What is your daily expense? Have you every tried to calculate the quantum of it? How to calculate daily expense?

Realisation of the quantum of daily expense is both interesting and important.

Just the realisation of this number will help you keep a check on your unnecessary expenses.

How? We will see in this blog post…

I am sure that each individual or family will have their own level of daily expense.

But important here is be aware of this number.

I have collected some data, and based on this lets try to quantify a typical daily expense.

The same approach one can used by my readers to quantify the daily expense for themselves.

To quantify the daily expense, I have assumed the following:

Not all expense happens on daily basis. In fact there are hardly anything that we purchase on daily basis.

Most of the people that I have come across does weekly purchasing.

Weekly purchases are the most likely frequency of purchasing.

So what I have done is to categorize the expense, and use the below formula to arrive at a daily expense figure…

- Daily Purchase (DP) : (Daily expense = DP/1)

- Weekly Purchase (WP) : (Daily expense = WP/7)

- Monthly Purchase (MP) : (Daily expense = WP/30)

- Quarterly Purchase (QP) : (Daily expense = QP/92)

- Semi Annual Purchase (SAP) : (Daily expense = SAP/182)

- Annual Purchase (AP) : (Daily expense = AP/365)

Some might ask that what we are considering monthly or annual purchases in our daily cost of living?

It is a very justified query. Allow me to explain.

Few typical examples of monthly expense are electricity bill, house rent, phone bill etc.

Though one does not pay these bills daily, but there is a cost build-up on daily basis.

Why there is a cost build-up?

Because we consume these services on daily basis.

While we are doing our calculation in this blog post, you will understand what I man by cost build-up.

Another example of quarterly expense can be school fee of children.

Though the fee is not paid daily, but here also there is a cost build-up on daily basis.

Why there is a cost build-up? Again, we consume the services of our education institution on daily basis.

Typical examples of annual expenses can be cost of health gym, auto maintenance, property tax etc.

For sure these are not daily costs. We pay them only once in 365 days.

But here also the cost gets build up everyday. Why?

Because we use their services day after day.

To perform this exercise of daily expense calculation, I have created a hypothetical character called Mr.Vyay (our expense man).

Lets calculate the daily cost of living of Mr.Vyay.

#1. Daily consumption leading to daily expense

Here we will identify and quantify only those expense that we consume on daily basis.

These are those items which keep draining our pocket on continuous basis (almost every passing hour).

#1.1. Electricity Bill:

This is one cost which keeps accruing every second.

In our house there is always something which is consuming electricity.

Even when we are out of our homes, some items like Refrigerator, Wifi, laptop kept on charging etc consumes electricity.

Electricity is one expense that drains us most frequently.

On an average, a house of four people can consume almost 225 units of electricity per month.

Assuming rate of electricity as Rs.6 per unit (including all charges, duties etc).

Electricity bill per month = 225 x 6 = Rs.1,350

Electricity bill per day for Vyay = 1,350 / 30 = Rs.45.00

#1.2. Cooking Gas:

This is another cost which keeps accruing every day.

In every family household, cooking is done regularly on daily basis.

Either it is for cooking of food, making tea, or warming/heating cooked food; consumption of cooking gas is bound to happen.

On an average, a house of four people can consume almost 1 LPG cylinder per month.

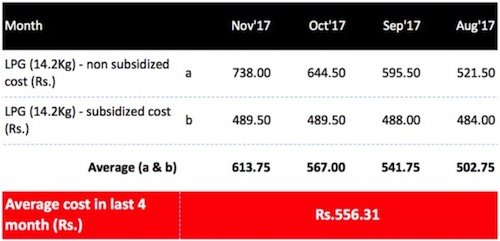

Assuming rate of LPG cylinder as Rs.556.31 per unit (including all charges, duties etc).

Cost of Cooking Gas per month = Rs.556.31

Cost of Cooking Gas per day for Vyay = 556.31 / 30 = Rs.19.00

#1.3. Internet Broadband:

These days the cost of internet broadband also keeps accruing every passing minute.

Internet usage has become almost a necessity these days.

Though it is also true the quantum of usage of internet data by people/family varies.

For a blogger like me, data consumption can be high. But for a family where both spouses are in a job, will consume less data.

Major consumption of internet data these days are done through broadband connections.

So here I would use my safe assumption.

On an average, a house of four people can consume close to 45GB of Internet data per month.

I am assuming a internet connection speed of 6Mbps.

In a city like Mumbai, a service provided like Airtel, Tata Docomo, Tikona etc provides 6Mbps plan (data 45GB per month) will charge Rs.650/month

Cost of Internet Broadband per month = Rs.650

Cost of Internet Broadband per day for Vyay = 650 / 30 = Rs.22.00

#1.4.Transportation cost:

People who travel using their own vehicle will have more cost.

People who use public transport will have less cost burden.

To simplify the calculations, I am using example of Mr. Vyay, who self drives his car.

On an average, a person who self drives his vehicle to commute to office each day, stays within the radius of 15 kilometers from his/her office.

Means every day, to and fro commutation to home-office-home will meter 30 kilometers.

If the person travels 5 days a week to office, his weekly meter will clock 30×5=150km.

Adding another 50km/week for miscellaneous leisure travels on weekends, total meter reading will be 200km per week.

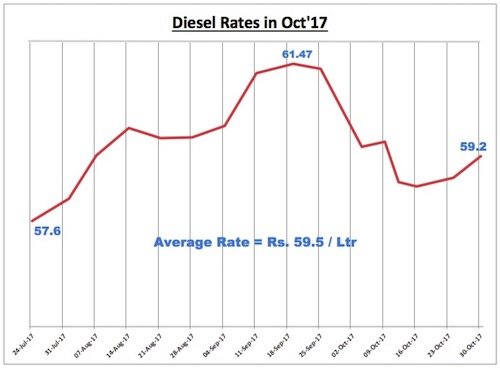

Here I have assumed the cost of diesel as Rs.59.5 / ltr.

Cost of travelling 200Km/week by a car with mileage of 12Km/Ltr, will have the following cost:

Transportation cost per week = (200/12) x 59.5 = Rs. 995

Transportation cost per day for Vyay = 995/7 = Rs.142.00

#1.5.Food:

Everyday we consume food in some form or the other.

Generally people buy grocery, vegetables, and other food products once every week.

There are people who buy these stuffs once a month.

I know few families who prefer to buy vegetables every day.

Nonetheless, what every is the buying pattern, we consume food each day and there is a cost to let.

Lets try to estimate this cost:

In a metro city in India, a house of four people does grocery etc purchases of worth Rs.2,000/week.

This includes milk, baked items, meat/fish etc in addition to standard grocery and vegetable items.

But this is not all, often families also consume food outside their home in restaurants.

I assume that people do this almost twice every month.

The cost of this dinning out will be close of Rs.1,000 (intentionally I have kept this value very low).

To get a realistic picture of how much we actually spend on food, we cannot forget to add outdoor snacks (street food) in our list.

Lets give it a budget of Rs.500 every month.

So what food costs we have here?

Grocery/vegetables = Rs.2000/week. Dinning out = Rs.1000/ 2 weeks. Snacks = Rs.500/month.

Cost of food per week = 2000 + 1000/2 + 500/4 = Rs.2,625

Cost of food per day for Vyay = 2625/7 = Rs.375.00

#1.6.Telephone / Mobile:

People pay telephone bill once every month. But we make telephone calls, consume mobile data almost every minutes.

Hence I though it suitable to include the mobile phone expense in our daily expense list.

In order to make a realistic judgement of mobile bill expense, it will essential here to understand the age of family members that I have considered.

- Spouses : 45 years of age

- Child 1 : 15 years of age

- Child 2 : 9 years of age

Here I have assumed that the above family will use 3 mobile phones.

Two will be used by the spouses and one by the child 1. Child 2 will also use the mobile but will share the phone of parent or sibling.

Such a family will spend close to Rs.2,000 per month on mobile bills.

Cost of mobile phone per month = Rs.2,000

Cost of mobile phone per day for Vyay = 2000/30 = Rs.67.00

#1.7. Accommodation (EMI / Rent):

House rent is a compensation that a tenant pays to the landlord.

Similarly, home loan EMI is also like a compensation that the borrower pays to the bank (till there is a loan balance).

Because we are occupying a residential property on daily basis, hence this cost also keeps accruing every second.

On a average, a middle class family of four members would buy a residential property worth Rs.50 lakhs in India.

Maximum home loan that a person can get to buy such a property will be Rs.40 lakhs.

As a rule of thumb, home loan of Rs.40 lakhs means, EMI payment of Rs.40,000 per month.

Here I would also like to add the cost of property tax. For a property worth Rs.50 lakhs, annual property tax to be paid would be close to Rs.7,000

Cost of EMI + P.Tax per month = 40,000 + 7,000/12 = Rs.40,584

Cost of accommodation per day for Vyay = 40,548 / 30 = Rs.1,352.00

#1.8. Education (School fees etc):

Our children avail the facility of education on daily basis.

Hence it is only prudent to include the cost of education in our daily expense calculations.

Here again I must repeat the age of child members I considered for education expense calculation.

Child 1 : 15 years of age

Child 2 : 9 years of age

In order to estimate the cost of education, I am assuming only following costs for simplicity:

Cost of education per month = Rs.14,759

Cost of education per month = Rs.14,759

Cost of education per day for Vyay = 14,759/30 = Rs.492.00

People who avail the day-care service for their kids can add that expense here as well.

#1.9. Domestic Help (Maid service):

Almost all middle class families in India avail the facility of maid services every day.

This service is mainly used for house maintenance purpose like cleaning etc.

There are people who also use the maid service for cooking purpose.

My estimate is, on an average a middle class Indian family spend close to Rs.3,000 per month to maintain a domestic help.

Cost of domestic help per month = Rs.3,000

Cost of domestic help per day for Vyay = 3000/30 = Rs.100.00

#1.10. Vehicle Maintenance :

When people keep vehicle (cars, motor bikes etc) for every day commutation, there is also a associated cost for its maintenance.

The maintenance cost of the vehicle will be proportionate to the value of the vehicle.

On an average, a middle class Indian generally drives on a vehicle whose cost will be close to Rs.12 Lakh rupees.

Annual maintenance cost of such a vehicle will be close to Rs.20,000.

There are also other costs which we can attribute to vehicle maintenance:

- Washing expense : Rs.500 / week

- Insurance premium : Rs.18,000 year

Cost of vehicle maintenance per year = 20,000 + 500*12 + 18,000 = Rs.44,000

Cost of vehicle maintenance per day for Vyay = 44,000/365 = Rs.121.00

#1.11. Health Maintenance :

These days people are becoming increasingly conscious of their health.

Everyday gymming has become a part of life of middle class families.

In addition to gymming, people also go for regular medical check-ups as a part of routine health care.

In addition to routine health check-up, I would like to include the expense of general medicine.

Women in family also consider their beauty treatment as necessary. They consider this as a part of their health care.

For sure there is a financial cost for maintaining a healthy lifestyle. But this cost is worth spending.

The costs that I have considered for health maintenance are as follows:

- (a) Gymming : Rs.10,000/month.

- (b) General medicine : Rs.5,000/3 months.

- (c) Routine health check-up : Rs.10,000/6 months.

- (d) Beauty treatment : Rs.1,500/month.

Cost of Health maintenance per month = 10,000 + 5,000/3 + 10,000/6 + 1,500 = Rs.14,834

Cost of Health maintenance per day for Vyay = 14,834/30 = Rs.495.00

#1.12. Entertainment :

I know we would not like to fall prey to entertainment expense on daily basis, but there is something that we cannot avoid.

I am talking about entertainment through television. We consume television programs on daily basis.

There is no denying of the fact that television has become an uncompromising part of our lives.

Hence I am considering DTH bill has a part of daily expense.

On an average, an Indian house hold will spend close to Rs.500 per month towards payment of DTH bills.

I would also like to add the cost of going to theater and watching a movie as part of entertainment expense.

For a family of four, going to a multiplex theatre for watching a movie will cost close to Rs.1,000.

I am assuming that this expense happens twice every month (power of Bollywood). ?

Cost of entertainment per month = 500 + 1,000×2 = 2,500

Cost of entertainment per day for Vyay = 2500/30 = Rs.85

Final words on daily expense calculation

When I first did this calculation for myself, I was surprised to see my total value.

The reason for this surprise was the comparison between my daily income verses daily expenses.

As a rule of thumb, ratio of total daily expense and daily income should not be more than 0.6. Mine was much higher.

Now a important question; why we need to calculate this ratio in such a cumbersome manner?

Yes this it is true that the above ratio after all is a monthly expense and income ratio.

We already remember our monthly income by heart.

With little bit of effort we will also quantity our monthly expense.

So calculating this ratio is less than a 15 minute work.

Why to go into the detailing of quantifying daily expenses?

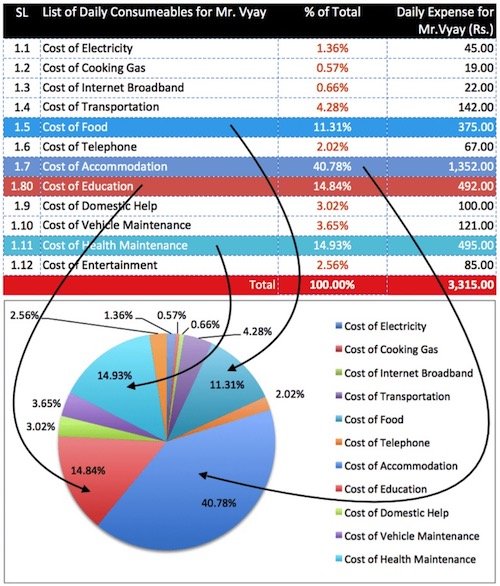

Remember, the twelve expense line items that we have discussed above are only those items that we consume on daily basis.

Just try to imagine that fact like this, the expenses that flows out of our pocket daily are more difficult to contain.

They almost become a habit and we take it for granted.

But those expenses which does not happen regularly, only catch our attention, right?

Logic is simple, daily expense drains us and we don’t even notice them.

Listing your potential daily expenses like this will keep you aware of the personal cash flow.

This awareness will eventually result in prevention of unnecessary expense.

It also gives us another essential realisation. Which expense line item is costing us the most?

Often we spend our energy in lowing those expenses whose impact on our life is negligible.

But the better strategy will be to focus on those daily expense which are costing us the most.

See the pie chart of Mr.Vyay to understand where he is spending the most.

In most cases, a common mans expenditure habits will be like Mr. Vyay. At least the pattern will be similar.

Just remember the rule of thumb:

Ratio of daily expense/ daily income < 0.6.

Mr. Vyay is spending Rs.3,315 on daily basis: I will suggest my readers to do a similar calculation for self.

I will suggest my readers to do a similar calculation for self.

Once this calculation is done, remember the final value. For Mr. Vyay this value was Rs.3,315.

Check if your expense/income ratio is more than 0.6. If ratio is below 0.6, you are well placed.

But in case the ratio is higher, it is the time to consider lower your daily expenses.

Learn how to save money by visiting this link…

thankyou for enlightening us