Mutual Funds vs Home Loan Prepayment: What’s the Right Choice for You?

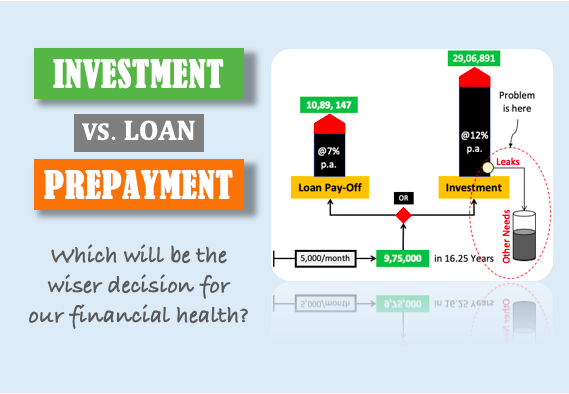

Recently a reader posted this question to me: “Should I use funds from my mutual funds corpus to prepay home loan?” If you are also considering mutual fund withdrawals to prepay your home loan, I think article will help. It’s an intuitive urge, and at some stage of investing almost all investors face this dilemma….