How to Choose the Best Mutual Fund for Your Retirement Goal: A Step-by-Step Guide

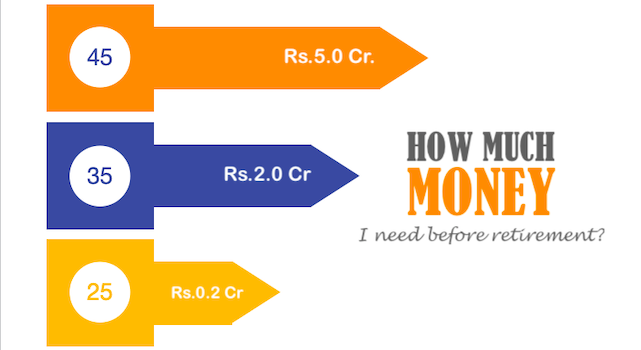

Summary: This article outlines a simple, step-by-step plan to build a substantial retirement corpus using mutual funds, emphasizing the power of early investing, compounding, and disciplined SIPs to achieve financial freedom. See calculator#1, and calculator#2. Introduction Why mutual funds are ideal for retirement? Imagine a situation like this, you’re on a south Goa beach side…