Today I’ll talk about some which has been swirling in my head – “Cash Out.” Sounds fancy, right? It’s basically a way to unlock some of the money that’s sitting pretty in our home. Think of a house as a piggy bank (gullak) that’s been steadily filling up over the years. Cash out is like taking some of that savings out.

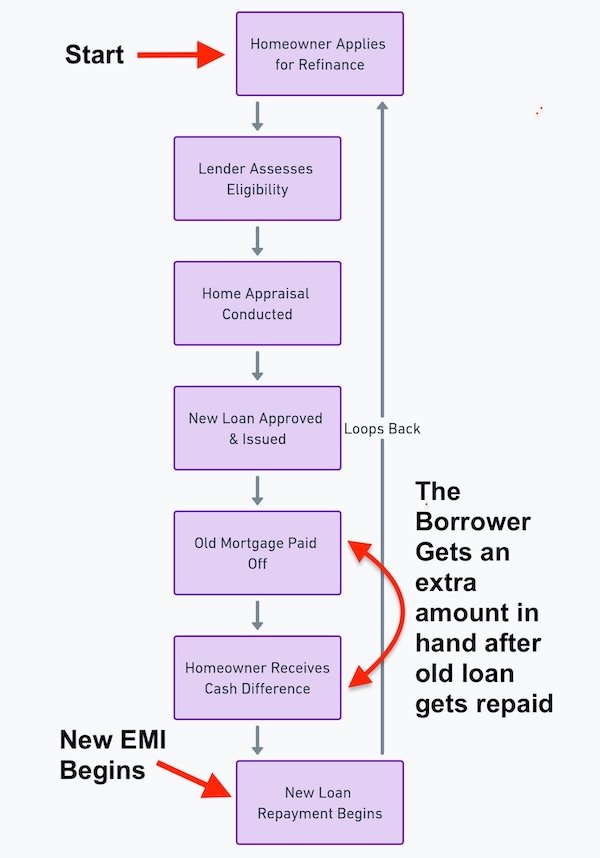

Now, before we get all excited and start dreaming of that new kitchen or a fancy foreign trip, let’s understand what this “cash out” business really is. In simple terms, it usually means refinancing your existing home loan for a bigger amount. Let’s say you owe Rs.50 lakh on your home, but its value has gone up, and the bank is willing to give you a loan of Rs.70 lakh. That extra Rs.20 lakh is what you “cash out.” You get it in hand, just like that.

Why people consider Cash Out?

Well, there are a few reasons:

- Home Improvement: Let’s be honest, who doesn’t want a better-looking house? Cash out can be used to renovate your home, maybe build that extra room for the kids, or finally get that modular kitchen you’ve been eyeing. And hey, a better-looking house means better value in the market, right? It is an investment for yourself, and you will find peace in your house.

- Debt Jugad: This is a big one. Credit card bills giving you sleepless nights? Personal loans eating away at your salary? You can use the cash out to pay off those high-interest debts and consolidate everything into one, hopefully lower-interest, home loan payment. It’s like getting all your chaotic bills under one disciplined umbrella.

- Emergency Fund: Life is unpredictable, yaar. Medical emergencies, unexpected job loss, aisa kuch bhi ho sakta hai. Having some extra cash tucked away can be a lifesaver. Cash out can act as that emergency fund, giving you peace of mind.

- Opportunity to Invest: This is where things get interesting, and also risky. If you’re a savvy investor and believe you can get better returns than the interest rate on your home loan, you could use the cash out to invest in stocks, mutual funds, or even real estate. But remember, yeh khel risk bhara hai (this game is full of risk).

It’s not all sunshine and rainbows with Cash Out

Cash our creates an increased Debt Burden. This is the biggest catch. When we are taking on more debt, it means higher EMIs every month for us. Before considering a cash out, we must make sure that we can comfortably afford those payments, even if things get a little tight.

There is also an inherent risk when we cash our on our home loans. Imagine we cash out to take that Rs.20 lakh, and maybe even spent it freely. But then, suddenly, the housing market takes a hit. Maybe a big company shuts down, or the economy slows down. Whatever the reason, property prices start to fall. This is where it gets tricky. If your home’s value drops significantly, let’s say it goes down from ₹1 crore to ₹75 lakh. You’re now in a situation where you owe the bank Rs.70 lakh (the refinanced loan amount), but your house is only worth ₹75 lakh.

This situation becomes particularly scary if you need to sell your house. If you sell for Rs.75 lakh, after paying off the Rs.70 lakh loan, you’re only left with Rs.5 lakh. Remember that Rs.20 lakh you cashed out? You’ve essentially used it all up, and then some, because the value of your house didn’t hold up.

Even worse, if you have to sell and can only get Rs.65 lakh, you’d actually owe the bank Rs.5 lakh even after selling your home. That is why, if you are considering a cash out, better do it when the real estate market is very buoyant.

What about interest ka Chakkar? For me interest payment is always like a trap. Even if the interest rate seems low, remember you’re paying interest on a larger amount for a longer period. Over the life of the loan, that interest can really add up (as a cumulative expense).

This is why, taking loan is something which is always an avoidable activity. For me, unless it is a matter of life and death, I’ll pick a choice of living within my means.

Conclusion

Look, cash out can be a useful tool if you use it wisely. It’s like a sharp knife – it can help you cook a delicious meal, or it can cut you if you’re not careful.

Personally, I’d only consider cash out if:

- I have a solid plan for the money. Not just a vague idea, but a well-researched plan with clear goals.

- I’m 100% confident I can comfortably afford the increased EMIs, even in a tough situation.

- I’ve done my homework on the housing market and I’m sure that there are not downward risks.

- I’ve compared all my options. Is a personal loan or simply saving up a better alternative?

Don’t get blinded by the glitter (chamak) of having extra cash in hand. Soch samajh kar faisla lo (Think wisely before making a decision).

Final Thoughts

Cash out is not a get-rich-quick scheme. It’s a serious financial decision that requires careful planning and a healthy dose of skepticism. Don’t let anyone pressure you into it. Aaram se socho, samjho, aur phir faisla lo (Think calmly, understand, and then decide).

Happy investing, and stay safe out there.