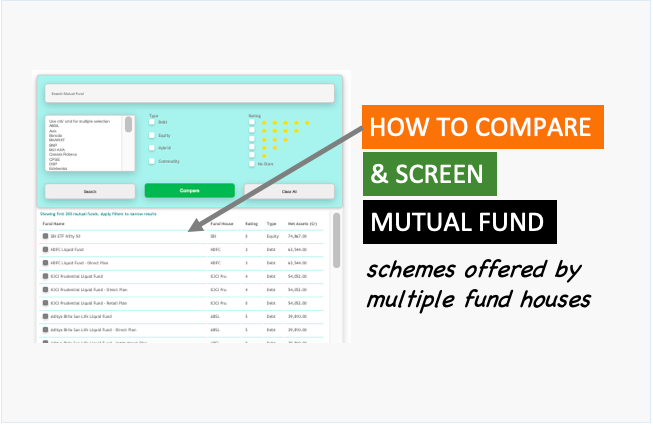

How to Compare Mutual Funds? Which Parameters To Use for Comparison

Let’s start with the most basic question. Why compare two mutual funds? It’s done to know which fund is better for investing. But such a comparative method is effective? If one knows the vital parameters for comparison, it can be more effective. In fact, unlike stock analysis, a detailed fundamental analysis of mutual funds is not possible….