If you’ve ever wondered whether you can make money from the stock market, you’re not alone. Many people, especially beginners, see the stock market as a mysterious place where fortunes are made and lost. Recently I was travelling to my native place and someone asked me few questions – like “Is earning from the share market easy?” or “How to make money daily from share market?” These questions show that many people view the market with equal parts, fascination and confusion.

I’ve been investing in the stock market since 2008. After all these years of experiencing the market, I can say that a lot of money can be made in the stock market. But the problem is that, stock market cannot generate income like we make from jobs. Someone asked me, if I can invested Rs.1000 in stocks daily, can it make Rs.200 extra daily? The answer to this question is, stock market do not work like this.

I know, there are daily traders who will make you think that a lot of people are making money like this (Example: Rs.200 from Rs.1000 – daily) but its untrue. Stock market is not a daily income generator, it’s a gradual wealth builder.

Topics:

1. What Is the Stock Market?

The stock market is a financial marketplace where shares of publicly listed companies are bought and sold.

- It serves as a platform for companies to raise capital for their business operations.

- For we investors, it is a place where we can buy and own a part of these companies.

As share prices of listed stocks fluctuate with every passing second/minute, people think that easy money can be made taking advantage of this volatility. How?

By buying low and selling high.

Conceptually, it looks easy and possible, but in practice, making money by day-trading is very hard.

1.1 What are shares?

A share represents partial ownership of a company.

For example, suppose a company declared a total of one crore (100,00,000) number shares during its IPO listing. You own about ninety thousand shares (90,000) of this company. It means, you own a 0.9% of the business.

The point to understand about shares is also this, the ownership comes with potential rewards and risks.

If the company grows and generates profits, its share price will also increase, benefiting its shareholders. As a beginner, this is how one should look at shares. A growing and profit making company will make money for its shareholder over time.

There are people who do day-trading of shares to make daily income. They try to buy low (say at Rs.1000) and sell high (say at Rs.1005). But as per a data analysis, less than 1% of all day trades actually make a profit.

1.2 Why do companies list their shares?

When companies need funds for expansion, research, or other growth activities, they have two basic ways to raise funds:

- Debt Route: One way of raising funds for such plans is to take loans from banks or financial institutions.

- Equity Route: The other way is to raise funds through the IPO. In an IPO companies sell shares to the public to raise funds.

Do the promoters of the company opts for IPO only to raise funds?

No, value unlocking of the business is also an unsaid objective. Let’s understand how value unlocking can take place after the IPO.

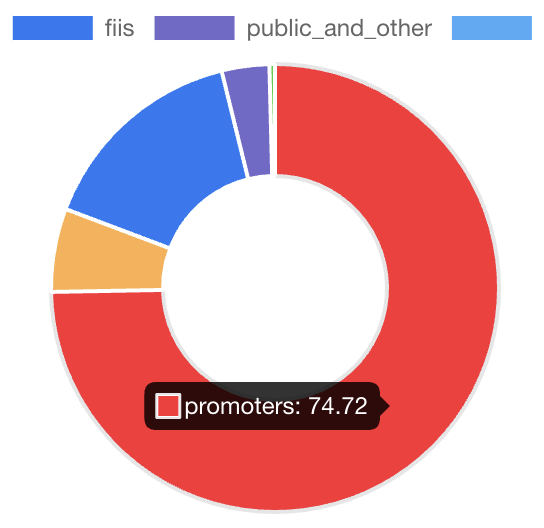

Lets take example of a hypothetical company. Suppose, it has raised funds through an IPO. Out of the total 100% shares of their company, they sold only 26% in the market. The balance 74% remain with the promoters. After listing, say the share price say has jumped by 30% in a matter of a year. So you can see, promoters liquidated 26% of their shares and in just 1 year, the value of their own holding shot up by more than 30%. The best part is, this is not the end. Good companies, will see market cap appreciation year after year.

1.3 How do investors benefit?

Investors purchase shares with the expectation of earning returns. These returns come in three primary ways:

- Capital appreciation – When the price of a share increase over time. For example, if you buy a share at Rs.500 and its value rises to Rs.600, you earn Rs.100 as profit.

- Dividends – Some companies distribute a portion of their profits to shareholders as dividends.

- Bonus Shares: Companies at times can also issue bonus shares to their shareholders (read about bonus shares currently issued by Wipro).

The stock market plays a vital role in the economy. It provides companies with funds and investors with opportunities to grow their wealth.

2. Can You Earn Money from the Stock Market?

Yes, the stock market can be a powerful tool for wealth creation.

However, making money from it isn’t about luck or shortcuts. It’s about understanding its mechanics, exercising discipline, and playing the long-term game.

2.1. Capital Appreciation

The most common way investors earn from the stock market is through capital appreciation.

This occurs when the price of the stock you own rises over time. For instance, imagine you invested Rs.2,000 in a share of Tata Consultancy Services (TCS), and after a few years, its price climbs to Rs.3,000. That Rs.1,000 gain per share represents your profit.

But this appreciation isn’t random. It is the result of the company’s growth, profitability, and market perception.

Identifying fundamentally strong businesses and staying invested allows you to capture such growth.

2.2. Dividends

Another avenue for returns is dividends.

These are portions of a company’s profits distributed to shareholders.

Banks, PSUs, and other blue chip companies, for example, consistently reward their investors with dividends.

Dividends are particularly valuable for long-term investors because they provide regular cash flow, which can be reinvested to compound wealth further.

The Key to Success

While these methods sound straightforward, achieving consistent returns requires patience and effort.

Markets are unpredictable in the short term. It is easily to get confused and take hasty calls when volatility is at its peak. In a falling market, people sell and exit. In a rising market, which is already near its peak, people buy heavily and face losses. What should be done?

Buy in a falling market and hold when market is bullish.

Buy stocks with objective of holding them for decades. The market reward those who focus on quality businesses with strong fundamentals.

So, does it mean that stock market cannot make us daily income?

3. Can You Make Money Daily in the Stock Market?

The lust of making daily profits in the stock market captivates many of us.

But the reality is far less glamorous.

While it’s true that some experienced day traders (may be one in a thousand) practice day-trading profitably. But making money from day trading is a approach which is fraught with risks and challenges.

Note: Most of the big names we hear in the stock market (like Rakesh Jhunjhunwala etc) were all stock traders once. But after regular trading, they realized that the real money can be made by investing (not trading).

3.1 Day Trading: A Tough Game

Day trading involves buying and selling stocks within a single day, aiming to capitalize on small price movements.

To succeed, one needs a profound understanding of technical charts, market trends, and an ability to make split-second decisions.

Even with these skills, the odds are stacked against most traders.

Market volatility, transaction costs, and emotional decision-making often lead to losses. Unlike long-term investing, day trading is not about wealth creation but speculative betting (like Gambling).

3.2 The Reality of Daily Profits

Let’s be clear: the stock market is not a daily income generator. It doesn’t work like a salary or a fixed return investment. While you may hear stories of traders earning Rs.10,000 or Rs.20,000 daily, you rarely hear about the days they lose double that amount.

For most people, it’s not a sustainable way to earn money.

Day trading requires constant market monitoring, deep knowledge of technical analysis, and the ability to handle extreme volatility—all while controlling emotions.

- Take the example of Ravi, a young trader from Mumbai who quit his job to pursue day trading full-time. In his first few months, he made impressive profits – sometimes earning Rs.10,000 or Rs.15,000 in a single day. But soon, market volatility turned against him. A single bad day wiped out an entire week’s gains. By the end of his first year, after accounting for brokerage fees, taxes, and losses, Ravi realized he had earned less than a fixed deposit would have offered.

Studies suggest that only a small percentage of day traders (<1%) consistently make money, and even they face immense stress.

What’s advisable? Do not come to the stock market to make quick bucks. Stock market is a place to make crores but it will be made in decades not days.

As an investor, focus on the bigger picture. Think like a business owner, not a gambler.

4. Is Earning Money from the Share Market Easy?

The simple answer is no.

Making money in the stock market is far from easy, especially for those looking for quick gains.

The market is influenced by numerous unpredictable factors: economic conditions, corporate earnings, interest rate changes, global geopolitical events, and even investor sentiment. These elements create short-term volatility that can mislead and frustrate even most experienced investors.

So, people who wants to deal with with the stock market like a casino, betting on random stocks without research or strategy, will lose money eventually.

But you will find influencers who will motivate people to venture in stock trading. There are people who fall for it, and start day trading with a hope to generate some income. But stock market is not for daily income generation. It is a long-term wealth-building machine.

People who start stock trading, quit after their first significant loss. They conclude that the stock market is not for them. But the truth is, “stock trading” is not for them.

So, how to deal with the market?

4.1 Practice Long-Term Investing

When approached with a long-term mindset, the same stock market which was looking like uncontrollable, starts to sound logical, more predictable and profitable.

Identifying fundamentally strong companies and holding their shares for years, even decades, has been a proven formula for wealth creation.

This strategy, benefiting from the power of compounding, shields investors from short-term market noise.

5. Is the Stock Market a Money-Making Machine?

The stock market often appears to be a magical place where fortunes are made overnight. This kind of image leads many to believe that stock market is a money-making machine.

However, this is a flawed and dangerous misconception.

The stock market doesn’t print money for anyone. Instead, it acts as a wealth-building tool for those who approach it with discipline, knowledge, and patience.

If you do not believe me, allow me to explain the point using a simple anecdote.

We all know who is Warren Buffett, right? What is the net worth of Warren Buffett, a stock market investor? His net worth as of today is $146.8 Billion (reported by Forbes). Do you remember name of a stock trader whose wealth is even 10% of Buffett’s? If your answer is “No”, you are in a majority. What does it tell us? People who have made money in the stock market have been investors and not traders.

5.1 The Reality Behind the Illusion

Many beginners are lured by tales of investors doubling their money in months or traders earning thousands in a day.

These stories rarely highlight the risks or the countless failures of those who lost significant amounts.

The truth is, while the market rewards some with short-term gains, it’s far more consistent at punishing the same people if they keep pushing their luck too often.

5.2 What It Truly Offers

The stock market’s real potential lies in its ability to create wealth over time (in 15-20 years).

It rewards investors who research, identify fundamentally strong companies, and remain invested through market cycles.

This process requires a deep understanding of businesses and the patience to ride out volatility.

What it means by remaining invested through cycles? Approximately, in a 10-year period, there will be one crash followed by a bull run. If a person has stayed invested for say three cycles, he has approximately been invested for at least 25-30 years.

Simple Example

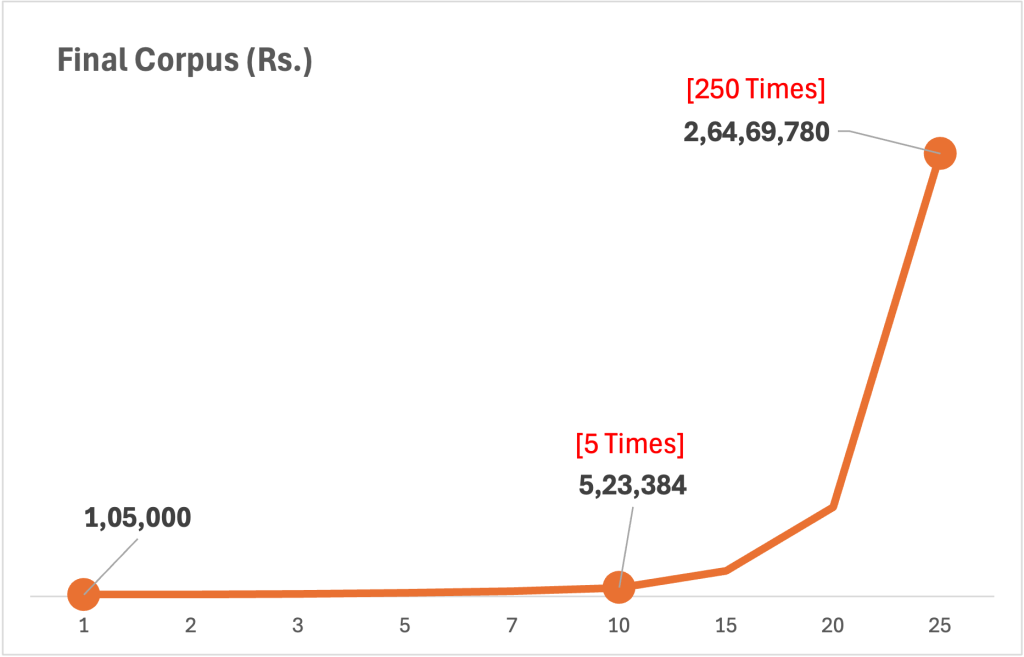

Let me tell you what this kind of period (25-30 years) can do to your wealth:

Suppose you invested (Rs.100,000) in a pure equity mutual fund. This fund will yield the following returns (my estimate) based on your investment time horizon:

- 5% per annum: When holding time is <=1 Year.

- 10% per annum: When holding time is <=2 Years.

- 12% per annum: When holding time is <=3 Years.

- 15% per annum: When holding time is <=5 Years.

- 17% per annum: When holding time is <=7 Years.

- 18% per annum: When holding time is <=10 Years.

- 20% per annum: When holding time is <=15 Years.

- 22% per annum: When holding time is <=20 Years.

- 25% per annum: When holding time is <=25 Years.

Let’s see how your money will grow with time.

| Holding Time (Years) | Invested Amount (Rs.) | Return | Final Corpus (Rs.) |

| 1 | 1,00,000 | 5% | 1,05,000 |

| 2 | 1,00,000 | 10% | 1,21,000 |

| 3 | 1,00,000 | 12% | 1,40,493 |

| 5 | 1,00,000 | 15% | 2,01,136 |

| 7 | 1,00,000 | 17% | 3,00,124 |

| 10 | 1,00,000 | 18% | 5,23,384 |

| 15 | 1,00,000 | 20% | 15,40,702 |

| 20 | 1,00,000 | 22% | 53,35,764 |

| 25 | 1,00,000 | 25% | 2,64,69,780 |

This table shows that when the holding periods are smaller (like below 10 years), there is no significant appreciation in capital. But as one crosses the 10-year holding period mark, the appreciation start to become more visible. If the equity is held for periods like 20-25 years, phenomenal wealth explosion takes place. See the below chart, it will make the growth more visible.

Conclusion

The stock market is a powerful tool for building wealth, but it demands patience, discipline, and a long-term mindset.

While stories of quick profits may tempt many, the reality is that consistent success comes from identifying fundamentally strong companies and holding investments through market cycles.

Day trading and attempts to earn daily income often lead to stress and losses, as the stock market is not designed for such purposes.

Instead, it rewards those who understand the principles of compounding and invest strategically over decades. By treating the market as a wealth-building platform, not a get-rich-quick scheme, individuals can unlock its full potential and achieve financial growth.

The journey may be slow, but for those who stay committed, the rewards can be life-changing.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.