Prepayment of loan can directly lowers the principal amount. If one keeps the tenure unaltered, lowering of principal amount will directly lower the EMI.

This is the way one can make a prepayment and save money. In order to understand how much EMI can be reduced by prepayment, I am providing here an excel based calculator. You can download it from here.

In this article, I’ll explain how one can use this calculator and estimate the potential savings from making a prepayment.

How to use this excel sheet?

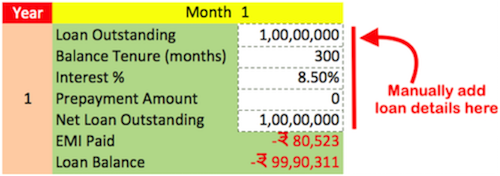

- Step #1 – Enter loan details like this:

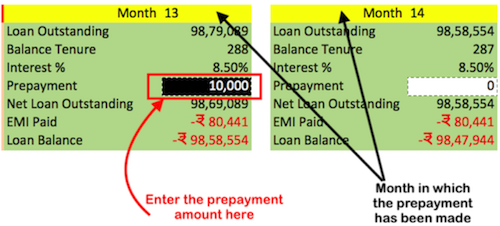

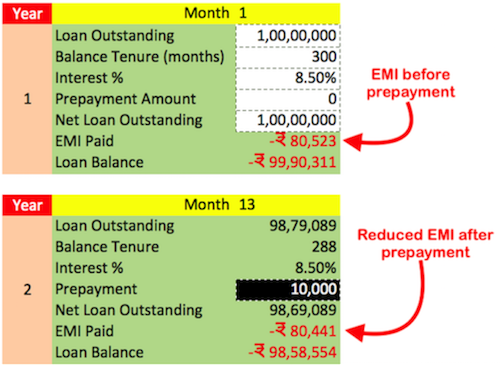

- Step #2 – Enter prepayment details. Suppose loan prepayment of Rs.10,000 in 13th month. Lets see how this data entry (related to loan prepayment) is made in this excel sheet:

- Step #3 – Just note the reduced EMI due to prepayment:

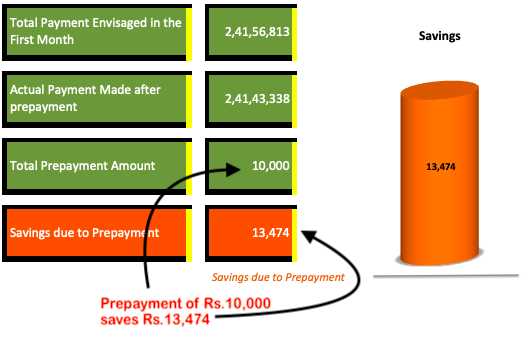

- Step #4 – Note the saving made due to prepayment. There are two clear benefits of prepayments: (1) It reduces EMI, and (2) It also saves some over time.

If you will compare the saving achieved due to “tenure reduction” and “EMI reduction”, the clear winner will be tenure reduction. But the reality is not like this. Read this detailed blog post on loan prepayment for EMI reduction.

Check this free online home loan prepayment calculator: