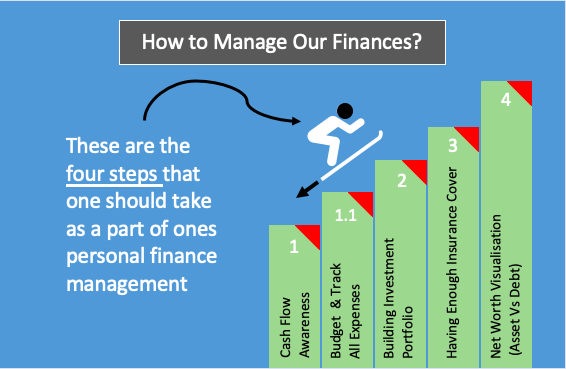

How To Manage Our Finances: How to do it in a systematic way?

If idea is to manage our finances seriously, we’ll resort to experts to handle it for us. But is it correct to be dependent on the external agency for this activity? It is not wrong, but it has its own limitations. The success is dependent on the skill of the allocated personal finance manager. More…

![Wealth Building: How To Build Wealth in 30s [Wealth Formula]](https://ourwealthinsights.com/wp-content/uploads/2010/07/Wealth-Building-Image.png)