[Check here for a list of blue chip stocks]. Investing in Blue Chip Companies is like having superheroes in your portfolio. Their stability, reliability, and financial strength make them your financial allies. Consider them for the long haul, and they could be your ticket to long-term financial growth. But remember, even superheroes have their weak moments, so diversify wisely. [For a broader perspective, check out our guide on Top Stocks to Buy in India.]

Investing in the stock market can be a fascinating yet puzzling adventure, especially when you’re just starting out. You might have heard about “blue chip companies in India” and wondered what they are and why they matter. Well, you’re in the right place, because in this article, we’re going to unlock the secrets of these fascinating companies and show you how to spot them in the bustling Indian stock market.

Imagine a game of cricket where you have players who are known for their incredible skills and consistency. They’re like the superstars of the game, right? In the world of stocks, these superstars are the blue chip companies. They are the crème de la crème, the giants, and the big shots. But what makes them so special, and why should you care?

Blue chip companies in India are the backbone of the stock market. They are the companies that have stood the test of time and are known for their stability, reliability, and strong financial health. When you invest in these companies, you’re essentially putting your money into businesses that are like the Sachin Tendulkar or Virat Kohli of the stock market.

In this article, we’re going to explore what blue chip companies are and why they are significant in the Indian stock market. We’ll break down their qualities, and we’ll even give you a list of some of the top blue chip companies in India. You’ll also discover how to identify them, making your first steps into the world of stock investing a lot less intimidating.

So, if you’re a beginner who is just starting the journey in stock investing, keep reading. By the end of this article, you’ll have a reasonable understanding of what blue chip companies are. Remember, for stock investors they are their like best friends.

Topics:

List of Best Blue Chip Companies in India

(Updated: January 03, 2025) Check The Stock Engine

| SL | Name | Industry | Revenue (Cr) | High MCap (Cr.) | Rev Growth (5Y) % | EPS Growth (5Y) % | D/E | ICR | GMR Score |

|---|---|---|---|---|---|---|---|---|---|

| 1 | INFY:[500209] | Software & Services – Diversified | 1,58,381.00 | 8,03,531.40 | 18.21 | 15.27 | 0.00 | 82.79 | 37.17 |

| 2 | ANANDRATHI:[543415] | Wealth Management | 751.97 | 16,438.09 | 84.68 | 79.30 | 0.01 | 46.86 | 37.12 |

| 3 | SHAKTIPUMP:[531431] | Pumps & Compressors | 1,303.23 | 14,726.87 | 53.25 | 139.82 | 0.12 | 14.47 | 36.08 |

| 4 | OLECTRA:[532439] | Commercial Vehicles | 1,126.19 | 12,188.99 | 60.95 | 113.99 | 0.06 | 3.92 | 34.16 |

| 5 | SAFARI:[523025] | Baggage and Luggage | 1,565.11 | 13,022.74 | 49.40 | 133.40 | 0.03 | 23.85 | 34.14 |

Point 1: Understanding Blue Chip Companies

Okay, let’s dive right in and unravel the intriguing world of blue chip companies in India. But first things first, what exactly is a blue chip company?

A blue chip company is like that superhero in your favorite comic book – strong, reliable, and legendary. These are the companies that have been around for a long time, and they’re a big deal in the stock market. In simple terms, they’re the superheroes of the stock market!

But why are they so special? Well, here’s the deal: Blue chip companies have a superpower – they’re incredibly stable and reliable. Imagine having a friend who never lets you down, who’s always there when you need them – that’s what blue chips are to investors. These companies have a history of making money year after year, which is like winning gold medals at every Olympic Games!

Historical Significance of Blue Chip Companies

Blue chip companies didn’t become superheroes overnight. They’ve been around for decades, sometimes even a century or more! Their track record is like a long, thrilling saga of success. Just like your grandparents might have told you stories about the good old days, these companies have stories of how they weathered economic storms and came out stronger.

Here’s why investors are so attracted to blue chip stocks: It’s because these stocks are a bit like real estate in the stock market. They’re like those prime properties in the city that everybody wants to own. People invest in blue chip companies because they believe they’re solid and dependable, just like a good friend.

When you buy shares of blue chip companies in India, you’re not just investing in a company; you’re investing in their stability, reliability, and reputation. These companies have a name that’s respected and admired. Think of it as being part of the fan club of your favorite superhero. When you own their shares, you’re joining the exclusive club of investors who trust in these superheroes of the stock market!

Point 2: Qualities of a Blue Chip Company

Now that we know blue chip companies in India are the superheroes of the stock market, let’s uncover what makes them so super!

- Market Leadership: Picture your favorite cricket team. The captain is usually the best player, right? Similarly, Blue Chip Companies are often the captains of their industries. They lead the way, set trends, and outshine their competitors. This leadership position isn’t just about being popular; it means they’re often the biggest, most influential, and well-respected companies in their field.

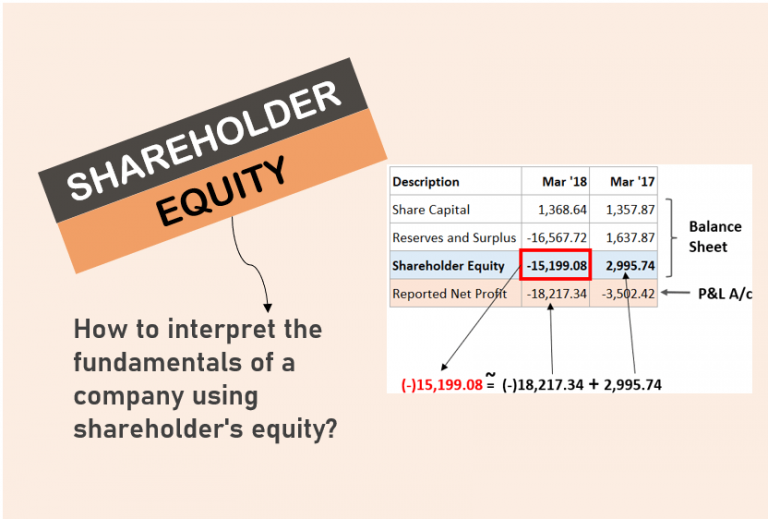

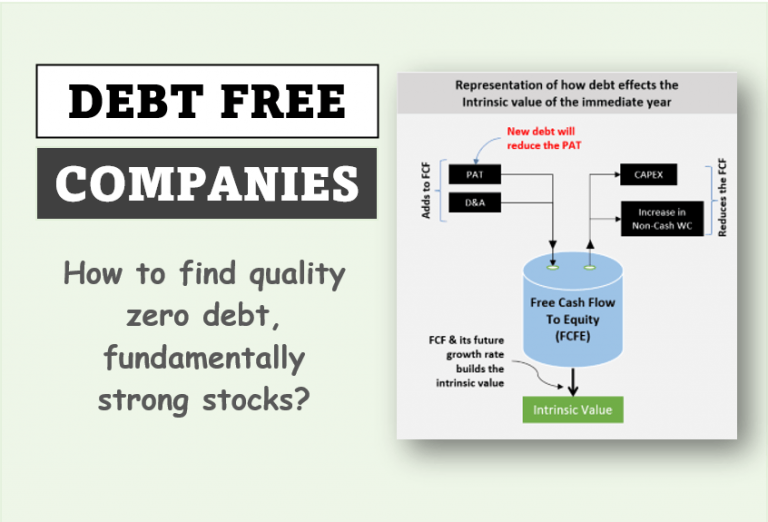

- Financial Stability: Just like superheroes need strong shields and armor, blue chip companies have rock-solid financial stability. They’ve got healthy bank accounts and low debt levels. This means they’re well-prepared to handle challenges, like a pro cricketer ready to take on any bowler. Their financial stability is a sign that they’re here to stay for the long run.

- Strong Balance Sheets: Think of a balance sheet as a superhero’s checklist. Blue chip companies have strong ones. Their assets (like cash, buildings, and investments) outweigh their liabilities (like debts and obligations). It’s like having more runs on the scoreboard than wickets lost in a cricket match. This financial strength is their secret weapon against market turbulence.

- Global Presence: Our superheroes don’t just protect their city; they watch over the world. Blue chip companies often have a global presence. They operate not only in India but also in other countries. This global reach makes them more resilient to economic changes. It gives them access to new opportunities.

- History of Consistent Growth: Just as superheroes keep getting stronger, blue chip companies have a history of consistent growth. They’re like those athletes who keep breaking records with every match. Over the years, they’ve shown that they can make money and make it grow. This consistency attracts investors who are looking for dependable returns.

These qualities are like the superpowers that make blue chip companies stand out in the stock market. When you invest in them, you’re banking on these typical abilities of the company.

Point 3: Identifying Indian Blue Chip Companies

Now that you know the superpowers of blue chip companies, you might be wondering, “How can I spot them in the stock market?” Well, it’s a bit like searching for treasure, but we’ve got a map for you!

- Market Capitalization: This is like the treasure chest’s size. Blue chip companies in India are often the biggest players. So, look for companies with a large market capitalization. It’s a bit like saying, “Show me the companies worth lots and lots of money!”

- Industry Leaders: Blue Chip Companies are called so because they are the leaders of their respective industries. For example, if you are looking for a blue-chip company in the software space, names like TCS, Infosys, etc will come up.

- Revenue Growth: Think of this as a superhero’s journey. Blue chips are known for their consistent growth. So, check if a company’s revenues have been growing steadily for the last few years. That’s like finding a superhero with a list of heroic deeds.

- Profitability: Superheroes aren’t broke, right? Blue chip companies should be profitable. Look for those that make money year after year. Profitability is like a company’s way of saying, “I can handle my own.”

- Dividends: Blue chip companies often pay dividends to their shareholders. These are like small gifts for investing in them. Look for companies with a history of regular dividend payments. It’s like being part of a club where you get cool goodies.

- Low D/E Ratio: Superheroes don’t like being weighed down. Blue chips keep their debts in check. So, look for companies with a low D/E ratio. This ratio tells you how much debt a company has compared to its own money. Lower is better.

Here’s the secret sauce: don’t rely on just one criterion. Blue chip status is like being a well-rounded superhero. Combine multiple criteria like market cap, revenue growth, profitability, and more to identify these stock market champions.

Remember, like a treasure hunt. Identifying blue chip companies may take a bit of effort.

Point 4: Investing in Blue Chip Companies

So, you’ve found a blue chip company in India, and you’re excited to invest. But how do you play the game with these stock market superheroes? Here’s the playbook:

1. Long-Term Holding: Think of investing in blue chip companies as a long-term partnership, like being friends forever. These companies are known for their stability, so hold onto their stocks for years, if not decades. It’s like planting a sturdy tree; it takes time to grow, but it provides shade for a long time.

2. Dividend Income: Blue chip companies often pay dividends, which are like pocket money for investors. You can reinvest those dividends to buy more shares. It’s like getting a bonus from your favorite superhero.

3. Risk Management: Even superheroes have their weak spots. Blue chip stocks can still face challenges, like economic downturns or industry changes. So, diversify your investments. Don’t put all your money into one blue chip basket. It’s like having multiple superheroes on your team.

4. Advantages: Investing in blue chip companies offers many perks. You’re more likely to get stable returns, less volatility, and lower risk compared to smaller, riskier stocks. It’s like playing a safe shot in cricket that gets you run without taking big risks.

5. Drawbacks: But here’s the catch: blue chip stocks might not give you those thrilling, fast returns you sometimes hear about with smaller stocks. They’re more like the dependable players in a cricket match, not the flashy ones who hit sixes. Read more about small-cap stocks.

Invest wisely, hold onto your blue chips, and let them be the steady backbone of your investment journey!

Point 5: Risks and Considerations

Alright, we’ve talked about how fantastic blue chip companies in India are, but it’s important to remember that even superheroes have their weaknesses. Here are some things to keep in mind:

1. Economic Downturns: Just like superheroes face tough challenges, blue chip companies can also feel the heat during economic downturns. Even they might see their stock prices drop when the overall market takes a hit. Read about stock market corrections.

2. Market Fluctuations: Blue chip stocks are strong, but they’re not invincible. Their prices can go up and down, just like a cricket match can swing in favor of one team and then the other. So, don’t be surprised if you see fluctuations in their stock prices.

3. Diversification: Think of diversification as having a team of superheroes, not just one. It’s important to spread your investments across different types of stocks, not just blue chips. This way, if one superhero has a tough day, others can still help you win the game. Diversification is like having a balanced cricket team where each player has a role to play.

Just as cricket teams have bowlers, batsmen, and fielders, a well-diversified portfolio has different stocks with different strengths. This way, you’re ready for whatever the market throws at you, whether it’s a googly or a yorker.

Conclusion

Well, we’ve covered quite a journey in our exploration of Blue Chip Companies in India, haven’t we? From understanding what they are to how to identify them and even how to invest in them – you’ve got the basics in your pocket!

In the world of stock investing, blue chip companies are like your trusty allies, there to support you in the long run. They’re like the strong pillars of a building, keeping everything steady. So, why should you care about these stock market superheroes?

Because they can make your financial dreams come true! Investing in Blue Chip Companies can be like planting a money tree in your backyard. Over time, it grows, providing you with the financial stability you’ve always wished for.

While it’s important to remember that even blue chips have their weak moments during market twists and turns, you can count on their strength and resilience.

But here’s the icing on the cake: by diversifying your investments and spreading your money across various types of stocks, you can build a formidable financial team, just like having different players in a cricket match.

Call to Action:

Ready to supercharge your stock investing journey? Subscribe to our Stock Engine, your ultimate fundamental analysis tool for researching stocks based on solid business fundamentals. Unlock a world of investment insights and make informed decisions. Don’t forget to explore our other articles for more financial wisdom. We love hearing from our readers, so share your thoughts, questions, or blue-chip investing experiences in the comments section below. Let’s grow together!

Frequently Asked Questions

Blue chips are like the all-stars of the stock market. They’re well-established, financially strong companies with a history of stable growth and reliable dividends. Think household names you trust, like big tech or consumer giants.

Blue chips rarely hit the bargain bin, but it can happen during market downturns or industry-specific issues. While the price dips, the company’s strong fundamentals often remain. This can be a buying opportunity for long-term investors seeking undervalued stability.

Look out for established companies with a long track record on financial websites. Look for a low P/E ratio compared to their industry average or historical P/E. This might indicate a potential value opportunity within a typically reliable company.

Have a Happy Investing

You should not do that. Use the tool as your first guide. Treat it as if you are using it to get a first impression about a stock.

The final call should be based on your self-research or upon advise of your investment advisor.

[P.Note: The stock engine gives no investment advice. Please check the disclaimer.]

Idea is to highlight those companies which have the capabilities to pay consistent-dividends. Hence, mostly blue chip, large companies are picked for evaluation. Only dividend yield may not be the right way to look as “dividend-paying stocks”.