Hi, I’m back with another dose of (hopefully) helpful insights. Today, I want to tackle a question that many of us wrestle with as investors: Is it better to buy high-quality stocks when the market crashes, or to focus on growth stocks? These growth stocks may not be fundamentally strong (currently), but are showing the promise of high growth? I think, most of us know the answer, but in this blog post, I’ll show you the proof that why long-term growth stocks are more important than quality (but slow-growing) stocks bought in a market crash. So let’s start the journey.

I see it all the time, a friend hears that a new promising company is coming in the market and they’re planning to grab that IPO in a jiffy. Or, the opposite also happens, they see the prices of their stocks crash and in panic, they sell their positions. Trust me, I’ve been there too.

But here’s the thing: that first-year drama is often just noise. It’s the long-term growth that truly builds wealth. Irrespective of how or when you get into a stock, as long as its fundamentals are sound, they can still build wealth for us no matter if the prices crash by even -50% today.

Now, to really understand this, let’s look at something that I think is super powerful. We’ll observe a few real-world examples (though I have taken some liberties to make the numbers look a bit cleaner to explain the point better).

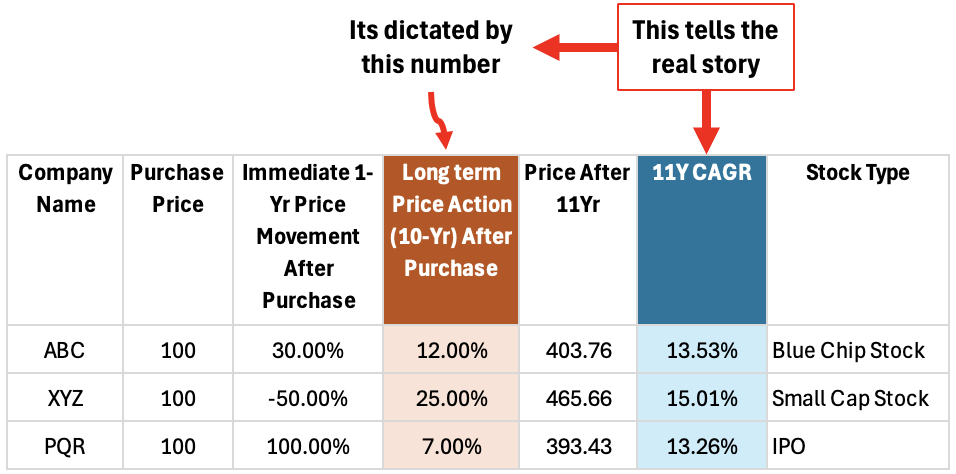

I’ve put together a table that paints the real picture.

It’ll emphasize the importance of consistent long term growth over timing the market (during a crash or corrections). Idea is to convey this fact that we retail investors should focus on buying such stocks which can grow fast for years together. Stocks bought at bottoms during crash may still not build enough wealth for us. How? This is what I’ll try to explain using three hypothetical but life-like examples.

Meet Our Three Stocks: ABC, XYZ, and PQR

| Company Name | Purchase Price | 1-Year Price Action | 10-Yr Price Action | Price After 11th-Yr | 11-Yr CAGR | Stock Type |

|---|---|---|---|---|---|---|

| ABC | 100 | 30.0% | 12.0% | 403.76 | 13.53% | Blue Chip Stock |

| XYZ | 100 | -50.0% | 25.0% | 465.66 | 15.01% | Small Cap Stock |

| PQR | 100 | 100.0% | 7.0% | 393.43 | 13.26% | Public Sector IPO |

Okay, let’s break this down. We’ve got three hypothetical stocks that we bought at Rs.100 each:

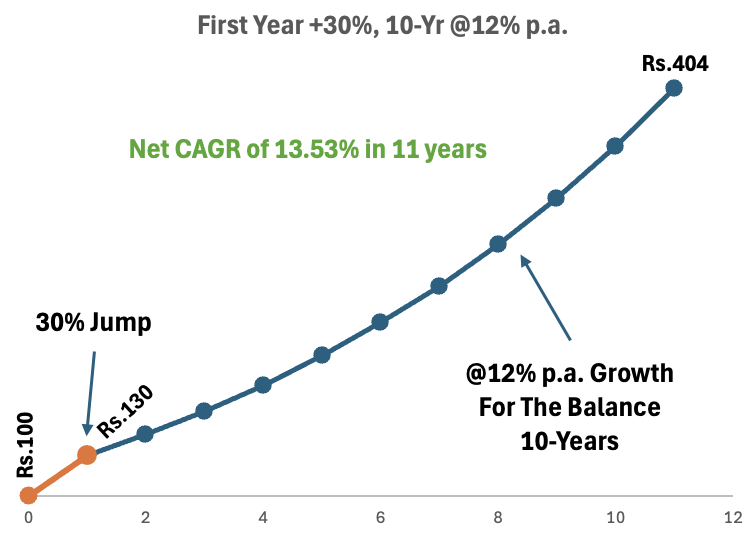

Example #1: ABC (The Blue-Chip Champ)

This one started strong, with a nice 30% jump in the first year. You might have bought this blue-chip stock say during the COVID crash. In the first year you must have thought, “Wow, I’m a genius.” But hold your horses.

Think of this like buying a blue-chip stock just at the bottom of the price crash, perfect timing, right?

After the first year’s jump, over the next 10 years, it grew only at a moderate rate of 12% per annum. Most Indian blue chip stocks grow at this average rate over 10-yr time horizons. What is the net result?

After 11 years of holding, the average return (CAGR) of this stock was only 13.53% (even after the 30% price action in the first year).

So now you tell me, which number is more reflecting in the 11-Year CAGR number, the first years’s 30% jump or the 12% long-term growth? The answer is obvious, right? Long-term growth rate (12%) dominated the compounding of pice in this 11 year period.

[Note: The longer will be the holding time, less relevant will be the initial years price actions.]

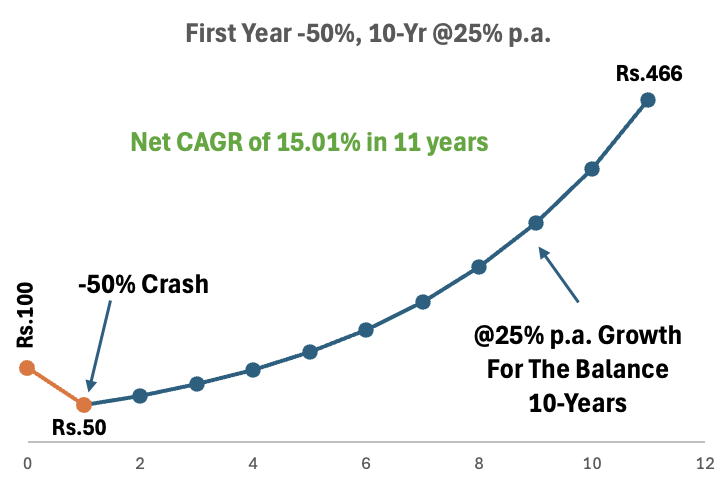

Example #2: XYZ (The Comeback Kid)

This one had a rough start, crashing down by -50% in the first year (Ouch!). But here’s the twist – this stock then went on a growth spurt. It could compound at 25% for the next 10 years.

Think of this like buying a growth stock just before a market crash. As the investor was confident about the company’s future potential, he did not panic. He could understand that just because its price has crashed, it does not alter the core business fundamentals of the company. Hence, he decided to hold on to it.

Over the next 10 years, being a growth stock operating in an expanding industry, it grew at a fast rate of 25% per annum. So let’s see what is the net result at the end of the 11th Year.

After 11 years of holding, the average return (CAGR) of this stock was only 15.01%. The stock bought at Rs.100, fell to Rs.50 in the first year itself, and then rising up till Rs.466.

So again the same question, which number dominates the 11-Year CAGR number, the first years’s -50% crash or the 25% long-term growth? Considering that the price crashed by -50% in the first year, still the stock reported a CAGR of 15% after 11 years. So yes, the effect of long-term growth rate dominates for sure.

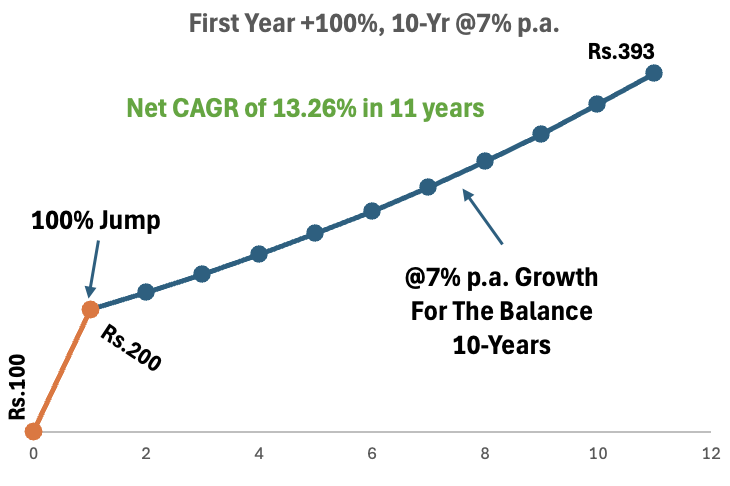

Example #3. PQR (A Public Sector IPO)

This one was hot off the press, with a IPO post-listing jump of a massive 100%.

Think of this like buying an upbeat government backed IPO. As it was a government IPO, in a post-COVID hype of public sector entities, this IPO got a massive jump (100%). Sounds fantastic, right?

But after the initial euphoria, it slowed down considerably. Being a public-sector company, its future growth prospects were limited subjected to government approvals. Hence, it revenues and profits grew only at a modest rate for the next decade.

This is like the typical growth story which seems promising and so everyone chases it. But such hyped and overvalued IPOs often falls short when it comes to long-term value.

Over the next 10 years, being a slow government backed company, it grew at slow rate of only 7% per annum. So let’s see what is the net result at the end of the 11th Year.

After 11 years of holding, the average return (CAGR) of this stock was only 13.26%. The stock bought at Rs.100, rose to Rs.200 in the first year itself, and then rising very slowly to Rs.393 in next 10 years.

So you can see, no matter how much is the initial hype, long-term return (CAGR) number is dictated by the long-term growth rate.

What’s the Big Lesson?

Look at the ‘11 Year CAGR’ column. This is the compounded annual growth rate over 11 years – and it tells the real story.

The stock that had a terrible first year (XYZ) actually ended up being the best performer. This illustrates that even a stock which corrects heavily, can give the highest returns, if its long term potential is intact.

Alternatively, the stock that had the best start (first-year euphoria), PQR gave the lowest growth rate over the period.

What does this proves?

- Short-Term Gains Are Often Misleading: That initial surge (or drop) is not indicative of long-term success.

- Patience is Key: The real magic happens when you give your investments time to grow.

- Consistency > Flashy Starts: The steady growth of XYZ, even after a crash, outpaced the initially “better” stocks. This illustrates that even though buying a stock during a crash is an excellent opportunity, it needs to be backed by long term growth potential and should not be chased for the sake of quick returns.

Conclusion

I can tell you from experience, I used to be the person who would panic when my stocks went down 15% and sell it immediately.

Now, I have learned that the long game is where true wealth is built.

Don’t fall for the trap of chasing quick profits. The real rewards come to those who research great companies, buy them at reasonable valuations, and especially when the market is down. Once this is done, the next step (which is more important) is to give the bought stock the time to compound.

Remember, you’re investing in the company’s potential, not just a ticker symbol. And sometimes, the best opportunities come after a short-term pullback.

Whether it is a quality stock we buy after the market crashes or it is a growth stock, we must make sure that our focus is on the long term growth potential. That is what will determine the overall returns we’ll make in the long run.

So next time you see your portfolio swinging wildly in the short-term, take a deep breath, remember this table, and ask yourself: “Is the company still doing well?” If the answer is “yes,” then hold tight and let the long-term magic work its charm.

I hope this post shed some light on the importance of long-term thinking in the stock market.

Don’t forget to share this with any new investor that you know.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.

![Stock Investment For Beginners – A Detail Guide [India]](https://ourwealthinsights.com/wp-content/uploads/2010/11/Stock-Investment-for-Beginners-image.png)