Investment Thought Process | How To Invest Money Wisely [For Beginners]

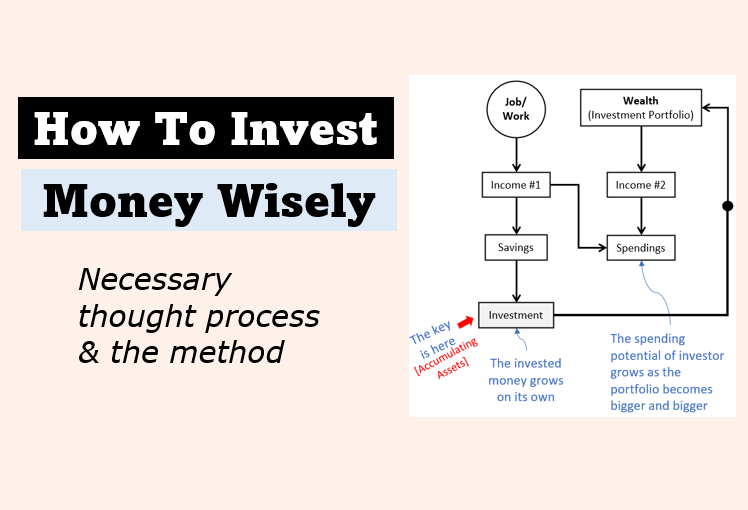

The objective of this article is to highlight the importance of building the right thought process to practice investment successfully. Beginners worry about how to invest money wisely. In this article, we take the matter of wise investment from its very core. We discuss what, why, and where about investing from the perspective of a…