commonly used to judge the valuation of a company. It is often used as an alternative to the (P/E) ratio. The EV/EBITDA ratio is considered to be a more comprehensive valuation metric. In this article, we’ll learn more about this ratio. EV/EBITDA Calculator Use this calculator…